Abstract

The Dutch disease literature reveals several gaps between empirical evidence and theoretical predictions. To bridge such gaps, I develop a model that accounts for uneven spillovers of technological progress from the resource sector to other domestic sectors. I then employ a dynamic panel approach to align the theory with the data. I find that the real exchange rate appreciation resulting from a resource boom (i.e., the spending channel) is more pronounced in resource-poor countries than in resource-rich countries. Additionally, the resource movement channel exhibits differences between resource-rich and resource-poor countries. In resource-rich countries, a resource boom reduces the growth rate in the manufacturing sector more than in the service sector, leading to a decrease in relative sectoral output and a slowdown in economic growth. On the other hand, in resource-poor countries, a resource boom accelerates the growth of the manufacturing sector and decelerates the growth of the service sector, resulting in an increase in relative sectoral output and economic growth.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Why do natural resources countries tend to experience slower growth than those without? What were the factors contributing to Sierra Leone’s economic growth deceleration to an average of 37% between 1971 and 1989 (Humphreys et al. 2007)? Similarly, what has caused per capita income stagnation in Nigeria over a span of forty years (Sala-i Martin and Subramanian 2013)? Overall, why have resource-rich countries generally failed to exhibit better economic performance than others?

In recent decades, these questions have attracted increasing attention from researchers. The Dutch disease hypothesis serves as a conventional explanation for these inquiries. The seminal work introduced by Corden and Neary (1982), and subsequent contributions by Van Wijnbergen (1984), Krugman (1987), Sachs and Warner (1995), Torvik (2001), Bjørnland and Thorsrud (2016), and Bjørnland et al. (2019), strives to elucidate the Dutch disease mechanism in natural resource countries. A body of empirical research provides supporting evidence for the predictions proposed by this theory, as evident in studies by Sachs and Warner (2001), Ismail (2010), and more recently, Harding et al. (2020).

A helpful initial step is to outline the overarching mechanism of the Dutch disease. This can be illustrated using a two-sector small open economy framework, where the labor force is fully employed and moves freely between the traded and non-traded sectors.Footnote 1 The model highlights two effects: the spending effect and the resource movement effect. A resource boom increases national income, thereby expanding the demand for both traded and non-traded goods. While the price of traded goods is determined exogenously by the international market, the relative price of non-traded goods to traded goods must rise to counterbalance the increased demand for non-traded goods (i.e., the spending effect). An appreciation in relative prices elevates the real wage of labor employed in the non-traded sector relative to the traded sector. This triggers labor to move from the traded sector to the non-traded sector (i.e., the resource movement effect). Consequently, the traded sector contracts, and the non-traded sector expands, leading to de-industrialization.

While the static framework might explain the Dutch disease mechanism in the short term, it would be more realistic to investigate the long-term dynamic mechanism driven by learning by doing (LBD). Evidence suggests that, in the long run, the traded sector gains more from LBD effects (Ulku 2004). Therefore, the non-resource traded sector, hit by worsening competitiveness, is unlikely to fully recover once the resource income runs out (Van der Ploeg 2011). In a preliminary attempt, Van Wijnbergen (1984) examined a two-period, two-sector model in which future productivity in the traded sector becomes increasingly dependent on the current output of the same sector. Krugman (1987) later postulated, within an increasing returns to scale model, that only labor in the traded sector contributes to the generation of learning. Lucas (1988) introduced a model where both sectors generate learning, but with no spillover between them. While Sachs and Warner (1995) and Gylfason et al. (1999) assumed that learning generated by labor employment in the traded sector spills over perfectly to the non-traded sector. These models demonstrate that the learning process drives endogenous growth in both sectors. A natural resource boom reduces labor’s share in the traded sector, hampers learning by doing (LBD), and potentially retards economic growth.

As one of the most influential studies, Torvik (2001) proposed a general model in which both sectors can contribute to the learning process, and there are imperfect learning spillovers between these sectors. The model demonstrates that a resource boom tends to depreciate the steady-state real exchange rate, while steady-state economic growth remains independent of a resource boom. Bjørnland and Thorsrud (2016) further developed the aforementioned model by assuming that external productivity spills over from the booming resource sector to other domestic sectors. The model concludes that a resource boom tends to accelerate steady-state growth rates at both the national and sectoral levels; however, it still leads to the depreciation of the steady-state real exchange rates.Footnote 2 In a three-sector framework, Bjørnland et al. (2019) extended the earlier literature by incorporating the effects of resource movement, endogenous sectoral productivity, and the possibility of learning spillovers. Their findings, supported by empirical evidence from Norway, demonstrate that an increase in oil prices may yield results similar to those found in Torvik (2001). Nevertheless, greater oil activity enhances productivity in most industries. Despite this, the model reaches the same conclusion as Torvik (2001) regarding the steady-state real exchange rate and economic growth.

While there is an extensive empirical literature on the Dutch disease, it can be broadly divided into three main categories. Firstly, there are those that concentrate on the connection between proxies of resource booms and growth rates at both the national and sectoral levels. Secondly, there are those that analyze the spending effect, and thirdly, there are those that examine the resource movement effect.

The influential works of Sachs and Warner (1995, 2001), Rodriguez and Sachs (1999) represent a body of empirical literature that examines the relationship between resource rents and economic growth.Footnote 3 In a cross-section of countries during 1970–1990, Sachs and Warner (2001) demonstrated that a 10% increase in the ratio of natural resource exports (% of GDP) is associated with a 0.4\(-\)0.7% lower annual per capita GDP growth. In recent studies, researchers have used panel data instead of a cross-sectional approach to alleviate concerns about omitted variable bias. Among these studies, some have shown that a natural resource boom hampers institutional development, consequently hindering economic growth [e.g., Murshed (2004); Collier and Hoeffler (2005); Mehlum et al. (2006)].

Furthermore, by utilizing annual data for 81 manufacturing sectors in 90 countries spanning the period 1977–2004, Ismail (2010) demonstrated that a 10% increase in oil prices, on average, slows down the manufacturing growth rate by 3.4%.Footnote 4 Similarly, Apergis et al. (2014) examined the impact of oil rents on agricultural value-added using a panel of MENA countries for the period 1970–2011. Their findings indicate a long-term negative relationship between oil rents and agricultural value added. Moreover, additional evidence for 135 countries from 1975 to 2007 reveals that windfall income from natural resources leads to a 30% increase in savings, a 35–70% reduction in non-resource exports, and a 0–35% expansion of non-resource imports (Harding and Venables 2016).

A group of studies exclusively examines the spending effect. Convincing evidence that supports the positive impact of commodity price increases on the real exchange rate has been documented by Koranchelian (2005) in Algeria, Zalduendo (2006) in Venezuela, Oomes and Kalcheva (2007) in Russia, and Beine et al. (2012) in Canada. Moreover, Cashin et al. (2004) analyzed a panel of 58 commodity-exporting countries spanning from 1980 to 2002. Korhonen and Juurikkala (2009) studied a sample of 12 oil-exporting countries covering the period from 1975 to 2005, and Ricci et al. (2013) investigated a panel of 27 developing countries and 21 developed countries from 1980 to 2004. All three studies established a robust positive correlation between commodity prices and the real exchange rate.

On the contrary, a group of the existing literature focuses solely on the resource movement effect. Empirical evidence demonstrates that an appreciation in the real exchange rate leads to a slowdown in growth. This is evident in studies such as Aguirre and Calderón (2005), Eichengreen (2007), Rodrik (2008), Williamson (2009), Habib et al. (2017)—all well-known contributors to this subject. Regarding sectoral performance, Sekkat and Varoudakis (2000) investigated this relationship in a panel of major Sub-Saharan African countries spanning from 1970 to 1992. Their findings suggested that a depreciation in the real exchange rate enhances performance in manufacturing exports. Additionally, using a panel dataset encompassing 39 Latin American countries and 22 manufacturing sectors during the period 1995–2008, Vaz and Baer (2014) demonstrated a positive and substantial impact on the manufacturing sector arising from the undervaluation of the real exchange rate.

Among the limited number of studies on both channels, Lartey et al. (2012) investigated the Dutch disease effect of remittances as a significant capital inflow. They utilized a dynamic estimation method for a sample of 109 countries spanning the period 1990–2003. The findings indicate that remittance flows (i.e., remittances to GDP) lead to an appreciation of the real exchange rate, an increase in the share of the service sector, a decrease in the share of the manufacturing sector, and a reduction in the relative sectoral output level (manufacturing to service sector). Their estimates also reveal that the resource movement effect is more pronounced under fixed nominal exchange rate regimes. Recently, Harding et al. (2020) estimated the effects of oil and gas discoveries on bilateral real exchange rates, sectoral labor share, and labor productivity in 23 OECD countries over the period 1970–2013. Using a quasi-natural experiment, they show that a discovery worth 10% of a country’s GDP results in a real exchange rate appreciation of 1.5% within ten years after the discovery. Moreover, a median discovery reduces the employment share in the manufacturing sector by 0.45%, while also increasing labor productivity in the traded sector by 1.8% and decreasing labor productivity in the non-traded sector by 0.3%.

This paper makes a substantial contribution to the existing literature in both theory and empirical methodology. First, I have developed a theoretical model to address major gaps between the predictions of Dutch disease dynamic models and empirical evidence. In contrast to empirical evidence, prevailing theories predict that a resource boom leads to the depreciation of the long-run real exchange rate and has either no effect or a positive impact on the long-run growth rate [e.g., Torvik (2001); Bjørnland and Thorsrud (2016)]. To address this, I introduce a two-sector growth model and assume the presence of learning by doing (LBD) in both sectors, along with spillovers between them. Additionally, I postulate that technological improvements are unevenly transferred from the resource sector to both domestic sectors. This novel aspect of the theory distinguishes the LBD mechanism from the one proposed in Torvik (2001), while retaining its core essence. The modified model demonstrates that a resource boom results in an appreciation of the real exchange rate (in the steady state) and stimulates the growth rate (in the steady state) at both the national and sectoral levels-outcomes not anticipated by previous models.

Second, this paper aims to test whether the spending and resource movement channels exhibit differences in resource-rich and resource-poor countries. The literature suggests that (i) these channels have been examined separately; (ii) less attention has been given to studying the impact of resource rents on sectoral growth, as opposed to GDP growth, within the context of resource movement channel analysis; and (iii) only a few studies have explored these channels for resource-rich and resource-poor countries, and/or discussed the disparities in resource rent mechanisms between them. To bridge these gaps in the existing literature, I employ a dataset that covers 152 countries and spans from 1970 to 2019. Initially, I investigate the impact of a resource proxy on the real exchange rate to explore the spending channel. Subsequently, for a more comprehensive examination of the resource movement channel, I analyze the effects of a resource proxy on growth rates within the manufacturing sector, the service sector, and the overall national economy, along with relative sectoral output. This approach allows me to delve into the mechanisms of resource rent within each category of resource-dependent countries.

Third, I examine the relationship between the key mechanism variables using an estimation method and data specifications that differ from those of prior studies. The adopted estimation procedure in this study is designed to address notable concerns. Several explanatory variables are jointly determined with the dependent variables. To tackle this challenge, I implement a generalized method of moments (GMM) model that addresses the endogeneity issue by employing lag differences and levels of explanatory variables as internal instruments. Regarding data specifications, earlier studies employ alternative proxies to represent a resource boom, including commodity prices, resource discoveries, or resource rents (% of exports). In contrast, this paper employs a distinct proxy for this variable: the total natural resource rent (% of GDP). This choice aligns with the theory and introduces a novel feature to the paper.

Fourth, empirical evidence that aligns with the theory significantly contributes to the literature. The primary findings reveal distinctions in the resource rent mechanism between resource-rich and resource-poor countries. Both groups experience a real exchange rate appreciation due to a resource boom, but this appreciation is more pronounced in resource-poor countries than in resource-rich ones. Furthermore, within resource-rich countries, the main driver behind productivity growth in domestic sectors is the LBD effect. As a result, a resource boom reduces the growth rate in the manufacturing sector more than in the service sector. This, in turn, leads to a lower relative sectoral output and slower economic growth. In contrast, resource-poor countries experience the primary driver of productivity growth in the manufacturing sector as the resource spillover effect. In these countries, a resource boom accelerates growth in the manufacturing sector while slowing down growth in the service sector. This, in turn, leads to an increase in relative sectoral output and faster economic growth. The empirical results contradict the predictions of the prevailing theoretical models developed by Sachs and Warner (1995), Torvik (2001), Bjørnland and Thorsrud (2016), but are entirely consistent with the theoretical predictions of my model.

Finally, to the best of my knowledge, this is the first study to employ net foreign assets (% of GDP) as a proxy for the resource rent variable. Evidence indicates that long-run net foreign assets are positive in most natural resource-rich countries (Lane and Milesi-Ferretti 2007). This potentially signifies the influence of natural resource rents on the real exchange rate through the international payment’s transmission channel (i.e., the transfer problem). Hence, if the transfer problem is paraphrased as a long-term change in natural resource income, it can offer additional evidence supporting the real exchange rate appreciation.

The rest of the paper is structured as follows: Sect. 2 introduces a developed theory, Sect. 3 conducts an empirical study, Sect. 4 discusses a cohesive and integrated approach between theory and empirics, and Sect. 5 concludes the paper.

2 A Developed Model of the Dutch Disease

Consider a two-sector economy: Manufacturing (Traded) and service (non-Traded), indexed by M and S respectively. Assume there are no assets and capital accumulation. The labor force is the only production factor and it can move freely across sectors.I normalize the total labor force to one: \(L_{M}+L_{S}=1\), where \(L_{M}\) and \(L_{S}\) denote the labor shares in the manufacturing and service sectors, respectively. As in Matsuyama (1992) and Torvik (2001), the production function in each sector operates under decreasing returns to scale, \(X_{M}=A_{M}\,L_{M}^{\alpha }\), and \(X_{S}=A_{S}\,L_{S}^{\alpha }\), where \(A_{J},\,J=\left\{ M,S \right\}\) is total factor productivity in sector J. To simplify the calculations, I assume the labor intensity \((\alpha )\) is equal in both sectors.

The price of manufacturing goods is normalized to unity. Thus, the price of service goods, denoted by P, represents the real exchange rate. Total income in an economy, denoted as Y, will now be the sum of the value of manufacturing goods, \(X_{M}\), service goods, \(PX_{S}\), and total resource rent, \(NR=A_{M}R\), where NR is measured in manufacturing goods’ units, as in Torvik (2001). This formulation prevents the resource rent from losing value relative to total income as the economy grows.Footnote 5

Finally, we assume productivity in the sectors to have the following growth rates:

The productivity growth rate of a unit of labor employed in sector J is denoted by \(\delta _{J}\) \((J=M,S)\). The constant \(0< \gamma_{J} < 1\) measures a fraction of the learning generated in sector J and spills over into another sector. Improvements in natural resource extraction caused by external factors, such as technology transfer, are likely to lead to productivity spillovers in domestic sectors. For example, complex technical processes for offshore oil (gas) exploitation or shale oil extraction can generate positive knowledge externalities that, in turn, benefit domestic sectors. This assumption is based on recent literature documenting strong positive spillovers from the resource sector to other sectors [see Weber (2012); Feyrer et al. (2017); Allcott and Keniston (2018); Bjørnland et al. (2019)]. Hence, the spillover effects from the exogenous resource sector to the manufacturing and service sectors are respectively governed by \(\delta _{RM}(R) > 0\) and \(\delta _{RS}(R) > 0\).

Furthermore, it is reasonable to assume that technological progress in the resource sector shifts the resource process activity (i.e., resource boom). Thus, increased resource activity can be translated as technological progress, so that the more resource rents are produced, the more productivity spills over to domestic sectors [i.e., \(\delta _{RM}^{' }\left( R \right) > 0\) and \(\delta _{RS}^{' }\left( R \right) > 0\)].Footnote 6

From the demand perspective, a representative household maximizes the utility function with a constant elasticity of substitution, \(\sigma\), subject to the budget constraint (\(PC_{S}+C_{M}=C=Y\)). Now, I characterize two combinations of the real exchange rate (P) and the labor share in the service sector \((L_{S})\) to determine the static equilibrium of the model. The first combination is derived by equalizing marginal labor productivity between sectors, which represents the equilibrium in the labor market, the LL-curve. The second one is determined by the market-clearing condition in the service sector (i.e., \(X_{S}=C_{S}\)), which represents the equilibrium in the goods market, the NN-curve. The relative productivity ratio between the two sectors is defined as \(\phi \equiv \frac{A_{M}}{A_{S}}\). Thus, the corresponding expressions are as follows:

Now, it is worthwhile to investigate a balanced growth path, in which the productivity levels grow equally in both sectors. The growth rate of the relative productivity ratio is,

where \(\delta _{R}\left( R \right) =\delta _{RM}\left( R \right) -\delta _{RS}\left( R \right)\) is the gap in the resource spillover between sectors. The rate of change in the relative productivity ratio is governed by:

Equation (4) states that a balanced growth path exists if and only if the labor share in the service sector increases as the relative productivity level goes up (i.e., \(\frac{dL_{S}}{d\phi }>0\)). As shown in Torvik (2001), the stability of the dynamic system is satisfied, and thus a balanced growth path exists if \(\sigma <1\) holds (see Appendix A.1).Footnote 7

When the stability condition is satisfied, the model possesses a stable solution for the relative productivity ratio, denoted by \(\phi ^{*}\). The steady-state level of the labor share in the service sector is then as followsFootnote 8

In Eq. (5), the steady-state labor share in the service sector is driven by both the direct and spillover effects of the LBD process, as well as the spillover effects of the resource process activity.Footnote 9 In earlier literature, the steady-state labor share in sectors remains unaffected by an exogenous shock to R. In models like those presented in Torvik (2001) and Bjørnland and Thorsrud (2016), the steady-state labor share in the service sector is determined by both the direct and indirect LBD effects: \(L_{S}^{*}\left( \phi ^{*}\right) =\frac{\left( 1-\gamma _{M} \right) \delta _{M}}{\left( 1-\gamma _{M} \right) \delta _{M}+\left( 1-\gamma _{S} \right) \delta _{S}}\).Footnote 10

Equation (5) also shows that a resource boom changes the steady-state labor share in the service sector,

Equation (6) suggests that a resource boom increases (or decreases) the steady-state labor share in the service sector when the marginal spillover benefit of the resource process activity in the manufacturing sector (i.e., \(\delta _{RM}^{'}\)) is greater (or smaller) than that in the service sector (i.e., \(\delta _{RS}^{'}\)). To clarify the intuition, let’s consider an economy initially in a steady state. A resource boom causes the labor force to shift from the manufacturing sector to the service sector. Over time, productivity levels change in both sectors, and the economy progresses towards a new steady state. The difference between the new steady-state level of the labor share in the service sector and its initial level depends on the gap in the marginal spillover benefit of the resource process activity (\(\delta _{R}^{'})\). If there is no resource spillover effect, as shown in Torvik (2001), or if the effects are equal across sectors, as seen in Bjørnland and Thorsrud (2016), there is no gap in the marginal resource spillover benefit (i.e., \(\delta _{R}^{'} = 0\)). Consequently, the labor share in the sectors returns to its initial level in the long run. In the presented model, the gap in marginal resource spillover effects plays a pivotal role. With a positive (or negative) gap, the service (or manufacturing) sector benefits more, resulting in a higher (or lower) labor share in the service sector at the new steady-state level compared to the initial steady-state level.

I now analyze the impact of a resource boom on the growth rate of the relative productivity ratio. Considering Eq. (3), the derivative of the growth rate of the relative productivity ratio with respect to the resource rent (R) is given by:

Referring to Eq. (7), when a resource boom causes a labor share in the service sector to become larger (smaller) than its steady-state level, the growth rate of the relative productivity ratio decreases (increases).Footnote 11 Further information about the dynamic Dutch disease is available in Appendix A.2.

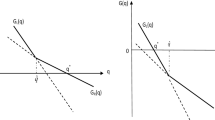

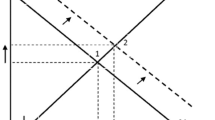

Figure 1 illustrates the dynamic Dutch disease. The LL-curve (Eq. 2a) and the NN-curve (Eq. 2b) are depicted as upward-sloping and downward-sloping curves, respectively. Initially, these curves intersect at point \(E_{0}\). A resource boom (R) increases the total national income (Y) and leads to higher demand for both manufacturing (traded) and service (non-traded) goods. The augmented demand for manufacturing goods might be counteracted by an increase in imported goods, while the real exchange rate (P) appreciates to accommodate the expanded demand for service goods. Graphically, the NN-curve shifts upwards while the LL-curve remains unchanged. The new static equilibrium is established at higher levels of the real exchange rate and the labor share in the service sector (point \(E_{1}\)). The appreciation of the real exchange rate increases the real wage of service sector workers relative to those in the manufacturing sector. Consequently, workers transition from the manufacturing sector to the service sector. As a result, the labor share in the service sector increases due to the resource boom (i.e., \(\frac{dL_{S}}{dR}>0\)). Therefore, in the short run when productivity levels are assumed to be constant, the manufacturing sector contracts while the service sector expands (i.e., deindustrialization).

In line with the empirical findings detailed in the upcoming section, I specifically address the case \(\delta _{RM}^{'}>\delta _{RS}^{'}\) \(\Rightarrow \frac{dL_{S}^{*}}{dR}>0\) to elucidate the dynamic mechanism of the model. The alternative scenario (i.e., \(\delta _{RM}^{'} < \delta _{RS}^{'}\)) is discussed in Appendix A.3. Considering Eq. (7), the response of relative productivity to a labor movement between sectors depends on to what extent the labor share in the service sector increases in the short term due to a resource boom. In the first case, let’s assume that a resource boom initially causes the labor share in the service sector to rise beyond the steady-state level (i.e., \(\frac{dL_{S}}{dR}>\frac{dL^{*}_{S}}{dR}\)) (see Fig. 1a). Now, \(L_{S}\) exceeds the steady-state level (\(L^{*}_{S}\)), resulting in a negative relative productivity growth (i.e., \(\frac{{\dot{\phi }}}{\phi }<0\)). Consequently, the productivity level decreases more in the manufacturing sector than in the service sector, leading to a decline in the relative productivity ratio throughout the transition path.Footnote 12 Graphically, both curves shift downward. As regards the NN-curve shifts more than the LL-curve (i.e., \(\sigma <1\) holds), the falling relative productivity ratio triggers a countervailing labor movement from the service to the manufacturing sector. This movement persists until the labor share in the service sector converges to a new steady-state level (\(E_{1}\) to \(E_{2}\) in Fig. 1a).Footnote 13

In a similar manner, I address the second case, in which the increase in the labor share of the service sector is below its steady-state level (i.e., \(\frac{dL_{S}}{dR}<\frac{dL^{*}_{S}}{dR}\)) (see Fig. 1b). The relative productivity growth is positive (i.e., \(\frac{{\dot{\phi }}}{\phi }>0\)). Since \(L_{S}\) is smaller than its steady-state value (\(L^{*}_{S}\)), the productivity level increases in the manufacturing sector, while it decreases in the service sector. This results in an increase in the relative productivity ratio throughout the transition path. Graphically, the NN-curve shifts upward more significantly than the LL-curve. The rising relative productivity ratio leads to additional labor movement from the manufacturing sector to the service sector. This causes the labor share in the service sector to gradually converge to a higher steady-state level (\(E_{1}\) to \(E_{2}\) in Fig. 1b).Footnote 14

A note about the real exchange rate at the steady-state level (i.e., \(P^{*}\)) can be deduced from a close graphical analysis of the various possible slopes of the isoclines. This analysis reveals that, in the first case (see Fig. 1a), the steady-state real exchange rate may conditionally be positioned at a higher level than its initial level. Conversely, in the second case (see Fig. 1b), it is placed unconditionally. Further details are discussed in Appendix A.4. As a result, this new feature of the model addresses one of the gaps present in the previous literature: the steady-state real exchange rate depreciation, as observed in Torvik (2001), Bjørnland and Thorsrud (2016).

I also analyze the dynamic adjustment of sectoral growth. Equation (1) reveal that sectoral productivity growth is driven by the LBD effects and the spillover effect from the resource sector. Let’s assume that the direct effect of the learning process in each sector is stronger than its indirect effect, which spreads from another section. Additionally, the resource process activity has a positive spillover effect on the productivity growth of domestic sectors. Consequently, an increase in the labor share of the service sector resulting from a resource boom tends to accelerate productivity growth in the service sector. Meanwhile, productivity growth in the manufacturing sector depends on whether the LBD effects or the spillover effect from the resource sector is stronger. If the LBD effect dominates, productivity growth decelerates; if the resource spillover effect dominates, productivity growth accelerates. Further discussion is presented in Appendix A.5.

So far, I have discussed how a resource boom impacts relative productivity growth and sectoral growth. However, studying the dynamic adjustment of the growth rate at the national level also holds significance. By substituting the steady-state labor share in the service sector (i.e., Eq. 6) into one of the two Eqs. 1, the steady-state growth rate, denoted as \(g^{*}\), is obtained as follows:

Equation (8) verifies that the steady-state growth rate is driven by the LBD effects and the spillover effects from the resource process activity. To simplify the discussion, let’s assume that the impact of a technological improvement in the resource sector spills over to one of the sectors. In this scenario, the response of the steady-state growth rate to a resource boom depends on the strength of the direct and indirect LBD effects in the other sector. If the direct LBD effect is stronger (weaker) than the indirect effect, the steady-state growth rate increases (decreases) as resource rents increase.Footnote 15 A general case is discussed in Appendix A.6.

Given Eq. (8), I can also compare the predictions of my model with the previous models by Torvik (2001) and Bjørnland and Thorsrud (2016). If there are no resource spillover effects (\(\delta _{RM}=\delta _{RS}=0\)), Eq. (8) simplifies to the results presented in Torvik (2001). Therefore, the steady-state growth rate is dependent only on the LBD effects: \(g^{*}=\frac{\left( 1-\gamma _{M}\gamma _{S} \right) \delta _{M}\delta _{S}}{\left( 1-\gamma _{M} \right) \delta _{M}+\left( 1-\gamma _{S} \right) \delta _{S}}\). In this special case, a resource boom affects the steady-state levels of sectoral productivity but not the steady-state growth rate.Footnote 16

Furthermore, if the effect of technological progress in the resource sector spreads equally to both sectors (\(\delta _{RM}=\delta _{RS}=\delta _{R}\,R\)), as observed in Bjørnland and Thorsrud (2016), the steady-state growth rate becomes a direct positive function of the resource rent: \(g^{*}=\delta _{R}\,R+\frac{\left( 1-\gamma _{M}\gamma _{S} \right) \delta _{M}\delta _{S}}{\left( 1-\gamma _{M} \right) \delta _{M}+\left( 1-\gamma _{S} \right) \delta _{S}}\). Hence, a resource boom enhances the steady-state growth rate. These models indicate that the steady-state growth rate remains constant (or increases) in the Dutch disease mechanism. In contrast, the proposed model can represent cases that align more closely with empirical evidence (as discussed in the next section). The model illustrates that a resource boom causes the sectoral growth rates to change not only along the transition path but also at the steady-state level. Therefore, this new feature of the model addresses another gap in the previous literature: the growth rate deceleration resulting from a resource boom.

3 Empirical Approach

The main contribution of this section is twofold. First, it provides empirical evidence relevant to the theoretical model. Second, it examines spending and resource movement channels in both resource-rich and resource-poor countries. To achieve this, the empirical study is conducted in the following four steps: (1) First, I analyze the real exchange rate response to the resource dependence proxy to investigate the spending channel. Then, for a more detailed exploration of the resource movement channel, I estimate the effects of the resource dependence proxy on (2) the relative output of the manufacturing sector to the service sector, (3) the per capita growth rate of sectoral output, and (4) the GDP per capita growth rate.

3.1 Data and Methodology

The dataset consists of an unbalanced panel of 152 countries, covering 5-year periods between 1970 and 2019.Footnote 17 The list of countries in the sample is presented in Table 6. Table 1 reports descriptive statistics for the variables.

The real effective exchange rate (REER) is collected from the Bruegel database (Darvas 2012). This serves as a proxy for the relative price of services (non-traded) to manufacturing (traded) goods.Footnote 18 I also gather data on GDP per capita (Constant 2010 US dollars) as well as manufacturing (M) and service (S) value-added (Constant 2010 US dollars) from the World Bank’s World Development Indicator Database (WDI) to construct the relative sectoral output of M to S and the natural logarithm of per capita output in each sector \((J=M,S)\).

Based on the theory, a resource boom (R) is defined as the total resource rent relative to the sectoral productivity levels (i.e., \(\frac{NR}{A_{M}}, \frac{NR}{A_{S}}\)) or national income (i.e., \(\frac{NR}{Y}\)). Hence, my primary treatment measure is the total natural resource rents (% of GDP), provided by WDI. This proxy ensures strong consistency between the empirical methodology and the theory. Thus, it is henceforth referred to as the resource-dependence index, representing the expansion of a resource rent relative to the income level. Control variables are detailed in Appendix B.

I adopt a dynamic panel data model to examine the symptoms of the Dutch disease hypothesis. The general regression model takes the form of:

where the subscripts \(i=1,\ldots N\) and \(t=1,\ldots T\) index the countries and periods in the panel dataset, respectively. \(y_{i,t}\) represents the dependent variable, \(R_{i,t-1}\) corresponds to the lagged resource boom proxy, and \(X_{i,t}^{'}\) denotes a vector of other explanatory variables. The lagged resource boom proxy can effectively capture the long-term effects of the resource boom, enabling me to test the empirical model in alignment with the theory. Additionally, \(\mu _{i}\) indicates the country-specific fixed effect and \(\varepsilon _{i,t}\) represents the error term, assumed to be independently and normally distributed with a mean of zero and constant variance (i.e., \(\varepsilon _{i,t}\simeq N \left( 0, \sigma _{u} \right)\)).

The lagged dependent variable \((y_{i,t-1})\) is incorporated both directly and indirectly in a dynamic panel, serving as the denominator in the resource boom proxy.Footnote 19 This violates the orthogonality assumption and leads to the endogeneity problem. Consequently, the OLS estimates of the coefficients on these independent variables are likely to be biased upwards (so-called dynamic panel bias) (Nickell 1981). The Differenced GMM method, proposed by Arellano and Bond (1991), and the System GMM method, developed by Blundell and Bond (1998), offer alternative estimators to address this potential econometric problem. The underlying concept of these methods is to use instrumental variables to mitigate the endogeneity problem associated with the explanatory variables. In the former method, lagged difference variables are employed as instruments for the explanatory variables, while in the latter method, both lagged differences and lagged levels are utilized.

The Differenced GMM approach suggests that the regression equation is first differenced to get rid of the country-specific fixed effect, and then used all possible lagged levels as instruments. Taking the first differences, Eq. (9) can be differenced as follows:

However, the OLS estimate of Eq. (10) generates inconsistent parameters due to the correlation between the variables of interest \((\Delta y_{i,t-1}, \Delta R_{i,t-1})\) and the transformed error term \((\Delta \varepsilon _{i,t})\). This correlation implies that these regressors are treated as endogenous variables. Consequently, the opportunity arises to employ lagged variables as instruments to tackle the endogeneity problem. When an endogenous variable is correlated with both past and current error terms, lagged levels from two or more periods earlier serve as valid instruments for it. This is because \(\Delta y_{i,t-2}, \Delta R_{i,t-2}\), and preceding values are correlated with \(\Delta y_{i,t-1}, \Delta R_{i,t-1}\) but not with \(\Delta \varepsilon _{i,t}\).Footnote 20

However, the Differenced GMM estimator is prone to yielding poor performance when the time series are persistent or closely resemble a random walk process. This is attributed to the weak correlation between the lagged values of the variables and the endogenously transformed variables. Blundell and Bond (1998) proposed a solution to this issue by introducing the System GMM estimator, which involves applying GMM to a system of two sets of equations. The first equation consists of the standard set of moment conditions in first differences, while the second equation comprises an additional set of moment conditions derived from the equations in levels. Under the assumption that \(\Delta X_{i,t}^{'}\) is not correlated with the country-specific fixed effect, the lagged first differences of dependent and independent variables can be utilized as instruments for the level equations.

The consistency of the estimators depends on assessing the proliferation of instruments, which can lead to overidentification in the regression model. Furthermore, these estimators cannot be considered consistent unless there is no serial autocorrelation in the error term. The proliferation of instruments is evaluated using the Hansen test for over-identifying restrictions.Footnote 21 Meanwhile, the second Arellano-Bond test is employed to confirm the absence of serial autocorrelation in the error term, thereby ensuring the validity of lagged variables as instruments.Footnote 22

Moreover, the first rule of thumb involves checking the coefficient of the lagged dependent variable. A consistent estimate of this coefficient is expected to fall between the OLS estimate as the upper bound and the fixed effect estimate as the lower bound (Bond et al. 2001). If the differenced GMM coefficient estimate is close to or lower than the fixed effect estimate, it could suggest a downward bias, potentially resulting from weak instruments. As a result, the System GMM method might be more preferable. The second rule of thumb suggests keeping the number of instruments lower than the count of country groups to prevent overidentification (Roodman 2009). Lastly, I employ a two-step System GMM (Differenced GMM) approach with Windmeijer (2005)’s robust correction procedure.

3.2 Empirical Results

3.2.1 Real Exchange Rate

The purpose of this section is to examine the response of the real exchange rate to a resource boom (i.e., the spending effect). The dependent variable in the dynamic regression model is the real effective exchange rate, and the explanatory variable of interest is the resource-dependence index. Additionally, GDP per capita, inflation, government spending, terms of trade, openness index, and foreign direct investment are included to control the regression model. Dependent and independent variables are log-transformed.

Table 2 presents the empirical results. As the coefficient value of the lagged dependent variable is smaller than the value estimated by the fixed-effect model, the system GMM appears to be the preferred method.Footnote 23 Column (1) reports the main results. The coefficient on the resource-dependence proxy enters with a positive sign and is significant at the 1% level. The estimate indicates that a 1% increase in the resource-dependence index appreciates the real effective exchange rate by approximately 0.023%. This result provides further confirmation of the findings in the literature. However, previous studies utilize remittance flows (Lartey et al. 2012), commodity prices (Ricci et al. 2013), or resource discovery (Harding et al. 2020), instead of total natural resource rent (% of GDP), which aligns with my proposed theoretical model.

Based on the theory, a question that arises is whether the real exchange rate appreciation resulting from an increase in the resource-dependence index is moderated along the transition path. To explore this, I introduce a second-lagged dependent variable into the regression model. The estimates for the full sample are outlined in Column (2). These results somehow shed light on the short-term (or medium-term) and long-term effects of resource booms on the real effective exchange rate. This implies that the appreciation in the real exchange rate slightly moderates over time. However, this reduction isn’t substantial enough for the long-term real exchange rate to settle at a level lower than the initial level (i.e., \(0.11 < 0.67\)).Footnote 24 Consistent with the predictions of the proposed theory (see Appendix A.4), these empirical findings may confirm that, for the full sample, a resource boom, on average, results in an appreciation of the real exchange rate. While this appreciation moderates in the long term, the real exchange rate eventually stabilizes at a level higher than the initial level. Moreover, it might implicitly confirm that resource booms increase the steady-state labor share in the service sector to a greater extent than the critical threshold (i.e., \(\frac{dL^{}{S}}{dR} > \frac{dL{S}^{}}{dR}|_{C}\)) (see Appendix A.4). Holding this condition is sufficient to lead to an appreciation of the real exchange rate in the long term. In summary, in a steady state, an increase in the real exchange rate is associated with a higher labor share in the service sector. This, in turn, might suggest that the advantages of resource process activity spill over more significantly to the manufacturing sector than to the service sector (i.e., Eq. 6).

I also examine the heterogeneity across countries regarding their dependence on resource rents. To achieve this, I utilize a criterion to classify countries as either resource-rich or resource-poor. The criterion stipulates that the average total natural resource rent (% of GDP) over the given period equals 4% (see Table 6). The sensitivity of the results to alternative thresholds (set at 2% and 6% of GDP) is detailed in Table 14 and discussed in Appendix F.Footnote 25

Under these cutting-off criteria, we have an adequate number of countries in each category to apply the instruments. Columns (3) and (4) present the results for the groups of resource-rich and resource-poor countries, respectively. The coefficients on the resource-dependence index have positive signs and are statistically significant at the 5% level. The relatively lower statistical significance might stem from the smaller number of countries in the sample, leading to a reduced number of instruments. Nevertheless, the coefficient values indicate that the appreciation of the real exchange rate is more pronounced in resource-poor countries than in resource-rich countries (i.e., \(0.0346 > 0.0166\)). These findings are in line with prior studies on resource-rich countries (Korhonen and Juurikkala 2009; Al-mulali and Che Sab 2012), but not for resource-poor countries (Chen and Chen 2007).Footnote 26 The key difference between these studies and the present paper lies in the use of a resource proxy. While most studies estimate this relationship using oil prices, the present study takes an alternative approach by incorporating resource rents as a percentage of GDP.

In addition, based on the theory, the results may suggest that in resource-rich countries, a resource boom leads to an increase in the labor share within the service sector beyond its steady-state level. As a result, the appreciation of the real exchange rate is moderated along the transition path (see Fig. 1a). Conversely, in resource-poor countries, a resource boom elevates the labor share in the service sector to a level below its steady-state level. Consequently, the appreciation of the real exchange rate will intensify along the transition path (see Fig. 1b).

The impact of natural resources on the real exchange rate may highlight the international transfer problem. The relationship between these variables is two-fold. First, empirical evidence indicates a positive long-run net foreign asset position (% of GDP) in most natural resource-rich countries [see Lane and Milesi-Ferretti (2007)]. Consistent with this evidence, I estimate the effect of the resource dependence index on net foreign assets. The results, as reported in Table 7, suggest that a natural resource boom leads to the accumulation of net foreign assets.

Second, a transfer from a foreign country to the home country implies a rise in domestic demand, leading to an increase in the real exchange rate. To elaborate further, within a simple Keynesian context, countries with substantial external assets (accumulated, for example, through commodity exports) would experience capital inflows, resulting in an appreciation of the real exchange rate. In this context, Lane and Milesi-Ferretti (2001, 2004, 2007) and later Ricci et al. (2013) documented that, in the long run, a larger net external position should be associated with a more significant appreciation of the real exchange rate. In general, these relationships might indicate the impact of natural resource rents on the real exchange rate through the international payments transmission channel, commonly referred to as the transfer problem.

The argument suggests that the variable of net foreign assets (% of GDP) might effectively reflect resource dependence. However, to the best of my knowledge, it has never been used as a proxy for natural resources. Therefore, this estimation stands as one of the novel features of my empirical study. In this regard, I substitute the resource-dependence index with net foreign assets as a percentage of GDP (log-transformed) in the baseline regression model (i.e., Column 1 in Table 2). The results are reported in Column (5). The coefficient of the variable of interest exhibits a positive value and holds significance at the 1% level. This presents compelling evidence of a robust transfer effect. The estimates indicate that a 1% increase in net foreign assets as a percentage of GDP leads to an appreciation of the real exchange rate by approximately 0.07%. The finding is consistent with previous studies (Lane and Milesi-Ferretti 2001, 2004, 2007; Ricci et al. 2013).

Furthermore, considering the potential impact of economic size heterogeneity on the transfer effect’s magnitude, I run the regression model for developing countries as outlined in the International Monetary Fund’s World Economic Outlook Database. The results in Column (6) demonstrate that the transfer effect remains statistically significant at the 1% level. However, the coefficient value within the sample of developing countries is slightly lower compared to the full sample. Aligning with Lane and Milesi-Ferretti (2004)’s findings, I can conclude that the transfer effect is less pronounced in developing economies.

3.2.2 Relative Sectoral Output

In this subsection, I analyze the effect of the real exchange rate and the resource-dependence index on the relative sectoral output to investigate the resource movement effect. Following the model proposed by Torvik (2001), labor allocation remains constant at the steady state [i.e., \(L_{S}^{*}=\frac{\left( 1-\gamma \right) \delta _{M}}{\left( 1-\gamma \right) \delta _{M}+\delta _{S}}\)]. Consequently, the relative sectoral output at the steady-state level becomes a function of the steady-state relative productivity ratio \(\phi ^{*}\) [i.e., \(\frac{X_{M}}{X_{S}}=\phi ^{*}\,\frac{\left( 1-L_{S} ^{*} \right) ^{\alpha }}{\left( L_{S}^{*} \right) ^{\alpha }}\)]. In the present theory, both the labor share in the service sector and the relative productivity ratio influence the steady-state relative sectoral output. Consistent with the real exchange rate adjustment along the transition path discussed in the previous subsection, the simultaneous increase in the labor share in the service sector and decrease in the relative productivity ratio diminish the relative sectoral output at the steady-state level. Nevertheless, due to the lack of a comprehensive dataset for sectoral productivity levels or insufficient data for required labor shares to estimate the sectoral productivity level, an alternative proxy becomes necessary.

It appears that the relative sectoral output remains a reliable and plausible proxy for the relative productivity level. Consequently, I consider the relative output of the manufacturing sector to the service sector (at constant prices) as the dependent variable. The explanatory variables of interest consist of the real effective exchange rate and the resource-dependence index. Additionally, I include per capita GDP, investment ratio, human capital index, openness index, government spending, and institution index as control variables.

The estimated results using the Differenced GMM method are shown in Table 3.Footnote 27 The estimated results in Column (1) indicate that a 1% increase in the real value of a country’s currency against the basket of the country’s trading partners results in a reduction of approximately 0.1% in the relative sectoral output. Furthermore, a one-percentage-point increase in the resource dependence index is associated with a 0.6% decrease in the relative sectoral output.Footnote 28

According to the theory, a resource boom triggers LBD effects through changes in the real exchange rate. Consequently, I omit the resource-dependence index to focus solely on the LBD effect. The results for this case are presented in Column (2). A negative and statistically significant coefficient on the real exchange rate may suggest that the contraction in the manufacturing sector is more pronounced than in the service sector, resulting in a decline in the relative sectoral output level.

I also estimate a regression model that solely includes the resource dependence index to analyze the combined effects of LBD and technological improvement spillover from the resource sector. The results are presented in Column (3). The coefficient on the resource-dependence index is negative and significant at the 1% level. The estimated results suggest that a one-percentage-point increase in the resource dependence index correlates with a 0.8% decrease in the relative sectoral output. Furthermore, it implicitly indicates that, for the full sample of countries, the positive spillover effects from the resource sector to domestic sectors cannot neutralize the LBD effects caused by the appreciation of the real exchange rate. To the best of my knowledge, only a few studies have explored the relationship between resource rents and the relative sectoral output ratio across a wide range of countries and over an extended time period. My study is akin to the one conducted by Lartey et al. (2012). Although they employ remittance flows as a proxy for resource income, unlike my specification, both studies yield the same qualitative results.

The results in Columns (1)–(3) may prompt the question of whether the response in relative sectoral output to the variables of interest is noteworthy, despite the statistical significance of the estimates. This issue could primarily be attributed to the fact that the economic response to a resource boom takes time. The estimation in Column (3) indicates that a one-percentage-point increase in the resource dependence index results in a long-term decrease of around 5% in relative sectoral output.Footnote 29

This issue could also be attributed to heterogeneity across country groups in terms of their dependence on resource rents.Footnote 30 The results for a sample of resource-rich and resource-poor countries are reported in Columns (4) and (5), respectively. The coefficient of the resource dependence index is negative for resource-rich countries and positive for resource-poor countries. Additionally, the results suggest a relatively larger economic significance in the country groups’ samples compared to the full sample. These results indicate that a one-percentage-point increase in the resource dependence index raises the relative sectoral output by approximately 3.3% in the resource-poor country group and decreases it by approximately 1.1% in the resource-rich country group. This latter finding aligns with the outcomes of a recent empirical study conducted by Amiri et al. (2019).

Furthermore, these statistically significant results are consistent with the findings of the preceding subsection and theoretical predictions. The theory suggests that a resource boom conditionally changes the growth rate of the relative productivity ratio through an appreciation in the real exchange rate (as detailed in Appendix A.2). The estimated result for the sample of resource-rich countries might suggest that the relative productivity ratio decreases when the resource boom leads to a greater increase in the labor share of the service sector than what would occur in the steady state. As a result, the relative productivity ratio (relative sectoral output) decreases along the transition path, thereby moderating the appreciation of the real exchange rate [i.e., \(\frac{dL_{S}}{dR}>\frac{dL^{*}_{S}}{dR} \Longrightarrow \frac{d \left( {\dot{\phi }}/\phi \right) }{d R }<0 \Rightarrow \frac{d\phi ^{*}}{dR}<0\)]. While the estimated result for the sample of resource-poor countries might imply that the relative productivity ratio increases when the resource boom leads to a smaller increase in the labor share of the service sector than what would occur in the steady state. Consequently, the relative productivity ratio (relative sectoral output) increases along the transition path, thereby accelerating the appreciation of the real exchange rate [i.e., \(\frac{dL_{S}}{dR}<\frac{dL^{*}_{S}}{dR} \Longrightarrow \frac{d \left( {\dot{\phi }}/\phi \right) }{d R }>0 \Rightarrow \frac{d\phi ^{*}}{dR}>0\)]. In conclusion, these findings can be regarded as another confirmation of the theory’s mechanism (see Fig. 1).

3.2.3 Sectoral Growth

Up to this point, I have analyzed the impact of a proxy for the natural resource boom and the appreciation of the real exchange rate on relative sectoral output. However, this is not the sole matter of interest. Following the proposed theoretical mechanism, it is valuable to examine the response of sectoral economic growth to the explanatory variables of interest. The dependent variable is the sector’s per capita income (in constant prices), and the desired explanatory variables are the effective real exchange rate and the resource dependence index. Additionally, GDP per capita (in natural logarithmic form), population growth, investment ratio, human capital index, openness index, government spending, and institution index are included in the regression model as control variables.

Table 4 presents the estimation results. Following the rule of thumb, the System GMM estimator is preferred. The first five columns display the results for the manufacturing sector, while the remaining columns present the results for the service sector. Columns (1) and (6) present the coefficients on the real exchange rate and the resource dependence index for the manufacturing and service sectors, respectively. The negative and statistically significant coefficients on the explanatory variables of interest indicate that the appreciation of the real exchange rate caused by the natural resource boom reduces the size of both sectors on average.

Furthermore, in accordance with the proposed theory, the resource boom stimulates sectoral growth rates through the LBD effect and the spillover impact of technological improvement from the resource sector. Therefore, I first exclude the resource dependence index and subsequently estimate the regression model to investigate the LBD effect triggered by real exchange rate appreciation. Columns (2) and (7) present the results. The coefficient on the real exchange rate for both sectors is negative and significant at the 1% level. The findings for the manufacturing sector align with those reported in Sekkat and Varoudakis (2000), Vaz and Baer (2014). Nevertheless, it is worth noting that these studies focused on specific groups of countries rather than encompassing all countries.Footnote 31 This might also suggest that the learning process of the LBD approach, originating in the manufacturing sector and spilling over to the service sector, serves as the dominant driving force behind productivity growth in both sectors. Additionally, this indirectly verifies the findings presented in Column (2) of Table 4. The estimated coefficient value in the manufacturing sector surpasses that in the service sector (i.e., 0.191%> 0.156%), indicating a more significant contraction in the manufacturing sector compared to the service sector due to the LBD effects. Consequently, this supports the notion of decreased relative sectoral output caused by exchange rate appreciation.

Following the previous subsection, I further investigate the impact of the resource spillover effect on sectoral growth in terms of cross-country resource dependence. In this context, I exclusively focus on the coefficient of the resource dependence index, which encompasses both the LBD effect and the resource spillover effect. Columns (3) and (8) present the estimation results for the full sample of countries in the manufacturing sector and the service sector, respectively. The estimates reveal that the coefficients exhibit negative signs and hold statistical significance at the 1% level. The estimated results indicate that a one-percentage-point increase in the resource dependence index leads to a 0.65% decrease in output per capita in the manufacturing sector and a 0.47% decrease in output per capita in the service sector. This finding is in line with Rajan and Subramanian (2011), who employed OLS panel regression to estimate the impact of the 10-year average of aid (% of GDP) on the growth rate of industry value added. Additionally, the results can be compared with those of Lartey et al. (2012), who studied the effect of remittance flows on sectoral growth. While their findings for the manufacturing sector are qualitatively similar to my estimated results, they differ for the service sector. This finding also appears to align with the decrease in the level of relative sectoral output discussed in the previous subsection. The coefficient values indicate that the contraction in the service sector is less pronounced than in the manufacturing sector, which likely contributes to a reduction in the level of relative sectoral output.

The results for the sample of resource-rich countries are presented in Columns (4) and (9) of Table 4. They show that the coefficient for the resource-dependence index is significantly negative in both sectoral estimations. The findings indicate that a one-percentage-point increase in the resource dependence index corresponds to an approximate 0.6% reduction in per capita output for both sectors. In summary, this implies that resource booms lead to slower growth in both sectors. The finding for the manufacturing sector aligns with the findings of Ismail (2010), who examined the effect of oil prices on the level of manufacturing firms in oil-exporting countries.

Furthermore, the negative coefficients on the resource dependence index can be explained by the proposed theory. This implies that the positive effect of the resource spillover effect on the growth rate of domestic sectors is insufficient to counteract the LBD effects induced by the appreciation of the real exchange rate. Moreover, this suggests two outcomes in resource-rich countries: (1) the dominance of the LBD effect over the resource spillover effect, and (2) a stronger direct LBD effect in the manufacturing sector and a weaker direct LBD effect in the service sector.Footnote 32

In a closer examination, the theory suggests that the deceleration in sectoral growth can result from slower growth in productivity levels, labor share, or a combination of both. Empirical evidence and the theory’s description indicate that an increase in the real exchange rate is associated with a rise in the labor share within the service sector. Therefore, the significant reduction in productivity levels should primarily account for the decline in the growth rate of the service sector. This, in turn, is a consequence of a more pronounced LBD effect in comparison to the resource spillover effect. On the other hand, the decrease in both productivity levels and the labor share within the manufacturing sector can potentially explain the deceleration in growth observed in this sector.

Furthermore, comparing the value of the coefficients reported in Columns (4) and (9) reveals that an increase in the resource dependence index results in slower growth in the manufacturing sector compared to the service sector. The more significant contraction in the manufacturing sector aligns with the empirical findings of the previous subsection. This observation may imply that declines in productivity levels and labor share contribute to a more pronounced contraction in the manufacturing sector than in the service sector.

Estimates for the sample of resource-poor countries are presented in Columns (5) and (10) of Table 4. These estimates indicate that a resource boom accelerates the growth rate in the manufacturing sector, while it decelerates the growth rate in the service sector. A one-percentage-point increase in the resource dependence index increases the output in the manufacturing sector by roughly 2.2% and decreases the output in the service sector by roughly 1.9%. In line with the proposed theory, this suggests that the LBD effect is stronger in the service sector and weaker in the manufacturing sector compared to the resource spillover effect. Consequently, the growth rate of the service sector in resource-poor countries will decrease similarly to that in resource-rich countries. However, the dominant resource spillover effect accelerates productivity growth in the manufacturing sector.Footnote 33 The latter is consistent with recent literature that documents strong positive spillovers from the resource sector to the manufacturing sector [e.g., Weber (2012); Kuralbayeva and Stefanski (2013); Feyrer et al. (2017); Allcott and Keniston (2018); Bjørnland et al. (2019)]. Since the majority of OECD countries in my dataset are categorized as resource-poor, my estimates also appear to align well with Harding et al. (2020), but not with Bjørnland and Thorsrud (2016).Footnote 34

Finally, the expansion in the manufacturing sector and the contraction in the service sector resulting from a resource boom confirm the increase in the relative sectoral output level discussed in the preceding subsection. Consequently, this may suggest a more pronounced appreciation of the real exchange rate for the sample of resource-poor countries.

3.2.4 Economic Growth

The model’s mechanism and previous empirical findings indicate that in resource-rich countries, the LBD effect dominates. As a result, a resource boom diminishes the growth rate of both the manufacturing and service sectors. In contrast, in resource-poor countries, the prevailing resource spillover effect accelerates the growth rate of the manufacturing sector, while the prevailing indirect LBD effect decelerates the growth rate of the service sector. Consequently, a resource boom leads to slower economic growth in resource-rich countries. However, if the manufacturing sector serves as the primary economic engine, resource-poor economies are likely to experience faster expansion.

This prompts me to investigate how economic growth responds to the explanatory variables of interest. The level of GDP per capita (at constant prices) is considered the dependent variable,Footnote 35 while the resource dependence index and the real exchange rate are the explanatory variables of interest. Additionally, I include population growth, investment ratio, human capital index, openness index, government spending, and institution index in the regression model as control variables.

Table 5 displays the results. Despite the rule of thumb suggesting System GMM as the preferred method, I employ the Difference GMM to estimate the regression model. This choice is driven by the suspicion that the System GMM estimator may yield a unit root process, whereas the Difference GMM estimates exhibit higher statistical significance.Footnote 36 The estimate reported in Column (1) indicates that both coefficients enter with negative signs and are significant at the 1% level. To investigate the effect of LBD, I initially exclude the resource dependence index and then proceed to estimate the regression model. The estimated results in Column (2) show that a 1% increase in the real value of a country’s currency against the basket of the country’s trading partners results in a reduction of approximately 0.1% in GDP per capita. This finding aligns with empirical studies that emphasize the adverse effect of real exchange rate appreciation on the growth rate [e.g., Eichengreen (2007); Rodrik (2008); Rajan and Subramanian (2008); Habib et al. (2017)]. In line with theoretical predictions, this result may suggest that the LBD effect caused by the appreciation of the real exchange rate tends to decrease economic growth on average.

Furthermore, I examine the impact of the resource spillover effect on the growth rate, taking into account the heterogeneity of resource dependence across countries. The estimates for the full sample of countries are displayed in Column (3), revealing that a one-percentage-point increase in the resource dependence index increases the GDP per capita by roughly 0.85%. This finding supports the hypothesis of the natural resource curse [e.g., Sachs and Warner (1995); Rodriguez and Sachs (1999); Gylfason et al. (1999); Zallé (2019)].

Following the preceding subsections, I also present results for samples of resource-rich and resource-poor countries. The results are detailed in Columns (4) and (5), respectively. These estimates indicate that a one-percentage-point increase in the resource dependence index decreases GDP per capita by approximately 0.48% in the resource-rich country group and raises it by approximately 3.9% in the resource-poor country group. These findings demonstrate a deceleration of growth in resource-rich countries and an acceleration of growth in resource-poor countries. In light of the empirical findings discussed earlier, a resource boom leads to contractions in both sectors in resource-rich countries. Consequently, a slower growth rate is expected for this particular group of countries. Theoretically, this suggests that the LBD effect plays a crucial role in determining the growth rate. Conversely, a resource boom triggers the expansion of the manufacturing sector while simultaneously reducing the service sector in resource-poor countries. Consequently, the observed acceleration in the growth rate signifies that the manufacturing sector functions as the primary economic engine in resource-poor countries. Theoretically, this suggests that the resource spillover effect governs the growth rate in resource-poor countries. The positive spillover effect from the resource sector is significant, fully compensating for the adverse impact of LBD on the manufacturing sector, thus facilitating a faster expansion of the manufacturing sector. This, in turn, becomes the primary driving force behind the economy, resulting in accelerated economic growth.

3.2.5 Robustness Tests

The Appendix presents several robustness checks, providing additional insights into my baseline results. Firstly, I analyze the robustness of the results regarding country-group heterogeneity, including development level, institutional quality, and currency union effects. Additionally, I examine the influence of the Great Recession and various real exchange rate measurement methods on result consistency. Tables 8, 9, 10, and 11 report these robustness checks, and the estimates are discussed in Appendix D. Furthermore, in line with Mihasonirina and Kangni (2011), I provide additional estimates to assess the sensitivity of the coefficient on the explanatory variables of interest to variations in sample size. The results are reported in Table 13 and discussed in Appendix E.

I reported the results of the AR(3) test instead of the AR(2) estimates in Tables 4 and 5. The assumption of no AR(2) correlation is rejected when only one lag of the output level is included. A specification with only one lag is incapable of adequately capturing the dynamics in the output level (Acemoglu et al. 2019). Therefore, I integrated deeper lags into the regression model. The results presented in Table 12 suggest no further evidence of serial correlation in the residuals when additional lags in output per capita are included. Furthermore, the estimates for the explanatory variable of interest show qualitative similarity to my baseline results, but not quantitative similarity. More discussion is presented in Appendix D.5.

4 Theory Meets Evidence

To provide context for our estimates, I first summarize the empirical results and then discuss them in terms of theory. The estimated empirical results provide clear evidence of symptoms related to the Dutch disease phenomenon. In summary, the empirical study demonstrates that a resource boom leads to an appreciation of the real exchange rate, which is more pronounced in resource-poor countries compared to resource-rich countries. Within resource-rich countries, a resource boom has a greater decelerating effect on the growth rate in the manufacturing sector than in the service sector. Consequently, this is associated with a lower level of relative sectoral output and slower economic growth. Conversely, in resource-poor countries, a resource boom accelerates the growth of the manufacturing sector while decelerating the growth of the service sector. This is associated with a higher level of relative sectoral output and faster economic growth.

The Dutch Disease mechanism, as illustrated in Fig. 1a, explains the empirical findings well for resource-rich countries. In the short run, a resource boom increases aggregate demand for both goods. Given the constant price of manufactured goods, the real exchange rate appreciates due to the expanded demand for service goods. This appreciation causes the real wage to rise in the service sector relative to the manufacturing sector. As a result, workers shift away from the manufacturing sector and move into the service sector. The labor share in the service sector increases to a greater extent than the given steady-state level. In the long-run process, the LBD effect serves as the primary driving force behind productivity growth in domestic sectors. Given the stability conditions of the dynamic system, the larger share of labor in the service sector compared to its steady-state level leads to a positive growth rate of the relative productivity ratio. Consequently, productivity growth in the manufacturing sector slows down more than in the service sector, resulting in a decrease in the economic growth rate. The declining relative productivity ratio along the transition path triggers a compensatory labor movement from the service to the manufacturing sector. This movement, in turn, mitigates the real exchange rate appreciation along the transition path. However, since the change in the service sector’s labor share in the steady state due to the resource boom surpasses the given critical threshold, the real exchange rate eventually settles at a higher level than the initial level.

While Fig. 1b explains the empirical findings well for resource-poor countries. In the short run, a resource boom appreciates the real exchange rate under a mechanism similar to that of resource-rich countries. However, it causes the labor share in the service sector to increase somewhat below the steady-state level. In the long run, the resource spillover effect becomes the main driver of productivity growth in the manufacturing sector, while the LBD effect remains the primary driver of productivity growth in the service sector. Given the stability conditions of the dynamic system, the lower share of labor in the service sector compared to its steady-state level leads to a negative growth rate of the relative productivity ratio. Consequently, productivity growth accelerates in the manufacturing sector and slows down in the service sector, leading to an increase in the economic growth rate. The rising relative productivity ratio along the transition path induces a stronger alignment of labor movement from the manufacturing to the service sector. In turn, this exacerbates the appreciation of the real exchange rate along the transition path.

5 Conclusion

This study provides robust empirical validation for a modified Dutch disease theory that considers unequal spillovers of technological progress from the resource sector to the domestic sector. The proposed model addresses significant gaps between the predictions of Dutch disease dynamic models and empirical evidence. Using a dataset spanning 152 countries from 1970 to 2019, I employ the GMM method to control for the endogeneity problem and apply the theory to real-world data. Through this approach, I estimate the impact of a theory-consistent proxy for resource booms on spending and resource movement channels, illustrating the mechanism of resource rents in both resource-rich and resource-poor countries.

I present robust evidence of real exchange rate appreciation in response to a resource boom (spending effect). This appreciation is more pronounced in resource-poor countries than in resource-rich countries. Furthermore, I provide additional evidence for the spending effect through the international payments transmission channel. Consistent with the proposed theory, I demonstrate differences in the resource movement channel between resource-rich and resource-poor countries. The LBD effect serves as the primary driver of sectoral productivity growth in resource-rich countries. Consequently, a resource boom diminishes the growth rate in the manufacturing sector more than in the service sector, leading to a decline in the relative sectoral output and a slowdown in economic growth. Conversely, the resource spillover effect underlies the manufacturing sector’s productivity growth in resource-poor countries. As a result, a resource boom accelerates productivity growth in the manufacturing sector and decelerates it in the service sector, leading to an increase in the relative sectoral output and an acceleration in economic growth.

These results emphasize the significance of distinguishing between resource-rich and resource-poor countries when analyzing the Dutch disease hypothesis. To the best of my knowledge, this is the first paper to discuss the spending and resource movement channels for groups of countries homogeneous in terms of resource dependence, establishing strong consistency between theory and empirical evidence.

Notes

According to the standard Dutch disease model proposed by Corden and Neary (1982), the model consists of three sectors: the booming sector, lagging sectors that produce traded goods, and the non-traded sector that produces service goods.

Bjørnland and Thorsrud (2016) use a Bayesian Dynamic Factor Model (BDFM) for Australia and Norway as representative case studies. Their results are twofold: (1) a resource boom has significant and positive productivity spillovers in non-resource sectors, and (2) there is a two-speed transmission phase in which the non-traded sector expands faster than the traded sector.

Two different criteria are utilized to categorize economies based on their natural resources: (1) resource dependence, which measures the value of natural resources as a percentage of GDP or total national wealth, and (2) resource abundance, which gauges the per capita stock of natural resource wealth. Empirical studies covering a comprehensive range of countries indicate that the abundance of natural resources positively influences economic performance [see Brunnschweiler and Bulte (2008); Alexeev and Conrad (2009); Esfahani et al. (2013); Cavalcanti et al. (2011)].

Several studies [e.g., Rajan and Subramanian (2011) among others] focus on foreign aid instead of resource rents, and they conclude that foreign aid contributes to slower growth in the manufacturing sector.

The other alternatives are the measurement of NR in the service goods’ unit or as a fraction of total income. Hence, R denotes total natural resource rent relative to the productivity level (i.e, \(R=\frac{NR}{A_{J}}\), where \(J=\left\{ M,S \right\}\)) or the income level (i.e, \(R=\frac{NR}{Y}\)). However, the qualitative outcomes of the model remain consistent regardless of these selections.

This general LBD model (i.e., Eq. 1) can also capture the earlier literature: Krugman (1987) represents the case where \(\delta _{RS}=\delta _{RM}=\delta _{S}=\gamma _{M}=\gamma _{S}=0\), while Lucas (1988) assumes the case where \(\delta _{RS}=\delta _{RM}=\gamma _{S}=\gamma _{M}=0\). Additionally, it can be simplified to the model proposed in Sachs and Warner (1995) when \(\delta _{RS}=\delta _{RM}=\delta _{S}=0\) and \(\gamma _{M}=1\), in Torvik (2001) when \(\delta _{RS}=\delta _{RM}=0\), and in Bjørnland and Thorsrud (2016) when \(\delta _{RS}=\delta _{RM}=\delta _{R} R\).

When a Cobb-Douglas utility function is used (i.e., \(\sigma = 1\)), the vertical shifts of both the LL and NN curves are equal. Therefore, the labor share in the service sector remains independent of changes in \(\phi\) (i.e., \(\frac{dL_{S}}{d\phi } = 0\)), thus leading to the existence of a set of growth paths.