Abstract

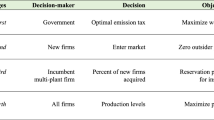

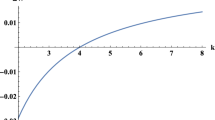

The purpose of this paper is to investigate optimal schemes for refunding the emission tax in a free-entry market where the production process generates emissions. We consider the regulation by a three-part tax policy: the government sets an emission tax, a refunding scheme, and an entry-license tax. In contrast to the case of the two-part tax-refund policy under no entry, we show that even if it is impossible to obtain subsidies from outside, the first-best outcome is always attained. Further, the government’s budget constraint is binding under the optimal schemes. Our result implies that the tax-refund system works effectively in a market with endogenous entry.

Similar content being viewed by others

References

Barnett AH (1980) The Pigouvian tax rule under monopoly. Am Econ Rev 70: 1037–1041

Baumol WJ, Oates WE (1988) The theory of environmental policy. 2nd edn. Cambridge University Press, Cambridge

Buchanan JM (1969) External diseconomies, corrective taxes, and market structure. Am Econ Rev 59: 174–177

Fischer C (2003) Market power and output-based refunding of environmental policy revenues. Discussion paper 03–27, Resources for the future

Fredrikssona PG, Sterner T (2005) The political economy of refunded emissions payment programs. Econ Lett 87: 113–119

Gersbach H, Requate T (2004) Emission taxes and optimal refunding schemes. J Public Econ 88: 713–725

Gersbach H, Winkler R (2007) On the design of global refunding and climate change. Working Paper, CER-ETH—Center of Economic Research at ETH Zurich

Gersbach H, Winkler R (2008) International emission permit markets with refunding. Working Paper, CER-ETH—Center of Economic Research at ETH Zurich

Katsoulacos Y, Xepapadeas A (1995) Environmental policy under oligopoly with endogenous market structure. Scand J Econ 97: 411–420

Lee DR (1975) Efficiency of pollution and market structure. J Environ Econ Manag 2: 69–72

Levin D (1985) Taxation within Cournot oligopoly. J Public Econ 27: 281–290

Mankiw NG, Whinston MD (1986) Free entry and social inefficiency. RAND J Econ 17: 48–58

Misolek WS (1980) Effluent of taxation in monopoly markets. J Environ Econ Manag 7: 103–107

Requate T (1993) Pollution control in a Cournot duopoly via taxes or permits. J Econ 58: 255–291

Requate T (1997) Green taxes in oligopoly if the number of firms is endogenous. Finanzarchiv 54: 261–280

Simpson RD (1995) Optimal pollution taxation in a Cournot duopoly. Environ Resour Econ 6: 359–369

Sterner T, Isaksson HL (2006) Refunded emission payments theory, distribution of costs, and Swedish experience of NO x abatement. Ecol Econ 57: 93–106

Suzumura K, Kiyono K (1987) Entry barriers and economic welfare. Rev Econ Studies 54: 157–167

Author information

Authors and Affiliations

Corresponding author

Additional information

I am grateful to Katsuhito Iwai and Toshihiro Matsumura for their helpful discussions and suggestions. I thank anonymous referees for constructive and valuable comments. Needless to say, I am responsible for any remaining errors. This paper is financially supported by Grant-in-Aids for Young Scientists (Start-up) from the Japan Society for the Promotion of Science and the Ministry of Education, Culture, Sports, Science and Technology.

Rights and permissions

About this article

Cite this article

Cato, S. Emission Taxes and Optimal Refunding Schemes with Endogenous Market Structure. Environ Resource Econ 46, 275–280 (2010). https://doi.org/10.1007/s10640-009-9340-2

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-009-9340-2