Abstract

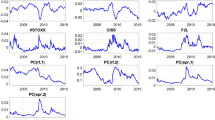

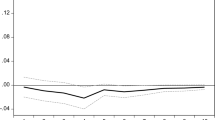

Government bond spreads increased rapidly during the financial turmoil in the euro area. In general, government bond spreads in the euro area are attributed to solvency and liquidity risks and determinants thereof. This paper proposes the use of latent processes to model the time variation present in the evaluation of these determinants. In contrast to approaches using global measures like the US corporate bond spreads or short-term interest rates to approximate time variation, our model is also flexible enough to deal with the unfolding of the financial crisis. The findings suggest that the expected debt-to-GDP ratio explains a major part of the differences in bond yields in the euro area between 2003 and the unfolding of the financial crises. Coefficients for many determinants increased rapidly during the financial crises. Especially market capitalization gained relative importance in winter 2008/2009.

Similar content being viewed by others

Notes

Since risk perception or risk aversion cannot be disentangled by the approaches used in the aforementioned literature and the approach we use we will refrain from differentiating between risk perception or risk aversion. For simplicity we will only use the term risk perception in the following.

Due to the adjustment speeds typically observed in financial markets and the high financial integration of the European monetary union (see Pagano and von Thadden 2004), this assumption seems adequate, especially compared to single equation time-series models.

As noted by Bollerslev (1986), a general test for the presence of GARCH effects is not feasible. Hence, we base the comparison of both model specifications on the Akaike information criterion (AIC) and the difference in log likelihood values. In combination with non-significance of all GARCH parameters, set almost all on the parameter boundary of zero of the parameter space during numerical optimization, neither the AIC nor the log likelihood difference provide any evidence in favor of the GARCH specification.

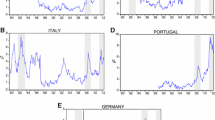

The countries considered are Austria, Belgium, Finland, France, Greece, Ireland, Italy, the Netherlands, Portugal, and Spain.

Data is taken from Thomson Reuters datastream.

This study does not rely on other sources of forecasts, since the European Commission consistently provides data for all variables and countries.

Bid-ask spreads are collected from Bloomberg. We always employ the bid-ask spread of the asset with a maturity closest to ten years.

Attinasi et al. (2009) also apply lower frequent macro variables to explain bond spreads.

Note that in all the figures depicting estimates of β t , we multiplied the coefficients by 100 to obtain an interpretation in terms of basis points.

Based on smoothed coefficients, we calculate the vector of increments \(\hat u_t=\beta_{t|T}-\beta_{t-1|T}\) and their approximate the time-varying covariance using the following formula: \(\Upsigma_t=\alpha \hat u_t \hat u_t' + (1-\alpha) \Upsigma_{t-1},\) with α = 0.05. We divide all of the diagonal elements of \(\Upsigma_t\) by the square roots of the corresponding diagonal elements to obtain the correlation. It turns out that both the correlation between the increments of the coefficients for the outstanding amount of debt securities and the debt-to-GDP ratio and the correlation between the increments of the coefficients for the outstanding amount of debt securities and the budget-balance-to-GDP ratio jumps in absolute terms to above 0.9 in autumn 2008. Thus, the risk perception of these determinants seems to be highly related in this period. Note that a direct single-step MGARCH approach would have allowed a similar analysis. However, we followed a two-step approach with its original assumption of u t that are cross-sectionally independent to circumvent numerical estimation problems often present in MGARCH models.

\(\mathcal{I}\) denotes the unity matrix.

References

Attinasi M-G, Checherita C, Nickel C (2009) What explains the surge in euro area sovereign spreads during the fiancial crisis? European Central Bank, Working Paper Series No. 1131

Barrios S, Iversen P, Lewandowska M, Setzer R (2009) Determinants of intra-euro area governtment bond spreads during the financial crisis. European Economy, Economic Paper No. 388

Beber A, Brandt M-W, Kavajecz K-A (2009) Flight-to-quality or flight-to-liquidity? Evidence from the euro-area bond market. Rev Financ Stud 22(3):925–957

Bernoth K, von Hagen J, Schuknecht L (2004) Sovereign risk Premia in the European government bond market. European Central Bank, Working Paper Series No. 369

Bollerslev T (1986) Generalized autoregressive conditional heteroscedasticity. J Econom 31:307–327

Codogno L, Favero C, Missale A, Portes R, Thum M (2003) Yield spreads on EMU government bonds. Econ Policy 18(37):503–532

Gómez-Puig M (2006) Size matters for liquidity: evidence from EMU sovereign yield spreads. Econ Lett 90(2):156–162

Favero C, Pagano M, von Thadden E-L (2008) How does liquidity affect government bond yields? CEPR Discussion Paper No. 6649

Harvey A, Ruiz E, Sentana E (1992) Unobserved component time series models with ARCH disturbances. J Econom 52:129–157

Haugh D, Ollivaud P, Turner D (2009) What drives sovereign risk premiums? An analysis of recent evidence from the euro area. OECD Economics Department, Working Paper No. 718

Heppke-Falk K, Hüfner F (2004) Expected budget deficits and interest rate swap spreads—evidence for France, Germany and Italy. Deutsche Bundesbank Discussion Paper Series 1, Studies of the Economic Research Centre, No. 40/2004

Jankowitsch R, Mösenbacher H, Pichler S (2006) Measuring the liquidity impact on EMU government bond prices. Eur J Finance 12(2):153–169

King M, Sentana E, Wadhwani S (1994) Volatility and links between national stock markets. Econometrica 62(4):901–933

Manganelli S, Wolswijk G (2009) What drives spreads in the euro area government bond market? Econ Policy 24(58):191–240

Pagano M, von Thadden E-L (2004) The European bond markets under EMU. Oxf Rev Econ Policy 20(4):531–554

Acknowledgments

We are grateful to the editor, two anonymous referees, and the participants of the meeting of the Verein für Socialpolitik in September 2010 for helpful comments and suggestions. We like to thank Christian Werner and Vaclav Zdarek for valueable research assistance and Paul Kramer for carefully proofreading the manuscript.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Modified Kalman filter

The model in Eqs. 1 through 4 can be directly interpreted as a state-space model. The modified Kalman filter needed to calculate the likelihood and to estimate β t is given as follows.

The predicted β t equals the filtered one due to the random walk assumption

Thus, the corresponding variance in the prediction is given as the filtered one plus the variance in the innovations:

If one assumed time invariant variances, \(\Upsigma_{t|t-1}\) would be constant over all t. However, the GARCH process has to be taken into account. Therefore the diagonal elements of \(\Upsigma_{t|t-1}\) follow

where u 2 k,t−1|t−1 is calculated via the filtered expectation and variance as

where filtered values are calculated as follows:

Note that the filtered β t applies simply by adding the predicted β t|t-1 and u t|t . The GARCH process of the ideosyncratic errors is modeled as followsFootnote 12:

where

and

denotes the filtered variance of the filtered errors and

represents the corresponding expectations.

1.2 Approximate partial coefficient of determination

The time-varying coefficient of determination is defined as follows:

whereby \(\widehat Y_t\) denotes the estimated vector of spreads based on the smoothed values of β t . Thus, \(\widehat y_{i,t}=X_{i,t}\beta_{t|T}.\)

The approximate partial coefficient of determination of different variables is calculated as the squared coefficient of correlation of some auxiliary variables. In all cases, the cross-sectionally demeaned spreads are employed, \(y_{i,t}^*=y_{i,t}-\frac{1}{n}\sum_i y_{i,t}.\) Further, a cross sectionally demeaned variable is constructed for each regressor variable, too, \(x_{k,i,t}^*=x_{k,i,t}-\frac{1}{n}\sum_i x_{k,i,t}. \) Note that index k runs from 2 to K as k = 1 represents the constant in Model 1. Correspondingly, a cross sectionally demeaned variable is constructed representing the “rest” of the model: \(z_{k,i,t}^*=z_{k,i,t}-\frac{1}{n}\sum_i z_{k,i,t}, \) whereby z k,i,t is given as X k i,t β k t|T and X k i,t represents all regressors of X i,t without the constant and the variable k.

Afterwards, for each \(k:2\rightarrow K, \) the demeaned spreads \( y_{i,t}^* \) are regressed on \( z_{k,i,t}^* \), and \( x_{k,i,t}^* \) are also regressed on \( x_{k,i,t}^* \). The squared coefficient of correlation between the resulting residual series is used as an approximate partial coefficient of determination.

Rights and permissions

About this article

Cite this article

Aßmann, C., Boysen-Hogrefe, J. Determinants of government bond spreads in the euro area: in good times as in bad. Empirica 39, 341–356 (2012). https://doi.org/10.1007/s10663-011-9171-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-011-9171-6