Abstract

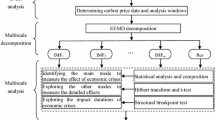

Mastering the underlying characteristics of carbon price changes can help governments formulate correct policies to keep efficient operation of carbon markets, and investors take effective measures to evade their investment risks. Empirical mode decomposition (EMD), a self-adaption data analysis approach for nonlinear and non-stationary time series, can accurately explain the formation mechanism of carbon price by decomposing it into several intrinsic mode functions (IMFs) and one residue from different scales. In this study, we apply EMD to the European Union Emissions Trading Scheme carbon price analysis. First, the carbon price is decomposed into eight IMFs and one residue. Moreover, these IMFs and residue are reconstructed into a high frequency component, a low frequency component and a trend component using hierarchical clustering method. The economic meanings of these three components are identified as short term market fluctuations, effects of significant trend breaks, and a long-term trend, respectively. Finally, some strategies are proposed for carbon price forecasting.

Similar content being viewed by others

References

Alberola, E., Chevallier, J., & Cheze, B. (2008). Price drivers and structural breaks in European carbon prices 2005–2007. Energy Policy, 2, 787–797.

Arouri, M. E. H., Jawadi, F., & Nguyen, D. K. (2012). Nonlinearities in carbon spot-futures price relationships during Phase II of the EU ETS. Economic Modelling, 29(3), 884–892.

Bredin, D., & Muckley, C. (2011). An emerging equilibrium in the EU emissions trading scheme. Energy Economics, 33, 353–362.

Chevallier, J., Ielpo, F., & Mercier, L. (2009). Risk aversion and institutional information disclosure on the European carbon market: A case-study of the 2006 compliance event. Energy Policy, 3, 15–28.

Chevallier, J. (2010). Modelling risk premia in CO\(_{2}\) allowances spot and futures prices. Economic Modelling, 27, 717–729.

Chevallier, J. (2011). Wavelet packet transforms analysis applied to carbon prices. Economics Bulletin, 31(2), 1731–1747.

Conrad, C., Rittler, D., & Rotfuß, W. (2012). Modeling and explaining the dynamics of European Union Allowance prices at high-frequency. Energy Economics, 34, 316–326.

Creti, A., Jouvet, P. A., & Mignon, V. (2012). Carbon price drivers: Phase I versus Phase II equilibrium? Energy Economics, 34, 327–334.

Crossland, J., Li, B., & Roca, E. (2013). Is the European Union Emissions Trading Scheme (EU ETS) informationally efficient? Evidence from momentum-based trading strategies. Applied Energy, 109, 10–23.

Feng, Z. H., Zou, L. L., & Wei, Y. M. (2011). Carbon price volatility: Evidence from EU ETS. Applied Energy, 88, 590–598.

Hintermann, B. (2010). Allowance price drivers in the first phase of the EUETS. Journal of Environmental Economics and Management, 59, 43–56.

Huang, N. E., Shen, Z., & Long, S. R. (1998). The empirical mode decomposition and the Hilbert spectrum for nonlinear and nonstationary time series analysis. Process of the Royal Society of London, A454, 903–995.

Huang, N. E., Shen, Z., & Long, S. R. (1999). A new view of nonlinear water waves: The Hilbert spectrum. Annual Review of Fluid Mechanics, 31, 417–457.

Huang, N. E., Wu, M. L., Qu, W. D., et al. (2003). Applications of Hilbert Huang transform to non-stationary financial time series analysis. Applied Stochastic Models in Business and Industry, 19, 245–268.

Keppler, J. H., & Bataller, M. M. (2010). Causalities between \({\rm CO}_2\), electricity, and other energy variables during phase I and phase II of the EU ETS. Energy Policy, 38, 3329–3341.

Lutz, B. J., Pigorsch, U., & Rotfuß, W. (2013). Nonlinearity in cap-and-trade systems: The EUA price and its fundamentals. Energy Economics, 40, 222–232.

Mansanet-Bataller, M. M., Pardo, A., & Valor, E. (2007). \({\rm CO}_2\) prices, energy and weather. The Energy Journal, 3, 73–92.

Moghtaderi, A., Flandrin, P., & Borgnat, P. (2013). Trend filtering via empirical mode decompositions. Computational Statistics & Data Analysis, 58, 114–126.

Montagnoli, A., & deVries, F. P. (2010). Carbon trading thickness and market efficiency. Energy Economics, 32, 1331–1336.

Peel, M. C., Amirthanathan, G. E., Pegram, G. G. S., et al. (2005). Issues with the application of empirical mode decomposition. In A. Zerger & R.M. Argent (Eds.), Modsim 2005 international congress on modeling and simulation 1681–1687.

Piia, A., Markku, O., & Anne, T. (2013). Price determination in the EU ETS market: Theory and econometric analysis with market fundamentals. Energy Economics, 36, 380–395.

Riling, G., Flandrin, P., & Conclaves, P. (2003). On empirical mode decomposition and its algorithms. In Proceedings of IEEE EURASIP Workshop on Nonlinear Signal and Image Processing, Grado (I).

Seifert, J., Marliese, U. H., & Michael, W. (2008). Dynamic behavior of \({\rm CO}_2\) spot prices. Journal of Environmental Economics and Management, 56, 180–194.

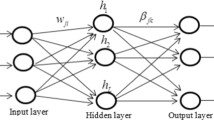

Yu, L., Wang, S. Y., Lai, K. K., et al. (2010). A multiscale neural network learning paradigm for financial crisis forecasting. Neurocomputing, 73, 716–725.

Zhang, X., Lai, K. K., & Wang, S. Y. (2008). A new approach for crude oil price analysis based on empirical mode decomposition. Energy Economics, 30, 905–918.

Zhang, Y. J., & Wei, Y. M. (2010). An overview of current research on EU ETS: Evidence from its operating mechanism and economic effect. Applied Energy, 6, 1804–1814.

Zhong, C., Miao, D., & Fränti, P. (2011). Minimum spanning tree based split-and-merge: A hierarchical clustering method. Information Sciences, 181, 3397–3410.

Zhu, B. Z. (2012). A novel multiscale ensemble carbon price prediction model integrating empirical mode decomposition, genetic algorithm and artificial neural network. Energies, 5, 355–370.

Zhu, B. Z., & Wei, Y. M. (2013). Carbon price prediction with a hybrid ARIMA and least squares support vector machines methodology. Omega, 41, 517–524.

Acknowledgments

We wish to thank the Editor-in-Chief, Hans Amman, as well as the input from anonymous reviewers for insightful comments which have led to a greatly improved version of our manuscript. This work is supported by “the Natural Science Foundation of China (NSFC) (71201010 and 71303174)”, “the Ministry of Education of China (11YJC630304)” and “the Natural Science Foundation of Guangdong (S2012010009991)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Zhu, B., Wang, P., Chevallier, J. et al. Carbon Price Analysis Using Empirical Mode Decomposition. Comput Econ 45, 195–206 (2015). https://doi.org/10.1007/s10614-013-9417-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-013-9417-4