Abstract

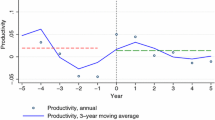

We provide evidence on the firm level productivity effects of imports of intermediates. By exploiting a large panel of Italian manufacturing firms, we are able to separately explore the role of importing from high and low income countries. Importing does not permanently affect the firm productivity growth. This finding holds both when we test for the import entry by means of Propensity Score Matching techniques and when we analyse the import intensity within a dynamic panel data model framework. On the contrary, we confirm the existence of self-selection into importing. Also, our evidence supports the learning-by-exporting effects in Italian manufacturing and we prove that this result is robust to the control of firm import activity.

Similar content being viewed by others

Notes

Mazzola and Bruni (2000) and Calabrese and Erbetta (2005) focus on firms’ production linkages for a sample of southern firms and for firms in the automotive industry, respectively, finding important effects of outsourcing on the firms’ performance, but they do not deal with international linkages. Finally, Barba Navaretti and Castellani (2004) study the impact of becoming a multinational on a bunch of firm level performance measures between 1993 and 1997. However, our focus is on firm level imports that do not necessarily coincide with foreign direct investments. Furthermore, whereas we distinguish between importing from high and low income economies, they do not dissect the impact of investing abroad according to the income level of the destination country.

Details on the sample representativeness are available from the authors upon request.

The original number of firms was slightly higher, however, as standard we cleaned the sample removing firms in NACE sectors 16 and 23 (these sectors include a small number of firms and for the nature of the performed activities they may behave differently from the rest of manufacturing sectors) and firms with some anomalous (zero or negative) or missing values for the main variables (output, materials, value added or capital). We have also excluded firms which are considered as outliers for at least one year in the sample period. We consider as outliers those observations from the bottom and top 0.5 % of the distribution of some main ratio (value added on labour and capital on labour).

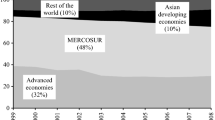

This breakdown has been performed by ISTAT researchers according to source countries’ per capita income level. It is worth to notice that the import measure at our disposal prevents us from disentangling the effects of input purchases from foreign affiliates versus arm’s length purchases. Nevertheless, we believe that our measure mainly captures the latter, as Italian multinationals only account for about 5 % of Italian manufacturing firms and 5 % of importers with at least 10 employees, then the vast majority of importers perform arm’s length transactions. The latter evidence is gathered from the representative EFIGE database for firms having at least 10 employees (http://www.efige.org). Furthermore, we are not able to identify the goods purchased abroad by Italian manufacturing firms, relabeled—without any production process—and resold. This phenomenon will deserve further investigation, as soon as suitable data will be available.

In the empirical analysis below, we will relax this assumption and we will also adopt a TFP index calculated on the basis of an output production technology with material and service inputs too.

See “Appendix 1” for the definition and the detailed description of the variables.

The inclusion of three digit sector dummies caused convergence problems so we decided to stick to the use of two digit dummies, also not to incur in the inconsistent parameter estimates related to the presence of a large number of fixed effects in short T panels when estimating a model with Maximum Likelihood (see Wooldridge 2002, p. 484).

Unfortunately, due to our sample time span, we are not able to test for third order autocorrelation. However, we rest on the Hansen test to evaluate the goodness of the instruments.

GMM–SYS estimations are available from the authors upon request. They mimic the findings of GMM–DIFF, and the impact of offshoring to low income countries turns to be non significant when the firm involvement in export markets is accounted for. However, even if the Hansen test often rejects the null in this set of estimates, the Hansen/Sargan test is found to be inclined to some weakness (Roodman 2006). As a matter of fact, Blundell and Bond (2000) observe some tendency for the Sargan/Hansen test statistics to reject a valid null hypothesis too often in their experiments, and this tendency is greater at higher values of the autoregressive parameter. Furthermore, the Hansen test rejection in large firm level samples is not an uncommon feature (Bontempi and Mairesse 2008). Meschi et al. (2011), indeed, discuss that the very large number of observations makes the occurrence of a significant Sargan/Hansen more likely. They report that when in their work they repeat the test over random subsamples the test was not significant most of the times.

As a matter of fact, in our sample we observe that if sectors are split into High Tech and Traditional according to Pavitt’s 1984 taxonomy, the largest stock of intangible assets is recorded for firms in the former group while the lowest stock is for firms in the latter.

Unfortunately, we are not able to control for the foreign ownership of the firm in this sample. We also lack any information on the firm foreign investments abroad. The inclusion of inward and outward FDI dummies would be desirable here, due to the large intra-firm share of trade that is generally operated by multinationals and to the higher efficiency stemming from being a multinational. To assess whether the omission of such controls may result in a serious misspecification of our empirical model, we made a check on the EFIGE representative database for manufacturing firms with at least 10 employees. This database reports that foreign owned firms (firms with 10 % or more of foreign owned capital) represent in Italy about 5 % of all manufacturing firms. At the same time, only 2.5 % of Italian firms declare to invest abroad. In addition, only 7 % of exporters and 9 % of importers are foreign owned and only 4 % of exporters and 5 % of importers are foreign investors. These figures, concerning the population of firms with at least 10 employees, confirm that multinational activity is not very common within the Italian manufacturing sectors, and that the majority of importers and exporters are not part of a multinational group.

Consistently with this view, Lööf and Andersson (2010) find that no import effect on productivity when focusing on persistent exporters.

We thank one referee for the suggestion of this line of inquiry.

However, it is worth to notice that the validity of GMM instruments is not strongly supported by Hansen tests.

Usually wages are considered as rigid in the Italian labour market.

To corroborate this interpretation we tested the impact of importing on the firm average cost, the costs of materials and of labour per unit of output and the ratio of material to labour costs. Importing from low income economies goes with a reduction in total average cost, an increase in the cost of material per unit of output and, a reduction in the cost of labour per unit of output and an increase in the ratio of material to labour cost. Results are not shown for brevity but are available upon request.

The choice of this index is motivated by its robustness. Van Biesebroeck (2007) shows that, apart the case of large measurement errors in the data, the index produces consistently accurate productivity growth estimates, even when firms are likely to employ different technologies.

Labour is measured as the number of employees in the firm, while capital is proxied by the balance sheet value of material assets.

References

Altomonte C, Békés G (2009) Trade complexity and productivity, IEHAS Discussion Papers 0914. Institute of Economics, Hungarian Academy of Sciences

Amiti M, Konings J (2007) Trade liberalization, intermediate inputs, and productivity: evidence from Indonesia. Am Econ Rev 97(5):1611–1638

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Aristei D, Castellani D, Franco C (2011) Firms’ exporting and importing activities: is there a two-way relationship? Discussion paper, mimeo

Barba Navaretti G, Castellani D (2004) Investments Abroad and performance at home: evidence from Italian Multinationals. CEPR Discussion Papers 4284, C.E.P.R. Discussion Papers

Bernard A, Jensen J (1999) Exceptional exporter performance: cause, effect, or both? J Int Econ 47(1):1–25

Bernard A, Jensen J (2004) Why some firms export. Rev Econ Stat 86(2):561–569

Bettin G, Lo Turco A, Maggioni D (2012) A firm-level perspective on migration. Development Working Papers 328, Centro Studi Luca d’Agliano, University of Milano

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econom 87(1):115–143

Blundell R, Bond S (2000) GMM estimation with persistent panel data: an application to production functions. Econom Rev 19(3):321–340

Blundell R, Dias MC (2000) Evaluation methods for non-experimental data. Fiscal Stud 21(4):427–468

Bond S (2002) Dynamic panel data models: a guide to microdata methods and practice. Discussion paper

Bontempi ME, Mairesse J (2008) Intangible capital and productivity: an exploration on a panel of Italian manufacturing firms. NBER Working Papers 14108, National Bureau of Economic Research, Inc

Bratti M, Felice G (2011) Are exporters more likely to introduce product innovations? Development Working Papers 306, Centro Studi Luca dÁgliano, University of Milano

Burger A, Rojec M (2011) International fragmentation of production and firm productivity: In Search of Focus Effect. mimeo

Calabrese G, Erbetta F (2005) Outsourcing and firm performance: evidence from Italian automotive suppliers. Int J Automot Technol Manag 5(4):461–479

Caliendo M, Kopeinig S (2008) Some practical guidance for the implementation of propensity score matching. J Econ Surv 22(1):31–72

Castellani D, Serti F, Tomasi C (2010) Firms in international trade: importers’ and exporters’ heterogeneity in Italian manufacturing industry. World Econ 33(3):424–457

Caves DW, Christensen LR, Diewert WE (1982) Multilateral comparisons of output, input, and productivity using superlative index numbers. Econ J 92(365):73–86

Chambers RG (1988) Applied production analysis, no. 9780521314275 in Cambridge Books. Cambridge University Press, Cambridge

Daveri F, Jona-Lasinio C (2008) Off-shoring and productivity growth in the Italian manufacturing industries. CESifo Econ Stud 54(3):414–450

De Loecker J (2007) Do exports generate higher productivity? Evidence from Slovenia. J Int Econ 73(1):69–98

Del Gatto M, Ottaviano GIP, Pagnini M (2008) Openness to trade and industry cost dispersion: evidence from a panel of Italian firms. J Reg Sci 48(1):97–129

Fernandes AM (2007) Trade policy, trade volumes and plant-level productivity in Colombian manufacturing industries. J Int Econ 71(1):52–71

Forlani E (2010) Irish firms’ productivity and imported inputs. Core discussion papers, Université catholique de Louvain, Center for Operations Research and Econometrics (CORE)

Görg H, Hanley A, Strobl E (2008) Productivity effects of international outsourcing: evidence from plant-level data. Can J Econ 41(2):670–688

Halpern L, Koren M, Szeidl A (2005) Imports and productivity. CEPR Discussion Papers 5139, C.E.P.R. Discussion Papers

ISGEP (2008) Understanding cross-country diffences in exporter premia: comparable evidence for 14 countries. Rev World Econ (Weltwirtschaftliches Archiv) 144(4):596–635

Jabbour L (2010) Offshoring and firm performance: evidence from French manufacturing industry. World Econ 33(3):507–524

Kasahara H, Lapham B (2008) Productivity and the decision to import and export: theory and evidence. CESifo Working Paper Series 2240, CESifo Group Munich

Kasahara H, Rodrigue J (2008) Does the use of imported intermediates increase productivity? Plant-level evidence. J Dev Econ 87(1):106–118

Lööf H, Andersson M (2010) Imports, productivity and origin markets: the role of knowledge-intensive economies. World Econ 33(3):458–481

Lo Turco A (2007) International outsourcing and productivity in italian manufacturing sectors. Rivista Italiana degli Economisti 12(1):125–146

Lo Turco A, Maggioni D (2012a) Offshoring to high and low income countries and the labor demand. Evidence from Italian firms. Rev Int Econ 20(3):636–653

Lo Turco A, Maggioni D (2012b) On the role of imports in enhancing manufacturing exports. World Econ (forthcoming). doi:10.1111/twec.12020

Lo Turco A, Maggioni D, Picchio M (2012) Offshoring and job stability: evidence from Italian manufacturing. mimeo, Universitá Politecnica delle Marche

Maggioni D (2012) Learning by Exporting in Turkey: An Investigation for Existence and Channels. Global Economy Journal 12

Mazzola F, Bruni S (2000) The role of linkages in firm performance: evidence from southern Italy. J Econ Behav Organ 43(2):199–221

Melitz MJ, Ottaviano GIP (2008) Market size, trade, and productivity. Rev Econ Stud 75(1):295–316

Meschi E, Taymaz E, Vivarelli M (2011) Trade, technology and skills: evidence from Turkish microdata. Labour Econ. doi:10.1016/j.labeco.2011.07.001

Muûls M, Pisu M (2009) Imports and Exports at the level of the firm: evidence from Belgium. World Econ 32(5):692–734

Oulton N, O’Mahony M (1994) Productivity and growth: a disaggregated Study of British Industry 1954–86. Cambridge Books, Cambridge University Press, Cambridge

Paul CJM, Yasar M (2009) Outsourcing, productivity, and input composition at the plant level. Can J Econ 42(2):422–439

Pavitt K (1984) Sectoral patterns of technical change: towards a taxonomy and a theory. Res Policy 13(6):343–373

Roodman D (2006) How to do xtabond2: an introduction to difference and system GMM in Stata. CGD working paper 103, Center for Global Development (CGD), Washington, DC

Serti F, Tomasi C (2008a) Self-selection and post-entry effects of exports: evidence from Italian manufacturing firms. Rev World Econ 144(4):660–694

Serti F, Tomasi C (2008b) Self-selection and post-entry effects of exports: evidence from Italian manufacturing firms. Rev World Econ (Weltwirtschaftliches Archiv) 144(4):660–694

Van Biesebroeck J (2005) Exporting raises productivity in sub-Saharan African manufacturing firms. J Int Econ 67(2):373–391

Van Biesebroeck J (2007) Robustness of productivity estimates. J Ind Econ 55(3):529–569

Vogel A, Wagner J (2010) Higher productivity in importing German manufacturing firms: self-selection, learning from importing, or both?. Rev World Econ (Weltwirtschaftliches Archiv) 145(4):641–665

Wooldridge J (2002) Econometric analysis of cross-section and panel data. MIT Press, Cambridge

Author information

Authors and Affiliations

Corresponding author

Additional information

The data used in this work are from the ISTAT Annual Report, 2006. All elaborations have been conducted at the ISTAT "Laboratorio per l’Analisi dei Dati ELEmentari” under the respect of the law on the statistic secret and the personal data protection. The results and the opinions expressed in this article are exclusive responsibility of the authors and, by no means, represent official statistics. We are particularly grateful to Dr. Monducci, Dr. Anitori and the ADELE staff for allowing the realization of this research. We are also grateful to participants in the SIE conference 2011 in Rome for useful advice and discussions.

Appendices

Appendix 1: Variables definition and description

-

tfp: total factor productivity. Throughout the paper the latter is computed following Caves et al. (1982) Footnote 20 as:

$$ \begin{aligned} ln TFP_{ft} &=ln Y_{ft} -\bar{ln Y_{t}}+\sum_{s=2}^{t} (\bar{lnY_{s}}-\bar{lnY_{s-1}})\\ & \quad -\frac{1}{2}\sum_{i=1}^{n}(S_{fit}+\bar{S_{it}})(lnX_{fit}-\bar{lnX_{it}}) + \frac{1}{2}\sum_{s=2}^{t}\sum_{i=1}^{n}(\bar{S_{is}}+\bar{S}{_{is-1}})(\bar{lnX_{is}}-\bar{lnX_{is-1}}) \end{aligned} $$(A.1)with Y and X respectively measuring real value added and the quantities of the n = 2 primary factors of production, i.e. labour and capital.Footnote 21 S refers to the expenditure share of each factor and the bar indicates the average over the relevant quantity. We define a hypothetical firm having input cost shares equal to the arithmetic mean cost shares over all observations, and with input and output levels equal to the geometric mean of inputs and output over all observations. The terms in the first sum describe the difference between the firm f and the hypothetical firm at time t, while the terms in the second sums chain together the hypothetical firms back to the base period. The index measure the productivity in each year relative to a hypothetical firm that represents the average firm in the sector in the first year of our sample time span.

-

tfp s: total factor productivity based on real sales. Throughout the paper the latter is computed following Caves et al. (1982) as:

$$ \begin{aligned} ln TFP^{s}_{ft} &= ln Y_{ft} -\bar{ln Y_{t}}+\sum_{s=2}^{t} (\bar{lnY_{s}}-\bar{lnY_{s-1}})\\ & \quad -\frac{1}{2}\sum_{i=1}^{n}(S_{fit}+\bar{S_{it}})(lnX_{fit}-\bar{lnX_{it}}) + \frac{1}{2}\sum_{s=2}^{t}\sum_{i=1}^{n}(\bar{S_{is}}+\bar{S}{_{is-1}})(\bar{lnX_{is}}-\bar{lnX_{is-1}}) \end{aligned} $$(A.2)This index depart from the one above since it rests on the output specification of the production function, where Y measures the real output and X denotes the quantities of the n = 3 primary factors of production, i.e. labour, capital and the sum of intermediate material and service purchases. S refers to the expenditure share of each factor and the bar indicates the average over the relevant quantity.

-

va: logarithm of the firm real value added;

-

lp: labour productivity, measured as the logarithm of the firm real value added over firm total employment;

-

Imp LI: import status from low income economies, measured as a dummy variable taking value 1 if the firm imports from low income countries and 0 otherwise;

-

Imp HI: import status from high income economies, measured as a dummy variable taking value 1 if the firm imports from high income countries and 0 otherwise;

-

ImpSh LI: import intensity from low income economies, measured as the share of imported inputs from low income countries over total output;

-

ImpSh HI: import intensity from high income economies, measured as the share of imported inputs from high income countries over total output;

-

Exp: export status, measured as a dummy variable taking value 1 if the firm exports;

-

ExpSh: export intensity, measured as the value of total exports over total output;

-

wage: average wage, logarithm of total labour cost over total employment;

-

kl: capital labour ratio, measured as the logarithm of the ratio between the firm real material assets and the firm total employment;

-

MatSh dom : firm level intensity in domestic materials, measured as the share of material inputs purchased domestically over total material purchases;

-

lab: size, measured as the logarithm of firm employment;

-

k int : intangible capital stock, measured as the logarithm of the firm real intangible assets;

-

imp_pen sect : sector level import penetration, measured as the three digit level sector imports over the summation of the total three digit level sector output and imports minus exports;

-

exp_open sect : sector level export openness, measured as the three digit level sector exports over total sectoral output;

-

skill sect : sector level skill ratio, measured as the ratio between the three digit level sector share of white collars over total sectoral employment.

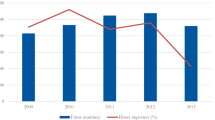

Appendix 2: Additional graphs and tables

Rights and permissions

About this article

Cite this article

Conti, G., Lo Turco, A. & Maggioni, D. Rethinking the import-productivity nexus for Italian manufacturing. Empirica 41, 589–617 (2014). https://doi.org/10.1007/s10663-013-9215-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-013-9215-1