Abstract

The effects of a unilateral cut in emissions are analyzed in a dynamic two-country model. Two (intermediate) goods are produced, one of which uses the fossil fuel. These inputs are traded and combine to produce a final good. The effect of a cut in fossil fuel use by a bloc (e.g. Annexure 1 countries in the Kyoto Protocol) depends on whether the fuel is priced at marginal cost or above. In the latter case a “green paradox” may appear. The paper’s contribution lies in analyzing the dynamics and trade implications of the unilateral action.

Similar content being viewed by others

Notes

The stock of carbon in the atmosphere will raise the mean temperature and increase weather variability. The world will see a rise in the sea-level (due to a melting of polar ice-caps) and a melting of glaciers where some of the big rivers of the world originate. The rise in the sea level will cause migration from the areas that would get inundated, while changes in the weather will require a major change of cropping pattern etc. Parts of the world would see land becoming more arid. Coping with this would require massive redeployment of resources.

“In the last 100 years, 63 % of the cumulative emissions of greenhouse gases have come from the developed economies. Of that, the US has accounted for 25 % and Western Europe for 21 %. China and India, home to 40 % of the world’s population, have contributed, respectively, 7 and 2 % of the last 100 years of cumulative emissions.” Dutta and Radner (2012) p. 2.

The green paradox is based on the reaction of producers to the decline in the price of fossil fuels when subsidies to clean fuel or taxes on the fossil fuel are set at arbitrary (as opposed to optimal) levels. Hoel (2010) discusses the nature of those taxes; see also van der Meijden et al. (2014). One can possibly appeal to (even in the absence of uncertainty) to Weitzman’s quantitative restriction argument because the effects of the green paradox occurring would be catastrophic.

In Smulders et al. (2012) there is a sunk cost of using the clean fuel.

A three-period model is also discussed as an extension.

In the two papers closest to ours, Maria and Werf (2008) look at carbon leakage but not the dynamic nature of fossil fuel pricing; while Eichner and Pethig (2011) have only one final good and no capital accumulation. Since they also do not allow for borrowing or lending, their intertemporal substitution parameter is redundant. In equilibrium, countries consume the production of their final good output. For an analysis of borrowing and lending and the effect of carbon leakage on the world interest rate, see van der Meijden et al. (2014).

Their conclusion about “aid” from the rich to the poor countries to make the latter participate in cutting back emissions is similar to the policy implications obtained in this paper. I focus on different issues, though.

We could treat the oil producers as part of the two economies. Then the gross output of the dirty good is also the value-added in that economy.

The two economies are different in terms of their endowments and policies. Making them even more dissimilar by assuming different rates of time preference can easily be incorporated.

Elisa and Wing (2013) discuss the importance of malleability of capital for climate change policies.

The specific factors are in given supply.

Our analysis imposes quantitative restrictions on fossil fuel use as is common in the literature e.g. Eichner and Pethig (2011). It is possible to include an abatement technology but it does not seem worth the additional complications.

If R and S are imported then \(\Omega \) is the GDP, otherwise the returns to the domestically-owned factors have to be added back.

The output supply is the derivative of the GDP function \(\Omega \) with respect to its price e.g. \(\hbox {Y}= \Omega _{p}.\,\Omega _{pp}\), the own price response, is then positive etc.

Nothing hinges on this. Assuming zero depreciation makes no difference to the analysis. A rate of depreciation that lies between zero and one would necessitate carrying the parameter of depreciation in calculating the expected marginal product of capital.

We can look at a permanent unilateral policy by combining the two cases discussed in the text.

Eichner and Pethig (2011) do not discuss marginal cost pricing of the fossil fuel—in their analysis the marginal cost is zero.

As mentioned earlier, I will discuss the modifications introduced by a stock-dependent marginal cost for the fossil fuel later.

In a large class of competitive models, there is equivalence between taxes and quantitative restrictions. This does not carry over to other scenarios e.g. When there is strategic interaction between agents, or even non competitive behavior. I am grateful to a referee for emphasizing this point.

We would require very high supply elasticities for investment for this not to hold. After all, capital accumulation and the consequent increase in income, creates demand for both the intermediate inputs, not just for Y.

In Eq. (18), the term \(\Omega _R^2\) is the effect of a change in R on the GDP of the North, etc.

This is because fossil fuel use changes in period 2 but the unilateral reduction happened in period 1.

In Indian English it is called “preponing”, in symmetry with postponing”.

References

Acemoglu D, Aghion P, Bursztyn L, Hemous D (2012) The environment and directed technical change. Am Econ Rev 102:131–166

Babiker MH (2005) Climate change policy, market structure, and carbon leakage. J Int Econ 65:421–445

Barrett S (2003) Environment and statecraft: the strategy of environmental treaty-making. Oxford University Press, Oxford

Burniaux J-M, Martins JO (2000) Carbon emission leakage: a general equilibrium view. In: OECD Economics Department Working Paper 242

Chakravorty U, Magne B, Leach A, Moreaux M (2011) Would Hotelling kill the electric car? J Environ Econ Manag 61:281–296

Chatterji S, Ghoshal S, Walsh S, Whalley J (2011) Unilateral measures emissions mitigation. In: NBER Working Paper 15441

Copeland B, Taylor MS (2015) Free trade and global warming: a trade theory view of the Kyoto Protocol. J Environ Econ Manag 49:205–234

di Maria C, van der Werf E (2008) Carbon leakage revisited: unilateral climate policy with directed technical change. Environ Resour Econ 39:55–74

Dutta P, Radner R (2012) Capital growth in a global warming model: will China and India sign a climate treaty? Econ Theor 49:411–443

Eichner T, Pethig R (2011) Carbon leakage, the green paradox and perfect futures markets. Int Econ Rev 52:767–805

Eichner T, Pethig R (2012) Flattening the carbon extraction path in unilateral cost effective action. J Environ Econ Manag 66:185–201

Eichner T, Pethig R (2014) Unilateral climate policy with production-based and consumption-based carbon emmision taxes. Environ Resour Econ. doi:10.1007/s10640-014-9786-8

Elisa L, Wing IS (2013) Carbon malleability, emission leakage and the cost of partial carbon policies: general equilibrium analysis of the European Union Emission Trading System. Environ Resour Econ 55:257–289

Finus M (2001) Game theory and international environmental cooperation. Edward Elgar, Cheltenham

Gerlagh R (2011) Too much oil. CESifo Econ Stud 57:79–102

Hoel M (2010) Is there a green paradox. In: CESifo Working Paper No. 3168

IPCC (2007) Climate change 2007, vol I, II, III. Cambridge University Press, Cambridge

Ritter H, Schopf M (2014) Unilateral climate policies: harmful or even disastrous? Environ Resour Econ 58:155–178

Sinn H-W (2008) Public policies against global warming: a supply side approach. Int Tax Public Financ 15:360–394

Smulders S, Tsur Y, Zemel A (2012) Announcing climate policy: can a green paradox arise without scarcity? J Environ Econ Manag 64:364–376

Strand J (2010) Optimal fossil-fuel taxation with backstop technologies and tenure risk. Energy Econ 32:418–422

van der Meijden G, van der Ploeg F, Withagen C (2014) International capital markets, oil producers and the green paradox. In: OxCarre Working Paper No. 130

Van der Ploeg F, Withagen C (2011) Growth and the optimal carbon tax: when to switch from exhaustible resources to renewable? In: OxCarre Discussion Paper No. 55

Van der Ploeg F, Withagen C (2012a) Is there really a “green paradox”? J Environ Econ Manag 64:342–363

Van der Ploeg F, Withagen C (2012b) Too much coal, too little oil. J Public Econ 96:62–77

Whalley J (2011) What role for trade in a post-2012 global climate policy regime?. In: NBER Working Paper No. 17498

Acknowledgments

Some of the material was presented in invited lectures at conferences in Exeter and the Singapore Economic Review Conference. The paper was also presented at the World Congress of Environment and Resource Economics in Istanbul, and at seminars in Oxford, Toulouse and the OECD. I am grateful to Jean-Pierre Amigues, Thomas Eichner, Michael Finus, Elisa Lanzi, Peter Lloyd, Michel Moreau and Francois Salanie for helpful comments.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

Differentiating Eqs. (15a)–(15d), we have:

Notationally, a change in the price of the clean energy (m) is just like the one for q i.e.

If we take the home country (North) to be the importer of the X-good (that uses fossil fuel), then a rise in \(\hbox {p}_{1}\) increases both \(\hbox {C}_{1}\) and \(\hbox {I}_{1}\). These are just the terms of trade effects on real income. A rise in \(\hbox {p}_{1}\) would then reduce both \(\hbox {C}_{1}^{*}\) and \(\hbox {I}_{1}^{*}\) . An increase in \(\hbox {q}_{1}\) decreases \(\hbox {C}_{1},\hbox { I}_{1},\,C_{1}^{*}\) and \(I_{1}^{*}\). The partial effects for the North used in the text are given below (for the South the expressions are identical except \(\Omega ^{*2}\) replaces \(\Omega ^{2}\) etc.):

where \(\Sigma \equiv \beta \left\{ {U}^{\prime }(C_2)\Omega _{KK}^2 +(1+r_1 ){U}^{\prime \prime }(C_2 )\Omega _K^2 \right\} +{U}^{\prime \prime }(C_1 )<0\)

Appendix 2

Outline of proof of Proposition 1

We want to show that there is leakage but \(<\)100 % i.e.

The market-clearing condition in the intermediate goods market for period 2 is given by Eq. (16b):

Differentiating this and setting, \(R_2 =\overline{R}_2\) we obtain the change in the price \(\hbox {p}_{2}\):

To obtain the leakage, we note that

The first term is the effect of p\(_{2 }\)on the product mix and the second is the capital accumulation effect of p\(_{2}\). So we have:

As noted above, \(\partial I^{*}_{1} / \partial p_{2} >0\). We have:

\(0\ge \frac{dR_2^*}{dp_2 }\ge \frac{\partial R_2^*}{\partial p_2 }\) because \(\left( {\frac{\partial R_2^*}{\partial K_2^*}} \right) \left( \frac{\partial I_1^*}{\partial p_2 }\right) \ge 0\).

In the South due to consumption smoothing, investment declines; this implies that emissions in the South are lower than it would have been had we not taken into account the dynamic effects. Thus an upper bound to carbon leakage is given by the “static” leakage (i.e. holding \(dI_1^*=0\)).

The first term in curly brackets on the right hand side of Eq. (27) is the static effect (negative) and the second one is the dynamic effect (positive).

Note that the change in fossil fuel use is obtained from the two equations, equating the marginal product of capital intersectorally and the marginal product of the fossil fuel to its given marginal cost. (we need to solve for S and substitute): That is, we use the three marginal productivity conditions:

After substitution we have:

And so:

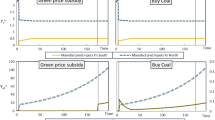

Now note that as the X-intermediate sector expands due to a fall in \(\hbox {p}_{2}\), the marginal product of capital in the Y sector rises. And this causes both \(K_2^{X*}\) and \(R_2^*\) to rise as shown in Fig. 1 below. The line RR is the combination of \(K_2^{X*}\) and \(R_2^*\) that gives a marginal product of R. The line KK is the intersectoral equality of the marginal product of capital.

The slopes are as shown because \([\{F_{KK}^*F_{RR}^*-(F_{KR}^*)^{2}\}+p_1 F_{RR}^*(G_{SS}^*)^{-1}\{G_{KK}^*G_{SS}^*-(G_{KS}^*)^{2}\}]>0\). The initial equilibrium is at A and the new one with \(d\overline{R}_2 <0\) at B. The vertical distance of \(d\overline{R}_2 <0\) is given by the point on \(\hbox {K}'\hbox {K}'\) vertically below A. So from the diagram as the KK line shifts down with \(d\overline{R}_2 <0\), there is an increase in \(dR_2^*\)but is less than \(\left| {d\overline{{R}}_2}\right| \) (KK has a slope steeper than RR). The algebra is trivial.

Therefore we have: \(1<\left( \left| {\frac{dR_2^*}{d\overline{R}_2 }} \right| \right) _{dI_1^*=0} <\left| {\frac{dR_2^*}{d\overline{R}_2 }} \right| <0 \blacksquare \)

Proof of Proposition 2

It proceeds as above for period 2. For period 1, we have:

Appendix 3

Equations for Sect. 4.1:

We have from Eqs. (12), (16a) and (16b) to solve for \(\hbox {p}_{2},\hbox { p}_{1}\) and \(\hbox {q}_{1}\):

Equations for Sect. 4.2:

In Sect. 4, any policy to restrict fossil fuel use in period 2 also impacts period 1 via a change in \(\hbox {q}_{1}\) and hence \(\hbox {p}_{1}\). As in Sect. 3.2, a cap on fossil fuel use at \(\overline{{R}}_1\) in period 1, of course, will have an impact on \(\hbox {p}_{2}\) via investment. But now there is the additional channel of a fall in \(\hbox {q}_{2}\).

Equation (12) implies:

Equations (12), (16a) and (16b) give (again to solve for \(\hbox {p}_{2},\hbox { p}_{1}\) and \(\hbox {q}_{1}\)):

Rights and permissions

About this article

Cite this article

Sen, P. Unilateral Emission Cuts and Carbon Leakages in a Dynamic North–South Trade Model. Environ Resource Econ 64, 131–152 (2016). https://doi.org/10.1007/s10640-014-9860-2

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-014-9860-2