Abstract

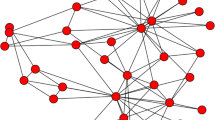

We examine the co-movement patterns of European business cycles during the period 1986–2011, with an obvious focal point the year 1999 that marked the introduction of the common currency, the euro. The empirical analysis is performed within the context of Graph Theory where we apply a rolling window approach in order to dynamically analyze the evolution of the network that corresponds to the GDP growth rate cross-correlations of 22 European economies. The main innovation of our study is that the analysis is performed by introducing what we call the threshold-minimum dominating set (T-MDS). We provide evidence at the network level and analyze its structure and evolution by the metrics of total network edges, network density, isolated nodes and the cardinality of the T-MDS set. Next, focusing on the country level, we analyze each individual country’s neighborhood set (economies with similar growth patterns) in the pre- and post-euro era in order to assess the degree of convergence to the rest of the economies in the network. Our empirical results indicate that despite a few economies’ idiosyncratic behavior, the business cycles of the European countries display an overall increased degree of synchronization and thus convergence in the single currency era.

Similar content being viewed by others

Notes

Officially “the Treaty on European Union”.

NUTS (Nomenclature of territorial units for statistics) is a hierarchical system that divides the total economic region of Europe in three levels of aggregates for statistical economic analysis purposes.

References

Aguiar, C. L., & Soares, J. M. (2011). Business cycle synchronization and the Euro: A wavelet analysis. Journal of Macroeconomics, 33(3), 477–489.

Altavilla, C. (2004). Do EMU members share the same business cycle? JCMS: Journal of Common Market Studies, 42(5), 869–896.

Amaral, L. A. N., Scala, A., Barthélémy, M., & Stanley, H. E. (2000). Classes of small-world networks. Proceedings of the National Academy of Sciences, 97(21), 11149–11152.

Artis, M. J., & Zhang, W. (1997). International business cycles and the ERM: Is there a European business cycle? International Journal of Finance & Economics, 2(1), 1–16.

Boginski, V., Butenko, S., & Pardalos, P. M. (2006). Mining market data: a network approach. Computers & Operations Research, 33(11), 3171–3184.

Bonanno, G., Caldarelli, G., Lillo, F., Miccichè, S., Vandewalle, N., & Mantegna, R. N. (2004). Networks of equities in financial markets. The European Physical Journal, B: Condensed Matter and Complex Systems, 38(2), 363–371.

Bowden, M. P. (2012). Information contagion within small worlds and changes in kurtosis and volatility in financial prices. Journal of Macroeconomics, 34(2), 553–566.

Canova, F., Ciccarelli, M., & Ortega, E. (2007). Similarities and convergence in G-7 cycles. Journal of Monetary Economics, 54(3), 850–878.

Cancelo, J. R. (2012). Cyclical synchronization in the EMU along the financial crisis: An interpretation of the conflicting signals. European Journal of Government and Economics, 1(1), 86–100.

Caraiani, P. (2013). Using complex networks to characterize international business cycles. PLoS One, 8(3), e58109.

Cheng, X., Huang, X., Li, D., Wu, W., & Du, D. Z. (2003). A polynomial-time approximation scheme for the minimum-connected dominating set in ad hoc wireless networks. Networks, 42(4), 202–208.

Euler, L. (1741). Solutio Problematis ad Geometriam Situs Pertinentis. Commentarii Academiae Scientiarum Imperialis Petropolitanae, 8, 128–140 [Reprinted in Opera Omnia, 1(7), 1–10].

Frankel, J. A., & Rose, A. K. (1998). The endogenity of the optimum currency area criteria. The Economic Journal, 108(449), 1009–1025.

Frankel, J.A. (1999). No single currency regime is right for all countries or at all times (No. w7338). National Bureau of Economic Research.

Freeman, L. C. (1979). Centrality in social networks conceptual clarification. Social Networks, 1(3), 215–239.

Garlaschelli, D., Di Matteo, T., Aste, T., Caldarelli, G., & Loffredo, M. I. (2007). Interplay between topology and dynamics in the World Trade Web. The European Physical Journal B, 57(2), 159–164.

Gogas, P. (2013). Business cycle synchronization in the European Union: The effect of the common currency. OECD Journal: Journal of Business Cycle Measurement and Analysis, 2013(1), 1–14.

Gomez, D.M., Ortega, J.G., & Torgler, B. (2012). Synchronization and diversity in business cycles: A network approach applied to the European Union. CREMA Working Paper, No. 2012–01.

Inklaar, R., & De Haan, J. (2001). Is there really a European business cycle? A comment. Oxford Economic Papers, 53(2), 215–220.

Kenen, P. B. (2000). Fixed versus floating exchange rates. Cato Journal, 20, 109–113.

Massmann, M., & Mitchell, J. (2004). Reconsidering the evidence: are Eurozone business cycles converging? Journal of Business Cycle Measurement and Analysis, 1(3), 275–308.

Milgram, S. (1967). The small world problem. Psychology Today, 2(1), 60–67.

Minoiu, C., & Reyes, A. J. (2013). A network analysis of global banking: 1978–2010. Journal of Financial Stability, 9(2), 168–184.

Montoya, L. A., & de Haan, J. (2008). Regional business cycle synchronization in Europe? International Economics and Economic Policy, 5(1–2), 123–137.

Mundell, R. A. (1961). A theory of optimum currency areas. The American Economic Review, 51(4), 657–665.

Nagurney, A., & Siokos, S. (1997). Financial Networks: Statics and Dynamics. Berlin: Springer.

Papadimitriou, T., Gogas, P., & Tabak, B. M. (2013). Complex networks and banking systems supervision. Physica A: Statistical Mechanics and its Applications, 392, 4429–4434.

Plotkin, S. (1995). Competitive routing of virtual circuits in ATM networks. IEEE Journal on Selected Areas in Communications, 13(6), 1128.

Savva, C. S., Neanidis, K. C., & Osborn, D. R. (2010). Business cycle synchronization of the euro area with the new and negotiating member countries. International Journal of Finance & Economics, 15(3), 288–306.

Schuster, S., Fell, D. A., & Dandekar, T. (2000). A general definition of metabolic pathways useful for systematic organization and analysis of complex metabolic networks. Nature Biotechnology, 18(3), 326–332.

Schiavo, S., Reyes, J., & Fagiolo, G. (2010). International trade and financial integration: A weighted network analysis. Quantitative Finance, 10(4), 389–399.

Silva, R. (2009). Business cycle association and synchronization in Europe: A descriptive review. Issues in Political Economy, 18, 6–53.

Tse, C. K., Liu, J., & Lau, F. (2010). A network perspective of the stock market. Journal of Empirical Finance, 17(4), 659–667.

Tinbergen, J. (1962). Shaping the world economy: Suggestions for an International Economic Policy. New York: The Twentieth Century Fund.

Tumminello, M., Lillo, F., & Mantegna, R. N. (2010). Correlation, hierarchies, and networks in financial markets. Journal of Economic Behavior & Organization, 75(1), 40–58.

Vandewalle, N., Brisbois, F., & Tordoir, X. (2001). Self-organized critical topology of stock markets. Quantitative Finance, 1, 372–375.

Watts, D. J., & Strogatz, S. H. (1998). Collective dynamics of ‘small-world’networks. Nature, 393(6684), 440–442.

Weng, G., Bhalla, U. S., & Iyengar, R. (1999). Complexity in biological signaling systems. Science, 284, 92–96.

Wu, J., Cardei, M., Dai, F., & Yang, S. (2006). Extended dominating set and its applications in ad hoc networks using cooperative communication. IEEE Transactions on Parallel and Distributed Systems, 17(8), 851–864.

Acknowledgments

This research has been co-financed by the European Union (European Social Fund (ESF)) and Greek national funds through the Operational Program ‘Education and Lifelong Learning’ of the National Strategic Reference Framework (NSRF)—Research Funding Program: THALES (MIS 380292). Investing in knowledge society through the European Social Fund.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Papadimitriou, T., Gogas, P. & Sarantitis, G.A. Convergence of European Business Cycles: A Complex Networks Approach. Comput Econ 47, 97–119 (2016). https://doi.org/10.1007/s10614-014-9474-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-014-9474-3