Abstract

Many environmental tax systems rely on self-reported emissions by firms. These emission reports are verified through costly auditing efforts by regulatory agencies that are constrained in their auditing budgets. A typical assumption in the literature is that the agencies allocate audit efforts randomly among otherwise identical firms (random audit mechanism). This paper compares the incentives on firms’ emissions and self-reporting behavior under the random audit mechanism to the incentives under competitive audit mechanisms (CAMs). Under CAMs, higher reported emissions by a firm relative to other firms result in a lower audit intensity. This creates a reporting contest between the firms. The two CAMs under investigation apply different degrees of competitiveness in the reporting contest. I find that both CAMs lead to more truthful reporting, which is in line with the previous literature. Interestingly and novel to the literature, I find that some competition in reporting may induce fewer emissions compared with random auditing, while too much competition in reporting may induce comparatively higher emissions caused by firms.

Similar content being viewed by others

Notes

Anecdotal evidence from Canada’s largest province Ontario shows that the operating budget of the Ministry of the Environment (MOE) decreased by 45 % since 1992/1993, while at the same time the operating budget of the Ontario government increased by 72 % (ECO 2011, p. 81). Currently, MOE is responsible for the inspection of at least 125,000 facilities to ensure that they are complying with all of its provincial environmental laws and regulations. However, MOE only has audit resources to conduct approximately 5,000 inspections each year and some facilities may go decades without inspections (ECO 2007, pp. 23–24). When MOE conducts inspections at polluting facilities, high levels of non-compliance are regularly found (ECO 2007, pp. 25–26).

See for instance EPA Victoria (2011) for a technical report about the auditing procedure at the Australian province Victoria.

Macho-Stadler and Pérez-Castrillo state: “ We have considered a model where the probability that a firm is audited is independent of the report [...]. We made this reasonable hypothesis because it simplifies the analysis.” Colson and Menapace (2012) write: “ In the Macho-Stadler and Pérez-Castrillo model, the auditing probability is by construction unaffected by firms’ actions because the enforcement agency has no useful information on which the inspection probability can be conditioned on.”

The level of welfare typically consists of aggregate firms’ profits reduced by the damages to the environment caused by firms’ emissions and by the costs of enforcement. Hence, if the tax was too large, non-compliance by firms might be welfare-improving. This assumption excludes these cases.

It is shown below that \(\alpha p_{i}\in [0,1]\).

If \(\alpha p_{i}\theta =t,\) firm \(i\) is indifferent about which report to choose, because the costs of emissions are identical for any \(r_{i}\in [0,e_{i}]\). I impose the assumption that it chooses \(r_{i}=e_{i}\) in this case. While this assumption simplifies the exposition, it does not influence the emissions choices of the firms in equilibrium. This is because for the choice of emissions, only the costs of emissions are relevant.

The profit function is \(E\Pi _{i}=[1-\alpha p_{i}(r_{i},r_{j})][g(e_{i})-tr_{i}]+\alpha p_{i} (r_{i},r_{j})[g(e_{i})-tr_{i}-\theta \max \{e_{i}-r_{i},0\}].\) Note, that choosing \(r_{i}>e_{i}\) is never optimal for the firm, because reporting higher emissions than what is actually released is not rewarded by the agency. Since \(r_{i}>e_{i}\) is never optimal, it follows that \(r_{i}\le e_{i}\) in any equilibrium. Thus, \(\max \{e_{i}-r_{i},0\}\) can be replaced by \([e_{i}-r_{i}]\), for \(r_{i}\le e_{i}\), resulting in Eq. (1).

The Tullock contest is a popular “workhorse model” used for the game-theoretic study of contest. A comprehensive overview of this and other contest models is given in Konrad (2009).

It is common to use corner solutions in reporting as benchmark. For instance, Gilpatric et al. (2011) find a corner solution in terms of reporting under the random audit mechanism in some cases. The focus in the current paper is on emissions however, and all emissions equilibria are interior whenever the agency is underfunded.

The second-order condition for a profit maximum, \(\frac{\partial ^{2}E\Pi _{1}}{\partial r_{1}^{2}}<0,\) holds because: \(\frac{\partial ^{2}E\Pi _{1}}{\partial r_{1}^{2} }=-2Br_{2}\frac{e_{1}+r_{2}}{\left( r_{1}+r_{2}\right) ^{3}}<0.\)

I will show below that \(e_{1}=e_{2}\) is a SPNE under certain conditions. Specifically, a necessary condition for the existence of the symmetric equilibrium in pure strategies will be derived when analyzing stage 1 of the game. Also a sufficient condition will be derived.

I write \(r_{1}^{*}\) for\(\ r_{1}^{*}(e_{1},e_{2},B)\) and \(r_{2}^{*}\) for \(r_{2}^{*}(e_{1},e_{2},B)\) whenever appropriate to simplify the exposition.

The strategic interaction between the firms is in the vein of Fudenberg and Tirole (1984) and thus the presentation is analog. I thank an anonymous referee for pointing this out.

I show below that in the case of symmetric firms, there is no pure-strategy equilibrium for \(n=2\) and \(\gamma \rightarrow \infty \). Analyzing the existence of a pure-strategy equilibrium for any combination of \(\gamma \) or \(n\) with asymmetries in the characteristics of the firms is beyond the scope of this paper. This is because the expected cost of being audited \(\alpha \theta (e_{i}-r_{i}^{*})\) in the audit contest is endogenous (depending on the two choices\(\ e_{i}\) and \(r_{i}\)), which is in contrast to standard contest models and makes the analysis complex. Note that in the standard Tullock contest with symmetric players, a symmetric equilibrium in pure strategies exists if \(\gamma \le n/(n-1)\) (Konrad 2009).

Gilpatric et al. (2011) note that “ as in all tournament models, sufficient variance of the noise is required for the existence of a pure-strategy equilibrium.” This is also the case in the Tullock audit mechanism. When \(\gamma \) is sufficiently high (the noise is low), there is no pure-strategy equilibrium.

See for example Rapoport and Amaldoss (2004) for a discussion of the equilibrium existence problem.

With discrete actions, the coin-flip tie-breaking rule (i.e.: \(p_{1}(r_{1} ,r_{2})=0.5\) if \(r_{1}=r_{2}\)) would work in the sense that the high-emitting firm could report exactly one reporting unit more in equilibrium than the low-emitting firm and win the audit auction. However, given discrete actions, the profit function would not be differentiable, which would cause problems for the analysis of the Tullock audit mechanism, because it relies on the differentiability of the profit function.

If the audit rule in the second round is as above (a second-price all-pay audit auction) both firms have a weakly dominant strategy to report truthfully. To see this, consider the case where \(e_{1}>e_{2}\) and\(\ 1<B<2\) (the remaining cases work equivalently). The payoff of firm 2 in the reporting stage is \(-te_{2}\) regardless of its report on the interval \(e_{2}\ge r_{2}\ge 0.\) Thus, \(r_{2}=e_{2}\) is a weakly dominant strategy for firm 2. Given \(r_{2}=e_{2}\) the payoff of firm 1 is \(-te_{2}-(\alpha -t/\theta )\theta (e_{1}-e_{2})\) [see Appendix “Derivation of the BR1” for details] regardless of its report on the interval \(e_{1}\ge r_{1}>e_{2}\) and to winning the audit-auction. Deviating to a smaller report leads to a lower payoff. Thus, \(r_{1}=e_{1}\) is a weakly dominant strategy for firm 1.

Note, that emissions under full compliance are decreasing in the tax rate, i.e. \(e_{i}^{\prime }(t)<0\) which can be seen from \(g^{\prime }(e_{i})=t\). If the marginal incentive of the tax to reduce emissions is decreasing, it has to be that \(e_{i}^{\prime \prime }(t)>0\). Differentiating \(g^{\prime }(e_{i})=t\) twice w.r.t. \(t\) and solving for \(e^{\prime \prime }(t)\) yields: \(e^{\prime \prime }(t)=-\frac{g^{\prime \prime \prime }(e)(e^{\prime }(t))^{2}}{g^{\prime \prime } (e)}.\) Since \(g^{\prime \prime }(e)<0,\) it follows that \(g^{\prime \prime \prime }(e)>0\) in order for \(e^{\prime \prime }(t)\) to be positive.

The online Appendix also has the result for the case when \(g^{\prime \prime \prime }(e)\le 0\).

References

Bayer R, Cowell F (2009) Tax compliance and firms’ strategic interdependence. J Public Econ 93(11–12):1131–1143

Colson G, Menapace L (2012) Multiple receptor ambient monitoring and firm compliance with environmental taxes under budget and target driven regulatory missions. J Environ Econ Manag (in press)

ECO (2007) Office of the Environmental Commissioner of Ontario. A special report to the Legislative Assembly of Ontario. “ Doing less with less: how shortfalls in budget, staffing and in-house expertise are hampering the effectiveness of MOE and MNR”. Technical Report, 2007

ECO (2011) Office of the Environmental Commissioner of Ontario. Annual report 2010/2011 to the Legislative Assembly of Ontario. “ Engaging solutions”. Technical Report, 2011

Endres A, Rundshagen B (2012) Escalating penalties: a supergame approach. Econ Gov 13:29–49

Epstein G, Nitzan S (2006) The politics of randomness. Soc Choice Welf 27:423–433

Evans MF, Gilpatric SM, Liu L (2009) Regulation with direct benefits of information disclosure and imperfect monitoring. J Environ Econ Manag 57:284–292

Friesen L (2003) Targeting enforcement to improve compliance with environmental regulations. J Environ Econ Manag 46:72–86

Fudenberg D, Tirole J (1984) The fat-cat effect, the puppy-dog ploy, and the lean and hungry look. Am Econ Rev Pap Proc 74(2):361–366

Gilpatric SM, Vossler CA, McKee M (2011) Regulatory enforcement with competitive endogenous audit mechanisms. RAND J Econ 42(2):292–312

Harford JD (1987) Self-reporting of pollution and the firm’s behavior under imperfectly enforceable regulations. J Environ Econ Manag 14:293–303

Harrington W (1988) Enforcement leverage when penalties are restricted. J Public Econ 37:29–53

Harsanyi J (1973) Games with randomly perturbed payoffs. Int J Game Theory 2:1–23

Heyes A, Rickman N (1999) Regulatory dealing—revisiting the Harrington paradox. J Public Econ 72(3):361–378

Hillman AL, Riley JG (1989) Politically contestable rents and transfers. Econ Politics 1(1):17–39

Kaplow L, Shavell S (1994) Optimal law enforcement with self-reporting of behavior. J Political Econ 102(3):583–606

Konrad K (2009) Strategy and dynamics in contests. Oxford University Press, New York

Livernois J, McKenna C (1999) Truth or consequences-enforcing pollution standards with self-reporting. J Public Econ 71(3):415–440

Macho-Stadler I, Pérez-Castrillo D (2006) Optimal enforcement policy and firms’ emissions and compliance with environmental taxes. J Environ Econ Manag 51:110–131

Marchi S, Hamilton JT (2006) Assessing the accuracy of self-reported data: an evaluation of the toxics release inventory. J Risk Uncertain 32:57–76

Maskin E, Riley J (2000) Equilibrium in sealed high bid auctions. Rev Econ Stud 67:439–454

Polinsky AM, Shavell S (1979) The optimal trade-off between the probability and magnitude of fines. Am Econ Rev 69(5):880–891

Rapoport A, Amaldoss W (2004) Mixed-strategy play in single-stage first-price all-pay auctions with symmetric players. J Econ Behav Organ 54:585–607

Sandmo A (2002) Efficient environmental policy with imperfect compliance. Environ Resour Econ 23(1):85–103

Stranlund JK (2007) The regulatory choice of noncompliance in emissions trading programs. Environ Resour Econ 38:99–117

Telle K (2013) Monitoring and enforcement of environmental regulations: lessons from a natural field experiment in Norway. J Public Econ 99:24–34

Tietenberg T (1998) Disclosure strategies for pollution control. Environ Resour Econ 11:587–602

Tullock G (1980) Efficient rent seeking. In: Buchanan JM, Tollison RD, Tullock G (eds) Toward a theory of the rent-seeking society. Texas A&M University Press, College Station, pp 97–112

Victoria EPA (2011) Environment Protection Authority Victoria. Compliance and enforcement policy, Technical Report, 2011

Weitzman M (1974) Prices versus quantities. Rev Econ Stud 41:477–491

van Zwet WR (1979) Mean, median, mode II. Stat Neerl 33(1):1–5

Acknowledgments

I am indebted to René Kirkegaard, John Livernois, and Asha Sadanand for their academic supervision, encouragement and valuable research advice. I am also grateful for comments and suggestions from three anonymous Referees as well as from J. Atsu Amegashie, Jeremy Clark, Ida Ferrara, Jean G. Forand, Johanna Goertz, Patrick González, Anthony Heyes, Mike Hoy, Emma Hutchinson, Lester Kwong, Bernard Lebrun, Charles Mason, Ross McKitrick, Dana McLean, Ray Rees and Steven Renzetti as well as from audiences at the 2014 Workshop on Game Theory and the Environment in Montreal, the 2012 ALEA Conference in Stanford, the 2012 EAERE Conference in Prague, the 2012 CREE Conference in Vancouver, the 2012 CEA Conference in Calgary, the 2011 ACEA Conference in Charlottetown, the 2012 UOttawa Ph.D. Workshop on Environmental Economics and Policy and the seminar of CES/Ifo Institute in Munich. I acknowledge the financial support from the Ontario Graduate Scholarship program as well as from the Sustainable Prosperity Network at the University of Ottawa.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendix

Appendix

1.1 Best Responses for the Reporting Stage 2

This section states and derives the complete best response function of firm 1 (BR1) at the reporting stage 2 of the game under the Tullock audit mechanism. If the funding level of the agency is such that \(B\in (0,1]\), the BR1 is defined as:

where \(\varepsilon \) is the smallest possible reporting unit. If \(B=1\), the BR1 is defined as: \(r_{1}(e_{1},r_{2},1)=\sqrt{r_{2}(r_{2}+e_{1})}-r_{2} \), i.e. for large \(r_{2}\) the BR1 converges to a parallel line somewhere between \(r_{1}=0\) and \(r_{1}=e_{1}.\) If \(B\in (1,2)\), the BR1 is defined as:

1.1.1 Derivation of the BR1

We note, that the FOC, \(\frac{\partial E\Pi _{1}}{\partial r_{1}}=0\), of the maximization problem in (4) is:

The assumption that the tax is low enough to guarantee positive profits under full-compliance, i.e. \(g_{i}(e_{i}^{fc})-te_{i}^{fc}>0\), eliminates the possibility of the case that \(e_{i}=0\) for \(i=1,2.\)

Thus, \(e_{1}>0.\) If \(e_{1}>0\) and \(r_{2}=0\) then the best response of firm \(1 \) is \(\varepsilon \). All remaining cases have \(e_{1}>0,\) and \(r_{2}>0.\)

I derive (18) first, i.e. the BR1 when the audit budget is such that \(B\in (0,1].\) Evaluating the first derivative (20) at \(r_{1}=0\) is proportional to \((r_{2}+e_{1})B-r_{2}.\) Hence, if \((r_{2}+e_{1})B-r_{2} <0\) (or \(r_{2}>e_{1}\frac{B}{1-B})\) then it is optimal to choose \(r_{1}=0.\)

Evaluating the first derivative (20) at \(r_{1}=e_{1}\) leads to \(r_{2}B-e_{1}-r_{2}.\) If \(B\le 1\) then this expressions is always less than zero and the inequality \(r_{2}B-e_{1}-r_{2}>0\) never holds, i.e. \(r_{1} =e_{1}\) can never be optimal if \(B\le 1,\) regardless of \(r_{2}.\) In all other cases, the optimal reporting choice is interior, i.e. \(0<r_{1}<e_{1}\) and the FOC (20) can be rearranged to \(r_{1}=\sqrt{r_{2}(r_{2}+e_{1})B} -r_{2}.\)

I derive (19) next, i.e. the BR1 when the audit budget is such that \(B>1.\) Firm 1’s problem is to chose some \(r_{1}\in [0,e_{1}]\) to maximize:

We analyze each of the three cases (i)–(iii):

-

Case (i): The first case, \(\frac{r_{2}}{r_{1}+r_{2}}\le \underline{p}, \) applies whenever \(r_{1}\ge \frac{1-\underline{p}}{\underline{p}}r_{2}.\) With \(B>1,\) I have \(\alpha \theta >t\ \)which means that \(\underline{p}=\max \{0,1-\frac{t}{\alpha \theta }\}=\frac{\alpha \theta -t}{\alpha \theta }\) and so \(r_{1}>\frac{1-\underline{p}}{\underline{p}}r_{2}=\frac{1}{B-1}r_{2}.\) In order for this case to exist I need to assume that \(e_{1}>r_{1}>\frac{1}{B-1}r_{2}.\) On this range, profit \(E\Pi _{1}=g(e_{1})-tr_{1}-(\alpha \theta -t)(e_{1}-r_{1})\) is decreasing in \(r_{1},\) i.e.: \(\frac{\partial E\Pi _{1}}{\partial r_{1}}=\alpha \theta -2t<0,\) for \(B\in (1,2).\) Hence, it can never be optimal to report some \(r_{1}>\frac{1}{B-1}r_{2}.\)

-

Case (ii): The first derivative (20) evaluated at \(r_{1}=e_{1} \) is proportional to \(r_{2}(B-1)-e_{1}.\) In order for this case to exist, I need to assume that \(r_{1}=e_{1}\) is feasible, i.e. that \(\frac{r_{2}}{e_{1}+r_{2}}\in [\underline{p},\overline{p}].\) We can see that there is at most one stationary point. So if \(r_{2}(B-1)-e_{1}\ge 0\) (or \(r_{2} \ge \frac{e_{1}}{B-1}\)) then \(r_{1}=e_{1}\) is optimal. Note, if \(r_{2} \ge \frac{e_{1}}{B-1}\) then \(\frac{1}{B-1}r_{2}\ge \frac{e_{1}}{(B-1)^{2} }>e_{1}\ge r_{1}\), and so the boundary defined in case (i) is never crossed.Next I investigate the boundary where \(r_{1}=\frac{1}{B-1}r_{2}.\) The first derivative (20) is proportional to \(-(r_{1}-r_{2})^{2}+r_{2}B(e_{1}+r_{2})=0.\) At the point where \(r_{1}=\frac{1}{B-1}r_{2}\) (which is finite) the derivative is positive whenever \(e_{1}\) is sufficiently large in comparison to \(r_{2},\) i.e.: \(-(\frac{1}{B-1} r_{2}-r_{2})^{2}+r_{2}B(e_{1}+r_{2})>0,\) if \(e_{1}\) is large in comparison to \(r_{2}\). Solving for \(r_{2}\) gives \(r_{2}<e_{1}\frac{(B-1)^{2}}{B-(B-1)^{2}} .\) In this case, profit is increasing in \(r_{1}\) when \(r_{1}\) is to the left of \(\frac{1}{B-1}r_{2}\) and decreasing when \(r_{1}\) is to the right of this point. Hence, I conclude that \(r_{1}=\frac{1}{B-1}r_{2}\) when \(r_{2} <e_{1}\frac{(B-1)^{2}}{B-(B-1)^{2}}.\)I need to assure that \(e_{1}>\frac{1}{B-1}r_{2}\) or \(r_{2}<e_{1}(B-1).\) But for \(B\in (1,2)\), I have \((B-1)>\frac{(B-1)^{2}}{B-(B-1)^{2}}.\) So if \(r_{2}<e_{1}\frac{(B-1)^{2} }{B-(B-1)^{2}},\) then it is automatically the case that \(r_{2}<e_{1}(B-1)\) or \(e_{1}>\frac{1}{B-1}r_{2}.\) Note further that if \(r_{2}=e_{1}\frac{(B-1)^{2} }{B-(B-1)^{2}}\) then \(\frac{1}{B-1}r_{2}=\frac{1}{B-1}(e_{1}\frac{(B-1)^{2} }{B-(B-1)^{2}})=-\frac{B-1}{B^{2}-3B+1}e_{1}\in (0,e_{1})\) for \(B\in (1,2).\) Finally, the reaction \(r_{1}=\sqrt{r_{2}(r_{2}+e_{1})B}-r_{2}\) is optimal if \(e_{1}\frac{(B-1)^{2}}{B-(B-1)^{2}}<r_{2}<e_{1}\frac{1}{B-1}.\)

-

Case (iii): The third case, \(\overline{p}<\frac{r_{2}}{r_{1}+r_{2}},\) applies whenever \(r_{1}<\frac{1-\overline{p}}{\overline{p}}r_{2}.\) With \(B>1, \) I have \(\alpha \theta >t\ \)which means that \(\overline{p}=\min \{\frac{t}{\alpha \theta },1\}=\frac{t}{\alpha \theta }\) and so \(r_{1}<(B-1)r_{2}\) (or \(\frac{r_{1}}{(B-1)}<r_{2})\). On this range, profit is always equal to \(E\Pi _{1}=g(e_{1})-te_{1}\) regardless of the report (\(0\le r_{1}\le e_{1} \)). Hence, any report equal or below \(e_{1}\) is a best response – in particular, \(r_{1}=e_{1}\) is a best response. And so \(e_{1}\ \)is a best response whenever \(\frac{e_{1}}{B-1}<r_{2}.\)I continue to assume that the firm chooses \(r_{1}=e_{1}\) in case it is indifferent between any \(r_{1} \in [0,e_{1}],\) such as in the present case (iii). While this assumption simplifies the analysis, it does not influence the emission choice of the firms in equilibrium. Referring to Fig. 2, the BRs only intersect once at exactly the same point with or without this assumption. Without this assumption, BR1 becomes a correspondence whenever it crosses the straight line with slope \(\frac{1}{B-1}.\) To the right of this crossing point, all BR1s are below the straight line; hence, BR1 and BR2 (which is always on or above the straight line) intersect only once at exactly the same point, with or without this assumption.

This concludes the derivation of the BR1. The best response function of firm 2 can be found equivalently.

1.2 Partial Derivatives of the Reporting Equilibrium

1.2.1 For the Case \(p_{i}\in (\underline{p},\overline{p})\)

In order to solve the emissions equilibrium at stage 1 of the game, I require the value of the partial derivative of \(r_{2}^{*}(e_{1},e_{2},B)\) with respect to \(e_{1}\). I find this value near equilibrium (\(p_{i}\in (\underline{p},\overline{p})\)) by applying the implicit function theorem to the system of best responses, which can be written as:

The total differentiation of system (21) leads to the following matrix:

It is required that the matrix on the left hand side of system (22) has to be non-singular, i.e. the determinant \(|D|\) of this matrix is different from zero, which is shown below. The value of \(|D|\) is given by:

Applying Cramer’s rule to the matrix system in (22) leads to the partial derivatives of interest:

1.2.2 For the Case \(p_{i}\notin (\underline{p} ,\overline{p})\)

For future reference, I state the matrix of partial derivatives of the reporting equilibrium w.r.t. changes in \(e_{1},\) for all three cases of \(p_{i}:\)

1.3 Single Crossing Property of the Best Response Functions

I show next, that the BRs only cross exactly once for \(B\in (0,2)\) and for any \(e_{i}\in (0,E]\) for \(i=1,2\). Hence, the reporting equilibrium is unique.

In case \(p_{i}\in (\underline{p},\overline{p}),\) \(r_{1}(e_{1},r_{2} ,B)=\sqrt{Br_{2}(r_{2}+e_{1})}-r_{2}\)

. The first and second derivatives of this part of the BR1 with respect to the report of firm 2 are:

From expressions (27), (28) and the complete BR1 stated in (18) and (19) above, I can derive the following properties about the shape of the BR1:

-

(1)

For small values of \(r_{2},\) the BR1 is always above the \(45^{\circ }\) line. This is because, if \(B\in (0,1],\) then the derivative\(\ \frac{\partial r_{1}(e_{1},r_{2},B)}{\partial r_{2}}\) is very large which can be seen from (27). If \(B\in (1,2)\), then \(p_{1}=\overline{p},\) and \(p_{2}=\underline{p}\), and the derivative \(\frac{\partial r_{1}(e_{1} ,r_{2},B)}{\partial r_{2}}\) takes on value \(\frac{1}{B-1},\) which is larger than \(1.\)

-

(2)

For large \(r_{2},\) the BR1 is below the \(45^{\circ }\) line. This is because, if \(B\in (0,1],\) the BR1 becomes negative-sloping or flat. If \(B\in (1,2)\), the BR1 becomes flat at \(r_{1}=e_{1}.\) Note, that the negative-sloping part of the BR1 cannot be smaller than \(-1,\) i.e. \(\frac{\partial r_{1}(e_{1},r_{2},B)}{\partial r_{2}}>-1.\) This can be seen from (27), because \(\frac{\sqrt{B}(e_{1}+2r_{2})}{2\sqrt{r_{2}\left( e_{1}+r_{2}\right) }}>0\).

-

(3)

We can learn from the negative second derivative in (28) that the BR1 is concave in case \(p_{i}\in (\underline{p},\overline{p}).\) If \(p_{i}\notin (\underline{p},\overline{p})\) the BR1 are straight lines. In fact, the best responses are concave whenever they are strictly positive.

Concluding, the BR1 is initially above the \(45^{\circ }\) line, and then crosses it once from above, for all \(B\in (0,2).\) It is evident from the discussion thus far, that the BRs only cross exactly once for \(B\in (0,2)\) and for any \(e_{i}\in (0,E]\) for \(i=1,2\).

1.4 Sufficient Condition for the Existence of \(e^{t}\) as Symmetric SPNE

This section works out a sufficient condition for the existence of \(e^{t}\) defined in (11) as a symmetric SPNE in pure strategies. This sufficient condition guarantees that \(e_{1}=e_{2}=e^{t}\) is the only stationary point. It is also shown that \(e_{1}=e_{2}=e^{t}\) is a local maximum. If \(e_{1} =e_{2}=e^{t}\) is a local maximum and in addition it is the only stationary point, it follows that it has to be a global maximum.

I begin by fixing the emission level of firm 2 at the equilibrium candidate identified in Eq. (11), i.e. \(e_{2}=e^{t}\) and rewrite the FOC (10) as:

where:

Expression \(L(e_{1})\) represents the marginal benefit associated with causing emissions and \(R(e_{1},e^{t})\) represents the marginal cost of causing emissions (both are divided by constant \(\alpha \theta \)). Whenever \(L(e_{1})=R(e_{1},e^{t}),\) the FOC holds and indicates a stationary point. Whenever \(L(e_{1})\) intersects \(R(e_{1},e^{t})\) from above in a diagram with \(e_{1}\) on the horizontal axis, a local maximum is identified.

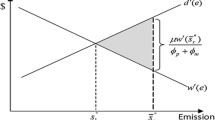

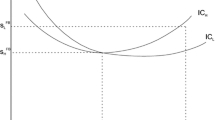

Figures 5 and 6 illustrate the value of \(L(e_{1})\) and\(\ R(e_{1},e^{t})\) for the cases \(B\in (0,1]\) and \(B\in (1,2)\) respectively. Specifically, the figures show the value of \(L(e_{1} )\) and\(\ R(e_{1},e^{t}), \) when the emissions of firm 2 are fixed at the emission level of the equilibrium candidate (\(e_{2}=e^{t})\) and the emissions of firm 1, \(e_{1}\) vary from \(0\) to \(E\) on the horizontal axis. It is straight forward to see that \(L(e_{1})\) is decreasing in \(e_{1}\), taking on value zero at \(e_{1}=E.\) In the following, I discuss the value of \(R(e_{1},e^{t})\) in both figures.

\(L(e_{1})\) and \(R(e_{1},e^{t}):\) LHS and RHS of the FOC defined in (29) with \(e_{2}\) fixed at the equilibrium candidate identified in (11), i.e. \(e_{2}=e^{t} \) and \(e_{1}\) varying from \(0\) to \(E\) when \(B\in (1,2)\). Note, it is \(\frac{1}{B}>\frac{8+B-B^{2}}{16-B^{2}}>\frac{B-1}{B}\) for \(B\in (1,2)\)

If the level of underfunding is such that \(B\in (1,2)\) as in Fig. 5, the graph can be partitioned into three scenarios with \(k_{1}\) and \(k_{2}\) as levels of emission of firm 1 as dividing points. The pair of emission levels \((e_{1},e_{2})=(k_{1},e^{t})\) leads to truthful reporting for firm 1 at stage 2 of the game; correspondingly, the pair \((k_{2},e^{t} )\) leads to truthful reporting for firm 2 at stage 2 of the game. Variables \(k_{1}\) and \(k_{2}\) are implicitly defined by:

Next, I discuss the convex downward-sloping shape of \(R(e_{1},e^{t})\) in Figs. 5 and 6 for interior reporting choices, i.e. \((k_{1}<e_{1}<k_{2})\). First it is important to state that \(R(e_{1} ,e^{t})\) is independent of the functional form of the benefit function, \(g(e)\). The value of \(R(e_{1},e^{t})\) is solely determined by \(e_{1},\) \(e_{2},\) \(r_{1}, r_{2},\) and \(B.\) Second, the best reporting responses for firm 1 in (5) and for firm 2 can be combined to the following equation:

From Eq. (34), we can see that multiplying both \(e_{1}\) and \(e_{2}\) by some constant, say \(p\) to \(pe_{1}\) and \(pe_{2}\) results in the reporting choices to increase by exactly factor \(p\) as well to \(pr_{1}\) and \(pr_{2}.\) From Eqs. (24) and (25), we can learn that the partial derivatives do not change if evaluated at \(pe_{1}\), \(pe_{2},\) and\(\ pr_{1}\) and \(pr_{2}.\) Now it is straight forward to see that the value of \(R(e_{1},e^{t})\) does not change either subsequent to this change in emissions and reporting. Hence, \(R(e_{1},e^{t})\) is homogenous of degree zero (HOD zero) to equal changes in \(e_{1}\) and \(e_{2}.\) Third, if I fix \(e_{2}\) at any level of emissions and let \(e_{1}\) vary from \(0\) to \(E\), the shape of \(R(e_{1},e^{t})\) on the interval \(e\in (k_{1},\min \{k_{2},E\})\) is revealed in its general form, because \(R(e_{1},e^{t})\) is HOD zero. In the example illustrated in Fig. 7 I fixed the emission level of firm 2 at the equilibrium candidate, i.e. \(e_{2}=e^{t}.\) This example reveals the convex downward-sloping shape of \(R(e_{1},e^{t})\) in Figs. 5 and 6.

With the help of the partial derivatives of the reporting equilibrium stated in (26), I can find the values for \(R(e_{1},e^{t})\) to conclude Figs. 5 and 6:

-

\(R(0,e^{t})=1,\) for \(B\in (0,1]\)

-

\(R(e_{1},e^{t})\Big |_{e_{1}\le k_{1}}=1/B,\) for \(B\in (1,2)\)

-

\(R(e_{1},e^{t})\Big |_{e_{1}\ge k_{2}}=\frac{B-1}{B},\) for \(B\in (1,2). \)

Whenever \(L(e_{1})\) intersects \(R(e_{1},e^{t})\) from above, a local maximum is identified. Whenever this local maximum is the only stationary point, it has to be a global maximum. A sufficient condition that guarantees that \(L(e_{1})\) intersects \(R(e_{1},e^{t})\) uniquely from above as illustrated in Figs. 5 and 6 is stated next:

Value of \(L(e_{1})\) and \(R(e_{1},e^{t})\) as defined in (30) and (31) for various funding levels of \(B,\) with \(B=(\alpha \theta )/t\). The emission level of firm 2 \(e_{2}\) is fixed at the emission level of the equilibrium candidate \(e^{t}\), defined in (11). The example was generated with the benefit function:\(\ g(e)=e^{0.5}-e\)

Sufficient condition for the existence of \((e^{t},e^{t})\) as symmetric pure strategy SPNE: There exists some \(m>0\) such that if \(|g^{\prime \prime }(e_{1})|>m\) for all \(e\in [\max \{0,k_{1}\},\min \{k_{2},E\}],\) then a symmetric pure strategy SPNE exists.

Put differently, if \(g^{\prime }(e_{1})\) is steep enough on the interval \([\max \{0,k_{1}\},\min \{k_{2},E\}],\) then it is guaranteed that the symmetric SPNE in pure strategies exists.

Rights and permissions

About this article

Cite this article

Oestreich, A.M. Firms’ Emissions and Self-Reporting Under Competitive Audit Mechanisms. Environ Resource Econ 62, 949–978 (2015). https://doi.org/10.1007/s10640-014-9855-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-014-9855-z