Abstract

China is currently undergoing an important stage wherein it is adjusting its development mode and upgrading its industrial structure. Green investment has become a major driving force through which China can achieve green and sustainable development. Based on the panel data of 30 Chinese provinces for the 2006–2017 period, this paper uses a spatial Durbin model and a dynamic threshold model to empirically analyze the impact of green investment and institutional quality on environmental pollution. The research results show that China’s environmental pollution is significantly characterized by spatial dependence. Local environmental pollution is negatively impacted by green investment, but it is not affected by green investment in neighboring areas; this conclusion remains valid after a series of robustness tests. Green investment can reduce environmental pollution by improving efficiency of energy conservation and emission reduction, expanding technological innovation capabilities and upgrading the industrial structure. The regression results of the dynamic threshold model show that green investment has a nonlinear impact on environmental pollution that is dependent on institutional quality. A higher degree of regional corruption can lead to a gradual decrease in the role of green investment in reducing environmental pollution. However, improvements in marketization and intellectual property protection can increase the positive influence of green investment in reducing environmental pollution. Significant regional heterogeneity is also found in the impact of green investment on environmental pollution, and this impact gradually decreases from the eastern coast to the western region.

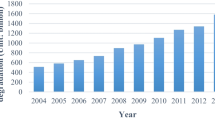

Source The data are from the National Bureau of Statistics (http://www.stats.gov.cn/ztjc/ztsj/hjtjzl/2014/201609/t20160913_1399641.html)

Similar content being viewed by others

Notes

More details can be found at https://epi.yale.edu/downloads/epi2018policymakerssummaryv01.pdf.

References

Abduqayumov S, Arshed N, Bukhari S (2020) Economic impact of institutional quality on environmental performance in post-soviet countries. Trans Stud Rev 27(2):13–24

Antonietti R, Marzucchi A (2013) Green investment strategies and export performance: a firm-level investigation

Arbatskaya M, Mialon HM (2020) The impact of the foreign corrupt practices act on competitiveness, bribery, and investment. Am Law Econ Rev 22(1):105–126

Awokuse TO, Yin H (2010) Intellectual property rights protection and the surge in FDI in China. J Comp Econ 38(2):217–224

Bao Q, Chen Y, Song L (2011) Foreign direct investment and environmental pollution in China: a simultaneous equations estimation. Environ Dev Econ 16(1):71–92

Baron RM, Kenny DA (1986) The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J Pers Soc Psychol 51(6):1173

Buchanan BG, Le QV, Rishi M (2012) Foreign direct investment and institutional quality: some empirical evidence. Int Rev Financ Anal 21:81–89

Callon M (2017) Markets, marketization and innovation. Edward Elgar Publishing, In The Elgar companion to innovation and knowledge creation

Case B, Clapp J, Dubin R, Rodriguez M (2004) Modeling spatial and temporal house price patterns: a comparison of four models. J Real Estate Finance Econ 29(2):167–191

Chung YH, Färe R, Grosskopf S (1997) Productivity and undesirable outputs: a directional distance function approach. J Environ Manage 51(3):229–240

Deng Y, You D, Wang J (2019) Optimal strategy for enterprises’ green technology innovation from the perspective of political competition. J Clean Prod 235:930–942

Dollar D, Levin V (2005) Sowing and reaping: institutional quality and project outcomes in developing countries. Available at SSRN 667882

Doval E, Negulescu O (2014) A model of green investments approach. Proc Econ Finance 15:847–852

Dreher A, Kotsogiannis C, McCorriston S (2009) How do institutions affect corruption and the shadow economy? Int Tax Public Financ 16(6):773–796

Eyraud L, Clements B, Wane A (2013) Green investment: trends and determinants. Energy Policy 60:852–865

Fredriksson PG, Svensson J (2003) Political instability, corruption and policy formation: the case of environmental policy. J Public Econ 87(7–8):1383–1405

Grossman GM, Krueger AB (1995) Economic growth and the environment. Q J Econ 110(2):353–377

Han XF, Song WF, Li BX (2019) Can the Internet become a new driving force for China’s regional innovation efficiency? China Ind Econ 07:119–136 ([In Chinese])

Hao Y, Gai Z, Wu H (2020). How do resource misallocation and government corruption affect green total factor energy efficiency? Evidence from China. Energy Policy 143:111562

He G, Wu X (2017) Marketization, occupational segregation, and gender earnings inequality in urban China. Soc Sci Res 65:96–111

He L, Zhang L, Zhong Z, Wang D, Wang F (2019) Green credit, renewable energy investment and green economy development: empirical analysis based on 150 listed companies of China. J Clean Prod 208:363–372

Heine D, Semmler W, Mazzucato M, Braga JP, Gevorkyan A, Hayde EK, Radpour S (2019) Financing low-carbon transitions through carbon pricing and green bonds. World Bank Policy Research Working Paper (8991)

Heinkel R, Kraus A, Zechner J (2001) The effect of green investment on corporate behavior. J Financ Quant Anal, pp 431–449

Huynh CM, Ho TX (2020) Institutional quality, shadow economy and air pollution: empirical insights from developing countries. Empiric Econ Lett 19(1):75–82

Huynh CM, Hoang HH (2019) Foreign direct investment and air pollution in Asian countries: does institutional quality matter? Appl Econ Lett 26(17):1388–1392

Inderst G, Kaminker C, Stewart F (2012) Defining and measuring green investments

Jennewein K (2006) Intellectual property management: the role of technology-brands in the appropriation of technological innovation. Springer Science & Business Media.

Karásek J, Pavlica J (2016) Green investment scheme: experience and results in the Czech Republic. Energy Policy 90:121–130

Kong Q, Peng D, Ni Y, Jiang X, Wang Z (2020) Trade openness and economic growth quality of China: empirical analysis using ARDL model. Finance Res Lett 101488

Krushelnytska O (2019) Introduction to green finance. World Bank, Global Environment Facility (GEF), Washington, DC http://documents.worldbank.org/curated/en/405891487108066678/Introduction-to-green-finance.

Lan J, Kakinaka M, Huang X (2012) Foreign direct investment, human capital and environmental pollution in China. Environ Resource Econ 51(2):255–275

Lau LS, Choong CK, Ng CF (2018) Role of institutional quality on environmental Kuznets curve: a comparative study in developed and developing countries. In Advances in pacific basin business, economics and finance. Emerald Publishing Limited.

Leitch S, Davenport S (2005) The politics of discourse: marketization of the New Zealand science and innovation system. Human Relat 58(7):891–912

Li ZZ, Li RYM, Malik MY, Murshed M, Khan Z, Umar M (2021) Determinants of carbon emission in China: how good is green investment? Sustain Product Consumpt 27:392–401

Liao X (2018) Public appeal, environmental regulation and green investment: Evidence from China. Energy Policy 119:554–562

Lindenberg N (2014) Definition of green finance. Social Science Electronic Publishing

Martin P, Moser D (2012) Managers’ green investment and related disclosure decisions. In Experimental economics, accounting and society: a conference in memory of John Dickhaut, pp. 13–14

Mishra A, Daly K (2007) Effect of quality of institutions on outward foreign direct investment. J Int Trade Econ Dev 16(2):231–244

Nassiry D (2019) The Role of Fintech in Unlocking Green Finance. Handbook of Green Finance 545:315–336

Pellegrini L, Gerlagh R (2006) Corruption and environmental policies: what are the implications for the enlarged EU? Eur Environ 16(3):139–154

Pisano G (2006) Profiting from innovation and the intellectual property revolution. Res Policy 35(8):1122–1130

Sachs JD, Schmidt-Traub G, Mazzucato M, Messner D, Nakicenovic N, Rockström J (2019) Six transformations to achieve the sustainable development goals. Nat Sustain 2(9):805–814

Sarkodie SA, Adams S (2018) Renewable energy, nuclear energy, and environmental pollution: accounting for political institutional quality in South Africa. Sci Total Environ 643:1590–1601

Shen Y, Su ZW, Malik MY, Umar M, Khan Z, Khan M (2020) Does green investment, financial development and natural resources rent limit carbon emissions? A provincial panel analysis of China. Sci Total Environ 755:142538

Sueyoshi T, Wang D (2014) Radial and non-radial approaches for environmental assessment by data envelopment analysis: corporate sustainability and effective investment for technology innovation. Energy Econ 45:537–551

Sun H, Edziah BK, Sun C, Kporsu AK (2019) Institutional quality, green innovation and energy efficiency. Energy Policy 135:111002

Voica MC, Panait M, Radulescu I (2015) Green investments–between necessity, fiscal constraints and profit. Proc Econ Finance 22(2015):72–79

Wang Q, Yang Z (2016) Industrial water pollution, water environment treatment, and health risks in China. Environ Pollut 218:358–365

Wang L, Su CW, Ali S, Chang HL (2020) How China is fostering sustainable growth: the interplay of green investment and production-based emission. Environ Sci Pollut Res 27(31):39607–39618

Wu H, Hao Y, Ren S (2020) How do environmental regulation and environmental decentralization affect green total factor energy efficiency: evidence from China. Energy Econ 91:104880

Xin D, Zhang Y (2020) Threshold effect of OFDI on China’s provincial environmental pollution. J Clean Product 258: 120608

Yang X, Zhang J, Ren S, Ran Q (2020) Can the New Energy Demonstration City policy reduce environmental pollution? Evidence from a quasi-natural experiment in China. J Clean Product, 125015

Yuan B, Li C, Xiong X (2020) Innovation and environmental total factor productivity in China: the moderating roles of economic policy uncertainty and marketization process. Environ Sci Pollut Res, pp 1–24

Zahan I, Chuanmin S (2021) Towards a green economic policy framework in China: role of green investment in fostering clean energy consumption and environmental sustainability. Environ Sci Pollutn Res, pp 1–11

Zakaria M, Bibi S (2019) Financial development and environment in South Asia: the role of institutional quality. Environ Sci Pollut Res 26(8):7926–7937

Zhang X, Yousaf HAU (2020) Green supply chain coordination considering government intervention, green investment, and customer green preferences in the petroleum industry. J Clean Prod 246, 118984

Zhang XP, Cheng XM, Yuan JH, Gao XJ (2011) Total-factor energy efficiency in developing countries. Energy Policy 39(2):644–650

Zhang J, Yu L, Bi Q, Pan J (2016) Media supervision, environmental regulation and Firm green investment. J Shanghai Univ Financ Econ 18(5):91–102 ((in Chinese))

Zhao J, Zhao Z, Zhang H (2019) The impact of growth, energy and financial development on environmental pollution in China: new evidence from a spatial econometric analysis. Energy Econ 104506

Zhao X, Wang Z, Deng M (2019b) Interest rate marketization, financing constraints and R&D investments: evidence from China. Sustainability 11(8):2311

Acknowledgements

The authors acknowledge financial support from the National Natural Science Foundation of China (72073010, 71761137001, 71521002), the National Social Science Fund of China (21ZDA086), the key research program of the Beijing Social Science Foundation (17JDYJA009), the Joint Development Program of the Beijing Municipal Commission of Education. The authors are also very grateful to the anonymous reviewers, Co-Editor Prof. Dr. Robert Elliott and Editor-in-Chief Prof. Dr. Ian J. Bateman for their insightful comments that helped us sufficiently improve the quality of this paper. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Ren, S., Hao, Y. & Wu, H. How Does Green Investment Affect Environmental Pollution? Evidence from China. Environ Resource Econ 81, 25–51 (2022). https://doi.org/10.1007/s10640-021-00615-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-021-00615-4