Abstract

As stock data is characterized by highly noisy and non-stationary, stock price prediction is regarded as a knotty problem. In this paper, we propose new two-stage ensemble models by combining empirical mode decomposition (EMD) (or variational mode decomposition (VMD)), extreme learning machine (ELM) and improved harmony search (IHS) algorithm for stock price prediction, which are respectively named EMD–ELM–IHS and VMD–ELM–IHS. Furthermore, to demonstrate the efficiency and performance of the proposed models, the results were compared with those obtained by other methods, including EMD based ELM (EMD–ELM), VMD based ELM (VMD–ELM), autoregressive integrated moving average (ARIMA), ELM, multi-layer perception (MLP), support vector regression (SVR), and long short-term memory (LSTM) models. The results show that the proposed models have superior performance in terms of its accuracy and stability as compared to the other models. Also, we find that the sizes of sliding window and training set have a significant impact on the predictive performance.

Similar content being viewed by others

References

Abu Doush, I., Al-Betar, M. A., Awadallah, M. A., Santos, E., Hammouri, A. I., Mafarjeh, M., et al. (2019). Flow shop scheduling with blocking using modified harmony search algorithm with neighboring heuristics methods. Applied Soft Computing, 85, 105861.

Alatas, B. (2010). Chaotic harmony search algorithms. Applied Mathematics & Computation, 216(9), 2687–2699.

Alia, O. M., & Mandava, R. (2011). The variants of the harmony search algorithm: An overview. Artificial Intelligence Review, 36, 49–68.

Ané, T., & Ureche-Rangau, L. (2006). Stock market dynamics in a regime-switching asymmetric power GARCH model. International Review of Financial Analysis, 15(2), 109–129.

Asl, A. A., & Manaman, N. S. (2018). Locating magnetic sources by empirical mode decomposition. Journal of Applied Geophysics, 159, 329–340.

Assad, A., & Deep, K. (2018). A hybrid harmony search and simulated annealing algorithm for continuous optimization. Information Sciences, 450, 246–266.

Bagheri, A., Ozbulut, O. E., & Harris, D. K. (2018). Structural system identification based on variational mode decomposition. Journal of Sound and Vibration, 417, 182–197.

Baldini, G., Steri, G., Giuliani, R., & Dimc, F. (2019). Radiometric identification using variational mode decomposition. Computers & Electrical Engineering, 76, 364–378.

Bisoi, R., Dash, P., & Parida, A. (2019). Hybrid Variational Mode Decomposition and evolutionary robust kernel extreme learning machine for stock price and movement prediction on daily basis. Applied Soft Computing, 74, 652–678.

Boryczka, U., & Szwarc, K. (2019). The harmony search algorithm with additional improvement of harmony memory for asymmetric traveling salesman problem. Expert Systems with Applications, 122, 43–53.

Burlando, P., Rosso, R., Cadavid, L. G., & Salas, J. D. (1993). Forecasting of short-term rainfall using ARMA models. Journal of Hydrology, 144(1), 193–211.

Cao, J., Zhao, Y., Lai, X., Ong, M. E. H., Yin, C., Koh, Z. X., et al. (2015). Landmark recognition with sparse representation classification and extreme learning machine. Journal of the Franklin Institute, 352(10), 4528–4545.

Chen, Z., Chen, W., & Shi, Y. (2020). Ensemble learning with label proportions for bankruptcy prediction. Expert Systems with Applications, 146, 113155.

Contreras, J., Espinola, R., Nogales, F. J., & Conejo, A. J. (2003). ARIMA models to predict next-day electricity prices. IEEE Transactions on Power Systems, 18(3), 1014–1020.

Dash, R., Dash, P., & Bisoi, R. (2014). A self adaptive differential harmony search based optimized extreme learning machine for financial time series prediction. Swarm and Evolutionary Computation, 19, 25–42.

Dragomiretskiy, K., & Zosso, D. (2014). Variational mode decomposition. IEEE Transactions on Signal Processing, 62(3), 531–544.

Efendi, R., Arbaiy, N., & Deris, M. M. (2018). A new procedure in stock market forecasting based on fuzzy random auto-regression time series model. Information Sciences, 441, 113–132.

El-Abd, M. (2013). An improved global-best harmony search algorithm. Applied Mathematics and Computation, 222, 94–106.

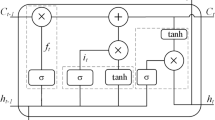

Fischer, T., & Krauss, C. (2018). Deep learning with long short-term memory networks for financial market predictions. European Journal of Operational Research, 270(2), 654–669.

Geem, Z. W. (2000). Optimal design of water distribution networks using harmony search. Ph.D. thesis, Korea University.

Girish, G. (2016). Spot electricity price forecasting in Indian electricity market using autoregressive-GARCH models. Energy Strategy Reviews, 11–12, 52–57.

Hosni, M., Idri, A., Nassif, A., & Abran, A. (2016). Heterogeneous ensembles for software development effort estimation. In 2016 3rd international conference on soft computing & machine intelligence (ISCMI) (pp. 174–178). https://doi.org/10.1109/ISCMI.2016.15.

Huang, G., Zhu, Q., & Siew, C. (2006). Extreme learning machine: Theory and applications designs. Neurocomputing, 70(1), 489–501.

Huang, G. B., Zhu, Q. Y., & Siew, C. K. (2004). Extreme learning machine: A new learning scheme of feedforward neural networks. In 2004 IEEE international joint conference on neural networks (IEEE Cat. No.04CH37541) (Vol. 2, pp. 985–990).

Huang, G., Huang, G. B., Song, S., & You, K. (2015). Trends in extreme learning machines: A review. Neural Networks, 61, 32–48.

Huang, N. E., Shen, Z., Long, S. R., Wu, M. C., Shih, H. H., Zheng, Q., et al. (1998). The empirical mode decomposition and the Hilbert spectrum for nonlinear and non-stationary time series analysis. Proceedings: Mathematical, Physical and Engineering Sciences, 454(1971), 903–995.

Jawadi, F., Chlibi, S., & Cheffou, A. I. (2019). Computing stock price comovements with a three-regime panel smooth transition error correction model. Annals of Operations Research, 274, 331–345.

Jianwei, E., Bao, Y., & Ye, J. (2017). Crude oil price analysis and forecasting based on variational mode decomposition and independent component analysis. Physica A: Statistical Mechanics and its Applications, 484, 412–427.

Keshtegar, B., Ozbakkaloglu, T., & Gholampour, A. (2017). Modeling the behavior of FRP-confined concrete using dynamic harmony search algorithm. Engineering with Computers, 33(3), 415–430.

Kim, M., Chun, H., Kim, J., Kim, K., Yu, J., Kim, T., et al. (2019). Data-efficient parameter identification of electrochemical lithium-ion battery model using deep Bayesian harmony search. Applied Energy, 254, 113644.

Krawczyk, B., & Cano, A. (2018). Online ensemble learning with abstaining classifiers for drifting and noisy data streams. Applied Soft Computing, 68, 677–692.

Laboissiere, L. A., Fernandes, R. A., & Lage, G. G. (2015). Maximum and minimum stock price forecasting of Brazilian power distribution companies based on artificial neural networks. Applied Soft Computing, 35, 66–74.

Lahmiri, S. (2016). Intraday stock price forecasting based on variational mode decomposition. Journal of Computational Science, 12, 23–27.

Lee, J., Wang, W., Harrou, F., & Sun, Y. (2020). Reliable solar irradiance prediction using ensemble learning-based models: A comparative study. Energy Conversion and Management, 208, 112582.

Lei, L. (2018). Wavelet neural network prediction method of stock price trend based on rough set attribute reduction. Applied Soft Computing, 62, 923–932.

Li, J., Zhu, S., & Wu, Q. (2019). Monthly crude oil spot price forecasting using variational mode decomposition. Energy Economics, 83, 240–253.

Li, X., & Wei, Y. (2018). The dependence and risk spillover between crude oil market and China stock market: New evidence from a variational mode decomposition-based copula method. Energy Economics, 74, 565–581.

Liu, C. F., Yeh, C. Y., & Lee, S. J. (2012). Application of type-2 neuro-fuzzy modeling in stock price prediction. Applied Soft Computing, 12(4), 1348–1358.

Liu, H., Xu, Y., & Chen, C. (2019). Improved pollution forecasting hybrid algorithms based on the ensemble method. Applied Mathematical Modelling, 73, 473–486.

Manjarres, D., Landa-Torres, I., Gil-Lopez, S., Ser, J. D., Bilbao, M., Salcedo-Sanz, S., et al. (2013). A survey on applications of the harmony search algorithm. Engineering Applications of Artificial Intelligence, 26(8), 1818–1831.

Mohammed, A., Minhas, R., Wu, Q. J., & Sid-Ahmed, M. (2011). Human face recognition based on multidimensional PCA and extreme learning machine. Pattern Recognition, 44(10), 2588–2597.

Ouyang, H. B., Gao, L. Q., Li, S., Kong, X. Y., Wang, Q., & Zou, D. X. (2017). Improved harmony search algorithm: LHS. Applied Soft Computing, 53, 133–167.

Poole, D. J., & Allen, C. B. (2019). Constrained niching using differential evolution. Swarm and Evolutionary Computation, 44, 74–100.

Rahmati, S. H. A., Ahmadi, A., & Govindan, K. (2018). A novel integrated condition-based maintenance and stochastic flexible job shop scheduling problem: Simulation-based optimization approach. Annals of Operations Research, 269, 583–621.

Razzaghi, T., Safro, I., Ewing, J., Sadrfaridpour, E., & Scott, J. D. (2019). Predictive models for bariatric surgery risks with imbalanced medical datasets. Annals of Operations Research, 280(1–2), 1–18.

Rilling, G., & Flandrin, P. (2008). One or two frequencies? The empirical mode decomposition answers. IEEE Transactions on Signal Processing, 56(1), 85–95.

Sarantis, N. (2001). Nonlinearities, cyclical behaviour and predictability in stock markets: International evidence. International Journal of Forecasting, 17(3), 459–482.

Sezer, O. B., & Ozbayoglu, A. M. (2018). Algorithmic financial trading with deep convolutional neural networks: Time series to image conversion approach. Applied Soft Computing, 70, 525–538.

Shen, S., Sadoughi, M., Li, M., Wang, Z., & Hu, C. (2020). Deep convolutional neural networks with ensemble learning and transfer learning for capacity estimation of lithium-ion batteries. Applied Energy, 260, 114296.

Tang, L., Wang, S., He, K., & Wang, S. (2015). A novel mode-characteristic-based decomposition ensemble model for nuclear energy consumption forecasting. Annals of Operations Research, 234, 111–132.

Ticknor, J. L. (2013). A Bayesian regularized artificial neural network for stock market forecasting. Expert Systems with Applications, 40(14), 5501–5506.

Wang, G., Jia, R., Liu, J., & Zhang, H. (2020). A hybrid wind power forecasting approach based on Bayesian model averaging and ensemble learning. Renewable Energy, 145, 2426–2434.

Wang, Z., Wang, Y., & Srinivasan, R. S. (2018). A novel ensemble learning approach to support building energy use prediction. Energy and Buildings, 159, 109–122.

Wei Liu, Y. C., & Cao, Siyuan. (2016). Applications of variational mode decomposition in seismic time-frequency analysis. Geophysics, 81(5), 365–378.

Weng, B., Lu, L., Wang, X., Megahed, F. M., & Martinez, W. (2018). Predicting short-term stock prices using ensemble methods and online data sources. Expert Systems with Applications, 112, 258–273.

Xiao, W., Zhang, J., Li, Y., Zhang, S., & Yang, W. (2017). Class-specific cost regulation extreme learning machine for imbalanced classification. Neurocomputing, 261, 70–82.

Yang, L., Zhao, L., & Wang, C. (2019). Portfolio optimization based on empirical mode decomposition. Physica A: Statistical Mechanics and its Applications, 531, 121813.

Yeh, C. Y., Huang, C. W., & Lee, S. J. (2011). A multiple-kernel support vector regression approach for stock market price forecasting. Expert Systems with Applications, 38(3), 2177–2186.

Yu, Z., Wang, D., You, J., Wong, H. S., Wu, S., Zhang, J., et al. (2016). Progressive subspace ensemble learning. Pattern Recognition, 60, 692–705.

Zhang, J., Teng, Y. F., & Chen, W. (2019). Support vector regression with modified firefly algorithm for stock price forecasting. Applied Intelligence, 49(5), 1658–1674.

Zhang, T., & Geem, Z. W. (2019). Review of harmony search with respect to algorithm structure. Swarm and Evolutionary Computation, 48, 31–43.

Zhou, F., min, Zhou H., Yang, Z., & Yang, L. (2019). EMD2FNN: A strategy combining empirical mode decomposition and factorization machine based neural network for stock market trend prediction. Expert Systems with Applications, 115, 136–151.

Zhou, Y., & Wang, P. (2019). An ensemble learning approach for XSS attack detection with domain knowledge and threat intelligence. Computers & Security, 82, 261–269.

Zhu, B., Ye, S., He, K., Chevallier, J., & Xie, R. (2019a). Measuring the risk of European carbon market: An empirical mode decomposition-based value at risk approach. Annals of Operations Research, 281, 373–395.

Zhu, J., Wu, P., Chen, H., Liu, J., & Zhou, L. (2019b). Carbon price forecasting with variational mode decomposition and optimal combined model. Physica A: Statistical Mechanics and Its Applications, 519, 140–158.

Zhu, Q., Tang, X., Li, Y., & Yeboah, M. O. (2020). An improved differential-based harmony search algorithm with linear dynamic domain. Knowledge-Based Systems, 187, 104809.

Zhukov, A., Tomin, N., Kurbatsky, V., Sidorov, D., Panasetsky, D., & Foley, A. (2019). Ensemble methods of classification for power systems security assessment. Applied Computing and Informatics, 15(1), 45–53.

Zou, D., Gao, L., Wu, J., Li, S., & Li, Y. (2010). A novel global harmony search algorithm for reliability problems. Computers & Industrial Engineering, 58(2), 307–316.

Acknowledgements

This research was supported by the National Natural Science Foundation of China (No.71720107002), the Project of High-level Teachers in Beijing Municipal Universities in the Period of 13th Five-year Plan (CIT&TCD20190338), and the Humanity and Social Science Foundation of Ministry of Education of China (No. 19YJAZH005), and the Young Academic Innovation Team of Capital University of Economics and Business of China (No. QNTD202002).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Jiang, M., Jia, L., Chen, Z. et al. The two-stage machine learning ensemble models for stock price prediction by combining mode decomposition, extreme learning machine and improved harmony search algorithm. Ann Oper Res 309, 553–585 (2022). https://doi.org/10.1007/s10479-020-03690-w

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-020-03690-w