Abstract

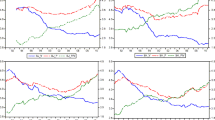

China’s first interest rate hike during the last decade, aiming to cool down the seemingly overheated real estate market, had aroused more caution on housing market. This paper aims to analyze the housing price dynamics after an unanticipated economic shock, which was believed to have similar properties with the backward-looking expectation models. The analysis of the housing price dynamics is based on the cobweb model with a simple user cost affected demand and a stock-flow supply assumption. Several nth-order delay rational difference equations are set up to illustrate the properties of housing dynamics phenomena, such as the equilibrium or oscillations, overshoot or undershoot and convergent or divergent, for a kind of heterogeneous backward-looking expectation models. The results show that demand elasticity is less than supply elasticity is not a necessary condition for the occurrence of oscillation. The housing price dynamics will vary substantially with the heterogeneous backward-looking expectation assumption and some other endogenous factors.

Similar content being viewed by others

References

Hanushek E A, Quigley J M. The dynamics of housing market: a stock adjustment model of housing consumption[J]. Journal of Applied Econometrics, 1979, 6:90–111.

Pozdena R J. Do interest rates still affect housing?[J]. Economic Review, 1990, 90(3):3–14.

TSE R Y C, HO C W, Ganesan S. Matching housing supply and demand: an empirical study of Hong Kong’s market[J]. Construction Management and Economics, 1999, 17(5):625–633.

Gauger J, Coxwell Synder T. Residential fixed investment and macroeconomy: has deregulation altered key relationships?[J]. Journal of Real Estate Finance and Economics, 2003, 27(3):335–354.

Meen G P. Housing cycles and efficiency[J]. Scottish Journal of Political Economy, 2002, 47:114–140.

Thomson L B, Ellis L. Housing construction cycles and interest rates[DB/OL]. Reserve Bank of Australia Research Discussion Papers, RDP2004-08. http://www.rba.gov.au/rdp/RDP2004-08.pdf.

Kahn G A. The changing interest sensitivity of the U.S. economy[J]. Federal Reserve Bank of Kansas City, Economic Review, 1990, 11(1):13–34.

Wheaton W C. Real estate “cycles”: some fundamentals[J]. Real Estate Economics, 1999, 27(2):209–230.

Poterba J M. Tax subsidies to owner-occupied housing: an asset-market approach[J]. The Quarterly Journal of Economics, 1984, 99:729–752.

Hommes C H. Financial markets as nonlinear adaptive evolutionary system[J]. Quantitative Finance, 2001, 1(1):149–167.

Muth J F. Rational expectations and the theory of price movements[J]. Econometric, 1961, 29(6):315–335.

Case K E, Shiller R J. The efficiency of the market for single family homes[J]. American Economic Review, 1989, 79:125–137.

Buchanan N S. A reconsideration of the cobweb theorem[J]. The Journal of Political Economy, 1939, 47(1):67–81.

Stein J L. Cobwebs, rational expectations and futures markets[J]. The Review of Economics Studies, 1992, 74(1):127–134.

Kaldor N. A classificatory note on the determinateness of equilibrium[J]. Review of Economics Studies, 1934, 1:122–136.

Ezekiel M. The cobweb model[J]. The Quarterly Journal of Economics, 1938, 52(2):255–280.

Nerlove M. Adaptive expectations and cobweb phenomena[J]. The Quarterly Journal of Economics, 1958, 72(2):227–240.

Brock W A, Hommes C H. Heterogeneous beliefs and routes to chaos in a simple asset pricing model[J]. Journal of Economic Dynamics and Control, 1998, 22(8):1235–1274.

Brock W A, Hommes C H. Heterogeneous beliefs and the non-linear cobweb model[J]. Journal of Economic Dynamics and Control, 2000, 24:761–798.

Kulenovic M R S, Ladas G. Dynamics of second order rational difference equations: with open problems and conjectures[M]. New York: Chapman & Hall/CRC, 2002.

Pielou E C. Population and community ecology[M]. New York: Gordon and Breach, 1974.

Milton J G, Belair J. Chaos, noise, and extinction in models of population growth[J]. Theoretical Population Biology, 1990, 37:273–290.

Graef J R, Qian C, Spikes P W. Stability in a population model[J]. Applied Mathematics and Computation, 1998, 89:119–132.

Hommes C H. Dynamics of the cobweb model with adaptive expectations and nonlinear supply and demand[J]. Journal of Economic Behaviour and Organization, 1994, 24:315–335.

Quigley J M. Real estate prices and economic cycles[J]. International Real Estate Review, 1999, 2:1–20.

Capozza D R, Hendershott P H, Mack C. An anatomy of price dynamics in illiquid markets: analysis and evidence from local housing markets[J]. Real Estate Economics, 2004, 32:1–32.

Pielou E C. An introduction to mathematical ecology[M]. New York: Wiley Interscience, 1969.

Kuruklis S A, Ladas G. Oscillation and global attractivity in a discrete delay logistic model[J]. Quarterly of Applied Mathematics, 1992, 50(2):227–233.

Liu P Z, Cui X Y. Hyperbolic logistic difference equation with infinitely many delays[J]. Mathematics and Computers in Simulation, 2000, 52:231–250.

Kocic V L, Ladas G. Dynamics of second order rational difference equations: with open problems and conjectures [M]. New York: Chapman & Hall, 2002.

Kocic V L, Ladas G. Global behavior of nonlinear difference equations of higher order with applications[M]. Holland: Kluwer Academic Publishers, 1993.

Levin S, May R. A note on difference-delay equations[J]. Theoretical Population Biology, 1976, 9(4):178–187.

Györi I, Ladas G. Oscillation theory of delay differential equations[M]. New York: Oxford Science, 1991.

Györi I, Ladas G, Vlahos P N. Global attractivity and persistence in a discrete population model[J]. Nonlinear Analysis, 1991, 17(5):473–479.

Liz E. On explicit conditions for the asymptotic stability of linear higher order difference equations[J]. Journal of Mathematics Analysis and Applications, 2005, 303:492–498.

Kahneman D, Tversky A. Prospect theory: an analysis of decision under risk[J]. Econometrica, 1979, 47:263–291.

Kahneman D, Tversky A. Judgement under uncertainty heuristics and biases[M]. Cambridge: Cambridge University Press, 1982.

Author information

Authors and Affiliations

Corresponding author

Additional information

Communicated by GUO Xing-ming

Rights and permissions

About this article

Cite this article

Leung, A.Y.T., Xu, Jn. & Tsui, W.S. Nonlinear delay difference equations for housing dynamics assuming heterogeneous backward-looking expectations. Appl Math Mech 28, 785–798 (2007). https://doi.org/10.1007/s10483-007-0609-z

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/s10483-007-0609-z

Key words

- housing price dynamics

- delay rational difference equations

- equilibrium and oscillations

- convergent and divergent

- overshoot and undershoot