Summary

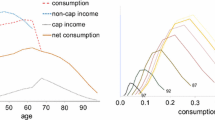

The efficient organisation of social insurance is an important problem for modern societies. The paper discusses evidence that shocks in labour income have largely persistent effects and analyses the implications of this observation for the optimal design of institutions for wage contracting, social security, and pensions. In an optimal contract, wages reflect variations in individual productivity for incentives reasons. However, the optimal contract insures workers against firm specific shocks. These can better be born by shareholders who can diversify risks on capital markets. Progressive income taxation provides further insurance. On top of that there is scope for additional insurance based on ‘verifiable’ information on unemployment and health conditions. As final form of ‘insurance’, the paper analyzes the role of self-insurance. Income shocks can be absorbed partially by precautionary saving. The individual’s saving plans for retirement and for precaution are, therefore, related issues. In an institutional setting with mandatory saving for retirement, an integration of disability and unemployment insurance on the one hand and the pension system on the other hand in a lifetime savings account allows for this interrelation. The paper analyzes how to deal with the uncertainty in the return on savings in the framework of a lifetime saving account.

Article PDF

Similar content being viewed by others

Avoid common mistakes on your manuscript.

References

Abowd J.M., Card D. (1989) ‘On The Covariance of Earnings and Hours Changes’. Econometrica 57: 411–445

Bodie Z., Merton R.C., Samuelson W.F. (1992) ‘Labor Supply Flexibility and Portfolio Choice in a Life Cycle Model’. Journal of Economics Dynamics and Control 16: 427–449

Bovenberg A.L., Koijen R., Nijman T., Teulings C.N. (2007) ‘Saving and Investing Over the Life Cycle and the Role of Collective pension funds’. De Economist 155: 347–415

Bovenberg, A.L. and C.N. Teulings (2008), ‘Rhineland Exit?’, CEPR Discussion paper.

Buhai, S. and C.N. Teulings (2007), Tenure Profiles and Efficient Separation in a Stochastic Productivity Model, Tinbergen Institute.

Buhai, S., M. Portela, C.N. Teulings and A. van Vuuren (2008), Returns to Tenure or to Seniority?, Tinbergen Institute.

Caballero R.J. (1990) ‘Consumption Puzzles and Precautionary Savings’. Journal of Monetary Economics 25: 113–136

Constantinides G.M. (1990) ‘Habit Formation: A Resolution of the Equity-Premium Puzzle’. Journal of Political Economy 48: 519–543

Gourinchas P., Parker J. (2002) ‘Consumption Over the Life Cycle’. Econometrica 70: 47–89

Guvenen F. (2007) ‘Learning Your Earning: Are Labour Income Shocks Really Very Persistent?’. American Economic Review 97: 687–712

Holmstrom B., Milgrom P. (1987) ‘Aggregation and Linearity in the Provision of Intertemporal Incentives’. Econometrica 55: 303–328

Hosios A.J. (1990) ‘On the Efficiency of Matching and Related Models of Search and Unemployment’. Review of Economic Studies 57: 279–298

Low, H., C. Meghir and L. Pistaferri (2006), ‘Wage Risk and Employment Risk Over the Life Cycle’, IFS Working Papers, WO6/27.

Meghir C., Pistaferri L. (2004) ‘Income Variance Dynamics and Heterogeneity’. Econo- metrica 72: 101–132

Pickety T. (2003) ‘Income Inequality in France, 1901–1998’. Journal of Political Economy 111: 1004–1042

Teulings C.N., Hartog J. (1998) Corporatism or competition. Cambridge University Press, Cambridge

Teulings C.N., De Vries C.G. (2006) ‘Generational Accounting, Solidarity and Pension Losses’. De Economist 154: 63–83

Topel R.H., Ward M.P. (1992) ‘Job Mobility and Careers of Young Men’. Quarterly Journal of Economics 107(2): 145–176

Open Access

This article is distributed under the terms of the Creative Commons Attribution Noncommercial License which permits any noncommercial use, distribution, and reproduction in any medium, provided the original author(s) and source are credited.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This is an open access article distributed under the terms of the Creative Commons Attribution Noncommercial License (https://creativecommons.org/licenses/by-nc/2.0), which permits any noncommercial use, distribution, and reproduction in any medium, provided the original author(s) and source are credited.

About this article

Cite this article

Teulings, C.N. How to Share Our Risks Efficiently? Principles for Optimal Social Insurance and Pension Provision. De Economist 158, 1–21 (2010). https://doi.org/10.1007/s10645-010-9134-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10645-010-9134-5