Abstract

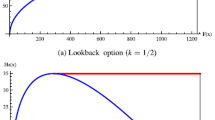

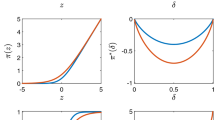

This paper is concerned with the Dynkin game (a zero-sum optimal stopping game). The dynamic of the system is modeled by a regime switching diffusion, in which the regime switching mechanism provides the structural changes of the random environment. The goal is to find a saddle point for the payoff functional up to one of the players exiting the game. Taking advantage of the method of penalization and the dynamic programming principle, the value function of the game problem is shown to be the unique viscosity solution to the associated variational inequalities. We also consider a financial example of pricing game option under a regime switching market. Both optimal stopping rules for the buyer and the seller and fair price of the option are numerically demonstrated in this example. All the results are markedly different from the traditional cases without regime switching.

Similar content being viewed by others

References

Akdim, K., Ouknine, Y., & Turpin, I. (2006). Variational inequalities for combined control and stopping game. Stochastic Analysis and Applications, 24, 1263–1284.

Bayraktar, E., & Yao, S. (2015). Doubly reflected BSDEs with integrable parameters and related Dynkin games. Stochastic Processes and Their Applications, 125, 4489–4542.

Bensoussan, A. (1982). Stochastic control by functional analysis methods. Amsterdam: North Holland.

Bensoussan, A., & Friedman, A. (1974). Non-linear variational inequalities and differential games with stopping times. Journal of Functional Analysis, 16, 305–352.

Crandall, M. G., Ishii, H., & Lions, P. L. (1992). User’s guide to viscosity solutions of second order partial differential equations. Bulletin of the American Mathematical Society, 27, 1–67.

Cvitanic, J., & Karatzas, I. (1996). Backward SDEs with reflection and Dynkin games. Annals of Probability, 24, 2024–2056.

Dolinsky, Y. (2013). Hedging of game options with presence of transaction costs. Annals of Applied Probability, 23, 2212–2237.

Dumitrescu, R., Quenez, M. C., & Sulem, A. (2017). Game options in an imperfect market with default. SIAM Journal on Financial Mathematics (SIFIN), 8, 532–559.

Ekström, E. (2006). Properties of game options. Mathematical Methods of Operational Research, 63, 221–238.

Elliott, R. J., & Siu, T. K. (2010). On risk minimizing portfolios under a Markovian regime-switching Black-Scholes economy. Annals of Operations Research, 176, 271–291.

Fleming, W. H., & Soner, H. M. (2006). Controlled Markov processes and viscosity solutions. New York: Springer.

Grigorova, M., Imkeller, P., Ouknine, Y., & Quenez, M. C. (2018). Doubly reflected BSDEs and \({\cal{E}}^{f}\)-Dynkin games: Beyond the right-continuous case. Electronic Journal of Probability, 23, 122.

Guo, X., & Zhang, Q. (2004). Closed-form solutions for perpetual American put options with regime switching. SIAM Journal on Applied Mathematics, 64, 2034–2049.

Guo, X., & Zhang, Q. (2005). Optimal selling rules in a regime switching market. IEEE Transactions on Automatic Control, 50, 1450–1455.

Hamadène, S. (2006). Mixed zero-sum stochastic differential game and American game options. SIAM Journal on Control and Optimization, 45, 496–518.

Hamadène, S., & Lepeltier, J. P. (2000). Reflected BSDEs and mixed game problem. Stochastic Processes and Their Applications, 85, 177–188.

Hamadène, S., Lepeltier, J. P., & Wu, Z. (1999). Infinite horizon reflected backward stochastic differential equations and applications in mixed control and game problems. Probability and Mathematical Statistics, 19, 211–234.

Hamadène, S., & Zhang, J. (2010). The continuous time nonzero-sum Dynkin game problem and application in game options. The SIAM Journal on Control and Optimization, 48, 3659–3669.

Kamizono, K., & Morimoto, H. (2002). On a variational inequality associated with a stopping game combined with a control. Stochastics, 73, 99–123.

Kifer, Y. (2000). Game options. Finance Stochastic, 4, 443–463.

Morimoto, H. (2003). Variational inequalities for combined control and stopping. The SIAM Journal on Control and Optimization, 42, 686–708.

Pham, H. (2009). Continuous-time stochastic control and optimization with financial applications. Berlin: Springer.

Sethi, S. P., & Zhang, Q. (1994). Hierarchical decision making in stochastic manufacturing systems. Boston: Birkhäuser.

Yin, G. G., & Zhang, Q. (2013). Continuous-time Markov chains and applications: A two-time-scale approach. New York: Springer.

Yin, G. G., & Zhu, C. (2010). Hybrid switching diffusions: properties and applications. New York: Springer.

Yong, J., & Zhou, X. Y. (1999). Stochastic controls: Hamiltonian systems and HJB equations. New York: Springer.

Zhang, Q. (1995). Risk-sensitive production planning of stochastic manufacturing systems: A singular perturbation approach. The SIAM Journal on Control and Optimization, 33, 498–527.

Zhang, Q. (2001). Stock trading: An optimal selling rule. The SIAM Journal on Control and Optimization, 40, 64–87.

Zhou, X. Y., & Yin, G. (2003). Markowitz’s mean-variance portfolio selection with regime switching: A continuous-time model. The SIAM Journal on Control and Optimization, 42, 1466–1482.

Zhu, C. (2011). Optimal control of risk process in a regime-switching environment. Automatica, 47, 1570–1579.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This work was supported by the National Natural Science Foundation of China (11801072, 11831010, 61961160732), the Natural Science Foundation of Jiangsu Province, China (BK20180354), the Natural Science Foundation of Shandong Province, China (ZR2019ZD42), and the Simons Foundation’s Collaboration Grant for Mathematicians (235179).

Rights and permissions

About this article

Cite this article

Lv, S., Wu, Z. & Zhang, Q. The Dynkin game with regime switching and applications to pricing game options. Ann Oper Res 313, 1159–1182 (2022). https://doi.org/10.1007/s10479-020-03656-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-020-03656-y