Abstract

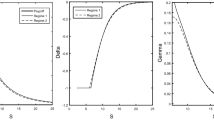

In this paper, a modification of the original global radial basis functions-based differential quadrature (RBF-DQ) method is set forth and analyzed. The improved RBF-DQ method is applicable to the numerical approximation of solutions of a wide range of partial differential equations with mixed derivative terms. However, it appears to be considerably faster than the original method. In support of this contention, the multi-asset option pricing problems under exponential Lévy framework have been solved numerically by using the proposed method and compared with results obtained via the original RBF-DQ method. For accuracy achieved versus work expended, the improved method performs better.

Similar content being viewed by others

References

Andersen, L., & Andreasen, J. (2000). Jump-diffusion processes: Volatility smile fitting and numerical methods for option pricing. Review of Derivatives Research, 4(3), 231–262.

Bellman, R., & Casti, J. (1971). Differential quadrature and long-term integration. Journal of Mathematical Analysis and Applications, 34(2), 235–238.

Bellman, R., Kashef, B., & Casti, J. (1972). Differential quadrature: a technique for the rapid solution of nonlinear partial differential equations. Journal of Computational Physics, 10(1), 40–52.

Black, F., & Scholes, M. (1973). The pricing of options and corporate liabilities. The Journal of Political Economy, 637–654

Briani, M., Natalini, R., & Russo, G. (2007). Implicit-explicit numerical schemes for jump-diffusion processes. Calcolo, 44(1), 33–57.

Broadie, M., & Detemple, J. B. (2004). Anniversary article: Option pricing: Valuation models and applications. Management Science, 50(9), 1145–1177.

Cont, R., & Voltchkova, E. (2005). A finite difference scheme for option pricing in jump diffusion and exponential lévy models. SIAM Journal on Numerical Analysis, 43(4), 1596–1626.

Eberlein, E. (2001). Application of generalized hyperbolic lévy motions to finance. In: Lévy processes (pp. 319–336). Springer.

Franke, R. (1982). Scattered data interpolation: Tests of some methods. Mathematics of computation, 38(157), 181–200.

Hanert, E., & Venkatramanan, A. (2009). Meshfree approximation for multi-asset options. Tech. rep.: Henley Business School, Reading University.

Hardy, R. L. (1971). Multiquadric equations of topography and other irregular surfaces. Journal of Geophysical Research, 76(8), 1905–1915.

Hon, Y., & Schaback, R. (2001). On unsymmetric collocation by radial basis functions. Applied Mathematics and Computation, 119(2), 177–186.

Khodayari, L., & Ranjbar, M. (2017). A numerical study of rbf-dq method for multi-asset option pricing problems. Boletin Sociedade Paranaense de Matematica, 35(2), 1–15.

Madan, D. B. (2001). Purely discontinuous asset price processes. Handbooks in mathematical finance: option pricing, interest rates and risk management (pp. 105–153).

Madan, D. B., Carr, P. P., & Chang, E. C. (1998). The variance gamma process and option pricing. European Finance Review, 2(1), 79–105.

Manuge, D. (2013). Multi-asset option pricing with exponential lévy processes and the mellin transform. arXiv preprint arXiv:1309.3035

Matache, A. M., Von Petersdorff, T., & Schwab, C. (2004). Fast deterministic pricing of options on lévy driven assets. ESAIM. Mathematical Modelling and Numerical Analysis, 38(01), 37–71.

Merton, R. C. (1973). Theory of rational option pricing. The Bell Journal of Economics and Management Science, 141–183

Micchelli, C. A. (1984). Interpolation of scattered data: Distance matrices and conditionally positive definite functions. Berlin: Springer.

Papapantoleon, A. (2007). Applications of semimartingales and lévy processes in finance: Duality and valuation. Ph. D. thesis, University of Freiburg.

Reich, N., Schwab, C., & Winter, C. (2010). On kolmogorov equations for anisotropic multivariate lévy processes. Finance and Stochastics, 14(4), 527–567.

Saib, A. A. E. F., Tangman, D. Y., & Bhuruth, M. (2012). A new radial basis functions method for pricing American options under merton’s jump-diffusion model. International Journal of Computer Mathematics, 89(9), 1164–1185.

Shu, C., Ding, H., & Yeo, K. (2004). Solution of partial differential equations by a global radial basis function-based differential quadrature method. Engineering Analysis with Boundary Elements, 28(10), 1217–1226.

Stulz, R. (1982). Options on the minimum or the maximum of two risky assets: Analysis and applications. Journal of Financial Economics, 10(2), 161–185.

Tankov, P. (2003). Financial modelling with jump processes. Boca Raton, FL: CRC Press.

Acknowledgments

Research of the authors was supported by Azarbaijan Shahid Madani University. The authors are grateful to the anonymous referee for a careful checking of the details and for helpful comments that improved this paper.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Khodayari, L., Ranjbar, M. A Numerical Method to Approximate Multi-Asset Option Pricing Under Exponential Lévy Model. Comput Econ 50, 189–205 (2017). https://doi.org/10.1007/s10614-016-9605-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-016-9605-0