Abstract

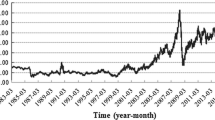

In this paper, the dynamic relationship between Chinese oil market and the main international oil market is investigated. The analysis is based on weekly price series and DCC-MGARCH approach is used to model the volatility and the co-movement relationship among Daqing (China), West Texas, Brent, and Dubai crude oil markets during a period from 1997 to 2011. Empirical results indicate that Daqing crude oil market has a significant high dynamic correlation with Dubai crude oil market, while the dynamic correlation with European and American markets is low. In particular, the co-movement of Daqing crude oil market with international crude oil market has been strengthened since the Tenth “Five year plan” in China. Moreover, all of the three main international oil markets are the granger cause of the Chinese oil market.

Similar content being viewed by others

Notes

We use the statistical data of the Energy Information Administration (EIA), which is available on the web site http://www.eia.doe.gov.

Data is available on the web site http://www.eia.doe.gov.s.

References

Ang, B. W., Zhou, P., & Tay, L. P. (2011). Potential for reducing global carbon emissions from electricity production—A benchmarking analysis. Energy Policy, 39, 2482–2489.

Bollerslev, T. (1990). Modelling the coherence in short run nominal exchange rates: A multivariate generalized ARCH model. The Review of Economics and Statistics, 72, 498–505.

Chang, C. L., McAleer, M., & Tansuchat, R. (2011). Crude oil hedging strategies using dynamic multivariate GARCH. Energy Economics, 33(5), 912–923.

Chen, K. C., Chen, S. L., & Wu, L. F. (2009). Price causal relations between China and the world oil markets. Global Finance Journal, 20(2), 107–118.

Engle, R. (1982). Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econometrica, 50, 987–1008.

Engle, R. (2002). Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. Journal of Business and Economic Statistics, 20, 339–350.

Engle, R. F., & Granger, C. W. J. (1987). Co-integration and error correction: Representation, estimation and testing. Econometrica, 55(2), 251–276.

Fattouh, B. (2011). An anatomy of the crude oil pricing system. Oxford: Oxford Institute for Energy Studies.

Filis, G., Degiannakis, S., & Floros, C. (2011). Dynamic correlation between stock market and oil prices: The case of oil-importing and oil-exporting countries. International Review of Financial Analysis, 20, 152–164.

Goldstein, J. (1993). Ideas and foreign policy: Beliefs, institutions, and political change. Cornell University Press.

Horsnell, P., Mabro, R. (1993). Oil markets and prices: The Brent market and the formation of world oil prices. Oxford: Oxford Institute for Energy Studies.

Lee, J. (2006). The co-movement between output and prices: Evidence from a dynamic conditional correlation GARCH model. Economics Letters, 91(1), 110–116.

Leung, G. C. K. (2010). China’s oil use, 1990–2008. Energy Policy, 38(2), 932–944.

Li, R., Leung, G. C. K. (2011). The integration of China into the world crude oil market since 1998. Energy Policy, 39(9), 5159–5166.

Marshall, A., Maulana, T., & Tang, L. (2009). The estimation and determinants of emerging market country risk and the dynamic conditional correlation GARCH model. International Review of Financial Analysis, 18(5), 250–259.

Reboredo, J. C. (2011). How do crude oil prices co-move?: A copula approach. Energy Economics, 33(5), 948–955.

Sharma, N. (1998). Forecasting oil price volatility. Virginia: Virginia Polytechnic Institute and State University.

The Energy Information Administration website. http://www.eia.doe.gov/.

Wei, Y., Wang, Y., & Huang, D. (2010). Forecasting crude oil market volatility: Further evidence using GARCH-class models. Energy Economics, 32(6), 1477–1484.

Zhou, P., Ang, B. W., & Zhou, D. Q. (2012). Measuring economy-wide energy efficiency performance: A parametric frontier approach. Applied Energy, 90(1), 196–200.

Acknowledgments

We thank the editor and reviewers for careful review and insightful comments. This study has been partly supported by National Natural Science Foundation of China (71303200, 71471152, 71171001 & 71471001), National Social Science Foundation of China (13&ZD148, 13CTJ001) and National Bureau of Statistics Funds of China (2015629).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Song, M., Fang, K., Zhang, J. et al. The Co-movement Between Chinese Oil Market and Other Main International Oil Markets: A DCC-MGARCH Approach. Comput Econ 54, 1303–1318 (2019). https://doi.org/10.1007/s10614-016-9564-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-016-9564-5