Abstract

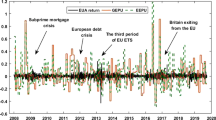

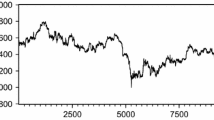

This study investigates how the investor structures affect the corn futures price volatility using corn futures and spot price daily data ranging from 5 January 2009 to 31 December 2022. Our contribution to the expanding literature lies in the introduction of an artificial Chinese corn futures market model based on the agent-based model (ABM), which offers an innovative solution to the issue of the unavailability of commercial positions data. Moreover, we improve the prediction accuracy of corn futures prices by the autoregressive neural network (AR-Net) model. The scenario simulation results demonstrate that hedgers can stabilize corn futures prices, and price volatility tends to be more dramatic in structures with a low hedger ratio. In addition, robustness tests by the empirical mode decomposition (EMD) model support the conclusion.

Similar content being viewed by others

Data Availability

The datasets generated during and/or analysed during the current study are available from the corresponding author on reasonable request.

References

Abar, S., Theodoropoulos, G., Lemarinier, P., & Hare, G. (2017). Agent based modelling and simulation tools: A review of the state-of-art software. Computer Science Review, 24, 13–33.

Acharya, V. V., Lochstoer, L. A., & Ramadorai, T. (2013). Limits to arbitrage and hedging: Evidence from commodity markets. Journal of Financial Economics, 109(2), 441–465.

Adjemian, M. K., & Smith, A. (2012). Using usda forecasts to estimate the price flexibility of demand for agricultural commodities. American Journal of Agricultural Economics, 94(4), 978–995.

Ait-Youcef, C. (2019). How index investment impacts commodities: A story about the financialization of agricultural commodities. Economic Modelling, 80, 23–33.

Alizadeh, A. H., Thanopoulou, H., & Yip, T. L. (2017). Investors’ behavior and dynamics of ship prices: A heterogeneous agent model. Transportation Research Part E: Logistics and Transportation Review, 106, 98–114.

An, Y., & Gong, Y. (2014). The market speculation characteristics and the irrational behavior research of china’s agricultural commodity futures. Securities Market Herald, 262(05), 46–51.

Angione, C., Silverman, E., & Yaneske, E. (2022). Using machine learning as a surrogate model for agent-based simulations: Introduction. Plos One, 17(2), 1–24.

Balcilar, M., Bonato, M., Demirer, R., & Gupta, R. (2017). The effect of investor sentiment on gold market return dynamics: Evidence from a nonparametric causality-in-quantiles approach. Resources Policy, 51, 77–84.

Basak, S., & Pavlova, A. (2016). A model of financialization of commodities. Journal of Finance, 71(4), 1511–1556.

Bianchi, R. J., Fan, J. H., & Todorova, N. (2020). Financialization and de-financialization of commodity futures: A quantile regression approach. International Review of Financial Analysis, 68, 101451.

Bloomfield, R. J., Tayler, W. B., & Zhou, F. H. (2009). Momentum, reversal, and uninformed traders in laboratory markets. The Journal of Finance, 64(6), 2535–2558.

Borgards, O., & Czudaj, R. L. (2022). Long-short speculator sentiment in agricultural commodity markets. International Journal of Finance and Economics, 28(4), 3511–3528.

Bosch, D., & Pradkhan, E. (2015). The impact of speculation on precious metals futures markets. Resources Policy, 44, 118–134.

Boswijk, H., Hommes, H., & Manzan, S. (2007). Behavioral heterogeneity in stock prices. Journal of Economic Dynamics and Control, 31(6), 1938–1970.

Bredin, D., Potì, V., & Salvador, E. (2023). Revisiting the silver crisis. Journal of Commodity Markets, 30, 100288.

Bushee, B. J., & Miller, G. S. (2012). Investor relations, firm visibility, and investor following. Accounting Review, 87(3), 867–897.

Chang, Y. K., Chen, Y. L., Chou, R. K., & Gau, Y. F. (2013). The effectiveness of position limits: Evidence from the foreign exchange futures markets. Journal of Banking and Finance, 37(11), 4501–4509.

Che, L. M. (2018). Investor types and stock return volatility. Journal of Empirical Finance, 47, 139–161.

Chen, C., Hu, C., & Yao, H. (2022). Noise trader risk and wealth effect: A theoretical framework. Mathematics, 10(20), 3873.

Chen, J. Z., Cai, C. X., Faff, R., & Shin, Y. (2022). Nonlinear limits to arbitrage. Journal of Futures Markets, 42(6), 1084–1113.

Chen, X., Li, M., Zhong, H., Ma, Y., & Hsu, C. (2022). Dnnoff: Offloading dnn-based intelligent iot applications in mobile edge computing. IEEE Transactions on Industrial Informatics, 18(4), 2820–2829.

Chen, Y. L., & Chang, Y. K. (2015). Investor structure and the informational efficiency of commodity futures prices. International Review of Financial Analysis, 42, 358–367.

Cheng, I. H., & Xiong, W. (2014). Financialization of commodity markets. Annual Review of Financial Economics, 6, 419–441.

Cho, S. J., Ganepola, C. N., & Garrett, I. (2019). An analysis of illiquidity in commodity markets. Journal of Futures Markets, 39(962–984), 8.

Chuang, W. I., & Lee, B. S. (2006). An empirical evaluation of the overconfidence hypothesis. Journal of Banking and Finance, 30(9), 2489–2515.

Chui, A. C. W., Titman, S., & Wei, K. C. J. (2010). Individualism and momentum around the world. Journal of Finance, 65(1), 361–392.

Cifarelli, G. (2013). Smooth transition regime shifts and oil price dynamics. Energy Economics, 38, 160–167.

Cong, R. G., Hedlund, K., Andersson, H., & Brady, M. (2014). Managing soil natural capital: An effective strategy for mitigating future agricultural risks? Agricultural Systems, 129, 30–39.

Contreras, J., Espinola, R., Nogales, F., & Conejo, A. (2003). Arima models to predict next-day electricity prices. IEEE Transactions on Power Systems, 18(3), 1014–1020.

D’Agostino, A. L., & Schlenker, W. (2016). Recent weather fluctuations and agricultural yields: Implications for climate change. Agricultural Economics, 47, 159–171.

Dou, D., & Lu, Y. (2010). Empirical study on the derivatives usage for hedging by china’s listed companies. State Assets Management, 12, 30–33.

Fagiolo, G., & Roventini, A. (2017). Macroeconomic policy in dsge and agent-based models redux: New developments and challenges ahead. JASSS-The Journal of Artificial Societies and Social Simulation, 20(1), 1–37.

Fei, J., & Liu, L. (2022). Real-time nonlinear model predictive control of active power filter using self-feedback recurrent fuzzy neural network estimator. IEEE Transactions on Industrial Electronics, 69(8), 8366–8376.

Fink, J. (2003). An examination of the effectiveness of static hedging in the presence of stochastic volatility. Journal of Futures Markets, 23(9), 859–890.

Frino, A., Lepone, A., Mollica, V., & Zhang, S. Q. (2016). Are hedgers informed? an examination of the price impact of large trades in illiquid agricultural futures markets. Journal of Futures Markets, 36(6), 612–622.

Gao, B., Hao, H. H., & Xie, J. (2022). Does retail investors beat institutional investors?-explanation of game stop’s stock price anomalies. Plos One, 17(10), e0268387.

Girshick, R. (2015). Fast r-cnn. arXiv preprint arxiv:1504.08083.

Gong, Q. B., & Diao, X. D. (2023). The impacts of investor network and herd behavior on market stability: Social learning, network structure, and heterogeneity. European Journal of Operational Research, 306(3), 1388–1398.

Gu, M., Kang, W. J., & Xu, B. (2018). Limits of arbitrage and idiosyncratic volatility: Evidence from china stock market. Journal of Banking and Finance, 86, 240–258.

Guan, W., & Zhang, M. (2016). Research on the price discovery function of chinese corn futures market. Atlantis Press, 33, 559–565.

Guo, D. (2020). A study on the price stability of inter-bank treasury bonds from the perspective of currency reflow based on abm simulation of investor heterogeneity. Financial Theory and Practice, 10, 19–27.

Haase, M., & Huss, M. (2018). Guilty speculators? range-based conditional volatility in a cross-section of wheat futures. Journal of Commodity Markets, 10, 29–46.

Hranaiova, J., & Tomek, W. (2002). Role of delivery options in basis convergence. The Journal of Futures Markets, 22(8), 783–809.

Hu, J.F., Y.Y. Tang, N. Yin, and X. Guo. (2023). Institutional investor information competition and accounting information transparency: Implications for financial markets and corporate governance in china. Journal of the Knowledge Economy.

Huang, N. E., Shen, Z., Long, S. R., Wu, M. C., Shih, E. H., Zheng, Q., Tung, C. C., & Liu, H. H. (1998). The empirical mode decomposition and the hilbert spectrum for nonlinear and nonstationary time series analysis. Proceedings of the Mathematical Physical and Engineering Sciences, 454, 903–995.

Hung, J. C., Liu, H. C., & Yang, J. J. (2021). Trading activity and price discovery in bitcoin futures markets. Journal of Empirical Finance, 62, 107–120.

Ju, R., & Yang, Z. (2019). Assessing the functional efficiency of agricultural futures markets in china. China Agricultural Economic Review, 11(2), 431–442.

Jäger, G. (2021). Using neural networks for a universal framework for agent-based models. Mathematical Computer Modelling of Dynamical Systems, 27(162–178), 1.

Kim, K., & Ryu, D. (2021). Term structure of sentiment effect on investor trading behavior. Finance Research Letters, 43, 102005.

Kingma, D.P. and J.L. Ba. (2015). Adam: A method for stochastic optimization. arXiv preprint arxiv:1412.6980.

Knill, A., Minnick, K., & Nejadmalayeri, A. (2006). Selective hedging, information asymmetry, and futures prices. Journal of Business, 79(3), 1475–1501.

Kuo, W. H., Chung, S. L., & Chang, C. Y. (2015). The impacts of individual and institutional trading on futures returns and volatility: Evidence from emerging index futures markets. Journal of Futures Markets, 35(3), 222–244.

LeBaron, B. (2021). Microconsistency in simple empirical agent-based financial models. Computational Economics, 58, 83–101.

Li, X., Zhu, M., & Yao, Z. (2021). Effect of temporary purchase and storage policy exit on the price discovery function in maize futures and spot markets. Journal of China Agricultural University, 26(3), 227–239.

Lien, D., & Wong, K. P. (2002). Delivery risk and the hedging role of options. Journal of Futures Markets, 22(4), 339–354.

Lin, E., Lee, C. F., & Wang, K. (2013). Futures mispricing, order imbalance, and short-selling constraints. International Review of Economics and Finance, 25, 408–423.

Lin, G. H., & Chen, J. X. (2018). Study on the transmission effect of corn price at home and abroad: Analysis based on the background of corn storage policy reform. Price: Theory and Practice, 405(3), 111–114.

Liu, Q., Luo, Q., Tse, Y., & Xie, Y. (2020). The market quality of commodity futures markets. Journal of Futures Markets, 40(11), 1751–1766.

McMillan, D. G., & Philip, D. (2012). Short-sale constraints and efficiency of the spot-futures dynamics. International Review of Financial Analysis, 24, 129–136.

Mo, D., Gupta, R., Li, B., & Singh, T. (2018). The macroeconomic determinants of commodity futures volatility: Evidence from chinese and indian markets. Economic Modelling, 70, 543–560.

Nademi, A., & Nademi, Y. (2018). Forecasting crude oil prices by a semiparametric markov switching model: Opec, wti, and brent cases. Energy Economics, 74, 757–766.

Ouyang, R., & Zhang, X. (2020). Financialization of agricultural commodities: Evidence from china. Economic Modelling, 85, 381–389.

Pan, Z. Y., Wang, Y. D., Wu, C. F., & Yin, L. B. (2017). Oil price volatility and macroeconomic fundamentals: A regime switching garch-midas model. Journal of Empirical Finance, 43, 130–142.

Peterson, H. H., & Tomek, W. G. (2005). How much of commodity price behavior can a rational expectations storage model explain? Agricultural Economics, 33(3), 289–303.

Rather, A. M., Agarwal, A., & Sastry, V. N. (2015). Recurrent neural network and a hybrid model for prediction of stock returns. Expert Systems with Applications, 42(6), 3234–3241.

Ryu, D., & Yang, H. (2019). Who has volatility information in the index options market? Finance Research Letters, 30, 266–270.

Sharma, A. (2022). A comparative analysis of the financialization of commodities during covid-19 and the global financial crisis using a quantile regression approach. Resources Policy, 78, 102923.

Spiegel, M., & Subrahmanyam, A. (1992). Informed speculation and hedging in a noncompetitive securities market. Review of Financial Studies, 5(2), 307–329.

Tedjopurnomo, D. A., Bao, Z. F., Zheng, B. H., Choudhury, F., & Qin, A. K. (2022). A survey on modern deep neural network for traffic prediction: Trends, methods and challenges. IEEE Transactions on Knowledge and Data Engineering, 34(4), 1544–1561.

Triebe, O., N. Laptev, and R. Rajagopa. (2019). Ar-net: A simple auto-regressive neural network for time-series.

Vashishtha, A. (2020). Cobweb price dynamics under the presence of agricultural futures market: theoretical analysis. International Review of Economics, 67(2), 131–162.

Williams, J. W. (2014). Feeding finance: A critical account of the shifting relationships between finance, food and farming. Economy and Society, 43(3), 401–431.

Working, H. (1953). Price supports and the effectiveness of hedging. Journal of Farm Economics, 35(5), 811–818.

Wu, L., & Ju, R. (2023). The withdrawal of temporary storage policy and the price discovery ability of agricultural futures market. China Circulation Economy, 37(3), 108–119.

Yan, Y., & Reed, M. (2014). Price discovery in the chinese corn futures market, with comparisons to soybean futures. Agribusiness, 30(4), 398–409.

Yang, C., Gong, X., & Zhang, H. W. (2019). Volatility forecasting of crude oil futures: The role of investor sentiment and leverage effect. Resources Policy, 61, 548–563.

Yang, C. P., & Zhou, L. Y. (2015). Investor trading behavior, investor sentiment and asset prices. North American Journal of Economics and Finance, 34, 42–62.

Yang, J. (2022). Dynamics of firm’s investment in education and training: An agent-based approach. Computational Economics, 60, 1317–1351.

Zhang, D., & Lou, S. (2021). The application research of neural network and bp algorithm in stock price pattern classification and prediction. Future Generation Computer Systems-The International Journal of Escience, 115, 872–879.

Zhang, G., & Liu, C. (2021). Systematic evaluation and promotion countermeasures of the commodity futures markets hedging efficiency. China Business and Market, 35(5), 42–51.

Zhang, T., & Brorsen, B. W. (2009). Particle swarm optimization algorithm for agent-based artificial markets. Computational Economics, 34(4), 399–417.

Funding

The authors are grateful to the anonymous referees for their careful revision, valuable suggestions, and comments which improved this paper. This study was supported by The National Social Science Fund of China (Grant numbers [21BJY211]).

Author information

Authors and Affiliations

Contributions

All authors contributed to the study conception and design. Material preparation, data collection, and analysis were performed by YZ and RJ. The first draft of the manuscript was written by YZ and RJ and all authors commented on previous versions of the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no Conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Zhao, Y., Ju, R. Investor Structure and Corn Futures Price Volatility in China: Evidence Based on the Agent-Based Model. Comput Econ (2024). https://doi.org/10.1007/s10614-024-10613-5

Accepted:

Published:

DOI: https://doi.org/10.1007/s10614-024-10613-5