Abstract

The determination of weights and the measurement of risk have been the core problems of portfolio optimization. In this paper, we propose the improved Quantum Beetle Antennae Search (IQBAS) algorithm for solve the first problem. Moreover, we use the GAS-MIDAS-Copula model to solve the second problem. Meanwhile, we combine both methods for portfolio optimization. Using a 5-min high-frequency returns covering ten sectors in the Shanghai Stock Exchange from September 1, 2019 to September 1, 2022, we find that the GAS-MIDAS-Copula model is very effective in describing the portfolio distribution and interdependence structure. Also, for different confidence levels and different optimization objectives, the IQBAS algorithm outperforms other popular optimization methods. In addition, when constructing a portfolio during the COVID-19 epidemic, China’s Medical industry should receive more weight, while China’s Information and Telecom industries should receive less. Our findings are informative on how to better invest during major public health emergencies.

Similar content being viewed by others

Notes

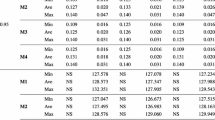

OFV refers to the objective function value.

References

Alexander, S., Coleman, T. F., & Li, Y. (2006). Minimizing CVaR and VaR for a portfolio of derivatives. Journal of Banking & Finance, 30(2), 583–605.

Alqahtani, A., Klein, T., & Khalid, A. (2019). The impact of oil price uncertainty on GCC stock markets. Resources Policy, 64, 101526.

Arouri, M. E. H., Jouini, J., & Nguyen, D. K. (2012). On the impacts of oil price fluctuations on European equity markets: Volatility spillover and hedging effectiveness. Energy Economics, 34(2), 611–617.

Artzner, P. (1997). Thinking coherently. Risk, 68–71.

Bai, M., & Sun, L. (2007). Application of Copula and Copula-CVaR in the multivariate portfolio optimization. In International Symposium on Combinatorics, Algorithms, Probabilistic and Experimental Methodologies, pp. 231–242. Springer.

Baumol, W. J. (1963). An expected gain-confidence limit criterion for portfolio selection. Management Science, 10(1), 174–182.

Cai, G. H., Xu, J., & Ying, X. H. (2021). Risk forecast of investment portfolio based on GAS MIDAS Copula model. Systems Engineering - Theory & Practice, 41(8), 2030–2044.

Creal, D., Koopman, S. J., & Lucas, A. (2013). Generalized autoregressive score models with applications. Journal of Applied Econometrics, 28(5), 777–795.

Cui, T., Du, N., Yang, X., & Ding, S. (2024). Multi-period portfolio optimization using a deep reinforcement learning hyper-heuristic approach. Technological Forecasting and Social Change, 198, 122944.

Dong, Y., Hu, W., Zhang, J., Chen, M., Liao, W., & Chen, Z. (2022). Quantum beetle swarm algorithm optimized extreme learning machine for intrusion detection. Quantum Information Processing, 21(1), 1–26.

Fei, F., Fuertes, A.-M., & Kalotychou, E. (2017). Dependence in credit default swap and equity markets: Dynamic Copula with Markov-switching. International Journal of Forecasting, 33(3), 662–678.

Gong, Y., Chen, Q., & Liang, J. (2018). A mixed data sampling copula model for the return-liquidity dependence in stock index futures markets. Economic Modelling, 68, 586–598.

Gong, Y., Ma, C., & Chen, Q. (2022). Exchange rate dependence and economic fundamentals: A Copula-MIDAS approach. Journal of International Money and Finance, 123, 102597.

Harrow, A. W., Hassidim, A., & Lloyd, S. (2009). Quantum algorithm for linear systems of equations. Physical Review Letters, 103(15), 150502.

Jiang, X., & Li, S. (2017). BAS: Beetle antennae search algorithm for optimization problems. International Journal of Robotics and Control1(1).

Jiang, K., & Ye, W. (2022). Does the asymmetric dependence volatility affect risk spillovers between the crude oil market and BRICS stock markets? Economic Modelling, 117, 106046.

Khan, A. T., Cao, X., Li, S., Hu, B., & Katsikis, V. N. (2021). Quantum beetle antennae search: A novel technique for the constrained portfolio optimization problem. Science China Information Sciences, 64(5), 1–14.

Konno, H., & Yamazaki, H. (1991). Mean-absolute deviation portfolio optimization model and its applications to Tokyo stock market. Management Science, 37(5), 519–531.

Laporta, A. G., Merlo, L., & Petrella, L. (2018). Selection of value at risk models for energy commodities. Energy Economics, 74, 628–643.

Liu, X., & Li, A.-D. (2023). An improved probability-based discrete particle swarm optimization algorithm for solving the product portfolio planning problem. Soft Computing, pp. 1–28.

Liu, S. K., He, X. Q., & Xia, L. Y. (2022). Analysis of time-varying VaR forecast based on GAS model. Journal of Applied Statistics and Management, 41(1), 179–189.

Mao, J. C. (1970). Models of capital budgeting, EV vs ES. Journal of Financial and Quantitative Analysis, 4(5), 657–675.

Markwitz, H. (1952). Portfolio selection. Journal of Finance, 7(1), 77–91.

Mokni, K., & Youssef, M. (2019). Measuring persistence of dependence between crude oil prices and GCC stock markets: A Copula approach. The Quarterly Review of Economics and Finance, 72, 14–33.

Nguyen, H., & Virbickaitė, A. (2023). Modeling stock-oil co-dependence with dynamic stochastic MIDAS Copula models. Energy Economics, 106738.

Nguyen, H., & Javed, F. (2023). Dynamic relationship between stock and bond returns: A GAS MIDAS Copula approach. Journal of Empirical Finance, 73, 272–292.

Okimoto, T. (2008). New evidence of asymmetric dependence structures in international equity markets. Journal of Financial and Quantitative Analysis, 43(3), 787–815.

Ouyang, Z., & Zhou, X. (2023). Multilayer networks in the frequency domain: Measuring extreme risk connectedness of Chinese financial institutions. Research in International Business and Finance, 65, 101944.

Pan, Y., Ou, S., Zhang, L., Zhang, W., Wu, X., & Li, H. (2019). Modeling risks in dependent systems: A Copula-Bayesian approach. Reliability Engineering & System Safety, 188, 416–431.

Righi, M. B., & Ceretta, P. S. (2013). Estimating non-linear serial and cross-interdependence between financial assets. Journal of Banking & Finance, 37(3), 837–846.

Salvatierra, I. D. L., & Patton, A. J. (2015). Dynamic Copula models and high frequency data. Journal of Empirical Finance, 30, 120–135.

Schrödinger, E. (1926). An undulatory theory of the mechanics of atoms and molecules. Physical Review, 28(6), 1049.

Song, J., Wei, S., & Jiang, K. (2023). Which industries are affected by risk spillovers from the Shanghai crude oil futures market more. Journal of Guizhou University of Finance and Economics, 227(6), 11–21.

Sukcharoen, K., Zohrabyan, T., Leatham, D., & Wu, X. (2014). Interdependence of oil prices and stock market indices: A Copula approach. Energy Economics, 44, 331–339.

Sun, J., Feng, B., & Xu, W. (2004). Particle swarm optimization with particles having quantum behavior. In: Proceedings of the 2004 Congress on Evolutionary Computation (IEEE Cat. No. 04TH8753), vol. 1, pp. 325–331. IEEE

Trabelsi, N., & Tiwari, A. K. (2023). CO2 emission allowances risk prediction with GAS and GARCH models. Computational Economics, 61(2), 775–805.

Uryasev, S. (2000). Conditional Value-at-Risk: Optimization algorithms and applications. In Proceedings of the IEEE/IAFE/INFORMS 2000 Conference on Computational Intelligence for Financial Engineering (CIFEr)(Cat. No. 00TH8520), pp. 49–57. IEEE

Wang, H., Yuan, Y., Li, Y., & Wang, X. (2021). Financial contagion and contagion channels in the forex market: A new approach via the dynamic mixture Copula-Extreme Value Theory. Economic Modelling, 94, 401–414.

Xu, Y., & Lien, D. (2022). Forecasting volatilities of oil and gas assets: A comparison of GAS, GARCH, and EGARCH models. Journal of Forecasting, 41(2), 259–278.

Zeng, Y., & Zhang, P. (2021). Multi-period mean-semi-absolute deviation portfolio selection with entropy constraint. China Journal of Management Science, 29(9), 36–43.

Zhang, Y., Li, S., & Xu, B. (2021). Convergence analysis of beetle antennae search algorithm and its applications. Soft Computing, 25(16), 10595–10608.

Funding

We would like to thank the financial support from the Southwest University of Science and Technology Doctoral Research Fund (Grant No. 22sx7111).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

We have no Conflict of interest to declare that are relevant to the content of this article.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Wei, S., Luo, P., Song, J. et al. Portfolio Optimization During the COVID-19 Epidemic: Based on an Improved QBAS Algorithm and a Dynamic Mixed Frequency Model. Comput Econ (2024). https://doi.org/10.1007/s10614-024-10621-5

Accepted:

Published:

DOI: https://doi.org/10.1007/s10614-024-10621-5