Abstract

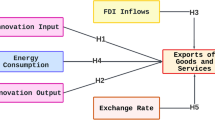

We examine variations in the South–North ratios (emerging vs. industrialized countries) of energy and labor intensities driven by imports. We use the novel World input-output database that provides bilateral and bisectoral data for 40 countries and 35 sectors for 1995–2009. We find South–North convergence of energy and labor intensities, an energy bias of import-driven convergence and no robust difference between imports of intermediate and investment goods. Accordingly, trade helps emerging economies follow a ‘green growth’ path, and trade-related policies can enhance this path. However, the effects are economically small and require a long time horizon to become effective. Trade-related policies can become much more effective in selected countries and sectors: China attenuates labor intensity via imports of intermediate goods above average. Brazil reduces energy intensity via imports of intermediate and investment goods above average. Production of machinery as an importing sector in emerging countries can immoderately benefit from trade-related reductions in factor intensities. Electrical equipment as a traded good particularly decreases energy intensity. Machinery particularly dilutes labor intensity. Our main results are statistically highly significant and robust across specifications.

Similar content being viewed by others

Notes

In the Melitz (2003) model, trade liberalization induces exit of low-productivity firms and and an expansion of the market share and the profits of high-productivity firms engaged in exporting. This raises overall productivity and welfare.

1. Australia, 2. Austria, 3. Belgium, 4. Canada, 5. Cyprus, 6. Czech Republic, 7. Denmark, 8. Estonia, 9. Finland, 10. France, 11. Germany, 12. Greece, 13. Hungary, 14. Ireland, 15. Italy, 16. Japan, 17. Korea, 18. Latvia, 19. Lithuania, 20. Luxembourg, 21. Malta, 22. Netherlands, 23. Poland, 24. Portugal, 25. Slovak Republic, 26. Slovenia, 27. Spain, 28. Sweden, 29. Turkey, 30. United Kingdom, 31. United States of America.

1. Brazil, 2. Bulgaria, 3. China, 4. India, 5. Indonesia, 6. Mexico, 7. Romania, 8. Russia, 9. Taiwan.

1. Agriculture, Hunting, Forestry and Fishing, 2. Mining and Quarrying, 3. Food, Beverages and Tobacco, 4. Textiles and Textile Products, 5. Leather, Leather and Footwear, 6. Wood and Products of Wood and Cork, 7. Pulp, Paper, Printing and Publishing, 8. Coke, Refined Petroleum and Nuclear Fuel, 9. Chemicals and Chemical Products, 10. Rubber and Plastics, 11. Other Non-Metallic Minerals, 12. Basic Metals and Fabricated Metal, 13. Machinery, NEC, 14. Electrical and Optical Equipment, 15. Transport Equipment, 16. Manufacturing, NEC, Recycling, 17. Electricity, Gas and Water Supply, 18. Construction, 19. Sale, Maintenance and Repair of Motor Vehicles and Motorcycles, Retail Sale of Fuel, 20. Wholesale Trade and Commission Trade, Except of Motor Vehicles and Motorcycles, 21. Retail Trade, Except of Motor Vehicles and Motorcycles, Repair of Household Goods, 22. Hotels and Restaurants, 23. Inland Transport, 24. Water Transport, 25. Air Transport, 26. Other Supporting and Auxiliary Transport Activities, Activities of Travel Agencies, 27. Post and Telecommunications, 28. Financial Intermediation, 29. Real Estate Activities, 30. Renting of M&E and Other Business Activities, 31. Public Admin and Defense, Compulsory Social Security, 32. Education, 33. Health and Social Work, 34. Other Community, Social and Personal Services, 35. Private Households with Employed Persons.

1. Food, Beverages and Tobacco, 2. Textiles and Textile Products, 3. Leather, Leather and Footwear, 4. Wood and Products of Wood and Cork, 5. Pulp, Paper, Paper, Printing and Publishing, 6. Coke, Refined Petroleum and Nuclear Fuel, 7. Chemicals and Chemical Products, 8. Rubber and Plastics, 9. Other Non-Metallic Minerals, 10. Basic Metals and Fabricated Metal, 11. Machinery, NEC, 12. Electrical and Optical Equipment, 13. Transport Equipment, 14. Manufacturing, NEC, Recycling.

The investment good adds to the recipient economy-wide capital stock used for production in any sector of the recipient country.

High-skilled labor means first and second stage of tertiary education (1997 ISCED levels 5 and 6).

The sum of OECD energy use divided by the sum of OECD GDP (gross domestic product)). The same for non-OECD.

The value of trade from OECD to non-OECD divided by non-OECD GDP.

The high maximum of manufacturing energy intensities on a sectoral level comes from ‘Inland Transport’ in Russia. While Russia’s energy intensity is in general about 2.5–3 times higher than that of China or India, the energy intensity in this particular sector is even higher.

1. Agriculture, Hunting, Forestry and Fishing, 2. Mining and Quarrying, 3. Food, Beverages and Tobacco, 4. Textiles and Textile Products, 5. Leather, Leather and Footwear, 6. Wood and Products of Wood and Cork, 7. Pulp, Paper, Printing and Publishing, 8. Coke, Refined Petroleum and Nuclear Fuel, 9. Chemicals and Chemical Products, 10. Rubber and Plastics, 11. Other Non-Metallic Minerals, 12. Basic Metals and Fabricated Metal, 13. Machinery, NEC, 14. Electrical and Optical Equipment, 15. Transport Equipment, 16. Manufacturing, NEC, Recycling, 17. Electricity, Gas and Water Supply, 18. Construction, 19. Hotels and Restaurants, 20. Financial Intermediation, 21. Other Community, Social and Personal Services.

1. Australia, 2. Austria, 3. Belgium, 4. Canada, 5. Czech Republic, 6. Germany, 7. Spain, 8. Estonia, 9. Finland, 10. France, 11. Great Britain, 12. Greece, 13. Hungary, 14. Ireland, 15. Italy, 16. Japan, 17. Korea, 18. Netherlands, 19. Poland, 20. Portugal, 21. Slovak Republic, 22. Slovenia, 23. Turkey, 24. United States.

Due to missing data, Romania is left out in the energy price sample and in the robustness check regression based on that.

As we will see in the dynamic estimations in the robustness check, the estimated value of \(\beta _0\) is only slightly below one.

We do not apply the dynamic model because of the caveats sketched above.

We also check the twofold interaction of the R&D intensity with the investment good trade flow, yet without finding a significant impact.

We show this by running the reduced sample R&D regression without R&D expenditures as a regressor for comparison.

The average annual growth rate of energy intensity in OECD between 1995 and 2009 is \(-\)2 %, in non-OECD it is \(-\)3 %. The average annual growth rate of labor intensity in OECD is also \(-\)2 %, in non-OECD it is \(-\)5 %.

References

Acemoglu D (2002) Directed technical change. Rev Econ Stud 69(4):781–809

Acemoglu D (2010) When does labor scarcity encourage innovation? J Polit Econ 118(6):1037–1078

Acemoglu D, Aghion P, Bursztyn L, Hemous D (2012) The environment and directed technical change. Am Econ Rev 102(1):131–166

Aitken BJ, Harrison AE (1999) Do domestic firms benefit from direct foreign investment? Evidence from Venezuela. Am Econ Rev 89(3):605–618

Albornoz F, Cole MA, Elliott RJR, Ercolani MG (2009) In search of environmental spillovers. World Econ 32:136–163. doi:10.1111/j.1467-9701.2009.01160.x

Amiti M, Konings J (2007) Trade liberalization, intermediate inputs, and productivity: evidence from Indonesia. Am Econ Rev 97(5):1611–1638

Antweiler W, Copeland BR, Taylor MS (2001) Is free trade good for the environment? Am Econ Rev 91(4):877–908

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error-components models. J Econ 68:29–51

Barassi MR, Cole MA, Elliott RJR (2008) Stochastic divergence or convergence of per capita carbon dioxide emissions: re-examining the evidence. Environ Resour Econ 40:121–137. doi:10.1007/s10640-007-9144-1

Bitzer J, Geishecker I (2006) What drives trade-related R &D spillovers? Decomposing knowledge-diffusing trade flows? Econ Lett 93(1):52–57

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econ 87(1):115–143

Bwalya SM (2006) Foreign direct investment and technology spillovers: evidence from panel data analysis of manufacturing firms in Zambia. J Dev Econ 81(2):514–526

Carraro C, De Cian E (2013) Factor-augmenting technical change: an empirical assessment. Environ Model Assess 18(1):13–26

Coe D, Helpman E, Hoffmaister A (1997) North-South R &D spillover. Econ J 107:134–149

Cole MA (2006) Does trade liberalization increase national energy use? Econ Lett 92:108–112

Cole MA, Elliott RJR, Zhang J (2011) Growth, foreign direct investment and the environment: evidence from Chinese cities. J Reg Sci 51(1):121–138

Copeland BR, Taylor MS (2003) Trade and the environment: theory and evidence. Princeton University Press, Princeton

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74:427–431

Egger P, Pfaffermayr M (2001) A note on labor productivity and foreign inward direct investment. Appl Econ Lett 8(4):229–232

Findlay R (1978) Relative backwardness, direct foreign investment, and the transfer of technology: a simple dynamic model. Q J Econ 92(1):1–16

Girma S (2005) Absorptive capacity and productivity spillovers from FDI: a threshold regression analysis. Oxf Bull Econ Stat 67(3):281–306

Girma S, Görg H (2007) The role of the efficiency gap for spillovers from FDI: evidence from quantile regressions. Open Econ Rev 18(2):215–232

Griffith R, Redding S, van Reenen J (2003) R &D and absorptive capacity: theory and empirical evidence. Scand J Econ 105(1):99–118

Griffith R, Redding S, van Reenen J (2004) Mapping the two faces of R &D: productivity growth in a panel of OECD industries. Rev Econ Stat 86(4):883–895

Grossman G, Krueger A (1993) Environmental impacts of a North American free trade agreement. In: Garber P (ed) The U.S. Mexico free trade agreement. MIT Press, Cambridge, pp 13–56

Havranek T, Irsova Z (2011) Estimating vertical spillovers from FDI: why results vary and what the true effect is. J Int Econ 85:234–244

Hübler M, Keller A (2010) Energy savings via FDI? Empirical evidence from developing countries. Environ Dev Econ 15(1):59–80

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econ 115:53–74

Jakob M, Haller M, Marschinski R (2012) Will history repeat itself? Economic convergence and convergence in energy use patterns. Energy Econ 34:95–104

Javorcik BS (2004) Does foreign direct investment increase the productivity of domestic firms? In search of spillovers through backward linkages. Am Econ Rev 94(3):605–627

Keller W (2004) International technology diffusion. J Econ Lit 42(3):752–782

Keller W, Yeaple SR (2009) Multinational enterprises, international trade and productivity growth: firm-level evidence from the United States. Rev Econ Stat 91(4):821–831

Kohpaiboon A (2006) Foreign direct investment and technology spillover: a cross-industry analysis of Thai manufacturing. World Dev 34(3):541–556

Kuo C-C, Yang C-H (2008) Knowledge capital and spillover on regional economic growth: evidence from China. China Econ Rev 19:594–604

Lai M, Peng S, Bao Q (2006) Technology spillovers, absorptive capacity and economic growth. China Econ Rev 17:300–320

Lee G (2006) The effectiveness of international knowledge spillover channels. Eur Econ Rev 50(8):2075–2088

Madsen JB (2007) Technology spillover through trade and TFP convergence: 135 years of evidence for the OECD countries. J Int Econ 72(2):464–480

Markandya A, Pedroso-Galinato S, Streimikiene D (2006) Energy intensity in transition economies: is there convergence towards the EU average? Energy Econ 28:121–145

Mayer-Foulkes D, Nunnenkamp P (2009) Do multinational enterprises contribute to convergence or divergence? A disaggregated analysis of US FDI. Rev Dev Econ 13(2):304–318

Melitz MJ (2003) The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica 71(6):1695–1725

Nelson R, Phelps E (1966) Investment in humans, technological diffusion, and economic growth. Am Econ Rev Pap Proc 61:69–75

Nickell SJ (1981) Biases in dynamic models with fixed effects. Econometrica 49(6):1417–1426

Perkins R, Neumayer E (2009) Transnational linkages and the spillover of environment-efficiency into developing countries. Glob Environ Chang 19(3):375–383

Perkins R, Neumayer E (2012) Do recipient country characteristics affect international spillovers of CO2-efficiency via trade and foreign direct investment? Clim Chang 112(2):469–491

Roodman D (2009a) How to do xtabond2: an introduction to ”Difference” and ”System” GMM in stata. Stata J 9(1):86–136

Roodman D (2009b) A note on the theme of too many instruments. Oxf Bull Econ Stat 71(1):135–158

Saggi K (2002) Trade, foreign direct investment, and international technology transfer: a survey. World Bank Res Obs 17(2):191–235

Suyanto RAS, Bloch H (2009) Does foreign direct investment lead to productivity spillovers? Firm level evidence from Indonesia. World Dev 37(12):1861–1876

Windmeijer F (2005) A finite sample correction for the variance of linear efficient two-step GMM estimators. J Econ 126:25–51

Acknowledgments

We thank two anonymous reviewers for their very helpful comments. We also thank Simon Koesler, Michael Schymura, Francois Laisney, Andreas Löschel, Peter Nunnenkamp and Holger Görg for valuable support and comments. Funding from the German Federal Ministry of Education and Research (BMBF) within the Call ‘Ökonomie des Klimawandels’ (funding code 01LA1105B: Climate Policy and the Growth Pattern of Nations—CliPoN) is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Hübler, M., Glas, A. The Energy-Bias of North–South Technology Spillovers: A Global, Bilateral, Bisectoral Trade Analysis. Environ Resource Econ 58, 59–89 (2014). https://doi.org/10.1007/s10640-013-9690-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-013-9690-7