Abstract

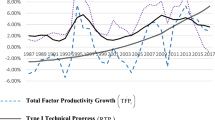

An important economic policy issue is to ascertain when and if technical change (TC) is driving measured growth in productivity. Was this the case for Japan during the late 1980s when a massive financial bubble was being formed? This paper addresses this question, after first further developing methods needed for this purpose. The movement of firms’ TC is of particular policy interest to Japan whose economy has been suffering from a prolonged recession for more than a decade since the burst of the bubble in 1990. In the period of time immediately prior to the burst of the bubble, our estimation results show a significant drop in technical progress. What we believe these results reflect is that Japanese manufacturing firms made excessive investments in production inputs in the years when the bubble was being formed. This excessive investment in inputs did not contribute positively to TC and hence the measured productivity and economic growth of the bubble period in the late 1980s was unsustainable.

Similar content being viewed by others

Notes

TC constitutes an integral part of total factor productivity growth (TFPG) but, as discussed below, TC is not identical to TFPG since the latter contains the effects due to economies of scale.

A financial bubble is defined here to mean that massive increases in asset prices take place in a short while without being accompanied by the corresponding increases in their fundamental value. In the Japanese bubble in the late 1980s the prices of assets such as stocks, land and golf club memberships increased by several hundred percent or more just within a few years but the Japanese CPI stayed virtually unchanged during this period. For example, the Nikkei stock average went up from 11,543 in 1985 to 38,922 in January 1990. It collapsed following the burst of the bubble in that year and came down to as low as 7,907 in 2003. It is still around 16,000. Land prices in Japan followed similar patterns, and they are still below the 1985 level also. All Japanese banks provided loans using these assets with inflated prices as collateral to finance households and firms to buy the assets. As soon as the prices of the assets collapsed, the borrowers ended up with massive loans they could not repay and the Japanese banks ended up with hundreds of billions of dollars worth of bad (non-performing) loans. Many banks, firms and households went broke, and the non-performing loans are still troubling the Japanese banks and companies (particularly in construction and real estate industries) which managed to survive. Japanese manufacturers did their part in the formation of the bubble. They did not do so much regarding the purchase of inflated assets but they did borrow massive amounts of funds and this helped fuel the over-expansion of production capacity.

This question has not been studied in the literature yet, in part because of the difficulty in estimating TC while controlling for scale economies.

The fear of the revival of another financial bubble prevented Japanese government policy makers involved in both fiscal and monetary policy measures from injecting adequate amounts of cash into the economy to cope with the serious post-bubble recession. But the lack of their decisive stimulus measures is thought to have caused the prolonged deflationary trend and less than optimal investment in general.

For example, the knowledge of the presence of solidly positive TC and returns to scale for the Japanese manufacturing industries in the 1990s which we find in this paper might have led to a different (and more stimulating) policy regime than the one that was actually implemented in Japan for coping with the post-bubble recession.

This is because regression equations for isolating scale economies by definition require either output or cost variables on the right-hand side and such variables are often highly correlated with the time trend or price variables.

The methodology here can be easily extended to the case where more than two time periods of cross-sectional data are available.

In order to allow for the possibility of changing production structures over time, our panels consist of just two years each (i.e. T = 2); “rolling” 2-year panels. It is not necessary to have a longer panel length.

Diewert and Nakamura (2007) define and discuss the Malmquist output quantity indexes.

Diewert and Nakamura (2007) explain that the Malmquist output quantity indexes correspond to the two output indexes defined in Caves et al. (1982, p. 1400) and referred to by them as Malmquist indexes because Malmquist (1953) proposed indexes similar to these in concept, though his were for the consumer rather than the producer context. They then go on in the next section to present and discuss Malmquist input quantity indexes. For more on Malmquist indexes, see Balk (2001), Grosskopf (2003), and Färe et al. (1994).

Using the exact index number approach, Caves et al. (1982, pp. 1395–1401) give conditions under which the Malmquist output and input volume indexes equal Törnqvist indexes, as noted also in the OECD (2001) manual on productivity measurement authored by Paul Schreyer, and also in Diewert and Nakamura (1993).

Note that the PU specific price vectors are treated as being given exogenously and are assumed not to depend on the level of production for a PU, though they can vary over the PUs.

In estimating scale economies and TC using aggregate time series, Chan and Mountain (1983), for example, had to estimate 22 unknown parameters using 25 annual observations.

For the particular data sets used, the correlation coefficients calculated for the 18 manufacturing industries are quite small and range between .009 and .025.

We carried out the estimation using both OLS and GLS. Since both estimates are similar, only GLS estimates are presented.

To estimate (3-9), a reference PU must be selected or created, and then the values must be calculated for the Törnqvist index for comparing the input quantities of each of the estimation sample PUs with the input quantities for the reference PU. In this study we have followed the standard method of using as the reference PU a construct (a hypothetical firm) possessing sample average firm characteristics. (See Diewert (1999) for more on this sort of approach and the alternatives.) We also used Törnqvist-type input index values.

The first section of the Tokyo Stock Exchange lists all established Japanese companies which are generally much larger than those listed in the second section (for smaller and less established firms) or the Jasdaq security exchange (for newly created enterprises).

This is measured on a cost basis and includes all expenses other than the expenses for labor, raw material and depreciation.

The numbers of manufacturing firms in our sample for the period 1997–1998 for the industries included in our study are: food (74), pulp (29), printing (19), chemicals (151), plastic products (28), rubber products (16), pottery and ceramics (47), steel and iron (47), nonferrous metals (36), metals (72), general machinery (a) (65), general machinery (b) (108), electric machinery (a) (114), electric machinery (b) (54), transportation machinery (112), precision (35), textile (41) and petroleum and coal products (5). The total number of firms in the sample is 1053.

Also the database we use updates all figures at source so that it contains updated income-statement and balance-sheet items as well as other financial information items for the firms involved in the acquisitions that took place in this section during our sample period.

There were a considerable number of corporate identity changes in the other stock exchanges in Japan where smaller and newer firms concentrate. We have not used these smaller firms because information required for this study is often missing for these firms.

This method is discussed below in this section.

The financial bubble burst in December 1990 (the period 1990–1991 in our tables).

OECD also reports the following business sector TFP growth rates for the periods 1960–1973, 1973–1979 and 1979–1997: 4.9%, 0.7% and 0.9% for Japan; 1.9%, 0.1% and 0.7% for the U.S.; and 3.7%, 1.6% and 1.3% for France.

See Tables B1 in Appendix B for decompositions of TFPG for establishments for 1988–1998.

A number of papers have pointed out that a rapid growth of output is possible over a period of years even though TFP growth during those years is negative. For example, Park and Kwon (1995) attribute the rapid growth of the South Korean economy for the period 1966–1989 to the effects of scale economies in particular while the TFP growth during the same period is often non-existent or negative. Their findings seem to be consistent with Kim and Lau’s (1995) findings that the rapid economic growth of newly industrialized countries in East Asia was accompanied by little indigenously generated TC.

Using aggregate time series data for the period 1961–1980 Tsurumi et al. (1986) also find that Japanese manufacturers spend relatively long periods of time (up to ten years) to adjust their production methods to incorporate new technological requirements. Their findings are consistent with ours.

This means that the cost of operation associated with a firm’s establishments including wage bills and the cost of materials and equipment is about 70% or less of the total budget of the firm. It used to be close to 90% in the 1980s.

As instruments we have used the average annual cash earnings per worker and the depreciation rate for fixed assets plus the average interest rate for one-year term-deposit. Both of these variables vary significantly from one firm to another. We have also used some additional firm-specific instruments including lagged variables and found the results to be robust with respect to the choice of IV instruments.

Both specification tests provided essentially the same test results.

Complete IV estimates are available from the authors on request.

Many policy makers believe, correctly or incorrectly, that these large firms drive Japan’s economic growth.

For example, after having agreed to merge on friendly terms in order to gain international competitiveness, the Mitsui Chemical and Sumitomo Chemical Companies (Japan’s second and third largest chemical firms) decided not to merge last year. Their reason was the incompatibility of the firm-specific management methods of the respective companies.

Permission to be listed on this stock exchange requires a significant amount of accomplishment on the part of the applicant firm. Few firms, once listed, exit from it.

Also the sample size varies only slightly from one period to another for most industries (Table B1).

The variation in the sample size comes primarily from the occasional lack of relevant data for a few companies in each of the industries. The major exceptions are: the petroleum industry in which, because of the substantial rise in oil price in recent years, major mergers took place: the printing industry in which some large firms listed their former divisions involved in printed circuit-related business lines; and the food industry in which some existing firms also separated and listed some of their divisions for new products.

This suggests that the type of variation we have is not correlated with the error terms of our estimating equations.

Such endogenous elements may be generated, for example, by firms’ investment in R&D and firm-specific training of their workers. (e.g., Romer (1990).)

Excessive investment in other sectors such as real estate and property development during the bubble period is another factor which has damaged the Japanese economy.

For example, Japanese manufacturing industries ranging from what many regard as declining industries (e.g., shipbuilding, steel) to traditionally competitive industries (e.g., auto, electronics) have shown persistent resilience in their global competitiveness. Lau (2003), for example, cites as Japan’s continuing comparative advantage the following: capital goods production, complex production processes and R&D capability.

References

Balk BM (1993) Malmquist productivity indexes and Fisher ideal indexes: comment. Econ J 103(418):680–682

Balk BM (1998) Industrial price, quantity, and productivity indices: the micro-economic theory and an application. Kluwer Acad emic Publishers, Boston

Balk BM (2001) Scale Efficiency and Productivity Change. J Prod Anal 15:159–183

Banker RD, Charnes A, Cooper WW, Maindiratta A (1988) A comparison of DEA and translog estimates of production frontiers using simulated observations from a known technology. In: Dogramaci A, Färe R(eds) Applications of modern production theory: efficiency and productivity. Kluwer, New York, pp 33–55

Burgess DF (1974) A cost minimization approach to import demand equations. Rev Econ Stat 56(2):224–234

Caves R, Barton D (1990) Efficiency in U.S. manufacturing industries. MIT Press, MA

Caves DW, Christensen L, Diewert WE (1982) The economic theory of index numbers and the measurement of input, output, and productivity. Econometrica 50(6):1393–1414

Chan NWL, Mountain DC (1983) Economies of Scale and the Törnqvist Discrete Measure of Productivity Growth. Rev Econ Stat 70:663–667

Christensen LR, Jorgenson DW, Lau LJ (1971) Conjugate duality and the transcendental logarithmic production function. Econometrica 39:255–256

Christensen LR, Jorgenson DW, Lau LJ (1973) Transcendental logarithmic production frontiers. Rev Econ Stat 60:28–45

Diewert WE (1974) Applications of duality theory. In: Intrilligator MD, Kendrick DA (eds) Frontiers of Quantitative Economics, vol II. North-Holland Publishing Co., Amsterdam, pp 106–171

Diewert WE (1976) Exact and superlative index numbers. J Econometrics 4(2):115–146, and reprinted as Chapter 8 in Diewert and Nakamura (1993), 223–252

Diewert WE, Fox KJ (2004) On the estimation of returns to scale, technical progress and monopolistic markups. Department of Economics, University of British Columbia, Discussion Paper, pp 04–09

Diewert WE, Fox KJ (2005) Malmquist and Törnqvist productivity indexes: returns to scale and technical progress with imperfect competition. Center for Applied Economic Research Working Paper 2005/03, University of New South Wales

Diewert WE, Lawrence D (2005) Australia’s productivity growth and the role of information and communications technology: 1960–2004. Report prepared by Meyrick and Associates for the Department of Communications, Information Technology and the Arts, Canberra

Diewert WE, Nakajima T, Nakamura A, Nakamura E, Nakamura M (2007) also referred to as DN4, The Definition and estimation of returns to scale with an application to Japanese industries. In: Diewert WE, Balk BM, Fixler D, Fox KJ, Nakamura AO (eds) Price and productivity measurement, Trafford Press

Diewert WE, Nakamura AO (1993) Essays in index number theory, vol I. North-Holland, Amsterdam

Diewert WE, Nakamura AO (2007) The measurement of productivity for nations. In: Heckman JJ, Leamer EE (eds) Handbook of Econometrics, vol 6. Elsevier Science (forthcoming)

Diewert WE (1999) Axiomatic and economic approaches to international comparisons. In: Heston A, Lipsey RE (eds) International and interarea comparisons of income, output and prices. Studies in Income and Wealth. vol 61. University of Chicago Press, Chicago, pp. 13–87

Färe R, Grosskopf S, Norris M, Zhang Z (1994) Productivity growth, technical progress, and efficiency change in industrialized countries. Am Econ Rev 84:66–83

Fisher I (1922) The making of index numbers. Macmillan, New York

Godfrey LG (1988) Misspecification tests in econometrics: the lagrange multiplier principle and other approaches. Econometric society monographs. Cambridge University Press, Cambridge, U.K

Grosskopf S (2003) Some remarks on productivity and its decompositions. J Prod Anal 20:459–474

Hall RE (1990) Invariance properties of Solow’s productivity residual. In: Diamond P (ed) Growth/Productivity/Employment. MIT Press, pp. 71–112

Heckman JJ (1976) The common structure of statistical models of truncation, sample selection and limited dependent variables. Annals of Economic and Social Measurement. December

Heckman JJ (1979) Sample selection bias as a specification error. Econometrica 47:153–161

Jorgenson DW, Nishimizu M (1978) U.S. and Japanese economic growth, 1952–1974: an international comparison. Econ J 88: 707–726

Kim JI, Lau LJ (1995) The sources of economic growth of the east Asian newly industrialized countries. J Jpn Int Econ 8:235–271

Kuroda M, Kawai H, Shimpo K, Nomura K, Hikita K (2003) Structural change and productivity growth in Japan: 1960–2000. Paper presented at the Rieti-Keio conference on the Japanese economy, Tokyo, May

Lau L (2003) The impact of economic development of east Asia, including China, on Japan. Paper presented at the Rieti-Keio conference on the Japanese Economy, Tokyo, May

Malmquist S (1953) Index numbers and indifference surfaces. Trabajos de Estadistica 4:209–242

Milana C (2005) The theory of exact and superlative index numbers revisited. EU KLEMS working paper number 3

Morck R, Nakamura M (1999) Banks and corporate control in Japan. J Fin 54:319–339

Morck R, Nakamura M, Shivsasani A (2000) Banks, ownership structure, and firm value in Japan. J Bus 73:539–569

Nakajima T, Nakamura M, Yoshioka K (1998) An index number method for estimating scale economies and technical change using time-series of cross-section data: sources of total factor productivity growth for Japanese manufacturing, 1964–1988. Jpn Econ Rev 49:310–334

Nakajima T, Nakamura M, Yoshioka K (2001) Economic growth: past and present. In: Nakamura M (ed) The Japanese business and economic system: history and prospects for the 21st century. Palgrave/MacMillan/St.Martin’s Press, New York, pp 13–40

Nakamura A, Nakamura M (1981) On the relationships among several specification error tests presented by Durbin, Wu and Hausman. Econometrica 49:1583–1588

Park S-R, Kwon JK (1995) Rapid economic growth with increasing returns to scale and little or no productivity growth. Rev Econ Stat 77:332–351

OECD (2001) Measuring productivity: measurement of aggregate and industry-level productivity growth. Organisation for Economic Co-operation and Development, Paris

Romer P (1990) Endogenous technological change. J Polit Econ 98:71–102

Theil H (1965) The information approach to demand analysis. Econometrica 33:288–293

Törnqvist L (1936) The bank of Finland’s consumption price index. Bank of Finland Monthly Bulletin 10:23–55

Tsurumi H, Wago H, Ilmakunnas P (1986) Gradual switching multivariate regression models with stochastic cross-equational constraints and an appllication to the KLEM translog production model. J Econ 31:235–253

Yoshioka K, Nakajima T, Nakamura M (1994) Sources of total factor productivity, Keio Economic Observatory. Keio University, Tokyo

Acknowledgements

Research in part supported by research grants from the Social Science and Humanities Research Council of Canada. We thank the editor and an anonymous referee for their helpful comments in revising the original version of the paper.

Author information

Authors and Affiliations

Corresponding author

Appendices

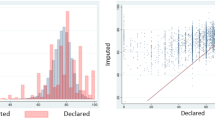

Appendix A. Descriptive statistics

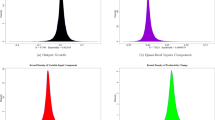

Appendix B. Decomposition of TFP Growth

Rights and permissions

About this article

Cite this article

Nakajima, T., Nakamura, A., Nakamura, E. et al. Technical change in a bubble economy: Japanese manufacturing firms in the 1990s. Empirica 34, 247–271 (2007). https://doi.org/10.1007/s10663-007-9040-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-007-9040-5