Abstract

We propose a combination of LASSO with panel-consistent estimation methods to investigate whether financial ratios are used in the decision-making process of CDS traders. Our results indicate that financial statement information does play a role in all the trading horizons surrounding the announcement date and the corresponding styles. These include pro-active analysts trying to predict quarterly results, news traders reacting to unanticipated information and value traders who fine-tune their estimates and act accordingly at a later stage. Our findings also suggest that CDS traders respond asymmetrically to financial ratio updates of different sign and intensity.

Similar content being viewed by others

Notes

For more details on the economic applications of quantile regression see Fitzenberger et al. (2002).

We want to thank in particular an anonymous referee for bringing up this representative example.

It is published on Moody’s KMV website.

In “Appendix 1”, an overview of LASSO applications is presented.

The fixed-effect estimator is unbiased and consistent under the random-effects hypothesis as well, as long as the independent variables are strictly exogenous. In that sense, even if the correct specification required the assumption of random effects, the error wouldn’t be very important at this stage of our analysis.

Although this method is not the best way to deal with the dynamic panel bias, this particular issue is not very important in our analysis given that we focus on the coefficients of the exogenous (financial statement) variables and not on those of the lagged CDS returns. Furthermore, the fact that all regressions are expressed in differences rather than levels allows us to expect that the estimation bias is not very pronounced.

Always using the panel-consistent modifications we described earlier.

The disproportionality in the explanatory power of the models we highlighted here, is also one of the reasons why most of the previous literature using arbitrary testing models, failed to detect the true relevance of the financial statement information for CDS trading: Unless one allows a very large number of financial ratios to enter the variable selection algorithm, the model structure is bound to be dominated by market variables.

See also Table 4 for more information regarding the descriptive statistics of the variables examined.

References

Acharya, V., & Johnson, T. (2007). Insider trading in credit derivatives. Journal of Financial Economics, 84, 110–141.

Acharya, V. V., & Mora, N. (2015). A crisis of banks as liquidity providers. Journal of Finance, 70(1), 1–43.

Altman, E. (1968). Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. Journal of Finance, 23, 589–609.

Au, S. T., Duan, R., Hesar, G. S., & Jiang, W. (2010). A framework of irregularity enlightenment for data pre-processing in data mining. Annals of Operations Research, 174, 47–66.

Avramov, D., Jostova, G., & Philipov, A. (2007). Understanding changes in corporate credit spreads. Financial Analysts Journal, 63, 90–105.

Bai, J., & Ng, S. (2008). Forecasting economic time series using targeted predictors. Journal of Econometrics, 146, 304–317.

Batta, G. (2011). The direct relevance of accounting information for credit default swap pricing. Journal of Business Finance and Accounting, 38, 1096–1122.

Beaver, W., McNichols, M., & Rhie, J. (2005). Have financial statements become less informative? Evidence from the ability of financial ratios to predict bankruptcy. Review of Accounting Studies, 10, 93–122.

Beaver, W., Correia, M., & McNichols, M. (2012). Do differences in reporting attributes impair the predictive ability of financial ratios for bankruptcy. Review of Accounting Studies, 17, 969–1010.

Benkert, C. (2004). Explaining credit default swap premia. Journal of Futures Markets, 24, 71–92.

Ben-Tal, A., & Nemirovski, A. (1999). Robust solutions of uncertain linear programs. Operations Research Letters, 25(1), 1–13.

Bertsimas, D., & Sim, M. (2004). The price of robustness. Operations Research, 52(1), 35–53.

Bonfim, D. (2009). Credit risk drivers: Evaluating the contribution of firm level information and of macroeconomic dynamics. Journal of Banking and Finance, 33, 281–299.

Borra, S., & Ciaccio, A. D. (2010). Measuring the prediction error. A comparison of cross-validation, bootstrap and covariance penalty methods. Computational Statistics and Data Analysis, 54, 2976–2989.

Callen, J., Livnat, J. L., & Segal, D. (2009). The impact of earnings on the pricing of credit default swaps. The Accounting Review, 84, 1363–1394.

Campbell, J., Hilscher, J., & Szilagyi, J. (2008). In search of distress risk. Journal of Finance, 63, 2899–2939.

Campbell, J. Y., & Taksler, G. B. (2003). Equity volatility and corporate bond yields. Journal of Finance, 58, 2321–2349.

Collin-Dufresne, P., Goldstein, S. R., & Martin, J. S. (2001). The determinants of credit spread change. Journal of Finance, 56, 2177–2207.

Cooper, J. M., Gulen, H., & Schill, J. M. (2008). Asset growth and the cross-section of stock returns. The Journal of Finance, 63, 1609–1651.

Correia, M., Richardson, S., & Tuna, I. (2012). Value investing in credit markets. Review of Accounting Studies, 17(3), 572–609.

Crosbie, P. J., & Bohn, J. R. (2003). Modeling Default Risk (KMV LLC). http://www.defaultrisk.com/pp_model_35.htm.

Das, S., Hanouna, P., & Sarin, A. (2009). Accounting-based versus market-based cross-sectional models of CDS spreads. Journal of Banking and Finance, 33, 719–730.

Davison, A. C., & Hinkley, D. V. (1997). Bootstrap methods and their application. Cambridge: Cambridge University Press.

Demirovic, A., & Thomas, D. C. (2007). The relevance of accounting data in the measurement of credit risk. The European Journal of Finance, 13, 253–268.

Durbin, R., & Willshaw, D. (1987). An analogue approach to the travelling salesman problem using an elastic net method. Nature, 326, 689–691.

Durbin, R., Szeliski, R., & Yuille, A. (1989). An analysis of the elastic net approach to the traveling salesman problem. Neural Computation, 1, 348–358.

Easley, D., Kiefer, M., N., & O’Hara, M. (1997). One day in the life of a very common stock. The Review of Financial Studies, 10, 805–835.

Efron, B., Hastie, T., Johnstone, I., & Tibshirani, R. (2004). Least angle regression. The Annals of Statistics, 32(2), 407–499.

Elkamhi, R., Jacobs, K., Langlois, H., Ornthanalai, C. (2012). Accounting information release and CDS spreads. Working paper.

Fitzenberger, B., Koenker, R., & Machado, A. F. J. (2002). Economic applications of quantile regression (Studies in Empirical Economics). Heidelberg: Physica Verlag.

Forte, S., & Pena, I. J. (2009). Credit spreads: An empirical analysis on the informational content of stocks, bonds and CDS. Journal of Banking and Finance, 33(11), 2013–2025.

Hastie, T., Tibshirani, R., & Friedman, J. (2001). The elements of statistical learning: Data mining inference and prediction. New York: Springer.

Hillegeist, S. A., Keating, E. K., Cram, D. P., & Lundstedt, K. G. (2004). Assessing the probability of bankruptcy. Review of Accounting Studies, 9, 5–34.

Hilscher, J., Pollet, M. J., & Wilson, M. (2015). Are credit default swaps a sideshow? Evidence that information flows from equity to CDS markets. Journal of Financial and Quantitative Analysis, 50, 543–567.

Hull, J., Predescu, M., & White, A. (2004). The relationship between credit default swap spreads, bond yields, and credit rating announcements. Journal of Banking and Finance, 28, 2789–2811.

Ioannidis, C., Peel, A. D., & Peel, J. M. (2003). The time series properties of financial ratios: Lev revisited. Journal of Business Finance & Accounting, 30, 699–714.

Kamarianakis, Y., Shen, W., & Wynter, L. (2012). Real-time road traffic forecasting using regime-switching space-time models and adaptive LASSO. Applied Stochastic Models in Business and Industry, 28, 297–315.

Kim, H., Huo, X., & Shi, J. (2014). A single interval based classifier. Annals of Operations Research, 216, 307–325.

Kohannim, O., Hibar, D. P., Stein, J. L., Jahanshad, N., Hua, X., Rajagopalan, P., et al. (2012). Discovery and replication of gene influences on brain structure using LASSO regression. Front Neuroscience, 6, 115.

Lobo, M., Faze, M., & Boyd, S. (2007). Portfolio optimization with linear and fixed transaction costs. Annals of Operations Research, 152, 341–365.

Mitchell, M., & Pulvino, T. (2012). Arbitrage crashes and the speed of capital. Journal of Financial Economics, 104(3), 469–490. doi:10.1016/j.jfineco.2011.09.002.

Molina, A. C. (2005). Are firms underleveraged? An examination of the effect of leverage on default probabilities. Journal of Finance, 60, 1427–1459.

Norden, L., & Weber, M. (2004). Informational efficiency of credit default swap and stock markets: The impact of credit rating announcements. Journal of Banking and Finance, 28, 2813–2843.

Norden, L., & Weber, M. (2009). The co-movement of credit default swap, bond and stock markets: An empirical analysis. European Financial Management, 15(3), 529–562.

Ohlson, J. (1980). Financial ratios and the probabilistic prediction of bankruptcy. Journal of Accounting Research, 19, 109–131.

Osborne, R. M., Presnell, B., & Turlach, A. B. (2000). A new approach to variable selection in least squares problems. IMA Journal of Numerical Analysis, 20, 389–403.

Park, M. Y., & Hastie, T. (2008). Penalized logistic regression for detecting gene interactions. Biostatistics, 9, 30–50.

Petersen, A. M. (2009). Estimating standard errors in finance panel data sets: Comparing approaches. Review of Financial Studies, 22(1), 435–480.

Shi, W., Wahba, G., Wright, S., Lee, K., Klein, R., & Klein, B. (2008). LASSO -pattern search algorithm with application to ophthalmology and genomic data. Statistics and its Interface, 1(1), 137–153.

Shumway, T. (2001). Forecasting bankruptcy more accurately: A simple hazard model. The Journal of Business, 74(1), 101–124.

Stine, R. A. (2004). Discussion of “least angle regression” by Efron et al. Annals of Statistics, 32(2), 475–481.

Tibshirani, R. (1996). Regression shrinkage and selection via the LASSO. Journal of the Royal Statistical Society, 58, 267–288.

Vassalou, M., & Xing, Y. (2004). Default risk in equity returns. Journal of Finance, 59, 831–868.

Verbeek, M. (2008). A guide to modern econometrics (1st ed.). Chichester: Wiley.

Verbesselta, J., Robinson, A., Stone, C., & Culvenor, D. (2009). Forecasting tree mortality using change metrics derived from MODIS satellite data. Forest Ecology and Management, 258, 1166–1173.

Wang, L., & Zhu, J. (2010a). Financial market forecasting using a two-step kernel learning method for the support vector regression. Annals of Operations Research, 174, 103–120.

Wang, L., & Zhu, J. (2010b). Image denoising via solution paths. Annals of Operations Research, 174, 3–17.

Wu, T. T., Chen, F. Y., Hastie, T., Sobel, E., & Lange, K. (2009). Genome-wide association analysis by LASSO penalized logistic regression. Bioinformatics, 25, 714–721.

Zou, C., Ning, X., & Tsung, F. (2012). LASSO-based multivariate linear profile monitoring. Annals of Operations Research, 192, 3–19.

Author information

Authors and Affiliations

Corresponding author

Additional information

This working paper should not be reported as representing the views of the Bank of Greece (BoG). The views expressed are those of the authors.

Appendices

Appendix 1: Other LASSO applications

LASSO is especially helpful in cases where the number of potential predictors is large relative to the number of observations in a dataset. By adapting the magnitude of the penalty, by means of calibrating the tuning constant \(\lambda \), the number of non-zero regressors is determined. Although the ridge regression follows a similar rationale in contracting parameter estimates by minimizing \(\lambda \sum \nolimits _{j=1}^p b_j^2 \), it is not as efficient in excluding many regressors. This flaw of ridge regression stems from the fact that for smaller values of the coefficients (\(b_j )\), \(b_j^2 \) is considerably smaller than \(\left| {b_j } \right| \).

Not surprisingly, LASSO applications abound in the area of biogenetics, since the number of potential genetic predictors that are related with the occurrence of a disease far exceeds the number of observations in the samples examined. Wu et al. (2009) assess the performance of LASSO logistic regression in selecting among a large number of single nucleotide polymorphisms (SNPs) for a disease gene mapping. By testing their model both on simulated and on real data, they not only find the same determinants with previous studies for coeliac disease but also unveil the potential interactions among various SNPs. Other studies from the field of biogenetics that use LASSO include Shi et al. (2008), who aim in identifying significant patters of various risk factors among a wide range of potential candidates, and Park and Hastie (2008), who examine the interaction of various genes in the occurrence of a disease.

LASSO has been also used in economic time series forecasting. Bai and Ng (2008) utilize LASSO as a soft thresholding means to identify the top-ranked predictors, that is, the “targeted predictors” to be used in the formation of the factors under the principal component analysis. They assess sundry methods in predicting inflation across various horizons and over several samples. The selection of inflation over other macroeconomic variables is due to its heightened importance for decision making both by private investors and by government bodies. On top of that, forecasting inflation series constitutes not an easy task. The use of LASSO enables Bai and Ng (2008) to avoid uninformative predictors, while at the same time refrain from selecting highly correlated ones. Their results indicate that the LARS-LASSO EN estimator outperforms the remaining methods in the selection of the “best” predictors for forecasting. Furthermore, Wang and Zhu (2010a, b) also utilize a two-step kernel learning methodology in financial forecasting. Kernel learning is attained via the use of L 1-norm regularization approach. Another application to finance is found in Lobo et al. (2007), who use the L 1 norm in portfolio optimization. Particularly, they address cases where non-linear fixed transaction costs are present, and hence convex optimization methods cannot be used to directly solve the problem.

In industry and manufacturing, LASSO has been used by Zou et al. (2012) to establish a new approach for monitoring general multivariate linear profiles, and test their approach by using data from a logistics service. Essentially, they use observed profile data and use their suggested control chart so as to identify the shift direction. Furthermore, Kim et al. (2014) develop an interval based classifier that can be employed in diagnosing problematic conditions in manufacturing, thus, preempting the production of defective products.

Applications of LASSO also abound in various fields, other than the ones mentioned above. For example, Verbesselta et al. (2009) utilize LASSO to identify the best measures whose changes are able to predict tree mortality, by examining images of the respective areas taken by a satellite. Similarly, Wang and Zhu (2010a, b) utilize the L 1-norm penalty in image denoising. This approach succeeds in removing only the noisy pixels, whereas at the same time the non-noisy pixels are kept intact. While, Kamarianakis et al. (2012) employ LASSO in real time forecasting of road traffic. In particular, they use LASSO for simultaneous model selection and coefficient calibration for each location.

Last but not least, LASSO has been used in data cleaning. Au et al. (2010) propose a generalized irregularity enlightenment structure so as to capture numerous irregularities in large datasets. In doing so, they use LASSO so as to opt for the significant characteristics occurring in large datasets. All in all, since LASSO succeeds in correctly identifying the most relevant predictors for explaining the dependent variable, its applications can be extended in almost all research fields for which a relation between a dependent variable and an extended series of regressors has to be investigated.

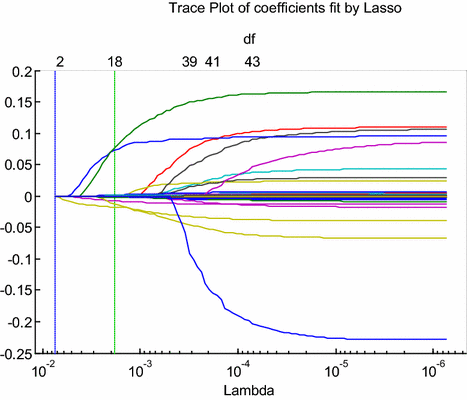

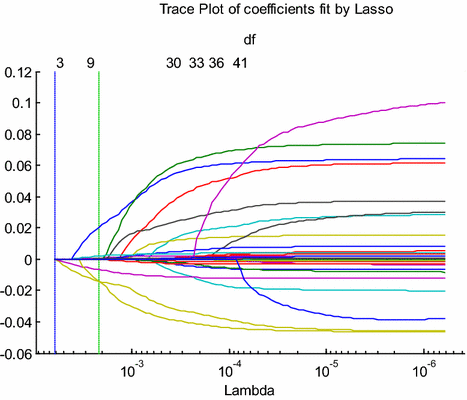

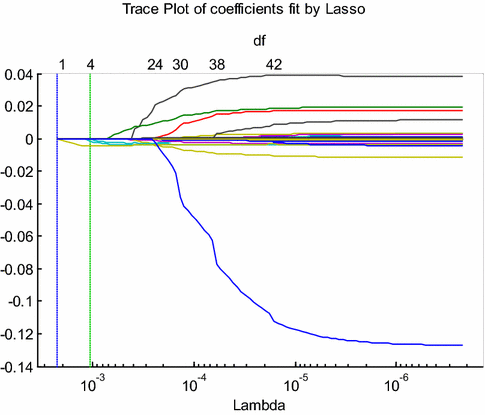

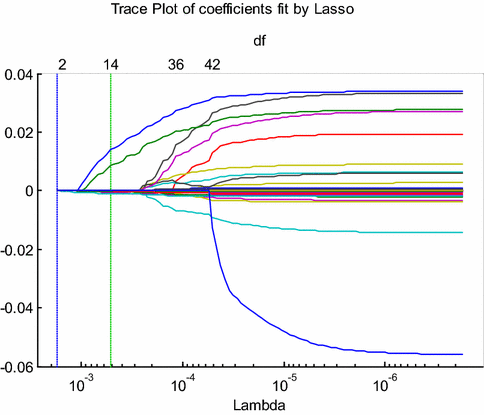

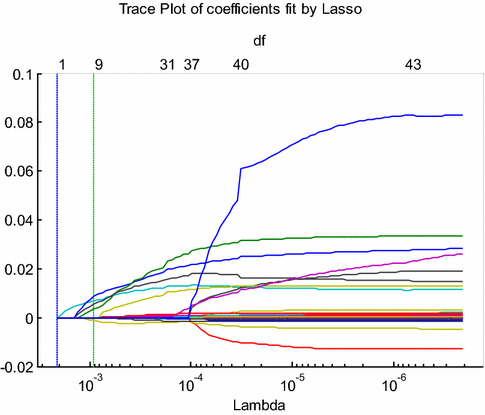

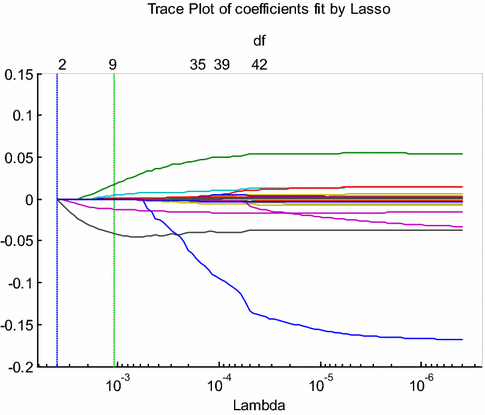

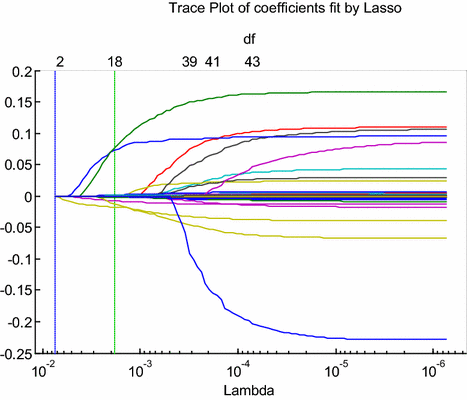

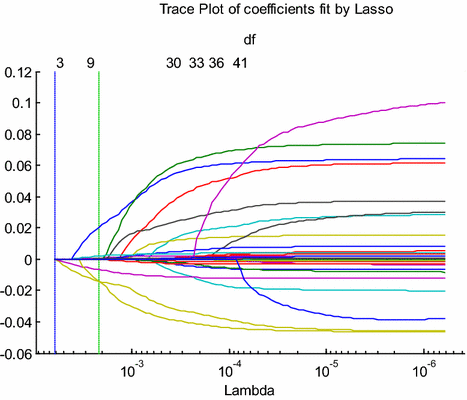

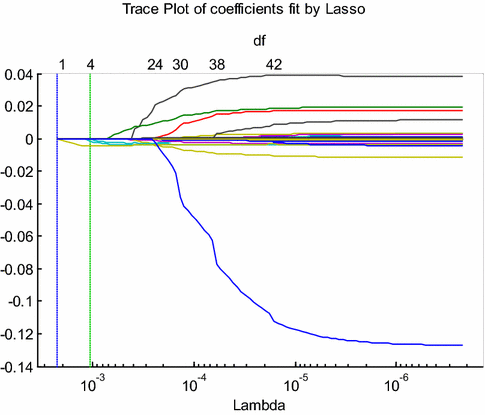

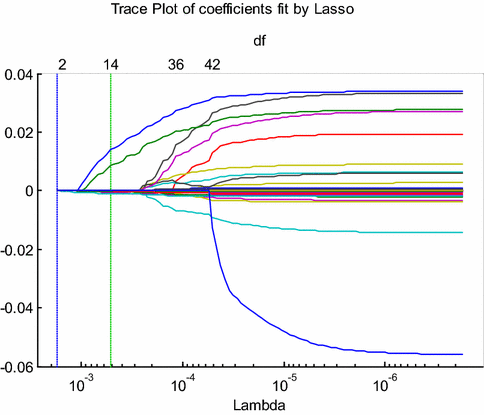

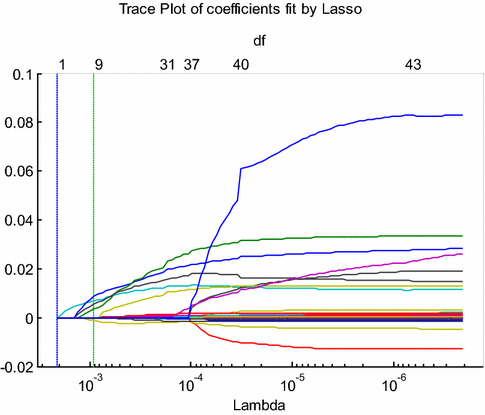

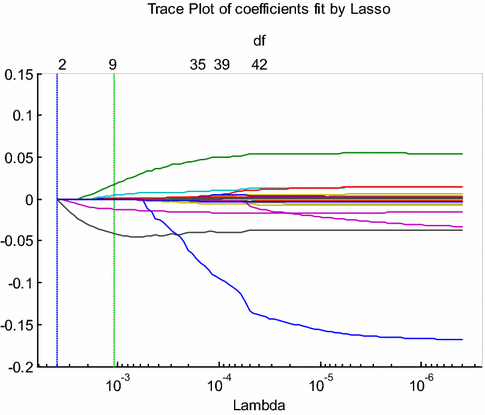

Appendix 2: Trace plots of LASSO coefficients

The trace plots (1–6) presented below illustrate how the number of the regressor coefficients shrinking to zero increases, as lambda increases in value itself. These graphs correspond to the model specifications under Hypotheses 1, 2a and 2b. The dashed vertical green line (the second one on the left side of the plot) reflects the number of non-zero regressor, when the Mean Square Error is minimized. In effect it denotes the size of the optimal model picked by our LASSO application.

-

1.

Trace plot on coefficients fit by LASSO on residuals\(_{q }\)(unexplained part of \(\Delta \hbox {CDS}_{q})\)

-

2.

Trace plot on coefficients fit by LASSO on residuals\(_{30-1 }\)(unexplained part of \(\Delta \hbox {CDS}_{30-1})\)

-

3.

Trace Plot on coefficients fit by LASSO on residuals\(_{1-1 }\)(unexplained part of \(\Delta \hbox {CDS}_{1-1})\)

-

4.

Trace plot on coefficients fit by LASSO on residuals\(_{1-7}\) (unexplained part of \(\Delta \hbox {CDS}_{1-7})\)

-

5.

Trace plot on coefficients fit by LASSO on residuals\(_{7-14 }\)(unexplained part of \(\Delta \hbox {CDS}_{7-14})\)

-

6.

Trace plot on coefficients fit by LASSO on residuals\(_{14-30 }\)(unexplained part of \(\Delta \hbox {CDS}_{14-30})\)

Rights and permissions

About this article

Cite this article

Chalamandaris, G., Vlachogiannakis, N.E. Are financial ratios relevant for trading credit risk? Evidence from the CDS market. Ann Oper Res 266, 395–440 (2018). https://doi.org/10.1007/s10479-016-2373-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-016-2373-3