Abstract

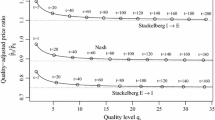

Firms that use an emerging technology often face uncertainty in both the arrival of new versions and the revenue that may be earned from their deployment. Via a sequential decision-making framework, we determine the value of the investment opportunity and the optimal replacement rule under three different strategies: compulsive, laggard, and leapfrog. In the first one, a firm invests sequentially in every version that becomes available, whereas in the second and third ones, it first waits for a new version to arrive and then either invests in the older or the newer version, respectively. We show that, under a compulsive strategy, technological uncertainty has a non-monotonic impact on the optimal investment decision. In fact, uncertainty regarding the availability of future versions may actually hasten investment. By comparing the relative values of the three strategies, we find that, under a low output price the compulsive strategy always dominates, whereas, at a high output price, the incentive to wait for a new version and adopt either a leapfrog or a laggard strategy increases as the rate of innovation increases. By contrast, high price uncertainty mitigates this effect, thereby increasing the relative attraction of a compulsive strategy.

Similar content being viewed by others

References

Balcer, Y., & Lippman, S. (1984). Technological expectations and adoption of improved technology. Journal of Economic Theory, 34, 292–318.

Boomsma, T. K., Meade, N., & Fleten, S. E. (2012). Renewable energy investments under different support schemes: A real options approach. European Journal of Operational Research, 220(1), 225–237.

Chronopoulos, M., De Reyck, B., & Siddiqui, A. (2013). The value of capacity sizing under risk aversion and operational flexibility. IEEE Trasactions on Engineering Management, 60(2), 272–288.

Décamps, J. P., Mariotti, T., & Villeneuve, S. (2006). Irreversible investment in alternative projects. Economic Theory, 28, 425–448.

Dixit, A. K. (1993). Choosing among alternative discrete investment projects under uncertainty. Economics Letters, 41, 265–268.

Dixit, A. K., & Pindyck, R. S. (1994). Investment under uncertainty. Princeton, NJ: Princeton University Press.

Doraszelski, U. (2001). The net present value method versus the option value of waiting: A note on Farzin, Huisman and Kort (1998). Journal of Economic Dynamics and Control, 25, 1109–1115.

Farzin, Y., Huisman, K. J. M., & Kort, P. M. (1998). Optimal timing of technology adoption. Journal of Economic Dynamics and Control, 22, 779–799.

Financial Times. (2012a). Burden of obsolescence becomes more acute. 6 May.

Financial Times. (2012b). Vestas a victim of its own Propaganda. 1 March.

Franklin, S. L. (2014). Investment decisions in mobile telecommunications networks applying real options. Annals of Operations Research. doi:10.1007/s10479-014-1672-9.

Gollier, C., Proult, D., Thais, F., & Walgenwitz, G. (2005). Choice of nuclear power investments under price uncertainty: Valuing modularity. Energy Economics, 27, 667–685.

Grenadier, S. R., & Weiss, A. M. (1997). Investment in technological innovations: An option pricing approach. Journal of Financial Economics, 44, 397–416.

Huisman, K., & Kort, P. M. (2004). Strategic technology adoption taking into account future technological improvements: A real options approach. European Journal of Operational Research, 159, 705–728.

International Business Times. (2014). Apple iPhone 5s lacks consumer interest new report says. 21 May.

Jensen, P., Morthorst, P., Skriver, S., Rasmussen, M., Larsen, H., Henrik Hansen, L., Nielsen, P., & Lemming, J. (2002). Økonomi for Vindmøller i Danmark, Annual report no. 1247, Technical University of Denmark, Denmark.

Kauffman, R. J., & Li, X. (2005). Technology competition and optimal investment timing: A real options perspective. IEEE Transactions on Engineering Management, 52(1), 15–29.

Kort, P. M., Murto, P., & Grzegorz, P. (2010). Uncertainty and stepwise investment. European Journal of Operational Research, 202(1), 196–203.

MacGillivray, A., Jeffrey, H., Winskel, M., & Bryden, I. (2014). Innovation and cost reduction for marine renewable energy: A learning investment sensitivity analysis. Technological Forecasting and Social Change, 87, 108–124.

Majd, S., & Pindyck, R. S. (1987). Time to build, option value, and investment decisions. Journal of Financial Economics, 18, 7–27.

Malchow-Møller, N., & Thorsen, B. J. (2005). Repeated real options: Optimal investment behaviour and a good rule of thumb. Journal of Economic Dynamics and Control, 29, 1025–1041.

Mauritzen, J. (2014). Scrapping a wind turbine: Policy changes, scrapping incentives and why wind turbines in good locations get scrapped first. The Energy Journal, 35(2), 157–181.

Miltersen, R. K., & Schwartz, E. (2007). Real options with uncertainty maturity and competition. NBER working paper series.

Siddiqui, A., & Fleten, S.-E. (2010). How to proceed with competing alternative energy technologies: A real options analysis. Energy Economics, 32, 817–830.

The Economist. (2009). Planned obsolescence. 23 March.

Wind Power. (2012). Upgrade old turbines to their full potential. 1 December.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Compulsive strategy with N = 1

The value of the investment option in state (0, 1, 1) is indicated in (26).

By expanding the first branch on the right-hand side of (26) using It\({\hat{\text {o}}}\)’s lemma, we obtain the differential equation for \(F^{^{(1)}}_{_{0,1,1}}(E)\), which together with its solution is indicated in (27).

Since \(\beta _{_{2}} < 0\), we have \(C^{^{(1)}}_{_{0,1,1}}E^{\beta _2} \rightarrow \infty \) as \(E \rightarrow 0\). Hence, \(C^{^{(1)}}_{_{0,1,1}} = 0\) and \(F^{^{(1)}}_{_{0,1,1}}\left( E\right) \) is indicated in (4), where \(A^{^{(1)}}_{_{0,1,1}}\) and \(\epsilon ^{^{(1)}}_{_{0,1,1}}\) are determined via the value-matching and smooth-pasting conditions between the two branches of (4). Similarly, in state (0, 0), \(A^{^{(1)}}_{_{0,0}}<0\) and \(B^{^{(1)}}_{_{0,0}}>0\) are obtained via value-matching and smooth-pasting conditions between the two branches of (8) and are indicated in (28) and (29) respectively.

\(\square \)

1.2 Compulsive strategy with N = 2

The value function in state (1, 2, 2) is obtained following the same steps as in (26). In state (1, 1), the differential equation for \(\varPhi ^{^{(2)}}_{_{1,1}}(E)\) is indicated in (30), and by solving (30) separately for \( E< \epsilon ^{^{(2)}}_{_{1,2,2}}\) and \( E\ge \epsilon ^{^{(2)}}_{_{1,2,2}}\) we obtain the expression for \(\varPhi ^{^{(2)}}_{_{1,1}}(E)\), that is indicated in (13), where \(A^{^{(2)}}_{_{1,1}}<0\) and \(B^{^{(2)}}_{_{1,1}}>0\) are indicated in (31) and (32), respectively.

Next, the value function in state (0, 1, 1), \(F^{^{(2)}}_{_{0,1,1}}(E)\), is indicated in (14), where \(A^{^{(2)}}_{_{0,1,1}}\) and \(\epsilon ^{^{(2)}}_{_{0,1,1}}\) are determined numerically via (33) and (34).

Finally, the dynamics of the value function in state (0, 0) are described in (35), and the expression of \(\varPhi ^{^{(2)}}_{_{0,0}}(E)\) is indicated in (17), where \(A^{^{(2)}}_{_{0,0}}<0\) and \(B^{^{(2)}}_{_{0,0}}>0\) are indicated in (36) and (37), respectively.

\(\square \)

Proposition 1 \(\forall \ell , m,n \in \mathbb {N}\) and \(\forall \lambda \in \mathbb {R}^+\), \(\varPhi ^{^{(n)}}_{_{m,m}}(E) \in \left[ \varPhi ^{^{(m)}}_{_{m,m}}(E), F^{^{(n)}}_{_{m,n,n}}(E)\right) \).

Proof

The value of the option to invest in state (m, n, n) is described in (38), while the value function in state (m, m) under a compulsive strategy is described in (39). Notice that \(\lambda = 0\Rightarrow \varPhi ^{^{(n)}}_{_{m,m}}(E) = \varPhi ^{^{(m)}}_{_{m,m}}(E)\) , i.e., the value function at each state consists only of the value of the active project since no embedded options are available.

Also, \(\lambda \rightarrow \infty \Rightarrow E^{\delta _1}\rightarrow \infty \), and, since \(A^{^{(n)}}_{_{m,m}}< 0\), \(A^{^{(n)}}_{_{m,m}}E^{\delta _1}\rightarrow -\infty \). Hence, \(\lambda \rightarrow \infty \Rightarrow A^{^{(n)}}_{_{m,m}} \rightarrow 0\), and, thus, \(\varPhi ^{^{(n)}}_{_{m,m}}(E) \in \left[ \varPhi ^{^{(m)}}_{_{m,m}}(E), F^{^{(n)}}_{_{m,n,n}}(E)\right) \). Finally, (40) indicates the impact of \(\lambda \) on the relative loss in \(\varPhi ^{^{(n)}}_{_{m,m}}(E)\) due to technological uncertainty.

\(\square \)

Proposition 2 Under a compulsive strategy, \(\forall \ell , m,n \in \mathbb {N}\) the impact of \(\lambda \) on \(\epsilon ^{^{(n)}}_{_{\ell ,m,m}}\) is non-monotonic.

Proof

By equating the MB of delaying investment to the MC in state (\(\ell ,m,m\)) we find that \(\lambda \) impacts only the last term of the left- and right-hand side of (41).

Consequently, the overall impact of \(\lambda \) on \(\epsilon ^{^{(n)}}_{_{\ell ,m,m}}\) can be determined by its impact on these two terms. Therefore, we define the function \(h(\lambda ) = \delta _{_{1}}A^{^{(n)}}_{_{m,m}} - \beta _{_{1}}A^{^{(n)}}_{_{m,m}}\). As indicated in (42), \(\beta _{_{1}}A^{^{(n)}}_{_{m,m}}\) decreases by more than \(\delta _{_{1}}A^{^{(n)}}_{_{m,m}}\) when \(\lambda \) is small, and, thus, the MB decreases by more than the MC, thereby lowering the optimal investment threshold.

At high values of \(\lambda \), the MC decreases by more than the MB and the marginal value of delaying investment decreases, i.e., \(\lim _{\lambda \rightarrow \infty } \frac{\partial h(\lambda )}{\partial \lambda } = \lim _{\lambda \rightarrow \infty }\left( \delta _{_{1}} - \beta _{_{1}}\right) \times \lim _{\lambda \rightarrow \infty }\frac{\partial A^{^{(n)}}_{_{m,m}}}{\partial \lambda } >0\). \(\square \)

Proposition 3: A tradeoff between two technology versions \(\ell \) and n exists if \(\frac{D_{_{n}}}{\sum ^n_{i = 1}I_{_{i}}}<\frac{D_{_{\ell }}}{\sum ^{\ell }_{i = 1}I_{_{i}}}, \ \forall \ell , n\) with \(\ell <n\).

Proof

We denote by \(\varepsilon \) the indifference point, i.e., the output price at which the NPVs of the two projects intersect. For simplicity, we will assume that there is no technological uncertainty, and, thus, ignore any embedded options implied by the arrival of new technology versions. In addition, we assume that \(n = \ell + 1\) so that \(\ell \) and n represent two subsequent technology versions. Thus, the expression of \(\varepsilon \) is indicated in (43).

In order to have a tradeoff between the two projects, their value functions at the indifference point \(\varepsilon \) must be positive. Otherwise, only investment in the new technology version is optimal. Consequently, the condition that must be satisfied for a tradeoff to exist is indicated in (44).

\(\square \)

Proposition 4: Under a a leapfrog or laggard strategy, \(\forall \ell ,m,n\in \mathbb {N}\) we have \(\epsilon ^{^{(n)}}_{_{\ell ,m,m}}< \underline{\epsilon }^{^{(n)}}_{_{\ell ,m,n}} \ \forall \lambda \in (0,+\infty )\), whereas \(\lambda = 0\Rightarrow \epsilon ^{^{(n)}}_{_{\ell ,m,m}} = \underline{\epsilon }^{^{(n)}}_{_{\ell ,m,n}}\) and \(\lambda \rightarrow \infty \Rightarrow \epsilon ^{^{(n)}}_{_{\ell ,m,m}}\rightarrow \underline{\epsilon }^{^{(n)}}_{_{\ell ,m,n}}\).

Proof

First, we rewrite the value of the option to invest in state (\(\ell ,m,n\)) as in (45)

and then apply first-order necessary conditions to (45) in order obtain the expression for \(\underline{\epsilon }^{^{(n)}}_{_{\ell ,m,n}}\), which is indicated in (46). Notice that \(\epsilon ^{^{(n)}}_{_{\ell ,m,m}} =\underline{\epsilon }^{^{(n)}}_{_{\ell ,m,n}}\) for \(\lambda = 0\), whereas \(\lambda \rightarrow \infty \) implies that the likelihood of at least one innovation occurring converges to one, and, therefore, we have \(\epsilon ^{^{(n)}}_{_{\ell ,m,m}}\rightarrow \underline{\epsilon }^{^{(n)}}_{_{\ell ,m,n}}\). Finally, \(\epsilon ^{^{(n)}}_{_{\ell ,m,m}}< \underline{\epsilon }^{^{(n)}}_{_{\ell ,m,n}}\) follows from Proposition 2.

\(\square \)

Proposition 5: \(\forall E\in \left( 0,\overline{\epsilon }^{^{(2)}}_{_{0,1,2}}\right] \), if the investment region in state \(\mathrm {(0,1\vee 2)}\) is dichotomous, then the compulsive strategy dominates the leapfrog/laggard strategy \(\forall \lambda \in \mathbb {R}^+\).

Proof

If the investment region in state (0,1\(\vee \)2) is not dichotomous, then it is optimal to wait until \(E=\epsilon ^{^{(2)}}_{_{0,2,2}}\) and then invest in the second version (Dixit 1993). However, if the investment region is dichotomous and \(E\in \left( 0,\overline{\epsilon }^{^{(2)}}_{_{0,1,2}}\right] \), then the expected NPV from investment in the first version of the technology under a compulsive strategy is indicated in (13). Although the payoff under a laggard strategy is the same, it is, nevertheless, conditional on the arrival of the second version, and, therefore, is lower compared to the immediate profit from a compulsive strategy. \(\square \)

Proposition 6: \(\exists \) \(\underline{\lambda }, \overline{\lambda }\in \mathbb {R}^+\) with \(\underline{\lambda }\le \overline{\lambda }\) \(\mathrm {:}\)

-

i:

\(\forall \lambda > \underline{\lambda }\), \(\exists \mathcal {B}\subseteq \left( \epsilon ^{^{(2)}}_{_{0,2,2}}, \infty \right) \) : \(\forall E\in \mathcal {B}\), the leapfrog strategy dominates

-

ii:

\(\forall \lambda >\overline{\lambda }\), \(\exists \mathcal {A}\subset \left[ \overline{\epsilon }^{^{(2)}}_{_{0,1,2}}, \epsilon ^{^{(2)}}_{_{0,2,2}}\right) \) : \(\forall E\in \mathcal {A}\), the leapfrog/laggard strategy dominates

Proof

-

(i)

Under a compulsive strategy and for \(E\ge \epsilon ^{^{(2)}}_{_{0,2,2}}\), we have \(\lambda = 0 \Rightarrow F^{^{(2)}}_{_{0,1,1}}(E) = \varPhi ^{^{(1)}}_{_{1,1}}(E)\) and \(\lim _{\lambda \rightarrow \infty }F^{^{(2)}}_{_{0,1,1}}(E) = \varPhi ^{^{(1)}}_{_{1,1}}(E) + A^{^{(2)}}_{_{1,2,2}} E^{\beta _1}\). Also, according to Proposition 2, \(\lambda \nearrow \ \Rightarrow \ \left| A^{^{(2)}}_{_{1,1}}\right| \searrow \) which implies that \(\frac{\partial F^{^{(2)}}_{_{0,1,1}}(E)}{\partial \lambda } > 0 \ \forall \lambda \in \mathbb {R^+}\). Additionally, under a leapfrog strategy and for \(E\ge \epsilon ^{^{(2)}}_{_{0,2,2}}\), we have \(\lambda = 0 \Rightarrow F^{^{(2)}}_{_{0,1,1}}(E) = 0\) and \(\lim _{\lambda \rightarrow \infty }F^{^{(2)}}_{_{0,1,1}}(E) = \frac{D_{_{2}} E}{\rho - \mu } - I_{_{2}}\) Hence, if \(\lambda \) is low, e.g., \(\lambda = 0\), then the compulsive strategy dominates since \(\varPhi ^{^{(2)}}_{_{1,1}}(E)\ge 0, \ \forall E \ge 0\). By contrast, as \(\lambda \rightarrow \infty \), the leapfrog strategy dominates. Indeed, if \(\varepsilon : \varPhi ^{^{(2)}}_{_{\overline{2,2}}}(\varepsilon ) = F^{^{(2)}}_{_{1,2,2}}(\varepsilon )\), then \(\varepsilon <\epsilon ^{^{(2)}}_{_{0,2,2}}\). If we set \(\mathbb L = \left\{ \lambda | \ \exists {\mathcal {B}}\subseteq \left( \epsilon ^{^{(2)}}_{_{0,2,2}}, \infty \right) : \mathrm {leapfrog \ dominates} \ \forall E\in {\mathcal {B}} \right\} \), then \(\exists \underline{\lambda }\in \mathbb {R}^+: \underline{\lambda }= \min \lambda \in \mathbb {L}\) and

$$\begin{aligned}&\frac{\underline{\lambda } D_{_{2}} E}{(\rho + \underline{\lambda } - \mu )(\rho - \mu )} - \frac{\underline{\lambda } I_{_{2}}}{\rho + \underline{\lambda }} + J^{^{(2)}}_{_{0,1,1}}E^{\delta _2} = \varPhi ^{^{(2)}}_{_{1,1}}(E) + A^{^{(2)}}_{_{1,2,2}} E^{\beta _1} + A^{^{(2)}}_{_{1,1}}E^{\delta _1}\quad \end{aligned}$$(47)while, \(\forall \lambda > \underline{\lambda }\), \(\exists \mathcal {B}\subseteq \left( \epsilon ^{^{(2)}}_{_{0,2,2}}, \infty \right) \) such that the leapfrog strategy dominates \(\forall E\in {\mathcal {B}}\).

-

(ii)

The derivation is similar to (i) and follows from the convexity of \(F^{^{(2)}}_{_{0,1,1}}(E)\) and the value-matching and smooth-pasting conditions that ensure that \(F^{^{(2)}}_{_{0,1,1}}(E)\) is \({\mathcal {C}}^{^{1}}\), \(\forall E>0\).

\(\square \)

Rights and permissions

About this article

Cite this article

Chronopoulos, M., Siddiqui, A. When is it better to wait for a new version? Optimal replacement of an emerging technology under uncertainty. Ann Oper Res 235, 177–201 (2015). https://doi.org/10.1007/s10479-015-2010-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-015-2010-6