Abstract

There is concern that prices in a market for Green Certificates (GCs) primarily based on volatile wind power will fluctuate excessively, leading to corresponding volatility of electricity prices. Applying a rational expectations simulation model of competitive storage and speculation of GCs the paper shows that the introduction of banking of GCs may reduce price volatility considerably and lead to increased social surplus. Banking lowers average prices and is therefore not necessarily to the benefit of “green producers”. Proposed price bounds on GC-prices will reduce the importance of banking and even of the GC system itself.

Similar content being viewed by others

References

Amundsen E. S., Mortensen J. B. (2001) The Danish Green Certificate Market: Some Simple Analytical Results. Energy Economics 23:489–509

Amundsen E. S., Mortensen J. B. (2002) The Danish Green Certificate Market: Some Simple Analytical Results; Erratum. Energy Economics 24:523–524

Cronshaw M. B., Kruse J. B. (1996) Regulated Firms in Pollution Permit Markets with Banking. Journal of Regulatory Economics 9:179–189

Deaton A., Laroque G. (1992) On the Behavior of Commodity Prices. Review of Economic Studies 59:1–23

Deaton A., Laroque G. (1996) Competitive Storage and Commodity Price Dynamics. Journal of Political Economy 104:896–957

EMD International (2004): “Monthly Wind Energy Index for Denmark”, www.vindstat.dk

Fristrup P. (2003) Some Challenges Related to Introducing Tradable Green Certificates. Energy Policy 31:15–19

Gustafson, R. L. (1958) “Carryover Levels for Grains” (US Department of Agriculture, Technical Bulletin 1178)

Jensen S. G., Skytte K. (2002) Interactions between the Power and Green Certificate Markets. Energy Policy 30:425–435

Kling C., Rubin J. (1997). Bankable Permits for the Control of Environmental Pollution. Journal of Public Economics 64:101–115

Roberts M. J., Spence M. (1976). Effluent Charges and Licenses Under Uncertainty. Journal of Public Economics 5:193–208

Rubin J. D. (1996). A Model of Intertemporal Emission Trading, Banking and Borrowing. Journal of Environmental Economics and Management 31:269–286

Spulber D. F. (1985) Effluent Regulations and Long-Run Optimality. Journal of Environmental Economics and Management 12:103–116

Unger T., Ahlgren E. O. (2003) Impacts of a Green Certificate Market on Electricity and CO2-Emission Markets in the Nordic Countries. In: Unger T. (eds), Common Energy and Climate Strategies for the Nordic Countries – A Model Analysis, Dissertation. Chalmers University of Technology, Gothenburg, Sweden

Williams J. C., Wright B. D. (1991) Storage and Commodity Markets. Cambridge University Press, Cambridge

Wright B. D., Williams J. C. (1984) The Welfare Effects of the Introduction of Storage. Quarterly Journal of Economics 98:169–192

Yates A., Cronshaw M. B. (2001) Pollution Permits Markets with Intertemporal Trading and Asymmetric Information. Journal of Environmental Economics and Management 42:104–118

Acknowledgments

Financial support from NERP and the Norwegian Research Council (RENERGI) is gratefully acknowledged. We are grateful to two anonymous referees for helpful comments and constructive criticisms. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Additional information

The paper benefited from presentations at Copenhagen University, Stockholm School of Economics and University of Iceland. Thanks are due to Lars Bergman, Torstein Bye, Pauli Murto and participants in the Nordic Energy Research Program (NERP).

Appendices

Appendix 1

Iterative algorithm

The iterative algorithm used to obtain solutions for the numerical model:

-

1.

Establish an interval \(\left[\underline{y},\overline{y}\right]\) for the state variable y. The lower bound is (naturally) \(\underline{y}=\underline{z}\), but the upper bound must be established by experimentation. It should be high enough so that the probability of hitting it is negligible.

-

2.

Set up a grid Y over \(\left[\underline{y},\overline{y}\right]\) defining permissible values of y.

-

3.

Define f 0(y) = S(y),y∈Y.

-

4.

For n = 1, 2,... calculate a new estimate of f by the equation

$$ f_{n}(y)=\max{\left\{{\beta E{\left[{f_{n-1}{\left({z+ {\left[{y-S^{-1}{\left({f_{n}(y)}\right)}}\right]}}\right)}}\right]} ,S(y)}\right\}},\,y \in Y. $$(27)Stop when \(\left\|{f_n-f_{n-1}}\right\|<\varepsilon\), where \(\varepsilon\) is a “small” number. The final f n is the numerical solution to (19).

When a numerical estimate of f has been determined it is easy to simulate time series for price, demand, the stock of certificates and other model variables by generating random numbers from the distribution of z. Simple MATLAB programs were written which perform the above calculations.

Appendix 2

Consumers’, producers’ and social surplus with a linear demand function

The inverse demand function for electricity is assumed given by:p(x) = a + bx, with constants a>0 and b<0. We denote the stochastic green electricity generation by \(\tilde {z}\) and its expected value by \(E\left[\tilde{z}\right]=\mu\). Furthermore, we denote the stochastic electricity consumption by \(\tilde{x}\) and its expected value and variance by \(E\left[\tilde{x}\right]=\lambda\) and \(V\left(\tilde{x}\right)\), respectively. With linear demand we have: \(E\left[p(\tilde{x})\right]=a+b\lambda\) and \(V\left(p(\tilde{x})\right)=b^{2}V(\tilde{x})\)

Consumers’ surplus (CS):

Producers’ surplus (PS):

Social surplus (SS):

Comparison with and without banking

We compare expected values generated from a stationary price process without banking to a stationary price process with banking. Denote the expected value and variance of the electricity price with banking by \(E_b\left[{\tilde{p}}\right]\) and \(V_b({\tilde{p}})\) and without banking by \(E_{nb}\left[{\tilde{p}}\right]\) and \(V_{nb}\left({\tilde{p}}\right)\), respectively. We know the two processes generate the same values of expected price and that the price process for the case with banking has a lower variance than the price process for the case without banking i.e.

Consequently: \(V_b\left({\tilde{x}}\right)< V_{nb}\left({\tilde{x}}\right)\). Inspection of expressions then shows:

Hence, going from a situation without banking to a situation with banking consumers’ surplus will fall, while producers’ surplus and social surplus will increase.

The effects of a lower price bound

Next assume that a lower bound \(\underline{s}\) on prices of GCs is introduced for the case without banking. The effect of this is to reduce the upper range of values for electricity consumption (and correspondingly the lower range of values for electricity prices). Consequently, the expected electricity price will increase, while expected electricity consumption will fall. Both variances will fall. Identifying quantities in the lower price bound case by \(\underline{s}\) we thus have \(E_{nb}^{\underline{s}}\left[{\tilde {p}}\right]> E_{nb}\left[{\tilde{p}}\right]\), \(\lambda ^{\underline{s}}< \lambda\), \(V_{nb}^{\underline{s}} (\tilde{p})< V_{nb}(\tilde{p})\) and \(V_{nb}^{\underline{s}} (\tilde{x})< V_{nb}(\tilde{x})\). Consulting the expression for consumers’ surplus above, we can immediately conclude that \(E_{nb}^{\underline{s}}\left[{\rm CS}\right]< E_{nb}\left[{\rm CS}\right]\).

Note that expected production is larger than the production level that maximizes producers’ surplus (i.e. where expected marginal revenue is equal to marginal cost) provided \(\underline{s}\leq({2\alpha})^{-1}({a-c})\) (note that we must have a>c so (2α)−1(a−c)>0). In what follows we assume this condition on \(\underline{s}\) is satisfied. We can then show that \(E_{nb}^{\underline{s}}\left[{\rm PS}\right]> E_{nb}\left[{\rm PS}\right]\). For this purpose, let F(x) be the cumulative distribution function of \(\tilde{x}\) in the absence of the constraint \(s\geq\underline{s}\). Let \(\overline{x}=(\alpha \underline{s}+c-a)/b> 0\) be the upper bound on demand corresponding to \(\underline{s}\) and let \(\overline{\pi}=P\left\{{\tilde{x}\geq \overline{x}}\right\}=1-F(\overline{x})\). Writing \(F^{\underline{s}}(x)\) for the c.d.f. of \(\tilde{x}\) in the presence of the constraint \(s\geq\underline{s}\) we get

Hence, we have,

It is easily checked that the expression p(x)x−cx is decreasing in x for \(x\geq\overline{x}\) provided \(\underline{s}\leq({2\alpha})^{-1}({a-c})\). Therefore, the integrand in the bottom integral above is strictly negative for \(x>\overline{x}\). It follows that we have \(E_{nb}^{\underline{s}}{\left[{\rm PS}\right]}> E_{nb}{\left[{\rm PS}\right]}\).

Comparing these results – i.e. that \(E_{nb}^{\underline{s}}\left[ {\rm CS}\right]< E_{nb}\left[{\rm CS}\right]\) and \(E_{nb}^{\underline{s}} \left[{\rm PS}\right]> E_{nb}\left[{PS}\right]\) – to the conclusions drawn above with respect to expected surpluses with banking, that comparison now becomes ambiguous and we may have \(E_{nb}^{\underline{s}}\left[{\rm PS}\right]> E_b\left[{\rm PS}\right]\) and \(E_{nb}^{\underline{s}}\left[{\rm CS}\right]< E_b\left[{\rm CS}\right]\) i.e. the introduction of banking under a GC-system with a lower price bound \(\underline{s}\leq({2\alpha})^{-1}({a-c})\) may lead to a reduction of expected producers’ surplus and an increase of expected consumers’ surplus as indeed observed in the simulation results reported in the paper, where \(\underline{s}=0\).

Appendix 3

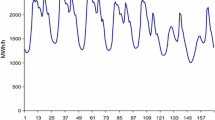

Volatility of the Danish wind energy content series

This appendix briefly describes the statistical properties of the series on energy content of wind in Denmark in the years 1979–2004.19 The data is depicted in Figure A3.1. The index average is 97.95 for the entire period 1979–2004; the standard deviation of the series is 9.77 so the coefficient of variation is approximately 10%. The null hypothesis that the data are normally distributed cannot be rejected (χ 22 = 1.487, P-value 0.48); this of course assumes independent and identically distributed observations. Autocorrelation is not significant in the series.

Looking at Figure A3.1 it seems that there is a shift in the series from 1995 onwards: the averages for 1979–1994 and 1995–2004 are 102.7 and 90.3, respectively. A Cusum test of stability of the mean, however, does not reject a stable mean (Harvey-Collier t(24) = −1.6, P-value 0.12). A Chow test of a structural break in 1995 on the other hand rejects the null hypothesis of no change (t-value of −3.98, P-value 0.0006). This should, however, be taken with some caution since we decide on the the timing of the structural break by looking at the data which makes P-values of Chow tests suspect. Testing for stationarity with the Augmented Dicky-Fuller (ADF) test, however, reveals that the null hypothesis of a unit root cannot be rejected (P-value of 0.27) indicating that the series is non-stationary.

The evidence as to whether the series can be described by a series of independent and identically distributed observations is therefore mixed, but in light of the ADF and Chow-test results it was decided to take another look at the data and transform it by dividing it into two periods, 1979–1994 and 1995–2004, and calculating the relative deviation from the mean in each period. The result is a data series, “dev”, defined by \({\rm dev}_t=\hbox{index}_t/102.7-1\) in the former period and by \({\rm dev}_t={\rm index}_t/90.3-1\) in the latter one, where “index” is the wind index. After this transformation, the mean of the series is obviously zero, and the standard deviation (adjusting for an extra degree of freedom lost due to the estimation of two mean parameters) is 0.078. An ADF test indicates that the series is stationary (P-value of 0.002). There is marginally significant negative autocorrelation (P-value of 10% for first lag) which indicates some overfitting. A Cusum test now reveals a very stable mean of the series. (The Chow test is now meaningless since we have adjusted for a shift of means.) Finally, the results of a Chi-Square test of normality, indicate that normality cannot be rejected (P-value of 0.26).

This analysis indicates that the wind energy series may for our purposes be modelled as a series of normally distributed i.i.d. observations and regardless of whether one assumes that a shift occured in the data the coefficient of variation is of the order of magnitude of 10%.

Rights and permissions

About this article

Cite this article

Amundsen, E.S., Baldursson, F.M. & Mortensen, J.B. Price Volatility and Banking in Green Certificate Markets. Environ Resource Econ 35, 259–287 (2006). https://doi.org/10.1007/s10640-006-9015-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-006-9015-1