Abstract

Carbon offsets from the Kyoto Flexible Mechanisms can be used by firms in the EU Emissions Trading Scheme for compliance in lieu of EU allowances, making these carbon assets interchangeable. We offer an explanation of the price spread using a structural model of the price for Certified Emissions Reductions that combines three features: a limit for the use of Kyoto offsets within the EU ETS; a disconnect between the current price of offsets and their marginal cost of production for institutional reasons; and uncertainty about future supply and demand of offsets. Our model expresses the offset price as an average of the EU allowance price and an offset’s outside value, weighted by the probability of a binding import limit. Using a monthly series of the United Nation’s Clean Development Mechanism and Joint Implementation about offset supply and demand, we provide empirical support for our theory of offset price formation. Counterfactual simulations suggest that the price process is dominated by uncertainty.

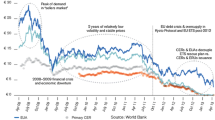

Source: Authors’ illustration based on data from Thomson Reuters Datastream

Source: Authors’ illustration based on Fig. 3.1 in UNFCCC (2013)

Source: Authors’ illustration based on data from UN CDM/JI pipelines (see footnote 17)

Source: Authors’ illustration based on World Bank data as reported by Bloomberg

Source: EUA and CER prices from Thomson Reuters Datastream; predictions based on authors’ calculations

Source: EUA price from TR Datastream; demand data from Bloomberg; predictions based on authors’ calculations

Similar content being viewed by others

Notes

This article contains a number of acronyms. To aid the reader, a table of relevant acronyms can be found in the Appendix 1.

Because prices for CERs and ERUs are practically identical, but the liquidity of the former far exceeded that of the latter before 2012, we use the CER price. In our empirical analysis, we focus on secondary CERs throughout the paper, which do not contain delivery risk.

Throughout this paper, the term “phase” refers to the different market phases of the EU ETS: Phase I (2005–2007), Phase II (2008–2012), and Phase III (2012–2020). For a more extensive discussion of the design of the EU ETS, see Hintermann and Gronwald (2015) and Ellerman et al. (2016). No explicit such phases exist in the market for CERs. A review of the literature focusing on the drivers of EUA prices is given by Hintermann et al. (2016).

For a more detailed illustration of this point, see Grüll and Taschini (2012).

Annex B countries agreed to binding emission reduction targets under the Kyoto Protocol. Countries’ emissions during a calendar year are not made publicly available until the various sources have been checked and verified, which often results in the publication of annual emissions with a delay of 1–2 years. The deadline for purchasing offsets was set by the end of the “true-up period”, which was on November 18, 2015; see the United Nations Framework on Climate Change, “True-up period reporting and review process”, available at http://unfccc.int/kyoto_Protocol/true-up_process/items/9023.php, last accessed on January 15, 2016.

Firms or organizations have to be registered by the UNFCCC in order to become DOEs. The Executive Board of the Clean Development Mechanism (CDM EB) maintains a public list of approved DOEs.

The DOE contracted for the verification of the achieved emission reductions usually differs from the DOE contracted for validation, but the same DOE can be contracted upon request.

This could theoretically have been the case for offsets generated between January and April of 2013, as this is the time when firms had to surrender allowances to cover their emissions for the year 2012.

Many offset projects consist of installing new production technology, which implies a combination of high fixed costs and low (or even negative) marginal abatement costs, compared to the situation without investment. In other words, once a more efficient production technology has been installed, it will be used independently of the CER price. Naturally, this assumption does not apply to CERs that are produced by means of fuel switching.

At very high offset prices, countries might prefer to institute new climate policies. However, the time lag between the proposition of new policy and results in terms of abatement may take years as well. In any case, the prices of offsets were below expectations throughout the Kyoto Phase, and certainly well below abatement costs e.g. by fuel switching.

Our focus is on pricing CERs based on their opportunity costs, and we abstract from the risk premia of EUAs and CERs by assuming that investors are risk-neutral. Under risk neutrality, the stochastic discount factor, which is the basis of pricing assets under risk, reduces to the rate of time preference. Using notation from Cochrane (2009), the price of an asset is given by \(p=E[mx]\), where m is the stochastic discount factor and x the payoff. Under risk neutrality, the marginal utility of income is the same across all states of the world, such that the pricing equation reduces to \(p=m \cdot E[x]\). In our context, the discount factor becomes \(m= e^{-r(T-t)}\), which results in Eq. (6).

Note that the pricing equation holds for future prices as well, provided that the delivery period is no later than T. Due to the import rules, CER futures with delivery beyond T would be priced according to only the second half of the price equation, since use in the EU ETS or Kyoto is not an option.

Note that this is true only if information about offset supply is instantaneously available. In reality and as discussed above, monitoring takes place irregularly and with a delay, such that eve at \(t=T\), the exact number of offsets available is not known.

During the Conference of Parties (COP) meeting in Copenhagen, it became clear that there would be no continuation of the Kyoto Protocol in the sense that there was no binding multinational treaty that specified mandatory emissions reductions. However, some countries (including all members of the EU), agreed to voluntary emissions reductions.

This procedure is referred to as “forward recursive” and is very common in the applied time series literature. Most recently, Phillips and Yu (2011) employ this procedure in order to identify origin and collapse date of stock market bubbles. This further development of so-called cointegration based tests for speculative bubbles also involves applications of unit root tests.

Available at www.cdmpipeline.org, last accessed in January 2016. The website only contains the current pipelines. We thank the UN’s Jorgen Fenhann for providing us with the historic pipelines.

Although this means that the UN data overestimates the true expected offset supply, from an empirical perspective it is preferable not to include a price-induced response in offset supply, as we assume that the supply of offsets drives the price, but not vice versa. In this sense, the UN supply estimates can be viewed as a quasi-exogenous (i.e., price-insensitive) instrument for true CER supply.

The longest price series for CERs is supplied by Thomson Reuters, which includes OCT transactions. However, this price series does not include trading volumes. To get information about the volume of trades, we use data from EEX and Bluenext, which covers a shorter time period.

Using Akaike’s Information Criterion and the average absolute error leads to the same switching month.

Given the large standard deviation \(\sigma _t\), \(\Phi (\cdot )\approx 0.5\), unless the shift in the expected excess demand becomes very large.

Note that each element in the sequences of p-values and adjustment speed parameter estimates represents the value at the end of each subsample. The cointegration tests indicates that the cointegration collapses some time after the loss of significance of the adjustment speed parameter. This result reflects that the cointegration test requires a certain number of “non-cointegrated” observations before the null of no cointegration is no longer rejected.

References

Braun N, Fitzgerald T, Pearcy J (2015) Tradable emissions permits with offsets. In: Gronwald M, Hintermann B (eds) Emissions trading as a policy instrument: evaluation and prospects. MIT Press, Cambridge, pp 239–266

Carmona R, Fehr M, Hinz J (2009) Optimal stochastic control and carbon price formation. SIAM J Control Optim 48(4):2168–2190

Chesney M, Taschini L (2012) The endogenous price dynamics of emission allowances and an application to CO2 option pricing. Appl Math Finance 19(5):447–475

Chevallier J (2011) Price relationships in the EU emissions trading system. IGI Global, pp 212–220

Chevallier J (2012) EUAs and CERs: interactions in a Markov regime-switching environment. Econ Bull 32(1):86–101

Cochrane JH (2009) Asset pricing: revised edition. Princeton University Press, Princeton

Ellerman AD, Marcantonini C, Zaklan A (2016) The European Union emissions trading system: ten years and counting. Rev Environ Econ Policy 10(1):89–107

Engle RF, Granger CWJ (1987) Co-integration and error correction: representation, estimation, and testing. Econometrica 55(2):251–276

European Union (2003) Directive 2003/87/EC of the European Parliament and of the Council of 13 October 2003

European Union (2009) Directive 2009/29/EC of the European Parliament and of the Council of 23 April 2009

Green JF (2017) Don’t link carbon markets. Nature 543(7646):484–486

Grüll G, Taschini L (2012) Linking emission trading schemes: a short note. Econ Energy Environ Policy 1(3):31–38

Hieronymi P, Schüller D (2015) The Clean-Development Mechanism, stochastic permit prices and energy investments. Energy Econ 47:25–36

Hintermann B (2012) Pricing emission permits in the absence of abatement. Energy Econ 34(5):1329–1340

Hintermann B, Gronwald M (2015) The EU ETS. In: Gronwald M, Hintermann B (eds) Emissions trading as a policy instrument. MIT Press, Cambridge, pp 15–23

Hintermann B, Peterson S, Rickels W (2016) Price and market behavior in Phase II of the EU ETS: a review of the literature. Rev Environ Econ Policy 10(1):108–128

Kanamura T (2016) Role of carbon swap trading and energy prices in price correlations and volatilities between carbon markets. Energy Econ 54:204–212

Koop G, Tole L (2013) Modeling the relationship between European carbon permits and certified emission reductions. J Empir Finance 24:166–181

Mansanet-Bataller M, Chevallier J, Hervé-Mignucci M, Alberola E (2011) EUA and sCER phase II price drivers: Unveiling the reasons for the existence of the EUA-sCER spread. Energy Policy 39(3):1056–1069

Mizrach B (2012) Integration of the global carbon markets. Energy Econ 34(1):335–349

Nazifi F (2013) Modelling the price spread between EUA and CER carbon prices. Energy Policy 56:434–445

Phillips YW, Peter CB, Jun Y (2011) Explosive behavior in the 1990s NASDAQ: when did exuberance escalate asset values? Int Econ Rev 52(1):201–226

Rahman SM, Kirkman GA (2015) Costs of certified emission reductions under the Clean Development Mechanism of the Kyoto Protocol. Energy Econ 47:129–141

Trotignon R (2012) Combining cap-and-trade with offsets: lessons from the EU-ETS. Clim Policy 12(3):273–287

Trotignon R, Leguet B (2009) How many CERs by 2013?. Mission Climat Working Paper Nr. 2009-5

UNFCCC (2006) Report of the Conference of the Parties serving as the meeting of the Parties to the Kyoto Protocol on its first session, held at Montreal from 28 November to 10 December 2005. Addendum, Part Two: Action taken by the Conference of the Parties serving as the meeting of the Parties to the Kyoto Protocol at its first session. FCCC/KP/CMP/2005/8/Add.2

UNFCCC (2013) Afforestation and reforestation projects under the Clean Development Mechanism: a reference manual. http://www.unfccc.int

UNFCCC (2015a) CDM project cycle procedure. CDM-EB65-A32-PROC, Version 9.0

UNFCCC (2015b) CDM project standard. CDM-EB65-A05-STAN, Version 9.0

UNFCCC (2015c) CDM validation and verification standard. CDM-EB65-A04-STAN, Version 9.0

Vasa A (2012) Certified emissions reductions and CDM limits: revenue and distributional aspects. Clim Policy 12(6):645–666

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: Additional Tables and Figures

See Table 3 and Figs. 8, 9, 10, 11, 12.

Appendix 2: Emissions Reductions via the Joint Implementation (JI) Mechanism

The guidelines for participation in the JI mechanism are described in UNFCCC (2006). Parties may apply to one of two different JI “tracks”. The first track consists in a simplified procedure that allows the host party itself to verify that emissions reductions of a project are indeed “additional to any that would otherwise occur” and issue the correspondent amounts of ERUs. Under track 2, verification and issuance of ERUs has to follow the verification procedure under the JI supervisory Committee.

As in the CDM, the first step consists in project participants developing a project design document (PDD), which contains all the information specified in the JI guidelines. The PDD must show that the project has been approved by all the involved Parties, how the emission reductions are to be achieved and that its baseline and monitoring plan is in line with the required criteria specified in JI guidelines. The PDD has to be submitted to an accredited independent entity (AIE), who makes the PDD publicly available for a 30-day-consultation period involving all relevant stakeholders. The AIE then determines whether the PDD provides all necessary information and makes its determination publicly available. If no review on the part of a party involved in the project or the JISC is requested within 45 days, the PDD is “determined” to be final, which means that the project can be implemented. After the project has started, project participants periodically have to submit a monitoring report about the achieved emissions reductions to an AIE (which is typically different to the AIE involved in the review of the PDD). The monitoring report is made publicly available, and the AIE has to verify the emission reductions. This verification report then is again made publicly available and declared final after 15 days, provided that no review on the part of a Party involved in the project or the JISC is requested. The last step consists in the issuance of Emissions Reduction Units (ERUs) according to the number of verified tons of \(\hbox {CO}_2\) during the monitoring period.

Appendix 3: Cointegration and Error Correction Anaylsis

This section provides some technical details for the cointegration and error correction analysis. As explained in a non-technical way in Sect. 3.2, initially a long-run relationship is estimated. Thus, we estimate the following model using OLS:

The estimated residuals \(\hat{u}_t\) are used in the subsequent steps. A Phillips-Perron unit root test is used in order to test for a unit root in the estimated residuals. This procedure is commonly referred to as Engle-Granger single equation cointegration test. The error correction model we estimate is specified as follows:

Please note that data properties require modeling \(e_t\) as a GARCH(1,1)-process. This cointegration and error correction analysis is conducted using daily data; the price series are in logs. The sample period is Spring 2009 - Spring 2017. The sequences of adjustment speed parameters and p-values are then aggregated to the monthly frequency used in the remainder of the paper.

Rights and permissions

About this article

Cite this article

Hintermann, B., Gronwald, M. Linking with Uncertainty: The Relationship Between EU ETS Pollution Permits and Kyoto Offsets. Environ Resource Econ 74, 761–784 (2019). https://doi.org/10.1007/s10640-019-00346-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-019-00346-7