Abstract

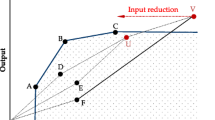

Past studies about the application of data envelopment analysis (DEA) to banking performance often follow the concept of technical efficiency (TE) and/or the productivity defined by the TE. In this paper, we propose an enhanced DEA model, based on a modification of the directional distance function by simultaneously but disproportionately seeking the maximum expansion of each desirable output and contraction of each undesirable output for efficiency measurement, which allows us to decompose the TE into operating efficiency (OPE) and risk management efficiency (RME). The OPE characterizes the ability of a bank to expand the room for profits through its regular business activities, while the RME describes a bank’s ability in risk management activities for sustaining operations. To illustrate the usefulness of the proposed model, a case study of Taiwan’s domestic commercial banks is presented. The major findings are that operating inefficiency is the main source of technical inefficiency, although banks with a higher OPE generally also have a higher RME. Banks subordinate to financial holding companies are more efficient in both OPE and RME than stand-alone banks.

Similar content being viewed by others

References

Al-Sharkas, A. A., Hassan, M. K., & Lawrence, S. (2008). The impact of mergers and acquisitions on the efficiency of the US banking industry: Further evidence. Journal of Business Finance and Accounting, 35, 50–70.

Altunbas, Y., Liu, M., Molyneux, P., & Seth, R. (2000). Efficiency and risk in Japanese banking. Journal of Banking and Finance, 24, 1605–1628.

Ataullah, A., Cockerill, T., & Le, H. (2004). Financial liberalization and bank efficiency: A comparative analysis of India and Pakistan. Applied Economics, 36, 1915–1924.

Avkiran, N. K. (1999). The evidence on efficiency gains: The role of mergers and the benefits to the public. Journal of Banking and Finance, 23, 991–1013.

Avkiran, N. K. (2009). Opening the black box of efficiency analysis: An illustration with UAE banks. Omega-The International Journal of Management Science, 37, 930–941.

Banker, R. D., Charnes, A., & Cooper, W. W. (1984). Some models for estimating technical and scale efficiencies in data envelopment analysis. Management Science, 30, 1078–1092.

Berg, S. A., Forsund, F. R., & Jansen, E. S. (1992). Malmquist indices of productivity growth during the deregulation of Norwegian banking, 1980-89. The Scandinavian Journal of Economics, 94(Suppl.), 211–228.

Bergendahl, G. (1998). DEA and benchmarks—an application to Nordic banks. Annals of Operation Research, 82, 233–249.

Berger, A. N., & Humphrey, D. B. (1992). Measurement and efficiency issues in commercial banking. In Z. Griliches (Ed.), Output measurement in the service industry (pp. 245–296). Chicago: University of Chicago Press and National Bureau of Economic Research.

Berger, A. N., & Humphrey, D. B. (1997). Efficiency of financial institutions: International survey and directions for future research. European Journal of Operational Research, 98, 175–212.

Castelli, L., Pesenti, R., & Ukovich, W. (2010). A classification of DEA models when the internal structure of the Decision Making Units is considered. Annals of Operation Research, 173, 207–235.

Chambers, R. G., Chung, Y., & Färe, R. (1996). Benefit and distance functions. Journal of Economic Theory, 70, 407–419.

Chang, T. C., & Chiu, Y. H. (2006). Affecting factors on risk-adjusted efficiency in Taiwan’s banking industry. Contemporary Economic Policy, 24, 634–648.

Chao, C. M., Yu, M. M., & Chen, M. C. (2010). Measuring the performance of financial holding companies. The Service Industries Journal, 30, 811–829.

Charnes, A., & Cooper, W. W. (1962). Programming with linear fractional functions. Naval Research Logistics Quarterly, 9, 181–185.

Charnes, A., Cooper, W. W., & Rhodes, E. (1978). Measuring the efficiency of decision making units. European Journal of Operations Research, 6, 429–444.

Chen, X., Skully, M., & Brown, K. (2005). Banking efficiency in China: Application of DEA to pre- and post-deregulation eras: 1993–2000. China Economic Review, 16, 229–245.

Copeland, T. E., Weston, J. F., & Shastri, K. (2005). Financial theory and corporate policy (4th ed.). Boston: Pearson Addison Wesley.

Dismuke, C. E., & Sena, V. (2001). Is there a trade-off between quality and productivity? The case of diagnostic technologies in Portugal. Annals of Operation Research, 107, 101–116.

Drake, M., & Hall, M. J. B. (2003). Efficiency in Japanese banking: An empirical analysis. Journal of Banking and Finance, 27, 891–917.

Emrouznejad, A., & Anouze, A. L. (2010). Data envelopment analysis with classification and regression tree—a case of banking efficiency. Expert Systems, 27, 231–246.

Färe, R., Grosskopf, S., Lovell, C. A. K., & Pasurka, C. (1989). Multilateral productivity comparisons when some outputs are undesirable: a nonparametric approach. Review of Economics and Statistics, 71, 90–98.

Färe, R., Grosskopf, S., & Weber, W. L. (2004). The effect of risk-based capital requirements on profit efficiency in banking. Applied Economics, 36, 1731–1743.

Farrell, M. J. (1957). The measurement of productive efficiency. Journal of the Royal Statistical Society Series A, 129, 253–351.

Fethi, M. D., & Pasiouras, F. (2010). Assessing bank efficiency and performance with operational research and artificial intelligence techniques: A survey. European Journal of Operational Research, 204, 189–198.

Fukuyama, H., & Weber, W. L. (2008). Japanese banking inefficiency and shadow pricing. Mathematical and Computer Modelling, 48, 1854–1867.

Fukuyama, H., & Weber, W. L. (2010). A slacks-based inefficiency measure for a two-stage system with bad outputs. Omega-The International Journal of Management Science, 38, 398–409.

Gilbert, R. A., & Wilson, P. W. (1998). Effects of deregulation on the productivity of Korean banks. Journal of Economics and Business, 50, 133–155.

Gugler, K., Mueller, D. C., Yurtoglu, B. B., & Zulehner, C. (2003). The effects of mergers: An international comparison. International Journal of Industrial Organization, 21, 625–653.

Hahn, F. R. (2007). Domestic mergers in the Austrian banking sector: A performance analysis. Applied Financial Economics, 17, 185–196.

Hsiao, H. C., Chang, H. H., Cianci, A. M., & Huang, L. H. (2010). First financial restructuring and operating efficiency: evidence from Taiwanese commercial banks. Journal of Banking and Finance, 34, 1461–1471.

Huang, L. H., Hsiao, H. C., Cheng, M. A., & Chang, S. J. (2008). Effects of financial reform on productivity change. Industrial Management and Data Systems, 108, 867–886.

Hughes, J. P., & Mester, L. J. (1993). A quality and risk-adjusted cost function for banks: Evidence on the ‘too-big-to-fail’ doctrine. Journal of Productivity Analysis, 4, 293–315.

Hughes, J. P. (1999). Measuring efficiency when competitive prices aggregate differences in product quality and risk. Research in Economics, 53, 47–76.

Isik, I., & Hassan, M. K. (2003). Financial deregulation and total factor productivity change: An empirical study of Turkish commercial banks. Journal of Banking and Finance, 27, 1455–1485.

Kohers, T., Huang, M. H., & Kohers, N. (2000). Market perception of efficiency in bank holding company mergers: The roles of the DEA and SFA models in capturing merger potential. Review of Financial Economics, 9, 101–120.

Kumbhakar, S. C., & Lozano-Vivas, A. (2005). Deregulation and productivity: The case of Spanish banks. Journal of Regulatory Economics, 27, 331–351.

Liu, W. B., Meng, W., Li, X. X., & Zhang, D. Q. (2010). DEA models with undesirable inputs and outputs. Annals of Operation Research, 173, 177–194.

Lovell, C. A. K., Pastor, J. T., & Turner, J. A. (1995). Measuring macroeconomic performance in the OECD: a comparison of European and non-European countries. European Journal of Operational Research, 87, 507–518.

McAllister, P. H., & McManus, D. A. (1993). Resolving the scale efficiency puzzle in banking. Journal of Banking and Finance, 17, 389–405.

Park, K. H., & Weber, W. L. (2006). A note on efficiency and productivity growth in the Korean Banking Industry, 1992–2002. Journal of Banking and Finance, 30, 2371–2386.

Pasiouras, F., Liadaki, A., & Zopounidis, C. (2008). Bank efficiency and share performance: Evidence from Greece. Applied Financial Economics, 18, 1121–1130.

Pastor, J. M. (1999). Efficiency and risk management in Spanish banking: A method to decompose risk. Applied Financial Economics, 9, 371–384.

Pastor, J. M. (2002). Credit risk and efficiency in the European banking system: A three-stage analysis. Applied Financial Economics, 12, 895–911.

Pastor, J. T., Lovell, C. A. K., & Tulkens, H. (2006). Evaluating the financial performance of bank branches. Annals of Operation Research, 145, 321–337.

Sealey, C. W., & Lindley, J. T. (1977). Inputs, outputs and theory of production cost at depository financial institutions. Journal of Finance, 32, 1251–1266.

Seiford, L. M., & Zhu, J. (2002). Modeling undesirable factors in efficiency evaluation. European Journal of Operational Research, 142, 16–20.

Sherman, H. D., & Zhu, J. (2006). Benchmarking with quality-adjusted DEA (Q-DEA) to seek lower-cost high-quality service: Evidence from a U.S. bank application. Annals of Operation Research, 145, 301–319.

Shephard, R. W. (1970). Theory of cost and production functions. Princeton: Princeton University Press.

Tone, K. (2001). A slacks-based measure of efficiency in data envelopment analysis. European Journal of Operational Research, 130, 498–509.

Tsionas, E. G., Lolos, S. E. G., & Christopoulos, D. K. (2003). The performance of the Greek banking system in view of the EMU: Results from a non-parametric approach. Economic Modelling, 20, 571–592.

Author information

Authors and Affiliations

Corresponding author

Additional information

The author would like to thank two anonymous referees for their helpful comments and suggestions on an earlier version. All remaining errors are the author’s responsibility.

Rights and permissions

About this article

Cite this article

Yang, CC. An enhanced DEA model for decomposition of technical efficiency in banking. Ann Oper Res 214, 167–185 (2014). https://doi.org/10.1007/s10479-011-0926-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-011-0926-z