Abstract

Legal challenges and transitions of political power cause the future of regulatory policies to be uncertain. In this article, I investigate how uncertainty about environmental policy affects investment and emissions at coal-fired power plants. I exploit a legal challenge to the Clean Air Interstate Rule (CAIR) that created variation in the probability that individual plants would need to comply with the new policy. I use a difference-in-differences approach to compare pollution reductions at power plants located in states subject to more uncertainty to plants in states that that were not. I find that plants with a lower probability of being regulated invested in fewer capital-intensive pollution controls and reduced pollution by 13% less on average. Many of these plants did switch to capital-intensive pollution controls after the court upheld CAIR. Policy uncertainty increased compliance costs by $124 million by delaying efficient investments.

Similar content being viewed by others

Notes

For instance, after the 2016 presidential election, Donald Trump withdrew from the Paris Climate Agreement, scrapped the Clean Power Plan, approved orders to build major pipelines, and signed an order to remove regulations on wetlands and waterways that were introduced by the Obama administration.

There is a recent empirical literature that investigates the effects of policy uncertainty (Born and Pfeifer 2014; Fernandez-Villaverde et al. 2015; Baker et al. 2016; Gulen and Ion 2015). I use a different identification strategy than these related studies because I can leverage quasi-experimental variation in exposure to policy uncertainty. I discuss the existing literature in more detail below.

SO2 is harmful to the human respiratory system and is a precursor to acid rain which can damage natural ecosystems. CAIR also introduced a program to reduce NOx emissions.

To mitigate concerns about selection bias, I provide evidence that compliance costs and environmental preferences were not systematically different in these “challenger” states.

One notable exception is Fabrizio (2012).

All coal units were regulated under a cap and trade program so they needed to hold permits for each ton of SO2 they emitted.

The court ruled that plants in Minnesota would not be required to participate in CAIR, but plants in Florida and Texas would be required to comply.

Specifically, I show how policy uncertainty affects a firm’s incentive to choose a capital-intensive abatement option (scrubber) relative to a reversible abatement option (buying low-sulfur coal). Viscusi (1983) only allows for a non-reversible abatement option.

This work is distinct from the literature that considers a decision maker with a potential investment project, and the expected net return from the project evolves over time according to a known stochastic process (McDonald and Siegel 1986; Pindyck 1988; Dixit and Pindyck 1994). The decision maker must decide when and how much to invest. This literature shows that increases in the variance of the stochastic process increase the incentives to delay investment. In practice, policy uncertainty rarely involves increases in the variance of a stochastic process (holding mean fixed) but instead involves changes in the probability that a fixed policy will be enacted.

A growing literature in environmental economics compares the theoretical effects of different regulatory policies for inducing investment and R&D in new technologies (Requate and Unold 2003; Requate 2005; Krysiak 2008; Laffont and Tirole 1996; Chao and Wilson 1993). Notably, Zhao (2003) develops a rational expectations general equilibrium model of irreversible abatement investment to show how uncertainties about costs affect investment under permit trading versus emissions taxes. In public economics, Hassett and Metcalf (1999) simulate the impact of tax policy uncertainty on the level of aggregate investment. In development economics, Rodrik (1991) shows that policy uncertainty can act as a tax on investment in developing countries attempting to enact reforms. In industrial organization, Teisberg (1993) presents a model of capital investment choices by regulated firms under uncertain regulation. The model justifies utilities delaying investment and choosing shorter-lead-time technologies.

Emissions were higher at plants in the “challenger” states relative to other plants regulated under CAIR.

Jet streams in North America typically cause the wind to blow from west to east.

Figure 1 depicts the states included in the CAIR SO2 program and separately identifies the “challenger” states which explicitly challenged their inclusion in the program.

The D.C. Circuit Court made an initial ruling in July 2008 to stay implementation of CAIR for all states. The court ruled that EPA did not do a satisfactory job accounting for the effects of pollution in particular downwind states. In December, the court changed the ruling to allow CAIR to stand while the EPA fixed issues with the rule.

North Carolina argued that the program did not mandate emissions reductions from sources that were contributing to non-attainment of NAAQS in downwind states. Under a cap-and-trade program, upwind plants could avoid making emissions reductions by instead choosing to purchase more allowances.

In fact, the court agreed with parts of both of these challenges, and as a result CAIR was replaced by the Cross-State Air Pollution Rule (CSAPR) in 2014. The CSAPR program did not use ARP permits and limited interstate trading, which contributed to the eventual collapse of SO2 allowance prices.

In the case of the CAIR program, \(P_2^L=P_1\) and \(P_2^H=2 P_1\). Each unit included in CAIR had to surrender two permits for each ton of SO2 emissions starting in 2010, units not include in CAIR would continue to submit one permit per ton of SO2.

For the empirical application, I focus on uncertainty that affected a small group of firms and was unlikely to have a substantial effect on the equilibrium permit market price.

In practice, switching to low-sulfur coal does incur a fixed cost to retrofit boilers and equipment; however, these costs are generally very small in comparison to the capital cost of installing a scrubber.

Modeling a new investment as reducing marginal abatement cost is standard in the theoretical literature investigating environmental policy instruments and technology adoption (Jung et al. 1996; Milliman and Prince 1989; Requate and Unold 2003; Shittu et al. 2015). Amir et al. (2008) and Baker et al. (2008) provide additional discussion about modeling technical change and the marginal cost of abatement. In the context of SO2 abatement, a coal unit that has not installed a scrubber (capital technology) can reduce emissions by purchase low-sulfur coal, which entails large shipping costs for plants located in the Midwest and East. Units that have installed the technology can reduce pollution by simply running their scrubber. This entails some operation and maintenance costs, but these costs are relatively small compared to buying more expensive low-sulfur coal.

See Requate and Unold (2003) for more details.

2002–2011 is the time frame for the primary analysis. I also collect data going back as far as 1996 that I use for an additional test.

As a robustness check, I also run regressions for the entire population of coal units (including those that were scrubbed before 2004) and for the complete unbalanced panel of units.

Table 4 in the next section shows that for the matched sample, CAIR units and Challenger units look very similar in age, baseline emissions, distance to PRB, and regulatory status.

I use SO2 per MMBtu instead of SO2 per MWH because gross output data is missing for some units in the sample. As a robustness check, I also run the model with SO2 emissions rate, total SO2 emissions (levels) as the outcome variable.

See Hotz et al. (2006) for a discussion of the identification of differential effects.

Total demand for permits can be determined by multiplying 2004 SO2 emissions by 2 for units included in CAIR, and multiplying 2004 SO2 emissions by 1 for non-CAIR units and summing across all units.

In 2011, the EPA announced a replacement policy for CAIR called the Cross State Air Pollution Rule (CSAPR), for that reason I do not consider any data beyond 2011 because any abatement choices beyond that point are likely related to the new policy.

I also investigate abatement and investment trends for each state individually in the Appendix. There were only nine units without scrubbers in MN after the court ruling and none installed scrubbers in 2010–2011.

The continous variables include the unit’s distance to the Powder River Basin, boiler age, and baseline emission rate in 2004.

The results are also robust to clustering at the plant level, operating-company level, state-year level, and state level. See Table 11 in the Appendix.

Allowance price data were obtained from EIA and EPA, the price data are the market clearing prices from the annual EPA allowance auction.

3.98% was the average rate for 10-Year U.S. Treasury bonds during this period.

Measuring the additional health costs that arose from increases in emissions is not straightforward. Although the legal challenge increased emissions in the “challenger” states, these increases were partly offset by later decreases in emissions after the court ruling (since firms still had to comply with the cap). Increased health costs are therefore a result of spatial and temporal shifts in emissions.

See Federal Register Vol. 70 (Thursday, May 12, 2005). The EPA estimated that the average cost of each ton of SO2 abated would be $500 and that the program would reduce emissions by 3.6 million tons in 2010.

These calculations are obtained by multiplying EPA’s predicted average cost of compliance by the required emission reduction under CAIR.

Recall \(a_1^I\) is the optimal first period abatement conditional on installing the capital technology, and \(a_1^N\) is the optimal first period abatement choice for firms that do not install the technology.

The semi-parametric DID estimator only allows for one treatment group and one control group so I omit units outside CAIR.

Estimation of the ATE requires the overlap condition: \(0<P(D=1|X)<1\).

2009 was after the court ruling so it is possible firms could have reduced emissions after the ruling was made. Scrubbers usually take over a year to install, and coal is usually purchased on 1-year contracts so this is unlikely but possible.

Many states elect PUC commissioners.

References

Abadie A (2005) Semiparametric difference-in-differences estimators. Rev Econ Stud 72(1):1–19

Abadie A, Imbens GW (2006) Large sample properties of matching estimators for average treatment effects. Econometrica 74(1):235–267

Amir R, Germain M, Van Steenberghe V (2008) On the impact of innovation on the marginal abatement cost curve. J Public Econ Theory 10(6):985–1010. https://doi.org/10.1111/j.1467-9779.2008.00393.x

Baker E, Clarke L, Shittu E (2008) Technical change and the marginal cost of abatement. Energy Econ 30(6):2799–2816

Baker SR, Bloom N, Davis SJ (2016) Measuring economic policy uncertainty. Q J Econ 131(4):1593–1636. https://doi.org/10.1093/qje/qjw024

Bernanke BS (1983) Irreversibility, uncertainty, and cyclical investment. Q J Econ 98(1):85–106. https://doi.org/10.2307/1885568

Born B, Pfeifer J (2014) Policy risk and the business cycle. J Monet Econ 68:68–85. https://doi.org/10.1016/j.jmoneco.2014.07.012

Chao H-P, Wilson R (1993) Option value of emission allowances. J Regul Econ 5(3):233–249

Cicala S (2015) When does regulation distort costs? Lessons from fuel procurement in US electricity generation\(\dagger\). Am Econ Rev 105(1):411–444. https://doi.org/10.1257/aer.20131377

Collard-Wexler A (2013) Demand fluctuations in the ready-mix concrete industry. Econometrica 81(3):1003–1037

Dixit AK, Pindyck RS (1994) Investment under uncertainty. Princeton University Press, Princeton

EPA U (2016) Progress report—clean air markets. US Environmental Protection Agency. https://www3.epa.gov/airmarkets/progress/reports/index.html

Fabrizio KR (2012) The effect of regulatory uncertainty on investment: evidence from renewable energy generation. J Law Econ Organ 29(4):765–798. https://doi.org/10.1093/jleo/ews007

Federal Register Vol. 70, N. . (Thursday, May 12, 2005) Rule to reduce interstate transport of fine particulate matter and ozone (Clean Air Interstate Rule); Revisions to Acid Rain Program; Revisions to the NOX SIP Call

Fernandez-Villaverde J, Guerron-Quintana P, Kuester K, Rubio-Ramirez J (2015) Fiscal volatility shocks and economic activity. Am Econ Rev 105(11):3352

Fowlie M (2010) Emissions trading, electricity restructing, and investment in pollution abatement. Am Econ Rev 100(3):837–869

Gulen H, Ion M (2015) Policy uncertainty and corporate investment. Rev Financ Stud 29(3):523–564

Hassett KA, Metcalf GE (1999) Investment with uncertain tax policy: does random tax policy discourage investment. Econ J 109(457):372–393. https://doi.org/10.1111/1468-0297.00453

Hitaj C, Stocking A (2016) Market effciency and the U.S. market for sulfur dioxide allowances. Energy Econ 55:135–147. https://doi.org/10.1016/j.eneco.2016.01.009

Hotz VJ, Imbens GW, Klerman JA (2006) Evaluating the differential effects of alternative welfare-to-work training components: a reanalysis of the California GAIN program. J Labor Econ 24(3):521–566

Hurn AS, Wright RE (1994) Geology or economics? Testing models of irreversible investment using north sea oil data. Econ J 104(423):363–371. https://doi.org/10.2307/2234756

Jens CE (2017) Political uncertainty and investment: causal evidence from US gubernatorial elections. J Financ Econ 124(3):563–579

Jung C, Krutilla K, Boyd R (1996) Incentives for advanced pollution abatement technology at the industry level: an evaluation of policy alternatives. J Environ Econ Manag 30(1):95–111

Kellogg R (2014) The effect of uncertainty on investment: evidence from texas oil drilling. Am Econ Rev 104(6):1698–1734. https://doi.org/10.1257/aer.104.6.1698

Kelly B, Pastor L, Veronesi P (2014) The price of political uncertainty: theory and evidence from the option market. Technical Report, National Bureau of Economic Research

Kim H, Kung H (2016) The asset redeployability channel: how uncertainty affects corporate investment. Rev Financ Stud 30(1):245–280

Krysiak FC (2008) Prices vs. quantities: the effects on technology choice. J Public Econ 92(5–6):1275–1287. https://doi.org/10.1016/j.jpubeco.2007.11.003

Laffont J-J, Tirole J (1996) Pollution permits and compliance strategies. J Public Econ 62(1):85–125

List JA, Haigh MS (2010) Investment under uncertainty: testing the options model with professional traders. Rev Econ Stat 92(4):974–984

McDonald R, Siegel D (1986) The value of waiting to invest. Q J Econ 101(4):707–728. https://doi.org/10.2307/1884175

Milliman SR, Prince R (1989) Firm incentives to promote technological change in pollution control. J Environ Econ Manag 17(3):247–265

Moel A, Tufano P (2002) When are real options exercised? An empirical study of mine closings. Rev Financ Stud 15(1):35–64

Muller NZ, Mendelsohn R (2009) Effcient pollution regulation: getting the prices right. Am Econ Rev 99(5):1714–1739. https://doi.org/10.1257/aer.99.5.1714

Pakes A (1986) Patents as options: some estimates of the value of holding European patent stocks. Econometrica 54(4):755–784. https://doi.org/10.2307/1912835

Pástor L, Veronesi P (2013) Political uncertainty and risk premia. J Financ Econ 110(3):520–545

Pindyck RS (1988) Irreversible investment, capacity choice, and the value of the firm. Am Econ Rev 78(5):969–985

Requate T (2005) Timing and commitment of environmental policy, adoption of new technology, and repercussions on R&D. Environ Resour Econ 31(2):175–199. https://doi.org/10.1007/s10640-005-1770-x

Requate T, Unold W (2003) Environmental policy incentives to adopt advanced abatement technology: will the true ranking please stand up? Eur Econ Rev 47(1):125–146

Rodrik D (1991) Policy uncertainty and private investment in developing countries. J Dev Econ 36(2):229–242. https://doi.org/10.1016/0304-3878(91)90034-S

Schmalensee R, Stavins RN (2013) The SO2 allowance trading system: the ironic history of a grand policy experiment. J Econ Perspect 27(1):103–121

Sharpe GW (2009) Update: what’s that scrubber going to cost? Power Magazine

Shittu E, Parker G, Jiang X (2015) Energy technology investments in competitive and regulatory environments. Environ Syst Decis 35(4):453–471

Stokey NL (2016) Wait-and-see: investment options under policy uncertainty. Rev Econ Dyn 21:246–265

Teisberg EO (1993) Capital investment strategies under uncertain regulation. Rand J Econ 24(4):591–604. https://doi.org/10.2307/2555747

Viscusi WK (1983) Frameworks for analyzing the effects of risk and environmental regulations on productivity. Am Econ Rev 73(4):793–801

Zhao J (2003) Irreversible abatement investment under cost uncertainties: tradable emission permits and emissions charges. J Public Econ 87(12):2765–2789. https://doi.org/10.1016/S0047-2727(02)00135-4

Acknowledgements

I thank Derek Lemoine, Ashley Langer, Ian Lange, Meredith Fowlie, Stan Reynolds, Steven Davis, Nicholas Bloom, Gisle Natvik, Eric Rasmusen, two anonymous referees, as well as seminar participants at the CU Environmental Economics Workshop, the University of Arizona, the WEAI Summer Conference, the AERE Summer Conference, and the Stanford SITE Workshop for helpful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendices

Proofs of Propositions

To simply exposition, I assume without loss of generality that the the discount rate r = 0. The firms’ problem in the first period can then be written as:

1.1 Proof of Proposition 1

Firms are differentiated by their costs of capital. Specifically, there are three groups of firms: (1) firms that will install the capital technology in the first period, (2) firms that will wait to install the capital technology only if the high emissions price is realized, (3) firms that will never install the capital technology. The third group will have the highest cost of capital and regardless of \(\rho\) they will never install the technology. Therefore, the share of firm’s adopting the technology in the first period will be determined by the cutoff capital cost \(K_1^*\) that separates the first and second groups. I will show that \(K_1^*\) is increasing in \(\rho\) and therefore the the share of adopters in period one \(F(K_1^*)\) will also be increasing in \(\rho\).

The expected net benefits from installing in period 1 are equal to: \(P_1\cdot a_1^I-C(a_1^I,1)-K+E[\underset{a_{2},I_2}{\hbox {min}}\{P_2\cdot a_2-C(a_2,I_2)\}|I_1=1]\).Footnote 37 If the firm installs the technology in period 1, it saves on permit costs and abatement costs in period 1 and anticipates saving on permit costs and abatement costs in period 2; however, it also must pay the capital cost K and the abatement cost \(C(a_1^I,1)\). If the firm waits until period 2 and only installs the capital technology if the stringent price is enacted, then its expected benefit will be \(P_1\cdot a_1^N-C(a_1^N,0)+E[\underset{a_{2},I_2}{\hbox {min}}\{P_2\cdot a_2-C(a_2,I_2)+K\cdot I_2\}|I_1=0]\). Firms should invest if:

Let \(a_2^{IH}\) be the optimal level of abatement in period 2, conditional on having installed the capital technology (\(I_2=1\)) and emission prices being high. Let \(a_2^{IL}\) be the optimal abatement level if permit prices are low and the firm has installed the technology. Furthermore, let \(a_2^{NH}\) and \(a_2^{NL}\) be the optimal abatement levels for firms who have not installed the technology for the high and low emission price cases respectively. Expanding the expectations, we have:

To understand the the right-hand side of the inequality, recall that firms in the second group will install the capital technology in the second period only if the high permit price is realized, which will occur with probability \(\rho\). The cutoff cost \(K_1^*\) for investment in the first period is determined by the capital cost at which a firm would be indifferent between investing and waiting. Setting the right and left hand sides of (10) equal to each other and solving for K we obtain:

differentiating (11) with respect to \(\rho\) we have:

Substituting in the equilibrium conditions, \(C_a(a_{1},I_1)=P_1\) and \(C_a(a_{2},I_2)=P_2\), and canceling terms we are left with:

We know that the first term in brackets must be larger than the second term in brackets. To see this, notice \(P_1\cdot a_1^I-C(a_1^I,1)\ge P_1 \cdot a_1^N-C(a_1^N,1)\) since \(a_1^I\) is the optimal abatement choice conditional on having \(I_1=1\) by definition. Additionally we know that \(P_1\cdot a_1^N-C(a_1^N,1)>P_1\cdot a_1^N-C(a_1^N,0)\) which follows from the assumption that marginal cost of abatement is lower once the capital technology is installed. This means the term in the large parentheses is positive, and since \(\frac{1}{(1-\rho )^2}\) is positive this implies \(\frac{dK_1^*}{d\rho }>0\). Finally, since the cumulative distribution function F must be non-decreasing in its argument it follows that \(\frac{dF(K_1^*)}{d\rho }\ge 0\)\(\square\)

1.2 Proof of Proposition 2

We will show that \(\frac{d{\mathbf {e_1}}}{d\rho }<0\). Total emissions is equal to the sum of emissions from firms that invest in the technology and emissions from those that do not:

We next differentiate with respect to \(\rho\) to obtain a comparative static:

where f is the probability density function of K. We know that the first term in the brackets, \(f(K^*) \frac{dK^*}{d\rho }(({{\overline{e}}}-a_1^I)-({{\overline{e}}}-a_1^N))\), is negative since f is non-negative by definition, \(\frac{dF(K_1^*)}{d\rho }\) is positive as shown above, and \((({{\overline{e}}}-a_1^I)-({{\overline{e}}}-a_1^N))\) is negative because firms that install the technology will have lower emissions. The next two terms in the brackets are equal to zero because \(\frac{da_1^I}{d\rho }=0\) and \(\frac{da_1^N}{d\rho }=0\), this can be shown by differentiating the first order condition \(C_a(a_{1},I_1)=P_1\) with respect to \(\rho\). Therefore, since M is also non-negative, it must be the case that \(\frac{d{\mathbf {e_1}}}{d\rho }\le 0\). \(\square\)

1.3 Proof of Proposition 3

Let \({\mathbf {a_1^N}}\) denote total abatement by firms that do not adopt the technology in the first period, \({\mathbf {a^N_1}}=\sum _i a_{i1}\cdot {\mathbb{1}}(I_{i1}=0)\). Total abatement by non-adopters is equal to:

Differentiating with respect to \(\rho\) we have:

As the probability of the high price regime increases, more firms adopt the technology, which works to reduce total abatement by non-adopters, this effect is labeled [1] in Eq. 17. This term is negative since \(f(K_1^*)\), \(a_1^N\) are positive and \(\frac{dK_1^*}{d\rho }\) is positive by Proposition 1. Since \(\frac{da_1^N}{d\rho }=0\), the term labeled [2] in Eq. 17 equals zero. Therefore, \(\frac{d{{{\mathbf {a}}}}_1^N}{d\rho }\le 0\).

1.4 Proof of Proposition 4

Define \(K_2^*\) as the the cutoff capital cost that a firm would be indifferent to installing the technology in the second period, conditional on the high price regime occurring:

Notice the cutoff does not depend on \(\rho\) since the uncertainty has already been resolved at this point. The number of firms that adopt is the number of firms that have capital costs smaller than \(K_2^*\) but have capital costs larger than \(K_1^*\) (i.e., did not invest in the first period). This number of firms can be expressed as:

Let \({{\hat{\rho }}}\) be defined such that \(K_2^*=K_1^*({{\hat{\rho }}})\). Then differentiating (19) we obtain:

It follows from the proof of Proposition 1 that \(M(-f(K_1^*)\frac{dK_1^*}{d\rho })<0\). Therefore, the number of adopters in period 2 must increase as \(\rho\) decreases, conditional on the high price regime occurring. \(\square\)

Propensity-Score Weighting Details

Let \(Y^0(i, t)\) represent the emission rate unit i would attain at time t in absence of treatment. Similarly, let \(Y^1 (i, t)\) represent the emission rate unit i would attain at time t if exposed to the treatment. The effect of the treatment on the outcome for unit i at time t is defined as \(Y^1 (i, t) - Y^0(i, t)\). Additionally, let D(i) be an indicator function determining if unit i receives the treatment. Also define \(P(D = 1 | X)\) as the propensity score, the probability a unit receives treatment conditional on observed covariates. For this analysis, the treatment group will be all units located in the “challenger” states and the control group will be all other units in CAIR.Footnote 38 I use the year 2004 emission rate as the pre-period observation and the 2009 emission rate as the post-period observation. The objective is to estimate the average treatment effect on the treated group (ATT): \(E[Y^1 (i, 2009) - Y^0(i, 2004) | D(i) = 1]\). Estimation of the ATT requires a weaker assumption on distribution of covariates than would be required to estimate the population average treatment effect (ATE). For identification, require that for all X, \(P(D=1|X)<1\), in addition to the unconfoundedness assumption.Footnote 39 Appendix 4 includes marginal kernel density plots of the continuous covariates for each group which demonstrate that this overlap condition is satisfied. Therefore, the average treatment on the treated is given by:

The third line follows from the unconfoundedness assumption, after controlling for observed covariates, the treatment and control groups would have followed parallel paths absent the intervention. The estimator is the sample analog of the fifth line in (21). Intuitively, the estimator is down weighting the distribution of \(Y(i,2009) - Y(i,2004)\) for the untreated group for values of the covariates which are over-represented among the untreated and weighting-up \(Y(i,2009) - Y(i,2004)\) for those values of the covariates under-represented among the untreated. I estimate the propensity score using a flexible logit model that includes interactions of all the covariates and quadratic terms.

Robustness Checks

To address additional identification concerns, I conduct several robustness checks. In Panel A of Table 7 in Appendix 4, I estimate the model, excluding 2009 from the sample to account for the possibility that firms reacted quickly to the court decision.Footnote 40 Dropping 2009 does not cause any noticeable changes to the estimated effects. In Panel B of Table 7, I restrict the sample to only units within 1000 miles of the centroid of Texas, Florida, or Minnesota. It is possible that the variable “Distance to the Powder River Basin” is not sufficiently controlling for coal purchasing opportunities. For example Florida and New Hampshire may be similar distance to the Powder River Basin but may face significantly different opportunity cost of buying low-sulfur coal. Restricting the sample to only nearby plants does not change the direction or statistical significance of the coefficients of interest.

It is also possible that other political or legal factors are driving differences in pollution abatement and not policy uncertainty. I attempt to address some of these potential concerns in Table 8 of Appendix 4. For instance, during the time frame of this study, some power plants were required to install pollution controls due to the New Source Review (NSR) lawsuits. It is a priori possible that NSR requirements are driving results if many of these lawsuits occurred in CAIR states. Panel A of Table 8 reports estimates of the baseline model on a restricted sample that excludes any plant that was subject to NSR litigation related to SO2 emissions. The results are robust to the exclusion of these plants, which mitigates concerns that NSR lawsuits are impacting the results.

Another potential concern is that other political or institutional factors impacted emission reductions. Panel B in Table 8 shows estimates of the baseline model from Eq. 4 but only including units in states that had a Republican governor in 2006 and choose PUC chairmen by appointment. In 2006, Texas, Minnesota, and Florida all had Republican governors and appointed PUC chairmen. This restricted sample attempts to deal with possible confounding political factors that would make installing pollution controls more feasible in some states. Since most states did not have both a Republican governor and an appointed PUC commission,Footnote 41 75% of the observation are dropped. However, the point estimate is still positive, statistically significant, and of similar magnitude. This result suggests that the baseline result is not being driven by confounding political factors.

An additional potential concern with the analysis is that the border states’ legal challenge initially only challenged the inclusion of Texas plants that were located west of the north-south I-35/I37 corridor. In the baseline analysis, I included all Texas units in the challenger group because EPA almost always levies regulations for entire states to avoid in-state pollution havens. As a robustness check, I have also run the baseline regressions with plants in East Texas, discluded from the “Challenger” group. The results are shown in Table 10 and the results are robust to this change.

I also account for the possibility that firms were changing electricity output as a method of compliance. In particular, I estimate the model with total annual SO2 emissions in tons as the dependent variable. I also estimate the baseline DID regression with the natural logarithm of SO2 in tons as the dependent variable and also with the emission rate as the outcome variable. The results of all of these regressions are consistent with the baseline model and are presented in Table 12 in the Appendix 4.

Finally, I present estimates with alternative standard error clusters. In Table 11, I allow for clustering at the unit level, plant level, state-year level, and state level. These alternative clusters do not change the significance of the estimated effects. In Table 9 also shows that the results are robust to using the entire sample of coal units (including scrubbed units) and also to using an unbalanced panel (including units that did not operate in each year of the sample).

Tables and Figures

See Figs. 7, 8 and Tables 6, 7, 8, 9, 10, 11 and 12.

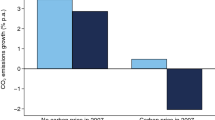

Source: Hitaj and Stocking (2016)

SO2 Allowance price history.

Rights and permissions

About this article

Cite this article

Dorsey, J. Waiting for the Courts: Effects of Policy Uncertainty on Pollution and Investment. Environ Resource Econ 74, 1453–1496 (2019). https://doi.org/10.1007/s10640-019-00375-2

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-019-00375-2