Abstract

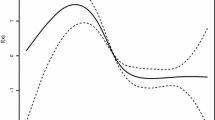

This paper concerns an optimal dividend-penalty problem for the risk models with surplus-dependent premiums. The objective is to maximize the difference of the expected cumulative discounted dividend payments received until the moment of ruin and a discounted penalty payment taken at the moment of ruin. Since the value function may be not smooth enough to be the classical solution of the HJB equation, the viscosity solution is involved. The optimal value function can be characterized as the smallest viscosity supersolution of the HJB equation and the optimal dividend-penalty strategy has a band structure. Finally, some numerical examples with gamma distribution for the claims are analyzed.

Similar content being viewed by others

References

Albrecher H, Thonhauser S. Optimal dividend strategies for a risk process under force of interest. Insurance Mathematics and Economics, 2008, 43(1): 134–149

Avram F, Palmowski Z, Pistorius M R. On Gerber-Shiu functions and optimal dividend distribution for a Lévy risk process in the presence of a penalty function. Annals of Applied Probability, 2015, 25(4): 1868–1935

Azcue P, Muler N. Optimal reinsurance and dividend distribution policies in the Crámer-Lundberg model. Mathematical Finance, 2005, 15(2): 261–308

Azcue P, Muler N. Stochastic Optimization in Insurance: a Dynamic Programming Approach. London: Springer, 2014

Benth F E, Karlsen K H, Reikvam K. Optimal portfolio selection with consumption and nonlinear integrodifferential equations with gradient constraint: a viscosity solution approach. Finance and Stochastics, 2001, 5(3): 275–303

Cai J, Feng R, Willmot G E. On the expectation of total discounted operating costs up to default and its applications. Advances in Applied Probability, 2009, 41(2): 495–522

Dickson, David C M, Waters H R. Some optimal dividends problems. Astin Bulletin, 2004, 34(1): 49–74

Feng R, Volkmer H W, Zhang S, Zhu C. Optimal dividend policies for piecewise-deterministic compound Poisson risk models. Scandinavian Actuarial Journal, 2015, 51(1): 423–454

Fleming W H, Soner H M. Controlled Markov Processes and Viscosity Solutions. Applications of Mathematics. New York: Springer-Verlag, 1993

Gerber H U. Entscheidungskriterien Fuer den Zusammengesetzten Poisson-Proze. Schweiz Verein Versicherungsmath Mitt, 1969

Gerber H U, Lin X S, Yang H. A note on the dividends-penalty identity and the optimal dividend barrier. Astin Bulletin, 2006, 36(2): 489–503

Marciniak E, Palmowski Z. On the optimal dividend problem for insurance risk models with surplusdependent premiums. Journal of Optimization Theory and Applications, 2016, 168(2): 723–742

Schmidli H. Stochastic Control in Insurance. London: Springer, 2008

Thonhauser S, Albrecher H. Dividend maximization under consideration of the time value of ruin. Insurance Mathematics and Economics, 2007, 41(1): 163–184

Zajic T. Optimal dividend payout under compound poisson income. Journal of Optimization Theory and Applications, 2000, 104(1): 195–213

Zhu J. Optimal dividend control for a generalized risk model with investment incomes and debit interest. Scandinavian Actuarial Journal, 2013, 2(2): 140–162

Liu J, Xu J C, Hu Y J. On the expected discounted penalty function in a Markov-dependent risk model with constant dividend barrier. Acta Mathematics Scientia, 2010, 30B(5): 1481–1491

Author information

Authors and Affiliations

Corresponding author

Additional information

This work was supported by National Natural Science Foundation of China (11471218), Hebei Higher School Science and Technology Research Projects (ZD20131017), Joint Doctoral Training Foundation of HEBUT (2018GN0001).

Rights and permissions

About this article

Cite this article

Li, J., Liu, G. & Zhao, J. Optimal Dividend-Penalty Strategies for Insurance Risk Models with Surplus-Dependent Premiums. Acta Math Sci 40, 170–198 (2020). https://doi.org/10.1007/s10473-020-0112-1

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10473-020-0112-1

Key words

- band strategy

- risk models with surplus-dependent premiums

- HJB equation

- viscosity solution

- Gerber-shiu function