Abstract

Many governments and charities adopt Rawlsian difference principle by maximizing the welfare of the least advantaged and giving priority to equality over efficiency. There are two views about which domain the principle should be applied to. The first applies it to the final distribution of income. Previous empirical studies have focused on this but found little evidence supporting it. The other view linked the principle with Rawlsian primary goods: Since the cost of losing primary social goods is huge, people will maximize the benefit of the least advantaged behind the veil of ignorance, such that everyone has access to necessary means. According to the latter reading of Rawls, we experimentally imposed a great cost for losing primary goods, and observed a salient majority of subjects obeying this principle, unlike previous studies finding a minority. Moreover, even if we lowered the cost for losing primary goods, more than one-third of the subjects still adopted this principle.

Similar content being viewed by others

Notes

The other two reasons for following the maximin criterion are: First, people would reject utilitarian “outcomes that one can hardly accept”. (Rawls argues that utilitarianism is unjust since it is willing to maximize total social welfare by sacrificing the welfare of few people.) Second, people may not even know the distribution of their social positions behind the VOI (ambiguity aversion, Ellsberg 1961); (Rawls 1971, p. 154). To test the latter, Gerber et al. (2019) give subjects either full, partial or no information of their social positions (defined by differences in productivity), and find higher demand for redistribution under the no and partial information than under the full information. .

Herne and Suojanen (2004) writes: “…participants’ incomes during the rest of their lives do not depend on the principles of distributive justice that they happen to choose in the experiment. Therefore, ending up in the lowest income class is not such a serious outcome to anyone.” (p. 179).

When the inequality of opportunity does exist, Krawczyk (2010) find a preference for income transfer from the rich to the poor, since the rich enjoy a higher opportunity to win a prize.

One subject was excluded in our data analysis because the subject accidentally participated twice. We dropped the data for his second attendance in a session of the 75 treatment.

One subject in the 35-threshold treatment performed exceptionally well in the real effort tasks even without numerical scales. We suspect that the subject exploited a loophole of the zTree interface and performed the slider tasks with left and right buttons on the keyboard although we physically disabled the buttons with pins. This subject not surprisingly chose Alternative 1.

The Holt and Laury (2002) task only provides a range of a subject’s value of \(r\). We take the average of the upper bound and the lower bound as each subject’s \(r.\) However, we only have an upper bound for the most risk averse subjects and a lower bound for most risk loving subjects. We assume the difference of \(r\) between the highest and second highest risk averse level is equal to the difference between the second highest and third highest risk averse level. \(r\) of the most risk loving subjects is derived in a similar fashion.

This explicitly assumes no learning effect. Gill and Prowse (2012) reported that subjects, on average, completed the fewest tasks (22.034) in round 1, and completed the most tasks (26.831) in round 8. The average increase per round was 0.6852. This increment is minor, compared to the 7.35 more tasks completed with the aid of numerical scales in our experiment. Hence, learning effect should not substantially change our results.

Specifically, each subject i’s expected utility for Alternative j is scaled by the following formula: \(\frac{{EU_{ij} - EU_{{i, { \hbox{min} }}} }}{{EU_{{i, { \hbox{max} }}} - EU_{{i,{ \hbox{min} }}} }}\), where \(EU_{{i, { \hbox{min} }}}\) and \(EU_{{i, { \hbox{max} }}}\) are the minimum and maximum values of subject i’s expected utility among Alternatives 1–9.

To counter-balance possible learning effects, error margins from the first to the seventh round are: 1, 3, 5, 6, 4, 2 and 0.

To maintain the 50% chance of implementation, after the PG and A treatments, subject also made a second decision. If she faced the PG treatment first, she would make the second decision under the A treatment, and vice versa. However, in the first decision subjects were only told their choices would be implemented with a 50% chance and the instructions for the second decision were not revealed. Hence, the first decision was not affect by the second, while the second might be prone to order effects. We refer to the second decision as the PG-after and A-after treatments and report their results in footnote 14.

Results of the PG-after treatment are quite different from those of the PG treatment. (Figure 6 in “Appendix 1” reports the choice distributions of PG-after and A-after treatments.) In particular, 65.79% subjects adopt the difference principle, significantly higher than 35% in the PG treatment (z = 2.7184, p = 0.0066, two-tailed test). The Epps-Singleton test also suggests that the two distributions are not identical (Wald Chi-squared = 13.262, p = 0.01, two-tailed test). In contrast, Results of the A-after treatment are not significantly different from that of the A treatment (Wald Chi-squared = 1.959, p = 0.74, two-tailed test).

We omitted one risk-loving subject who earned 0 when error margin was 0 (since a payoff of 0 in the denominator yields infinite utility). We also omitted three subjects who chose dominated options (Allocations 10–13) to conduct the same analysis only on Allocation 1–9.

The average number of tasks completed by a subject with marginal errors 0, 2 and 6 are 2.76, 11.61 and 21.36, respectively, and (2.76 + 21.36)/2 = 12.06.

When subjects also make decisions in the PG treatment, either after the A treatment or simultaneously, results vary from 65.79% (PG-after) to 14% (PG-sim).

The Google scholar search was conducted on the 7th, November, 2016.

References

Alexander, S. S. (1974). Social evaluation through notional choice. The Quarterly Journal of Economics,88(4), 597–624.

Arneson, R. (1999). Against Rawlsian equality of opportunity. Philosophical Studies,93(1), 77–112.

Arneson, R. (2015). Equality of opportunity. Stanford Encyclopedia of Philosophy, March 25. http://seop.illc.uva.nl/entries/equal-opportunity/.

Atkinson, A. B., & Stiglitz, J. E. (1980). Lectures on Public Economics. New York: McGraw-Hill.

Becker, A., & Miller, L. M. (2009). Promoting justice by treating people unequally: An experimental study. Experimental Economics,12(4), 437–449.

Beckman, S. R., Formby, J. P., Smith, W. J., & Zheng, B. (2002). Envy, Malice and Pareto efficiency: An experimental examination. Social Choice and Welfare,19(2), 349–367.

Blind Children UK. (2013). Cost of a guide dog. Accessed August 10, 2015. http://www.blindchildrenuk.org/media/3701632/Cost-of-a-guide-dog-2013.pdf.

Bond, D., & Park, J.-C. (1991). An empirical test of Rawls’s theory of justice: A second approach, in Korea and in the United States. Simulation & Gaming,22(4), 443–462.

Bosmans, K., & Schokkaert, E. (2004). Social welfare, the veil of ignorance and purely individual risk: An empirical examination. Research on Economic Inequality,11, 85–114.

Cappelen, A., Konow, J., Sørensen, E. Ø., & Tungodden, B. (2013). Just luck: An experimental study of risk-taking and fairness. American Economic Review,103(4), 1398–1413.

Carlsson, F., Gupta, G., & Johansson-Stenman, O. (2003). Choosing from behind a Veil of Ignorance in India. Applied Economics Letters,10(13), 825–827.

Charness, G., & Rabin, M. (2002). Understanding social preferences with simple tests. Quarterly Journal of Economics,117(3), 817–869.

Daniels, N. (2003). Democratic equality: Rawls’s complex egalitarianism. In S. Freeman (Ed.), Cambridge companion to Rawls (pp. 241–276). Cambridge: Cambridge University Press.

dela Cruz-Doña, R., & Martina, A. (2000). Diverse groups agreeing on a system of justice in distribution: Evidence from the Philippines. Journal of Interdisciplinary Economics,11(1), 35–76.

Ellsberg, D. (1961). Risk, ambiguity, and the savage axioms. Quarterly Journal of Economics,75(4), 643–669.

Engelmann, D., & Strobel, M. (2004). Inequality aversion, efficiency and maximin preferences in simple distribution experiments. American Economic Review,94(4), 857–869.

Eusepi, G. (2006). Public finance and welfare: From the ignorance of the Veil to the Veil of ignorance. Journal of Economic Behavior & Organization,59(4), 460–477.

Fischbacher, U. (2007). Zurich toolbox for readymade economic experiments. Experimental Economics,10(2), 171–178.

Frohlich, N., & Oppenheimer, J. A. (1990). Choosing justice in experimental democracies with production. American Political Science Review,84(2), 461–477.

Frohlich, N., Oppenheimer, J. A., & Eavey, C. L. (1987a). Choices of principles of distributive justice in experimental groups. American Journal of Political Science,31(3), 606–636.

Frohlich, N., Oppenheimer, J. A., & Eavey, C. L. (1987b). Laboratory results on rawls’s distributive justice. British Journal of Political Science,17(1), 1–21.

Gajdos, T., & Maurin, E. (2004). Unequal uncertainties and uncertain inequalities: An axiomatic approach. Journal of Economic Theory,116(1), 93–118.

Gerber, A., Nicklisch, A., & Voigt, S. (2019). The role of ignorance in the emergence of redistribution. Journal of Economic Behavior & Organization,163, 239–261.

Gill, D., & Prowse, V. (2012). A structural analysis of disappointment aversion in a real effort competition. American Economic Review,102(1), 469–503.

Herne, K., & Suojanen, M. (2004). The role of information in choices over income distributions. Journal of Conflict Resolution,48(2), 173–193.

Holt, C. A., & Laury, S. K. (2002). Risk aversion and incentive effects. American Economic Review,92(5), 1644–1655.

Jackson, M., & Hill, P. (1995). A fair share. Journal of Theoretical Politics,7(2), 169–180.

Johannesson, M., & Gerdtham, U. L. F.-G. (1995). A pilot test of using the veil of ignorance approach to estimate a social welfare function for income. Applied Economics Letters,2(10), 400–402.

Johansson-Stenman, O., Carlsson, F., & Daruvala, D. (2002). Measuring future grandparents’ preferences for equality and relative standing. The Economic Journal,112(479), 362–383.

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica,47(2), 263–291.

Kariv, S., Zame, W. R. (2008). Piercing the Veil of ignorance. Working paper.

Krawczyk, M. (2010). A glimpse through the Veil of Ignorance: Equality of opportunity and support for redistribution. Journal of Public Economics,94(1–2), 131–141.

Lamont, J. (2013). Distributive justice. Stanford Encyclopedia of Philosophy, January 2. http://seop.illc.uva.nl/entries/justice-distributive/.

Laruelle, A., & Valenciano, F. (2003). Power indices and the Veil of Ignorance. International Journal of Game Theory,31(3), 331–339.

Lissowski, G., Tyszka, T., & Okrasa, W. (1991). Principles of distributive justice: Experiments in Poland and America. The Journal of Conflict Resolution,35(1), 98–119.

Michelbach, P. A., Scott, J. T., Matland, R. E., & Bornstein, B. H. (2003). Doing Rawls justice: An experimental study of income distribution norms. American Journal of Political Science,47(3), 523–539.

Nussbaum, M. C. (2000). The costs of tragedy: Some moral limits of cost-benefit analysis. Journal of Legal Studies,29(S2), 1005–1036.

Rawls, J. (1971). A Theory of Justice. Cambridge, MA: The Belknap Press of Harvard University Press.

Rawls, J. (1974). Reply to Alexander and Musgrave. Quarterly Journal of Economics,88(4), 633–655.

Rawls, J. (1999). A theory of justice, Revised edition. Cambridge, MA: The Belknap Press of Harvard University Press.

Saito, K. (2013). Social preferences under risk: Equality of opportunity versus equality of outcome. American Economic Review,103(7), 3084–3101.

Schildberg-Hörisch, H. (2010). Is the Veil of Ignorance only a concept about risk? An experiment. Journal of Public Economics,94(11–12), 1062–1066.

Swedish Institute. (2015). Sweden’s disability policy. Accessed August 10, 2015. http://sweden.se/society/swedens-disability-policy/.

Traub, S., Seidl, C., Schmidt, U., & Levati, M. V. (2005). Friedman, Harsanyi, Rawls, Boulding: Or somebody else? An experimental investigation of distributive justice. Social Choice and Welfare,24(2), 283–309.

Acknowledgements

We are grateful for comments from two anonymous referees, participants in the 2014 Behavioral Models of Politics Conference, Robert Sugden, Hannah Schildberg-Hörisch, and Ulrich Schmidt. This research is supported by the National Science Council, Taiwan, Grant 101-2410-H-305-002-.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

1.1 Additional figures and tables

To compare our results with those in Schildberg-Hörisch (2010), we conduct OLS regressions shown in Table 7. The dependent variable, as in Schildberg-Hörisch’s model, is the amount transferred from Player 1 to Player 2. We introduce two explanatory variables. The first variable is the dummy variable for gender: the value is 1 for female and 0 for male. The second one is subject’s coefficient of relative risk aversion elicited in accordance with the experiment of Holt and Laury (2002).

The results are similar to the results of Schildberg–Hörisch: We also find that female subjects transfer more to Player 2 in the 0 and 35 treatments (Fig. 6).

Appendix 2

2.1 English translation of experiment instruction

2.1.1 Payoff from the experiment

At the end of this experiment, a show-up fee of NT$ 100 and the NT$ you have earned during the course of the experiment will be paid. During the experiment, the earnings are denominated as ESC (Experimental Standard Currency). Your ESC earnings in the experiment are dependent on your decisions, your effort, others’ decisions, and some random processes. Each of you will be paid privately. You are not obligated to tell others your payoff. Note that in this experiment, the ESC/NT$ exchange rate is: 3 ESC = NT$ 1

2.1.2 Procedures of the experiment

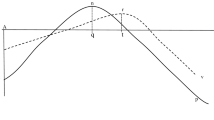

There are three rounds slider tasks in this experiment. In each round, you have 120 s to conduct 48 slider tasks at most. From each successful task, you earn 30 ESC. As shown in Fig. 7a, a single slider is composed with a line and a positional point, whose location is displayed by the ‘numerical scale’ to the right of the slider. The positional point is originally located at the farthest left of the line, with a 0 numerical scale. The point can be adjusted along the line an unlimited number of times. When it is located at the farthest right of line, the numerical scale shows that its location is 100. Your task, as shown in Fig.7b, is to use the mouse to adjust the positional point to the location of 50. As shown in Fig. 8, there are 48 slider tasks in each round. The remaining time is shown at the top-right corner of the screen. Below it, there is a banner showing how many tasks you have successfully completed so far.

In each round, when you conduct slider tasks, you are not guaranteed to see the numerical scale and how many tasks you have completed. (The two information are called ‘adjustment information’ thereafter.) Whether you can see adjustment information is dependent on the following specified conditions:

The first two rounds slider tasks: The computer will randomly choose one round where adjustment information is visible, while in the other round the information is invisible.

The third round slider tasks: Before the third round slider task, there is an ‘allocation stage’. In order to see adjustment information in the third round, your payoff in the allocation stage must be above or equal to 0 ESC. (For 35- and 75-threshold treatments, 0 ESC is replaced by 35 ESC and 75 ESC, respectively.)

In the allocation stage, the computer will randomly divide all subjects into groups of two. Each group includes Player 1 and Player 2. There are 13 possible payoffs for Player 1 and Player 2, as shown by the 13 distributions in Table 8. In Distribution 1, Player 1 receives 240 ESC, and Player 2 receives 0 ESC. Every time when you move towards right to the next distribution, Player 1’s payoffs will reduce by 20, but player 2’s payoffs will only increase by 10. Therefore, the total payoffs of Player 1 and Player 2 will reduce by 10.

The step by step procedure of the allocation stage is illustrated as follows:

Step 1 The computer will randomly choose another subject as ‘the other participant’ in your group. During and after this experiment, no one is able to know whom the other participant in her/his group is. You have to choose one distribution from the 13 possible distributions. Note that when you choose, you do not know if you will become Player 1 or Player 2.

Step 2 The computer will randomly arrange you as Player 1 or Player 2. If you are Player 1, the other participant is Player 2. If you are Player 2, the other participant is Player 1.

Step 3 The computer will randomly choose one from your group as ‘the decisive person’, and her/his chosen distribution will determine your payoffs in the allocation stage. Note that you and the other participant are both likely to be chosen by the random process to determine your payoffs in the allocation stage. So, please make your decision carefully, just as your decision is going to be realized.

For example, under the circumstance without knowing whom will be Player 1 or Player 2, you choose Distribution 1 (Player 1 will receive 240; Player 2 will receive 0), and the other participant chooses Distribution 2 (Player 1 will receive 220; Player 2 will receive 10). Next, the computer randomly arranges you as Player 1, and the other participant as Player 2. Finally, the computer randomly chooses one from you two as the ‘decisive person’, and you are chosen. Therefore, your chosen Distribution 1 will determine your payoffs of the allocation stage. You receive 240 and the other participant receives 0. Thus, in the third round slider tasks, both you and the other participant will be able to see ‘adjustment information’. (In the 35- and 75-threshold treatments, the last sentence is replaced by: Thus, in the third round slider tasks, you will be able to see ‘adjustment information’, and the other participant will not able to see it.)

At the end of the third round slider tasks, the payoffs in the allocation stage and the third round slider tasks will be definitely realized. Besides, the computer will randomly choose one of the first two rounds slider tasks. And the payoffs of the chosen round will be realized. Note that any of the first two rounds is likely to be chosen by the random process to determine your payoffs in this experiment. So, please conduct each round slider tasks as that round is going to be chosen!

The total ESC payoffs in this part of experiment is:

If you have any questions, please raise your hand. We will come to you to explain to you.

Rights and permissions

About this article

Cite this article

Teng, J.CY., Wang, J.Ty. & Yang, C.C. Justice, what money can buy: a lab experiment on primary social goods and the Rawlsian difference principle. Const Polit Econ 31, 45–69 (2020). https://doi.org/10.1007/s10602-019-09297-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10602-019-09297-z