Abstract

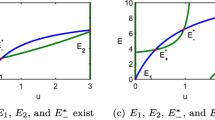

In this work a simple financial model with fundamentalists and imitators is being considered. In order to describe the price dynamics of the heterogeneous stock market, a synergetic approach is used and some global bifurcations arising in the model are being studied. It is shown that the fundamental equilibrium point P* may be destabilized through a subcritical Neimark–Sacker bifurcation and that two invariant closed curves, one attracting and one repelling, appear when P* is still stable. This particular bifurcation scenario allows us to show some noticeable features of the market that emerge when the imitation effect is emphasized. Among these features are, for instance, the volatility clusters associated with the presence of multistability (i.e. coexistence of attractors) and the hysteresis phenomenon.

Similar content being viewed by others

References

Agliari A. (2006). Homoclinic connections and subcritical Neimark bifurcation in a duopoly model with adaptively adjusted productions. Chaos, Solitons and Fractals 29(3): 739–755

Agliari A. (2007). On the bifurcation mechanisms causing the appearance of invariant closed curves. Grazer Mathematische Berichte 351: 1–20

Agliari A., Bischi G.I., Dieci R. and Gardini L. (2005). Global bifurcations of closed invariant curves in two-dimensional maps: A computer assisted study. International Journal of Bifurcations and Chaos 15(4): 1283–1328

Agliari A., Gardini L. and Puu T. (2005). Some global bifurcations related to the appearance of closed invariant curves. Computer in Mathematics Simulations 68: 201–219

Bischi G.I., Gallegati M., Gardini L., Leombruni R. and Palestrini A. (2006). Herd behavior and non-fundamental asset price fluctuations in financial markets. Macroeconomic Dynamics 10(4): 502–528

Brock W.A., Hommes C.H. and Wagener F.O.O. (2005). Evolutionary dynamics in markets with many traders types. Journal of Mathematical Economics 41(1–2): 7–42

Day R.H. and Huang W. (1990). Bulls, bears and market sheep. Journal of Economic Behaviour and Organization 14: 299–329

Foroni I. and Grassi R. (2006). The contagion process in a financial model: A synergetic approach. Pure Mathematics and Applications 16(4): 377–398

Gale D. and Rosenthal R. (1999). Experimentation, imitation and strategic stability. Journal of Economic Theory 84: 1–40

Gaunersdorfer, A., Hommes, C., & Wagener, F. O. O. (2000). Bifurcation routes to volatility clustering under evolutionary learning. CeNDEF working paper (pp. 00–04). University of Amsterdam.

Haken H. (1983). Synergetics, an introduction. Springer-Verlag, Berlin

Kaizoji T. (2006). Speculative bubbles and crashes in stock markets: An interacting agent model of speculative activity. Physica A CLXXXVII: 493–506

Levy M., Levy H. and Solomon S. (2000). Microscopic simulation of financial market. Academic Press Inc., Orlando, FL, USA

Lux L. (1995). Herd behavior, bubbles and crashes. Economic Journal 105: 881–896

Lux T. and Marchesi M. (2000). Volatility clustering in financial markets: A microsimulation of interacting agents. International Journal of Theoretical and Applied Finance 3: 675–702

Weidlich W. and Braun M. (1992). The master equation approach to nonlinear economics. Journal of Evolutionary Economics 2: 233–265

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Foroni, I., Agliari, A. Complex Price Dynamics in a Financial Market with Imitation. Comput Econ 32, 21–36 (2008). https://doi.org/10.1007/s10614-008-9132-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-008-9132-8