Abstract

We develop models for portfolio diversification in the sovereign credit default swaps (CDS) markets and show that, despite literature findings that sovereign CDS spreads are affected by global factors, there is sufficient idiosyncratic risk to be diversified. However, we identify regime switching in the times series of CDS spreads and spread returns, and the optimal diversified strategies can be regime dependent. The developed models trade off the CVaR risk measure against expected return, consistently with the statistical properties of spreads. We consider three investment strategies suited for different CDS market participants: for investors with long positions, speculators that hold uncovered long and short positions, and hedgers with covered long and short exposures. We use the models to illustrate that diversification pays in the CDS market. The models are also tested for active portfolio management in Eurozone core and periphery, and Central, Eastern and South-Eastern Europe countries, and the optimized portfolio results outperform the broad S&P/ISDA Eurozone Developed Nation Sovereign CDS index. The paper concludes by identifying open questions in developing integrated enterprise-wide risk management models using CDS.

Similar content being viewed by others

Notes

See REUTERS SUMMIT-Investors overpaying for yield after years of low rates, Thu. Nov. 20, 2014, http://www.reuters.com/article/investment-yearend-yield-idUSL2N0T82YH20141120.

The GAUSS code is available from Zhongjun Qu as “GAUSS code: Estimating and Testing Structural Changes in Multivariate Regressions” at http://people.bu.edu/qu/code.htm.

\(\alpha \in (0,1]\) and all numerical experiments in this paper are carried out for \(\alpha =0.95\).

References

Alexander, C., & Kaeck, A. (2008). Regime dependent determinants of credit default swap spreads. Journal of Banking and Finance, 32(6), 1008–1021.

Augustin, P., Subrahmanyam, M. G., Tang, D. Y., & Wang, S. Q. (2014). Credit default swaps: A survey. Foundations and Trends in Finance, 9(1–2), 1–196.

Augustin, P., Subrahmanyam, M. G., Tang, D. Y., & Wang, S. Q. (2016). Credit default swaps: Past, present, and future. Annual Review of Financial Economics, 8, 175–196.

Bai, J., & Perron, P. (1998). Evaluating and testing linear models with multiple structural changes. Econometrica, 66(1), 47–78.

Bai, J., & Perron, P. (2003). Computation and analysis of multiple structural change models. Journal of Applied Econometrics, 18(1), 1–22.

Consiglio, A., Tumminello, M., & Zenios, S. A. (2016). Pricing sovereign contingent convertible debt. Working Paper 16-05. The Wharton Financial Institutions Center, University of Pennsylvania, Philadelphia. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2813427

Cont, R., Deguest, R., & Scandolo, G. (2010). Robustness and sensitivity analysis of risk measurement procedures. Quantitative Finance, 10(6), 593–606.

Cont, R., & Kan, Y.-H. (2011). Statistical modeling of credit default swap portfolios. SSRN. http://ssrn.com/abstract=1771862

Criado, S., Degabriel, L., Lewandowska, M., Linden, S., & Ritter, P. (2010). Sovereign CDS report. Official report DG COMP, DG ECFIN and DG MARKT. Brussels: European Commission.

European Union. (2012). Regulation (EU) of the European Parliament and the Council on short selling and certain aspects of credit default swaps. Regulation EU 236/2012, Official Journal of the European Union.

Fabozzi, F., Giacometti, R., & Tsuchida, N. (2016). Factor decomposition of the eurozone sovereign CDS spreads. Journal of International Money and Finance, 65, 1–23.

Giesecke, K., Kim, B., Kim, K., & Tsoukalas, G. (2014). Optimal credit swap portfolios. Management Science, 60(9), 2291–2307.

Hamilton, J. D. (1994). Time series analysis. Princeton, NJ: Princeton University Press.

Holmer, M. R., & Zenios, S. A. (1995). The productivity of financial intermediation and the technology of financial product management. Operations Research, 43(6), 970–982.

IMF. (2013). A new look at the role of sovereign credit default swaps, volume Global Financial Stability Report, (chapter 2, pp. 57–92). Washington, DC: International Monetary Fund.

Jobst, N., Mitra, G., & Zenios, S. A. (2006). Integrating market and credit risk: A simulation and optimization perspective. Journal of Banking and Finance, 30, 717–742.

Krokhmal, P., Palmquist, J., & Uryasev, S. (2002). Portfolio optimization with conditional Value-at-Risk objective and constraints. Journal of Risk, 4(2), 11–27.

Longstaff, F. A., Pan, J., Pedersen, L. H., & Singleton, K. J. (2011). How sovereign is sovereign credit risk? American Economic Journal: Macroeconomics, 3, 75–103.

Mulvey, J. M., & Vladimirou, H. (1992). Stochastic network programming for financial planning problems. Management Science, 38(11), 1642–1664.

Packer, F., & Suthiphongchai, C. (2003). Sovereign credit default swaps. BIS Quarterly Review, December, pp. 79–88.

Qu, Z., & Perron, P. (2007). Estimating and testing structural changes in multivariate regressions. Econometrica, 75, 459–502.

Rockafellar, R., & Uryasev, S. (2002). Conditional Value-at-Risk for general loss distributions. Journal of Banking and Finance, 26, 1443–1471.

Rockafellar, R. T., & Uryasev, S. (2000). Optimization of conditional Value-at-Risk. Journal of Risk, 2(3), 21–41.

Schönbucher, P. (2003). Credit derivatives pricing models: Models, pricing and implementation. New York, NY: Wiley.

Sharpe, W. F. (1994). The Sharpe ratio. The Journal of Portfolio Management, 21(1), 49–58.

Stulz, R. (2010). Credit default swaps and the credit crisis. Journal of Economic Perspectives, 24(1), 73–92.

Zenios, S. A. (2007). Practical financial optimization. Decision making for financial engineers. Malden, MA: Blackwell/Wiley.

Zenios, S. A., Holmer, M. R., McKendall, R., & Vassiadou-Zeniou, C. (1998). Dynamic models for fixed-income portfolio management under uncertainty. Journal of Economic Dynamics and Control, 22(10), 1517–1541.

Ziemba, W. T. (2005). The symmetric downside risk Sharpe ratio. Journal of Portfolio Management, 32(1), 108–122.

Acknowledgements

Stavros Zenios is holder of a Marie Sklodowska-Curie fellowship funded from the European Union Horizon 2020 research and innovation programme under Grant Agreement No. 655092. The authors benefited from the comments of two anonymous referees and participants at the Macro seminars at the Finance Department of the Wharton School.

Author information

Authors and Affiliations

Corresponding author

Appendices

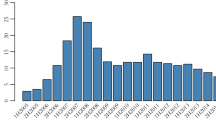

Appendix A: Regime switching in the CDS spread levels of CESEE and Baltic countries

Appendix B: CDS spread moments of all country groups under different regimes

Appendix C: Efficient frontiers under different regimes

Rights and permissions

About this article

Cite this article

Consiglio, A., Lotfi, S. & Zenios, S.A. Portfolio diversification in the sovereign credit swap markets. Ann Oper Res 266, 5–33 (2018). https://doi.org/10.1007/s10479-017-2565-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-017-2565-5