Abstract

Network neutrality regulations are intended to preserve the Internet as a non-discriminatory, public network and an open platform for innovation. Whereas the U.S. reversed its regulations in 2017, returning to a less strict regime, the EU has maintained its course and recently revised implementation guidelines for its strict and rather interventionist net neutrality regulations. To this day, there exist only a few empirical investigations on the impact of network neutrality regulations, based on rather broad measures of investment activities for individual countries. Our paper provides the first estimation results on the causal impact of net neutrality regulations on new high-speed (fiber-optic cable-based) infrastructure investment by Internet service providers. We use a comprehensive and most recent OECD panel data set for 32 countries for the period from 2000 to 2021 covering the entire high-speed broadband network deployment period. We employ various panel estimation techniques, including instrumental variables estimation. Our empirical analysis is based on theoretical underpinnings derived from a simplified model in a two-sided market framework. We find empirical evidence that net neutrality regulations exert a significant and strong negative impact on fiber investments. Our results suggest that, while we cannot provide evidence on the overall welfare consequences of net neutrality, imposing strict net neutrality regulations clearly slow down the deployment of new fiber-based broadband connections.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

What regulatory rules are required to preserve the Internet as a non-discriminatory, public network and a platform for innovation? For almost two decades, this question has been at the centre of one of the most protracted controversies in the history of modern telecommunications: the network neutrality debate. While the origins of the debate can be traced back to the late 1990s and discussions about open access, it was law scholar Tim Wu (2002, 2003) who coined the term ‘network neutrality’ and the underlying narrative that the codification of non-discrimination principles is necessary to safeguard an open Internet.

While there has never been a generally accepted definition of what network neutrality entails (e.g., Krämer et al., 2013), a continuum of interpretations and a variety of regulations have emerged over time. Proponents of network neutrality regulations argue that the introduction of such rules is imperative in order to prevent gatekeeping broadband Internet service providers (ISPs) from selectively discriminating against (unaffiliated) content providers (CPs) by means of unreasonable network management and/or pricing, safeguard consumer choice, and maintain the public Internet as an open platform that facilitates permissionless innovation; opponents contend that such harmful behaviour cannot be expected. Rather, they argue, such regulations would unduly restrict the entrepreneurial freedom and lead to distorted investment decisions and innovation incentives. By 2015, after almost a decade of back-and-forth, both the EU and the U.S. had imposed strict forms of network neutrality regulations. Beyond imposing transparency rules, these regulations codified rules to prevent discriminatory behaviour and thus unreasonable network management. While some developed countries, like New Zealand and Australia, never implemented network neutrality regulations in the first place,Footnote 1 the U.S. reversed their regulations in 2017, thus returning to a less strict regime based mainly on transparency obligations. The EU, however, has maintained its course and recently published the second version of its net neutrality implementation guidelines (BEREC, 2020).

In contrast to the strong visions embedded in strict network neutrality regulations in the EU and some other OECD countries, clear evidence of the impact of net neutrality regulation on firm decisions does not exist thus far. This is remarkable, as net neutrality regulations represent a major market intervention with ambiguous welfare effects for key economic stakeholders in the Internet ecosystem (CPs, ISPs, and users). Numerous theoretical contributions have examined various trade-offs related to net neutrality regulation, in particular, its effects on network investments, content innovation, and social welfare (Easley et al., 2018; Greenstein et al., 2016). However, there still do not exist studies empirically assessing the welfare effect of net neutrality regulations, while only a very few (and mostly U.S.-based) studies provide evidence on its impact on ISPs’ network investment using rather broad measures of investment. This paper aims to contribute to this stream of analyses by providing first empirical results on the causal impact of net neutrality regulations on ISP platforms’ investment using a comprehensive and recent OECD panel data set for 32 countries for the years from 2000 to 2021 which covers the entire fiber deployment period. Our main dependent variable measures investment activities by ISPs in terms of newly installed fiber-based broadband connections. To obtain our main variable of interest, i.e., net neutrality regulations implemented in a particular OECD country, we reviewed past regulatory decisions and constructed indicator variables measuring the year of implementation of net neutrality regulations as well as the year of the first official announcement of intended measures in proposals or other official draft documents.

In order to identify causal effects, we employ panel data estimation techniques, including instrumental variables. We first explore a scenario in which we assume that decisions to implement or withdraw net neutrality regulations have been made by politicians who do not observe on a day-to-day basis relevant market outcome variables, but rather decide according to ideological and partisan views and in light of bureaucratic goals. We then relax the assumption that net neutrality regulations are uncorrelated with idiosyncratic error terms and re-estimate our empirical specification using two-stage least square estimation. Since net neutrality regulations have been implemented on the basis of political decisions, political economy variables should have strong predictive power. Accordingly, we employ measures of political orientation, government intervention, and the international state of net neutrality regulations as exogenous sources of variation.

In view of the core arguments of net neutrality proponents and opponents, as well as the main trade-offs identified in the relevant economics literature, we aim to investigate the following research question: Do net neutrality regulations lower the incentives of ISPs to invest in new fiber-based network infrastructure (as suggested by net neutrality opponents)?

We find that net neutrality exerts a negative impact on fiber investment. This empirical result indicates that strict network neutrality regulations slow down investment in fiber-based broadband connections and thus also indirectly on related subscriptions of consumers. Though we cannot provide an overall assessment on the effect of net neutrality regulations on social welfare, which would also have to take into account the impact on content provision and prices consumers have to pay for high-speed broadband connections, our main result indicates that net neutrality regulations seriously impact the deployment of general-purpose broadband infrastructures which generate considerable externalities across a wide range of sectors of the economy (Akerman et al., 2015; Briglauer & Gugler, 2019; Czernich et al., 2011; Lobo et al., 2020).

The remainder of this article is structured as follows. Section 2 provides an overview of the related theoretical and empirical literature. Section 3 discusses the relevant institutional background and provides a description of net neutrality regulations and historical developments, with a special focus on the EU and U.S. Section 4 then outlines our empirical specification and identification strategy. Section 5 characterizes our OECD panel data set. Section 6 discusses our main estimation results, while the final section concludes with a review of our main findings and most relevant policy implications for the ongoing debate.

2 Literature review and predictions

Economists approached the topic of network neutrality regulations somewhat belatedly. Scholars from other fields, such as law and computer science, had recognized the relevance of the topic earlier (Faulhaber, 2011). In the meantime, however, a considerable body of theoretical economic literature has formed. Acknowledging the large amount of literature, which has been summarized in several surveys, we briefly review the main findings from related economic theory models based on two-sided market frameworks in Sect. 2.1. In this Section we also briefly report the main results of a two-sided model we developed and presented in Appendix 1. In contrast, the empirical literature is still very scant, and is reviewed comprehensively in Sect. 2.2.

2.1 Theoretical contributions and predictions

A majority of the theoretical economic literature explores the impact of network neutrality regulations on market outcomes by applying game-theoretical analyses in the context of two-sided market frameworks. While typically investigating the effects of vertical control by ISPs, this literature conceptualizes network neutrality regulations as strict forms of ex-ante market interventions—either imposing traffic regulations that instate an egalitarian regime in which ISPs are legally obliged to treat all traffic equally, or else banning ISPs from charging CPs termination fees (i.e., positive prices for the delivery of content and applications to users). The impact of network neutrality regulations is then assessed based on the comparison of two different scenarios. One presents a ‘neutral’ scenario in which strict network neutrality is legally enforced and ISPs offer a single ‘best-effort’ service to all CPs. Price and quality differentiations are excluded. This scenario is compared with a second one in which ISPs can deviate from the best-effort service model. In addition to a best-effort-type basic and free service class, ISPs offer CPs prioritized traffic delivery via a premium service class against a fee. In these model frameworks, ISPs can – absent network neutrality regulations – freely enter into contractual agreements with CPs.

Schuett (2010), Sidak and Teece (2010), Faulhaber (2011), Krämer et al. (2013), Greenstein et al. (2016), Easley et al. (2018) and Jamison (2019) provide excellent reviews of this strand of literature. The model approaches typically assume imperfect competition and market structures characterized by monopolistic or duopolistic ISPs, which act as gatekeepers between CPs on one market side and users on the other. While the models explore different trade-offs related to market outcomes like social welfare, network investment, (content) innovation, and consumer prices, they vary with regard to the underlying modelling assumptions (e.g., concerning revenue models or traffic architectures and whether or how congestion and traffic stochastics are taken into account) and the market structures on the CP market side and the market for ISPs.

Choi and Kim (2010) is the first paper to examine investment under a strict network neutrality regime. The authors consider a monopolistic ISP and duopolistic CP market in a Hotelling framework and find that capacity expansion might decrease the sale price of the priority right under the discriminatory regime, leading to ambiguous effects on ISPs’ investment.Footnote 2 Another paper that examines the impact of network neutrality on ISP investment incentives is Cheng et al. (2011). The authors consider a setting of a monopolistic ISP and duopolistic CP market in a Hotelling framework and find that – “except in some specific circumstances” (Cheng et al., 2011, p. 60) – investment incentives for the ISP are higher under net neutrality. ISP’s investment incentives were also examined in Baranes and Vuong (2020). In their model, a monopolistic ISP could technically provide separate quality upgrades to two vertically differentiated CPs. The authors show that ISP provides asymmetric quality upgrades, in favor of the high-quality CP. However, this practice increases the degree of content differentiation, softening competition between the CPs. Their main result is that ISP’s investment level is higher if the ISP can charge the CPs, but this regulatory option might negatively affect CPs’ competition and the overall welfare.

Other papers adopted an oligopolistic setting both in the ISPs’ and CPs’ markets. Bourreau et al. (2015) analyze how the change from a strict network neutrality regime to a ‘discriminatory regime’ impacts social welfare, ISPs’ investments, and CPs’ innovation. Examining the case of two competing and horizontally differentiated ISPs and heterogeneous CPs, the authors find that removing a strict net neutrality regime would lead to higher ISP investments, more innovation by CPs, and increased social welfare. Similarly, Njoroge et al. (2017) also examine investment incentives of ISPs under both a neutral and non-neutral network regime. The authors model two interconnected ISPs competing over quality and prices for heterogenous CPs and heterogeneous consumers. They show that ISPs’ quality-investment levels are driven by the trade-off between softening price competition on the consumer side and increasing revenues extracted from CPs. Since in the non-neutral regime, ISPs can extract surplus through pricing CPs, ISPs’ investment levels are higher.

In Appendix 1, we also present a simplified model to capture the effect of network neutrality on ISPs’ investment incentives in presence of both a monopolistic or oligopolistic ISPs segment. We expand the model by Economides and Tåg (2012) by incorporating ISP investment to upgrade the network by deploying fiber-optic cable infrastructure in the access network. Such network investments increase broadband capacity and the quality characteristics of broadband services and applications, thus allowing CPs to offer better service and customer experience and more content to users. Our results show that both in a monopolistic ISP setting, ISP investment incentives are higher under a paid regime than under strict network neutrality in which no payments between CPs and ISPs are permitted. Instead, results are more ambiguous in an oligopolistic setting. ISPs’ investment is higher under the conditions that CPs value additional users more highly than users value additional CPs. Intuitively, in the presence of unrestricted duopolistic competition, ISPs compete to attract both users and CPs. On the one hand, investing in high-speed broadband infrastructure is fundamental to providing more capacity to both users and CPs, thus increasing market share. On the other hand, more intense competition attracts more users and this, in turn, attracts more CPs via cross-side externalities, especially when the value of an extra user for CPs is larger than the value of an extra CP for users. When the opposite case emerges, i.e. CPs value additional users less than users value additional CPs, however, our model results point out that net neutrality regulation does spur investment by ISPs, reverting the previous results. While we intentionally kept the model as simple as possible regarding the assumed market characterization and specification of the NN regulation as a strict zero-price rule à la Economides and Tåg (2012), our model emphasizes the relevance of the trade-off between net neutrality regulations and ISP investments and the need for sound empirically assessments.

2.2 Empirical contributions

Table 1 provides an overview of the available empirical evidence. Most contributions investigate the impact of net neutrality regulations on network investment. Existing evidence is mostly based on U.S. data using (too) broad measures (such as CAPEX) for investment, which are only indirectly impacted by net neutrality regulations. All available contributions find a negative impact of such regulations on network investment, which is also broadly in line with the theoretical analysis.Footnote 3 Only Lee and Kim (2014), as well as Layton (2017), use non-U.S. based data – from South Korea and two EU countries (Denmark and the Netherlands), respectively – to examine the impact on content innovation and social welfare. Due to this limited number of investigations, however, there is no conclusive evidence with respect to these outcome variables.

Reliable empirical evidence on the various channels of net neutrality regulation is very limited, even more when focusing on empirical studies with a reliable identification strategy. We use an insrumental variables (IV) approach by implementing political variables as identification of the decision to adopt net neutrality.

3 Institutional background

3.1 Scope of net neutrality regulations

Beyond imposing transparency requirements, network neutrality regulations codify conduct rules for the Internet to safeguard non-discrimination in, and the openness of, the public Internet. For the sake of preventing access ISPs from selectively discriminating against CPs (e.g., through the blocking of lawful content, throttling of traffic of unaffiliated CPs, or paid prioritization), these regulations introduce traffic rules that draw a dividing line between reasonable and unreasonable and thus prohibited forms of network management and pricing. In the economic literature, such regulations have been mainly conceptualized via two definitions: a ‘non-discrimination rule’ (NDR) and a very basic zero-price rule (ZPR) (Schuett, 2010, pp. 1, 2; Greenstein et al., 2016, p. 128). The NDR implies an egalitarian traffic regime in which there is no traffic prioritization. It is intended to prevent network management practices by ISPs that could be used to discriminate against specific CPs, e.g., based on the selective treatment of affiliated CPs or the degradation of non-affiliated CPs. The ZPR implies that ISPs must not charge CPs a termination fee for the (prioritized) delivery of traffic.

Modern broadband platforms support the delivery of more than just access to the Internet. Relevant capacities are shared between different types of services. Broadly speaking, one can distinguish between three distinct service types (Stocker, 2020). First, there are (non-IP) legacy services like voice telephony or cable television service. These services are not IP-based and are not considered Internet services. They are not subject to network neutrality regulations. Second, there are broadband Internet access services. These services provide users with Internet connectivity. They facilitate access to the global Internet population and the evolving range of content of the public Internet. This service category constitutes the focal point of the regulatory intervention of network neutrality rules, which restrict the scope of negotiations between ISPs and CPs regarding the delivery and/or pricing of content and application services and thus the entrepreneurial freedom of ISPs to introduce price and quality differentiations. Third, there are specialized services. Although similar in many respects to broadband Internet access services, other IP-based services (i.e., specialized services) are exempt from the same rules. These services are ‘private’/‘closed’ and available only to a subset of the Internet population. They are inherently application-specific and often rely on the heavy use of network management. Thus, the heterogeneous and stringent requirements regarding the quality of traffic delivery – as become relevant for a widening range of applications and use cases (e.g., IPTV, VoIP, Tactile Internet, or the IoT) – can be met in a customized fashion. The role of specialized services will increase in view of the anticipated role of purpose-built network slices in the context of next generation mobile access networks like 5G and beyond. The emergence of 5G and the rise and evolution of clouds (e.g., content delivery networks, CDNs) further imply that growing numbers of servers – and thus content, applications, and computing resources – are being moved closer to users. Servers are increasingly deployed within the networks of access ISPs, potentially rendering corresponding services more private, intra-ISP services. Taking these developments into account, the line between what is considered public Internet or private networking, and the distinction between services that are subject to the rules and those that are not, are becoming increasingly blurred (Stocker et al., 2020).

Figure 1 below illustrates the main market players involved, traffic flows, as well as actual and potential payment streams subject to net neutrality regulations, in a stylized fashion. ZPR and NDR rules apply only to access ISPs and more specifically to the ‘Broadband Internet Access Services’ they offer.

3.2 A concise history of net neutrality regulations in the EU and the U.S.

The first efforts to impose network neutrality in the U.S. can be traced back to a set of guiding principles for the conduct of ISPs that was presented in 2005 (FCC, 2005a; b). In 2010 the FCC adopted its Open Internet Order (OIO), instating transparency regulations and a regulatory market split: broadband Internet access services were subject to strict conduct rules while other IP-based services (i.e., specialized services) were exempt from these rules. A court decision found in 2014 that the FCC lacked the authority to implement such rules. This decision motivated subsequent efforts by the FCC – dominated by a Democratic majority – to reclassify relevant broadband services as a ‘telecommunications service’, thus assuming the authority to impose common carriage, utility-style regulation. In 2015, the FCC adopted the new Open Internet Order (FCC, 2015), which instated this reclassification as well as three net neutrality rules (no blocking, no throttling, no paid prioritization) and a general conduct rule to impose a non-discrimination standard. With President Trump taking office in 2017, and a shift in party majority within the FCC, the reclassification decision and strict network neutrality rules of the 2015 OIO were reversed in 2018 (FCC, 2018). The order is still active but has become the subject of debate once again under President Biden. Democratic FCC Chairwoman Jessica Rosenworcel is committed to bring back 2015 OIO-style net neutrality regulations.Footnote 4

Initially, the regulatory stance towards network neutrality was fundamentally different in the EU. The revised regulatory telecoms framework of 2009 contained a Declaration on Network Neutrality and introduced a set of comparatively soft regulations to deal with network neutrality issues via transparency rules (EC, 2009). After a series of member states began to consider the introduction of national network neutrality regulations, with Slovenia and the Netherlands introducing national legislation, the European Commission changed course. Arguably driven by the intent to prevent regulatory fragmentation within the Digital Single Market (Marcus, 2016, pp. 265–270), in 2013, the EC issued a proposal for a regulation that subsumed network neutrality regulations, aiming to implement enhanced transparency rules and a regulatory market split that contained strict network neutrality regulations. In 2015, Regulation (EU) 2015/2120 (European Union, 2015) was adopted. It reinstated harmonization among net neutrality regimes within the EU member states. In the fall of 2016, BEREC, the Body of European Regulators for Electronic Communications, released their first guidelines for the implementation of the regulations (BEREC, 2016), which have been revised in the meantime (BEREC, 2020). The regulation is still in force, which marks a fundamental difference from the situation in U.S. for the years from 2018 to 2021.

4 Regression framework

4.1 Empirical specification

In order to answer our research question, we estimate empirical models of investment in new (fiber-based) broadband access capacities (fiber_inv). Considering the relationship between fiber investment and fiber subscription, the former is logically a pre-condition for the subscription decision of consumers. Note that the subscription decision depends on new content innovation as willingness to pay for the “fiber-premium” is determined by the incremental benefit consumers derive from innovative applications and services that can be delivered only via high-speed broadband Internet access. The consumer’s subscription decision does not depend directly on net neutrality regulations, denoted with NNR, however, NNR indirectly exerts an impact on fiber subscription by affecting ISP investment incentives (see Eq. (11) and (19) in Appendix 1). In our empirical analysis we conduct Granger causality tests to examine this relationship but also a potential feedback mechanism from the number of subscriptions on investment.

Our empirical estimation equation for fiber investment for OECD country i in year t read as follows:

Since we use the logarithm of our dependent variable measuring fiber investment, the estimation results are interpreted as percentage changes, which facilitates cross-country comparisons. Also, residuals for fiber investment data in levels are positively skewed. The binary variable NNR indicates whether net neutrality regulations (as described in Sect. 3) were introduced in a certain OECD country in a specific year; no neutrality regulation represents the base category. Note that the presence of net neutrality regulations cannot be measured as a continuous variable, it rather represents a discretionary choice of legislators at the national or EU level. The coefficient on the net neutrality variable, α2, in Eq. (1) can be used to answer our research question. As we do not have all the necessary data to estimate equilibrium conditions as outlined in Appendix 1 we can only test the shift effect of introducing net neutrality regulations. Identifying the direction of the overall effect is, however, sufficient in view of our research question and allows us to derive essential policy implications.

We include a lagged dependent variable since large infrastructure projects, like fiber-based broadband deployment, can take years to complete in practice due to rigidities (Briglauer, 2015; Briglauer et al., 2018). The dynamic specification of Eq. (1) can also be empirically tested. If α1 is equal to 0, then there are no dynamics, whereas coefficient estimates between 0 and 1 are consistent with a dynamic adjustment process that leads to a steady state. Note that 1 − α1 measures the speed of investment adjustment and the coefficients for the long-run (static) relationships can be derived from the dynamic model as α2/(1 − α1) (Briglauer et al., 2018; Grajek & Röller, 2012). Equation (1) further contains a vector of covariates, Xit. We add fixed effects (αi) to capture time-invariant heterogeneity within countries and period effects (αt). Finally, εit represents an additive error term.

4.2 Identification strategy

First, in view of the potentially strong role of fixed effects as a determinant of broadband deployment, we start with an ordinary two-way fixed effects (FE) estimator. The fixed effects model ensures that individual country-level effects capture any time-invariant unobserved heterogeneity that is possibly correlated with the regressors. To obtain consistent estimates for the vector of coefficients, this specification requires strict exogeneity which represents a strong identifying assumption in general. However, major cost determinants of broadband investment, such as costs of civil engineering and network construction, are impacted by topographical factors such as ground conditions and stable regulations, including rights of way and provisions on network cooperation. These factors show either no or only very low variation over time and are therefore largely captured by the fixed effects (Briglauer et al., 2018). Furthermore, broadband infrastructure upgrades are subject to rather long investment horizons; hence, both represent a long-run decision that relies on the expectation of stable market conditions.

Period effects cover common shocks, such as macroeconomic business cycles, that are (to a large extent) common to all OECD countries, which already exhibit by their member status rather similar levels of economic development. Controlling for country fixed and period effects thus already provides strong support for the ‘selection on observables’ identifying assumption. In a similar vein, Akerman et al. (2015), examining basic broadband investment, summarize as follows: “We find that 89% of the variation in broadband coverage can be attributed to time-invariant municipality and industry characteristics and common time effects, while less than 1% of the variation in broadband coverage can be attributed to a large set of time-varying variables.”

Second, as shown in Sect. 3.2, net neutrality policy decisions have been subject to strong ideological and partisan views. An extreme case is the sequence of past net neutrality policy decisions in the U.S., where the nature of the debate surrounding net neutrality has been unusually partisan for an ICT issue (Jamison, 2019). Whereas the U.S. regulatory authority introduced strict net neutrality regulations in 2015 – the three Democratic commissioners voted for the 2015 decision and the two Republican commissioners voted against it – the decision was effectively vacated in 2017 when Republicans gained a 3:2 majority at the FCC. Despite Chairwoman Rosenworcel’s commitment to bring back 2015 OIO-style net neutrality regulations, the pending confirmation of the 5th FCC commissioner is currently delaying law making in this matter (DiMolfetta, 2022). Similarly, in other OECD countries, and within EU member states in particular, the shift in net neutrality regulations can be seen as an outcome of a political decision-making process such as bureaucrats striving to maximize harmonization within the EU. This bureaucratic goal is apparently not driven by relevant market variables such as investment, innovation, or subscription choices. Also, politicians do not observe on a day-to-day basis relevant market outcome variables and therefore do not react to market shocks. In that sense, our binary indicator variable measuring net neutrality regulations represents a political economy variable, which is presumably exogenous with respect to market decisions.

Third, to deal with remaining endogeneity concerns related to time-variant heterogeneity, we perform two-way fixed effects regressions with external instrumental variables. Using several instrumental variables not only allows us to test the validity of instruments but also our presumption of net neutrality regulations being an exogenous policy variable.

Whereas the partisan influence on net neutrality regulations has likely not been as strong in all OECD countries, left-wing political parties tend to exhibit a stronger preference for regulations and equality concerns in general (“free Internet for all”), whereas right-wing parties tend to prefer deregulation and market-driven outcomes. Accordingly, a variable measuring right- and left-wing political majorities should be an informative predictor of whether or not net neutrality regulations are implemented in a certain country. Similarly, we employ measures of the overall degree of governmental intervention in a certain OECD country. The higher the degree of overall public intervention, the greater the extent of sector-specific intervention such as net neutrality. These variables represent political economy variables at the national level. Finally, the discussion in Sect. 3.2 identified international spillover effects of net neutrality regulations, which have affected most of the developed countries since the early 2000s. Although these spillover effects might not induce policy debates and decisions in all regions, they have certainly impacted policy debates and decisions within supranational regions and similar jurisdictions.

Finally, the inclusion of a lagged dependent variable as a right-hand side regressor in Eq. (1) introduces another source of endogeneity. Estimating our baseline equations by means of an ordinary FE estimator would yield inconsistent and biased results, since the lagged dependent variable and the error terms would be correlated (Nickell, 1981). For this reason, we also employ a bias-corrected fixed-effects estimator (FEC), developed by Bruno (2005a, b) for dynamic and potentially unbalanced panel data, and a small number of cross-sectional units (N = 32).Footnote 5

5 Data

We investigate the effects of net neutrality regulations in 32 OECD countries using panel data for the years from 2000 to 2021. Note that our period of analysis covers the entire fiber-based broadband deployment period, which started with some early projects in Sweden, Norway, Japan and South Korea. The source for our dependent variables (Sect. 5.1) is the database of the FTTH Council Europe, which includes annual numbers of deployed fiber-based broadband connections for all OECD countries. Our main independent variable of interest, i.e., implemented net neutrality regulations in a particular OECD country, is constructed as a binary indicator based on our own research (Sect. 5.2). Finally, we use several other data sets for our control and instrumental variables (Sects. 5.3 and 5.4). All sources and variable definitions are described in detail in Table 4, while descriptive statistics are provided in Table 5 in Appendix 2. Because a few values are missing, there are fewer than the maximum number of observations.Footnote 6

5.1 Dependent variables: fiber investment and subscription

Our dependent variable measures relevant fiber investments by local access ISPs in logarithmic form, denoted with ln(fiber_inv). Fiber investment is measured in real terms as the absolute number of connections deployed, representing newly installed fiber-based broadband Internet access capacity in a given country. In contrast, fiber subscription measures the absolute number of subscribing consumers and businesses who show a willingness to pay for new high-speed broadband access and related content and services under a commercial contract.

We include all relevant fiber-based broadband technologies, which either deploy fiber-optic cables directly to the premises of consumers (homes or offices) or partly rely on old (‘legacy’) copper wire and coaxial cable connections in the remaining segment of the access network (‘hybrid fiber’) connecting the customer premises with the last distribution point. From that point on, all data transmission is fiber-based (see Table 4 in Appendix 2 for further technical details). Note that, instead of using broad investment measures such as CAPEX, we have a physical measure of investment, i.e., new fiber-based lines related to ISP local access networks, which are subject to net neutrality regulations (Sect. 3.1).

5.2 Main explanatory variables: net neutrality regulations

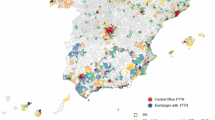

30 out of 32 selected OECD countries implemented net neutrality regulations as described in Sect. 3.1 during the period of analysis. Only Australia and New Zealand opted not to implement any net neutrality regulations during this period.Footnote 7 In all other OECD countries, there have been some kind of net neutrality regulations imposed for at least one year during the period from 2000 to 2021. Note that strict net neutrality regulations in terms of ZPR and/or NDR also include soft regulations such as codes of conduct or transparency regulations. The dummy variable NNR hence takes on value 1 if legally binding net neutrality regulations are implemented in country i in year t (and 0 otherwise). The date of the net neutrality regulations is based on the time of rulemaking via national or, in the case of EU member states, supranational legislation. As investment decisions are subject to strong rigidities, we also include lagged values of our net neutrality variable (L.NNR) in estimating Eq. (1). Moreover, if firms correctly anticipated (and responded to) future implementation of net neutrality regulations, then the effects of currently implemented regulations would underestimate the true total effect of net neutrality regulations. For this reason, we also consider the impact of the first public announcement of proposed net neutrality regulations and related expectation effects (NNR(expect)). Table 6 (Appendix 2) provides a detailed overview of net neutrality regulations in individual OECD countries with their respective year of rulemaking, date of first announcement, and sources.

5.3 Control variables

All control variables are described in detail in Table 4 of Appendix 2. The vector of investment covariates, Xit, contains measures of macroeconomic conditions relevant for the investment decision, including the long-term interest rate, lt_ir, and the investment freedom, free_invest, of a country. Deployment costs are determined by population density, pop_dens, in view of the strong role of economies of density in broadband deployment, and average wages, wages, capturing the costs of civil engineering work as construction work represents by far the largest share of total deployment costs. Investment further depends on market structural characteristics, such as the degree of competition among wireline cable TV broadband infrastructures, cable_comp, and from wireless broadband (mobile) networks, mobile_comp, as well as potential revenues captured by the average price level for telecommunications services, telecom_prices, and the potential market size proxied by basic broadband subscriptions, basic_broadband.

5.4 Instrumental variables

In order to capture the outcome of political election processes at EU and national levels, we grouped political parties into two ideologically distinct groups of “(rather) left-wing” and “(rather) right-wing”. The variable left_wing measures the share of the population of country i in year t voting for (rather) left-wing parties (Grajek & Röller, 2012). For all EU member states, the share is determined by the share of elected representatives joining a certain faction of the European Parliament. The different factions are then classified as (rather) left- or (rather) right-wing and the respective shares are cumulated. For all other (non-EU) countries, the political parties elected in the national parliamentary elections are classified as (rather) left-wing or (rather) right-wing. Table 7 (Appendix 2) provides an overview of country-specific sources. As another sort of political economy variable at the national level, we proxy governmental intervention in fiber deployment with the variable gov_spend, which measures the overall degree of governmental spending in the economy. We expect that more left-leaning governments, as well as governments showing higher levels of public spending, will favour regulatory measures such as interventionist net neutrality regulations.

Finally, we construct Hausman-type spatial instruments as another sort of a political economy variable at the international level. As the discussion in Sect. 3.2 illustrated, net neutrality regulations and the corresponding debates were subject to strong regional spillover effects. In view of the historical development of net neutrality regulations, we distinguish the following regions into which we categorize OECD countries accordingly: Europe, Americas, Australia & New Zealand, and Asia. Spatial instruments are then defined as the ratio of implemented (announced/proposed) net neutrality regulations in all other countries within a certain region (i.e., other than the focal country i) to the total number of other (i.e., non-focal) countries in that region and denoted with NNRi≠i (NNR(expect)j≠i).

6 Empirical results

Two-way fixed effects estimation results for the fiber investment equation are reported in Table 2.Footnote 8 In all the specifications, the coefficient of the lagged dependent variable is positive, but smaller than one, and highly significant, which means that investment is indeed subject to significant adjustment costs as expected. As described in Sect. 5.2, an ordinary FE estimator would yield inconsistent and biased results, since the lagged dependent variable and the error terms would be correlated (Nickell, 1981). It can be shown that OLS and FE estimators are likely to be biased in opposite directions in autoregressive models (Bond, 2002). Whereas OLS leads to upward biased estimates of the coefficient of lagged dependent variables, since the values of the lagged dependent variable are positively correlated with the omitted country fixed effects, FE estimates are downward biased for small T. Hence, if the dynamic model in Eq. (1) is correctly specified, the true coefficient estimates are between OLS and FE estimates. Comparing the respective coefficient estimate in regressions (1) to (3) to those in (5) to (6) in Table 2, we can indeed infer that the bias corrected (FEC) estimates lie within the interval of FE and OLS estimates. Also, the ‘dynamic bias’ introduced by including a lagged dependent variable appears to be not too severe and can thus be neglected in the further analysis of the causal effect of net neutrality regulations.Footnote 9

The coefficient estimates of our main variable of interest, i.e., net neutrality regulations (NNR), point to a negative impact on fiber investment in all regressions in Table 2. Whereas the contemporaneous impact of implemented net neutrality regulations (NNR) and the coefficient of the variable reflecting expectations due to announcements of net neutrality regulations NNR(expect) are insignificant, the coefficient estimate of the lagged net neutrality variable (L.NNR) is significant at the 5% level in all FE regressions in regressions (1) to (4). As our net neutrality variables exhibit collinearity, we also conducted joint hypotheses tests. According to F-statistics tests (not reported), the group of net neutrality variables is jointly significant at the 5% level. Individual significance tests indicate that the negative impact of net neutrality does not immediately manifest in current investment plans of ISPs but only with some delay due to considerable rigidities in broadband deployment. The extent of this effect is, however, substantial. The respective coefficients of the lagged net neutrality variable in regressions (1) to (4) suggest that the introduction of NNR leads to a total decrease in new fiber investments by ISPs of about 22–25%.Footnote 10 We further examine whether net neutrality regulations might also capture regulatory intensity in general, the latter appears to be particularly strong under the EU regulatory framework. For this reason, we have also conducted regression (4) for the subset of European OECD states only. The respective coefficient estimates on the lagged net neutrality variable appears to be slightly higher ( − 0.268 in regression (4) vs. − 0.256 in regression (2)) for European countries and thus provides some, albeit weak, support for our presumption.

Finally, we also interacted the net neutrality variables with the coefficient of the lagged dependent variable to test whether net neutrality also shows an impact on the speed of adjustment. The corresponding estimation coefficients were consistently insignificant (results not shown but available upon request). That is, while the desired capital stock decreases once but permanently by about 25%, there is, in contrast, no difference in the adjustment process to the long-term equilibrium. The adjustment process is driven by cost considerations of network deployment or regulatory hurdles (rights of ways, access regulations, etc.). Net neutrality regulations have no impact on these costs and factors of inertia.

All control variables in the fiber investment equation exhibit the expected signs when significant, which further reaffirms that our estimation equations are valid. Moreover, taking into account all controls, along with country fixed effects and period effects, our FE fiber investment estimation equation explains about 92% of the total within variation.

Regarding the identification of causal effects of NNR variables in the fiber investment equation, we further deal with remaining endogeneity concerns related to time-variant heterogeneity due to omitted variables by employing several sources of exogenous variation from instrumental variables (IV), as described in Sect. 4.2. Table 3 below reports the corresponding results of FE-IV estimations for the fiber investment equation where regressions (1) to (5) vary with respect to the number of observations and sets of included control and instrumental variables. Importantly, one can infer that all coefficient estimates of the lagged variable, L.NNR, remain negative and significant, although the coefficient estimates are much higher than the respective FE estimates in Table 2. Likewise, coefficient estimates of all other independent variables appear to be robust with respect to the FE and FE-IV estimators, having the same signs and similar magnitude of coefficients.

Also, all postestimation analysis of residuals and regression diagnostics show that FE-IV estimation results represent reliable robustness analysis. According to Hansen J statistics of the overidentification test of all instruments, our respective instrument sets are jointly valid in all specifications in regressions (1) to (5). The Kleibergen-Paap (KP) test (LM statistic) of under-identification clearly rejects the null hypothesis that the estimation equation is underidentified for all regressions at the 5% significance level, implying that the excluded instruments are correlated with the endogenous regressors and thus relevant. Testing for the strength of instruments in the case of multiple endogenous variables, the inspection of the individual first-stage F-statistics is no longer sufficient. We therefore also reported Sanderson-Windmeijer multivariate F tests of excluded instruments (SWF) in our first stage results in Table 8, which suggest that our instruments are strong. Durbin-Wu-Hausman (DWH) endogeneity tests do not reject the null hypothesis of NNR variables being an exogenous variable in all regressions (1) to (5). Hence, DWH tests confirm our presumption that net neutrality regulations can, in fact, be considered as exogenous policy decisions and the respective coefficient estimates of NNR variables as reported in Table 2 are thus consistent and more efficient, representing a reliable basis for our policy conclusions in the final section.

Finally, another source of endogeneity might come from a potential indirect impact of NNR variables on investment via subscriptions on the demand side. Although such a channel is ruled out from our theoretical model, we examined this potential relationship empirically by conducting Granger causality tests. According to these tests, fiber investment indeed Granger-causes fiber subscription (p-value = 0.0000, H0: ln(fiber_inv) does not Granger-cause ln(fiber_sub)), but fiber subscriptions do not Granger-cause fiber investment (p-value = 0.1850, H0: ln(fiber_sub) does not Granger-cause ln(fiber_inv)).Footnote 11 This confirms our theoretical expectation and reaffirms us that our coefficient estimates represent true causal effects.

7 Summary and policy implications

Network neutrality regulations have been subject to major controversies in the telecommunications arena over the last two decades and major policy changes in some OECD countries. Despite substantial direct and indirect costs related to network neutrality regimes, there is no supportive evidence so far for the central claims of net neutrality proponents. In this paper, we focus on a specific effect that net neutrality may have on ISPs’ incentives to invest in high-speed broadband networks. More specifically, we provide first results on the causal impact of network neutrality regulations on fiber-based network investment by ISPs. Our empirical analysis finds that network neutrality regulations exert a significantly negative and substantial impact on fiber investments. Employing various panel estimation techniques, including instrumental variables, underlines the exogeneity of our variables measuring net neutrality policies in OECD countries, pointing to true causal effects. Comparing FE and FE-IV estimation results confirms our presumption that net neutrality regulations can be considered as an exogenous impact primarily driven by politics rather than relevant market outcomes. This negative effect does not allow us, however, assessing the overall effect of network neutrality regulations since other channels should be investigated, primarily the welfare effect of net neutrality policies on content provision and innovations. Still, as long as fiber-based investment is a precondition for consumer subscription, this also implies that net neutrality might generate another relevant societal cost.

Strict network neutrality regulations, as implemented in the EU and specified in the BEREC Guidelines, reveal a regulatory preference for network investments over the use of network management to avoid long-lasting or recurrent states of congestion (EU, 2015, Recital 15; BEREC, 2020, para. 93 at p. 29). This focus on ISP investments furthermore ignores the fact that other actors like large CPs, such as Google, Amazon, Facebook, Akamai, and Microsoft, have invested heavily in their own private networks of cables and strategically distributed servers – often jointly contributing to producing customer experience together with ISPs. Notably, these providers can to some extent introduce service differentiations and partly bypass the public and regulated Internet as they carry traffic via their private backbone networks and may also deliver content from servers positioned close to the users. From a user experience perspective, these and other mechanisms can act as technological substitutes for network management or network investment by ISPs. They are typically deployed by entities other than ISPs and provide a means for service differentiations that do not violate network neutrality regulations (Stocker et al., 2017, 2020). The majority of Internet traffic is already delivered via third-party CDNs like Akamai or Cloudflare or the distributed serving infrastructures of large CPs like Google, Netflix or Facebook that have strongly expanded their footprints of servers deployed within ISP networks in recent years (Gigis et al., 2021; Labovitz, 2019, 2020).Footnote 12 In addition to these developments, the emergence of 5G and beyond mobile broadband access networks emphasizes the future role of applications and use cases that vary considerably in their networking demands. For example, some of these applications are anticipated to have stringent demands with regard to reliable and (ultra) low latency connectivity and local computing via mobile edge computing. Notably, the delivery of such service is expected to require purpose-specific network slices – customized and application-driven virtual networks that can flexibly scale and adapt to meet the heterogeneous and dynamically changing requirements of an evolving set of different applications. Potential conflicts between anticipated 5G-based business models and strict network neutrality regulations have been discussed by several scholars (e.g., Yoo & Lambert, 2019; Frias and Martinez, 2017).

Such developments also raise questions regarding the scope and effectiveness of network neutrality regulations. Effective enforcement of network neutrality regulations requires a clear understanding of who the relevant players are, where the dividing lines between the (regulated) public Internet and (unregulated) specialized services are, and what types of network management practices are reasonable or not. In terms of welfare effects of net neutrality regulations, future research should seek to provide empirical evidence regarding relevant outcomes such as consumer prices for ISP access or content innovation. Also, as net neutrality regulations apply to mobile broadband networks as well, future research should investigate welfare related effects of net neutrality regulations on the deployment of mobile broadband networks as all previous empirical analyses exclusively referred to wireline broadband networks. Further empirical evidence is much needed in view of current developments related to the reintroduction of net neutrality regulation in the U.S. and current revisions of existing frameworks in the UK and EU.

Change history

01 November 2022

The original article has been corrected since there was formatting error

Notes

Information available at: https://www.crowninfrastructure.govt.nz/ufb/what/ and https://www.nbnco.com.au/corporate-information/about-nbn-com.

Using a similar model, Gautier and Somogyi (2020) compare a network neutrality regime with two alternative regimes: traffic prioritization and zero-rating, i.e., two alternative business practices aimed at extracting surplus by discriminating in terms of service quality (prioritization) or price level (zero-rating). The authors show that for high levels of advertising revenues and/or high levels of congestion, the monopolistic ISP prefers prioritization over network neutrality. Otherwise, the preferred regime is zero-rating and never network neutrality.

In contrast, a major weakness of GMM estimators is that their properties hold only when N is large, so they can be severely biased and imprecise in panel data with a small number of cross-sectional units. The FEC estimator requires, however, strictly exogenous covariates. As this assumption might be unrealistic, we only refer to the FEC estimator to evaluate the extent of the „dynamic bias “ related to the inclusion of the lagged dependent variable.

Luxembourg and Iceland also had OECD membership status during our period of analysis; however, data are not available for the control variable telecom_prices; see Table 4 in Appendix 2. Including this control variable thus lowered the number of OECD countries with member status from 34 to 32. There are four more missing values in our data set.

We do not drop these units in our regressions to identify period effects and effects of time-varying covariates.

Stata 16.1 was used to estimate the regressions.

For a similar line of reasoning, see Grajek and Röller (2012).

We are aware that the magnitude of the estimated coefficients of our NNR variables may seem large, but at the beginning of our sample, all the countries had virtually zero fiber-based connections and towards the end of our sample, fiber coverage exceeded 100% of households in many countries due to parallel infrastructure coverage in (sub-)urban areas. This implies that the increases we observed in (log) percentage terms tend to be large. Hence, the large magnitude of this effect is also, to some extent, driven by the low base of fiber investment in the first years of our sample. For a similar reasoning see Briglauer et al. (2018) who examine the impact of mandatory access regulation imposed on new fiber-based broadband infrastructure on investment incentives. Using a dummy variable indicating whether access regulations are imposed on new broadband networks and panel data for 27 EU member states from 2004 to 2014, the authors found that the implementation of fiber access regulation almost completely offsets incentives to invest by regulated network operators.

Tests are performed using the Stata command ‘xtgcause’, which implements a procedure proposed by Dumitrescu and Hurlin (2012) for testing Granger causality in panel data sets. We included a maximum number of three lags. p-values are reported for the Z-bar statistic and computed using 200 bootstrap replications.

The data volume of global content delivery network Internet traffic grew by more than 360%, from 54 exabytes per month in 2017 to 252 exabytes per month in 2020 (information available at: https://www.statista.com/statistics/267184/content-delivery-network-internet-traffic-worldwide/).

This setting corresponds to what Greenstein et al., (2016, p. 128) describe as “the most basic definition of net neutrality” regulations used in some of the economic literature on the topic as presented in Sect. 2, according to which any kind of payments from CPs to ISPs are prohibited (see also Sect. 3.1 and Fig. 1).

The parameter v can thus be interpreted as an option value for having a connection and thus being able to get access to a range of services and contents.

Positivity conditions dictate that \(\alpha \beta\) < c, implying that the cross-side externalities should not be too strong; and v > p-φ. For ensuring that the second order conditions hold, we further assume that \(\alpha \beta\) < c/2, again implying not too strong network externalities and/or relatively high fixed costs c for content creation.

The optimal condition applies when cross-side externalities among the two sides are not too strong, i.e., when \(\alpha \beta\) < c/2.

Using assumptions similar to those used by Economides and Tåg (2012), we presuppose that 2c – (\(\alpha\) + β)2 > 0, implying that cross-group externalities are not too strong or, equivalently, that consumers and CPs are sufficiently differentiated. This condition is more stringent than the one for ensuring a positive subscription price but it is necessary in order to guarantee that the second order conditions be satisfied.

Indeed, we have to verify that \(\frac{2cv}{2c-{\left(\alpha +\beta \right)}^{2}}>\frac{cv}{c-2\alpha \beta }\). It results in \(2\left(c-2\alpha \beta \right)>2c-{\left(\alpha +\beta \right)}^{2}\), implying \({\left(\alpha +\beta \right)}^{2}-4\alpha \beta ={\left(\alpha -\beta \right)}^{2}>0\) which is always true for any values of \(\alpha\) and β.

To guarantee a positivity condition, as before, we assume c > \(\alpha \beta\). Moreover, to ensure the existence of an equilibrium, we further assume that \(6c-{\alpha }^{2}-4\alpha \beta -{\beta }^{2}>0\). As in Economides and Tåg (2012), under these conditions, second order conditions are satisfied.

References

Akerman, A., Gaarder, I., & Mogstad, M. (2015). The skill complementarity of broadband internet. Quarterly Journal of Economics, 30, 1781–1824.

Armstrong, M. (2006). Competition in two-sided markets. The RAND Journal of Economics, 37(3), 668–691.

BEREC (2016). BEREC guidelines on the implementation by national regulators of European net neutrality rules, BoR (16) 127. https://berec.europa.eu/eng/document_register/subject_matter/berec/regulatory_best_practices/guidelines/6160-berec-guidelines-on-the-implementation-by-national-regulators-of-european-net-neutrality-rules

BEREC (2020). BEREC Guidelines on the Implementation of the Open Internet Regulation, BoR (20) 112. https://berec.europa.eu/eng/document_register/subject_matter/berec/regulatory_best_practices/guidelines/9277-berec-guidelines-on-the-implementation-of-the-open-internet-regulation

Bond, S. (2002). Dynamic Panel Data Models: A Guide to Micro Data Methods and Practice. CeMMAP working papers from Centre for Microdata Methods and Practice, No CWP09/02, Institute for Fiscal Studies.

Böttger, T., Cuadrado, F., Tyson, G., Castro, I., & Uhlig, S. (2018). Open connect everywhere: A glimpse at the internet ecosystem through the lense of the netflix CDN. ACM SIGCOMM Computer Communication Review, 48(1), 28–34.

Bourreau, M., Kourandi, F., & Valletti, T. (2015). Net neutrality with competing internet platforms. The Journal of Industrial Economics, 63(1), 30–73.

Bresnahan, T., & Trajtenberg, M. (1995). General purpose technologies ‘engines of growth’? Journal of Econometrics, 65, 83–108.

Briglauer, W., Cambini. C. & Grajek, M. (2018). Speeding Up the Internet: regulation and Investment in the European Fiber Optic Infrastructure. International Journal of Industrial Organization, 61(C), 613–652.

Briglauer, W. (2014). The impact of regulation and competition on the adoption of fiber-based broadband services: Recent evidence from the European union member states. Journal of Regulatory Economics, 46(1), 51–79.

Briglauer, W. (2015). How EU sector-specific regulations and competition affect migration from old to new communications infrastructure: Recent evidence from EU27 member states. Journal of Regulatory Economics, 48(2), 194–217.

Briglauer, W. & Gugler, K. (2019). Go for gigabit? First evidence on economic benefits of high-speed broadband technologies in Europe. Journal of Common Market Studies, 57(5), 1071–1090.

Bruno, G. (2005a). Approximating the bias of the LSDV estimator for dynamic unbalanced panel data models. Economics Letters, 87, 361–366.

Bruno, G. (2005b). Estimation and inference in dynamic unbalanced panel-data models with a small number of individuals. The Stata Journal, 5, 473–500.

Cheng, H. K., Bandyopadhyay, S., & Guo, H. (2011). The debate on net neutrality: A policy perspective. Information Systems Research, 22(1), 60–82.

Choi, J. P., & Kim, B. C. (2010). Net neutrality and investment incentives. The RAND Journal of Economics, 41(3), 446–471.

Czernich, N., Falck, O., Kretschmer, T., & Woessmann, L. (2011). Broadband infrastructure and economic growth. The Economic Journal, 121(552), 505–532.

De Hoyos, R. E., & Sarafides, V. (2006). Testing for cross-sectional dependence in panel-data models. The Stata Journal, 6(4), 482–496.

DiMolfetta, D. (2022). Telecom players divided on Gigi Sohn's FCC prospects as August recess looms, S&P Global. https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/telecom-players-divided-on-gigi-sohn-s-fcc-prospects-as-august-recess-looms-70878011

Dumitrescu, E. I., & Hurlin, C. (2012). Testing for Granger non-causality in heterogeneous panels. Economic Modelling, 29, 1450–1460.

Easley, R. F., Guo, H., & Krämer, J. (2018). Research commentary – from net neutrality to data neutrality: A techno-economic framework and research agenda. Information Systems Research, 29(2), 253–272.

EC (European Commission) (2009). Directive 2009/136/EC of the European Parliament and of the Council of 25 November 2009 Amending Directive 2002/22/EC on Universal Service and Users’ Rights Relating to Electronic Communications Networks and Services, Directive 2002/58/EC, Official Journal of the European Union, L 337, 11–36, 18 December, Brussels, Belgium.

EC (European Commission) (2013). Proposal for a Regulation of the European Parliament and of the Council Laying Down Measures Concerning the European Single Market for Electronic Communications and to Achieve a Connected Continent, and Amending Directives 2002/20/EC, 2002/21/EC and 2002/22/EC and Regulations (EC) No 1211/2009 and (EU) No 531/2012, COM(2013) 627 final, 11 September, Brussels, Belgium.

Economides, N., & Tåg, J. (2012). Network Neutrality on the Internet: A two-sided market analysis. Information Economics and Policy, 24(2), 91–104.

European Commission (2020). Digital Economy and Society Index (DESI) 2020 Connectivity. https://ec.europa.eu/digital-single-market/en/connectivity, Brussels, Belgium.

EU (European Union) (2015). Regulation (EU) 2015/2120 of the European Parliament and of the Council of 25 November 2015 Laying Down Measures Concerning Open Internet Access and Amending Directive 2002/22/EC on Universal Service and Users’ Rights Relating to Electronic Communications Networks and Services and Regulation (EU) No 531/2012 on Roaming on Public Mobile Communications Networks within the Union, Official Journal of the European Union, L 310, 1–18, 26 November, Brussels, Belgium.

Faulhaber, G. R. (2011). Economics of net neutrality: A review. Communications & Convergence Review, 3(1), 7–25.

FCC (Federal Communications Commission) (2005a). In the Matters of Appropriate Framework for Broadband Access to the Internet over Wireline Facilities et al., Policy Statement, CC Docket No. 02–33 et al. (FCC 05–151), Washington, D.C.: Federal Communications Commission.

FCC (Federal Communications Commission) (2005b). In the Matter of Madison River Communications, LLC and Affiliated Companies, Order, File No. EB-05-IH-0110 (DA 05–543), adopted: 3 March, released: 3 March, Washington, D.C.: Federal Communications Commission.

FCC (Federal Communications Commission) (2010). In the Matter of Preserving the Open Internet; Broadband Industry Practices, Report and Order, GN Docket No. 09–191, WC Docket No. 07–52 (FCC 10–201), adopted: 21 December, released: 23 December, Washington, D.C.: Federal Communications Commission.

FCC (Federal Communications Commission) (2015). In the Matter of Protecting and Promoting the Open Internet, Report and Order on Remand, Declaratory Ruling, and Order, GN Docket No. 14–28 (FCC 15–24), adopted: 26 February, released: 12 March, Washington, D.C.: Federal Communications Commission.

FCC (Federal Communications Commission) (2018). In the Matter of Restoring Internet Freedom, Declaratory Ruling, Report and Order, and Order, WC Docket No. 17–108 (FCC 17–166), adopted: 14 December, released: 4 January, Washington, D.C.: Federal Communications Commission.

Ford, G. S. (2018). Regulation and Investment in the US telecommunications industry. Applied Economics, 50(56), 6073–6084.

Ford, G. S., Spiwak, L. J., & Stern, M. L. (2010). The broadband credibility gap. Commlaw Conspectus, 19, 75.

Frias, Z., & Martínez, J. P. (2018). 5G networks: Will technology and policy collide? Telecommunications Policy, 42(8), 612–621.

Gigis, P., Calder, M., Manassakis, L., Nomikos, G., Kotronis, V., Dimitropoulos, X., & Smaragdakis, G. (2021). Seven years in the life of Hypergiants' off-nets. Proceedings of the 2021 ACM SIGCOMM 2021 Conference, 516–533.

Grajek, M., & Kretschmer, T. (2012). Identifying critical mass in the global cellular telephony market. International Journal of Industrial Organization, 30(6), 496–507.

Grajek, M., & Röller, L. H. (2012). Regulation and investment in network industries: Evidence from European telecoms. Journal of Law and Economics, 55, 189–216.

Greenstein, S., Peitz, M., & Valletti, T. (2016). Net neutrality: A fast lane to understanding the trade-offs. Journal of Economic Perspectives, 30(2), 127–150.

Guo, H., Bandyopadhyay, S., Lim, A., Yang, Y., & Cheng, H. K. (2017). Effects of competition among internet service providers and content providers on the net neutrality debate. MIS Quarterly, 41(2), 353–370.

Hazlett, T. W., & Wright, J. D. (2017). The effect of regulation on broadband markets: Evaluating the empirical evidence in the FCC’s 2015 “open internet” order. Review of Industrial Organization, 50(4), 487–507.

Hermalin, B. E., & Katz, M. L. (2007). The economics of product-line restrictions with an application to the network neutrality Debate. Information Economics and Policy, 19(2), 215–248.

Jamison, M. (2019). Net neutrality policies and regulation in the United States. Review of Network Economics, 17(3), 151–174.

Kourandi, F., Krämer, J., & Valletti, T. (2015). Net neutrality, exclusivity contracts and internet fragmentation. Information Systems Research, 26(2), 320–338.

Krämer, J., Wiewiorra, L., & Weinhardt, C. (2013). Net neutrality: A progress report. Telecommunications Policy, 37(9), 794–813.

Labovitz, C. (2019). Internet Traffic 2009–2019. Presentation at NANOG 76, 9–12 June. Washington, DC. https://pc.nanog.org/static/published/meetings/NANOG76/1972/20190610_Labovitz_Internet_Traffic_2009-2019_v1.pdf

Labovitz, C. (2020). Effects of COVID-19 lockdowns on service provider networks. Presentation at NANOG 79, 1–3 June [Online Event]. https://storage.googleapis.com/site-media-prod/meetings/NANOG79/2208/20200601_Labovitz_Effects_Of_Covid-19_v1.pdf.

Layton, R. (2017). Which Open Internet Framework is Best for Mobile App innovation? An empirical inquiry of net neutrality rules around the world. Aalborg Universitetsforlag. Ph.d.-serien for Det Tekniske Fakultet for IT og Design, Aalborg Universitet https://doi.org/10.5278/vbn.phd.engsci.00181

Lee, D., & Kim, Y. H. (2014). Empirical evidence of network neutrality: The incentives for discrimination. Information Economics and Policy, 29, 1–9.

Lobo, B. J., Alam, M. R., & Whitacre, B. E. (2020). Broadband speed and unemployment rates: Data and measurement issues. Telecommunications Policy, 44(1), 101829.

Marcus, J. S. (2016). New Network Neutrality Rules in Europe: Comparisons to those in the US. Colorado Technology Law Journal 14(2), 259–280.

Nickell, S. (1981). Biases in dynamic models with fixed effects. Econometrica, 49, 1417–1426.

Njoroge, P., Ozdaglar, A., Stier-Moses, N.E., & Weintraub, G.Y. (2014). Investment in Two-Sided Markets and the Net Neutrality Debate. Review of Network Economics, 12(4), 355-402.

Nurski, L. (2012). Net Neutrality, foreclosure and the fast lane: an empirical study of the UK. Foreclosure and the Fast Lane: An Empirical Study of the UK (October 1, 2012) .NET Institute Working Paper, 12-13.

Sacco, D., & Schmutzler, A. (2011). Is there a U-shaped relation between competition and investment? International Journal of Industrial Organization, 29(1), 65–73.

Schuett, F. (2010). Network neutrality: A survey of the economic literature. Review of Network Economics, 9(2), 1–15.

Sidak, J. G., & Teece, D. J. (2010). Innovation spillovers and the “dirt road” fallacy: The intellectual bankruptcy of banning optional transactions for enhanced delivery over the internet. Journal of Competition Law & Economics, 6, 521–594.

Stocker, V. (2020). Innovative Capacity Allocations for All-IP Networks: A Network Economic Analysis of Evolution and Competition in the Internet Ecosystem. Nomos Baden-Baden.

Stocker, V., Smaragdakis, G., & Lehr, W. H. (2020). The state of network neutrality regulation. ACM SIGCOMM Computer Communication Review, 50(1), 45–59.

Stocker, V., Smaragdakis, G., Lehr, W. H., & Bauer, S. (2017). The growing complexity of content delivery networks: Challenges and implications for the internet ecosystem. Telecommunications Policy, 41(10), 1003–1016.

Tudón, J. (2019). Prioritization vs. Neutrality on Platforms: Evidence from Amazon’s Twitch.tv. NET Institute Working Paper No. 17–14. https://ssrn.com/abstract=3049371.

Wu, T. (2002). A Proposal for Network Neutrality. http://www.timwu.org/OriginalNNProposal.pdf.

Wu, T. (2003). Network neutrality, broadband discrimination. Journal on Telecommunication and High Technology Law, 2, 141–179.

Yoo, C. S., & Lambert, J. (2019). 5G and net neutrality. In: Knieps G, Stocker V (Eds.), The Future of the Internet - Innovation, Integration and Sustainability(pp. 221–245). Nomos

Acknowledgements

The authors are grateful to the participants at the 23rd Biennial Conference of the International Telecommunications Society (ITS) for valuable discussions and comments. Wolfgang Briglauer acknowledges financial support from the WU anniversary foundation and funding through a research fellowship at the Weizenbaum Institute for the Networked Society/TU Berlin in 2020. Volker Stocker would like to acknowledge that this work has been funded by the Federal Ministry of Education and Research of Germany (BMBF) under grant no. 16DII113 (‘Deutsches Internet-Institut’). Carlo Cambini gratefully acknowledges the fund from MIUR Award TESUN-83486178370409 finanziamento dipartimenti di eccellenza CAP. 1694 TIT. 232 ART. 6. The views expressed in this article are those of the authors only.

Funding

Open access funding provided by Vienna University of Economics and Business (WU).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

We first model a monopolistic ISP platform provider of a two-sided market. In a next step we model a duopolistic platform. The platform (in our setting, a monopolistic telecom incumbent operator/a duopoly formed by incumbent and another operator, e.g., cable broadband operator) sells broadband access to consumers at a subscription price p and possibly collects a fee a from each CP. We can interpret a as the fee a CP must pay an access ISP to secure a certain amount of capacity to distribute its content to that ISP’s end users, i.e., consumers. By contrast, in the presence of a net neutrality regime (under the terms of a strict ZPR) as conceptualized in Economides and Tåg (2012), CPs do not pay any fee a to reach consumers, while in absence of regulations the fee a is uniformly applied to all CPs.Footnote 13 Without loss of generality, we assume that the cost of providing the ISP platform per consumer is normalized to 0.

We use a standard Hotelling model as extended to a two-sided market framework by Armstrong (2006). On the consumers’ side, each consumer i is located in xi for accessing new broadband services through the ISP and interacting with the CPs. Consumers pay a transportation cost equal to t = 1 per unit of distance ‘‘traveled”. Consumers’ locations are uniformly distributed on the interval zero to one with the platform located at x = 0. Consumer i’s utility is given by:

where v is an intrinsic value that a consumer receives from subscribing to a broadband connection provided by an ISP, irrespective of the amount of content.Footnote 14 Broadband access, however, also provides access to numerous new services and applications offered by independent CPs. β is the marginal value that a consumer places on an additional CP and ncp is the number of active CPs. The utility of consumers increases if the platform decides to invest in higher broadband access capacities, φ. More investment by the platform generates better connection quality or provides an improved capacity to be used to consume new or greater volumes of content, increasing the value of the connection. For example, switching from basic broadband to a high-speed (fiber-based) broadband connection may induce consumers to use new services or services with rather high capacity requirements.

In our model, CPs are assumed to rely on advertising revenue per consumer, \(\alpha\), to generate revenue. As in Economides and Tåg (2012), we first assume that CPs are independent monopolists in their own market segment and are uniformly distributed on the unit interval with unit mass. Each CP thus obtains revenues equal to \(\alpha\) nc, where nc, is the number of consumers paying the platform for access to CPs. The parameter \(\alpha\) can thus be interpreted as the value for a CP of having an additional consumer connected to the network. CPs are heterogeneous in terms of their cost to create new content. Assuming this cost to be equal to c, each provider indexed by j thus faces a cost equal to cyj, where yj is the index of the CP’s location on the unit interval. As for consumers, the same normalization to 0 holds for the (marginal) cost incurred by each CP for serving advertisements to consumers. In presence of net neutrality regulations, CPs do not pay any fee for using the network to access consumers. Conversely, if net neutrality regulations do not apply, each CP must pay the platform a uniform lump sum fee equal to a to gain access to consumers. Thus, a CP j’s profit is:

Finally, the ISP profit function is given by:

In the case of net neutrality, the ZPR implies a = 0 so that the platform obtains no revenues from CPs. φ2/2 is the quadratic investment cost for upgrading the access network from basic to high-speed broadband connections. This functional form means that investment cost is increasing and convex, implying that if an ISP decides to expand the fiber-based coverage in a country, the investment costs increase more than proportionally. Thus, we capture the real difference in broadband deployment costs in case an ISP wants to expand its network from low-cost urban areas to more costly suburban and high-cost rural areas (Briglauer et al., 2018).

The structure of the game is as follows: first, the ISP decides how much to invest (φ) in increasing the quality of the existing network; then, the ISP sets the price p users must pay to subscribe to high-speed broadband connections, as well as the fixed fee a for CPs; lastly, users and CPs decide whether or not to access the upgraded ISP network.

1.1 Monopolistic ISP: Equilibrium in the case of net neutrality regulations (NNR)

Under net neutrality regulations, the strict ZPR prevents the ISP from charging the CPs any fee. In this case, marginal consumer xi, who is indifferent on the question of subscribing vs. not subscribing, is located at:

The marginal CP, who is indifferent on the question of being active or leaving the market, is given by:

where \({n}_{c}^{e}\) and \({n}_{cp}^{e}\) are the expected number of consumers and CPs, respectively. As in Economides and Tåg (2012), we look for fulfilled expectations equilibria where each side’s expectations are fulfilled and thus \({n}_{c}^{e}={n}_{c}\) and \({n}_{cp}^{e}={n}_{cp}\). Simultaneously solving Eqs. (4) and (5) yieldsFootnote 15:

Moving to the profit of the ISP, we have:

The ISP provider first sets the user price p that maximizes its profit:

In the second stage equilibrium, users’ demand becomes:

Going backward, the sub-Nash firm’s profit becomes:

Maximizing the above condition, we obtain the optimal level of investment under the net neutrality ruleFootnote 16:

Note that as the optimal investment level rises, there is a corresponding increase in users’ willingness to pay for having the Internet connection. Moreover, as the investment increases, the value of an additional consumer for CPs, \(\alpha\), goes up, as does the value of an additional user for CPs, β.

Finally, given (11) and (12), in equilibrium, the number of consumers subscribing to the platform is:

1.2 Monopolistic ISP: Equilibrium in the absence of net neutrality regulation

Assume now that the ISP can charge a fixed fee a to CPs for accessing the ISP’s consumers and thus being active in the market. Following the same steps shown in the previous paragraph, the users’ and CPs’ demands are given by:

The profit function of the ISP is given by:

or equivalently

Since p and a are set simultaneously, their optimal value is given by the following first order conditions:

The optimal monopolistic prices in the absence of net neutrality regulations are given by the followingFootnote 17: