Abstract

This paper explores the role of private label trade intermediation in shaping the range and diversity of exports and imports. Whereas direct sales maintain a firm’s unique product characteristics, or ‘brand equity’, trade through an intermediary often takes the form of ‘private label’ sales, under which multiple firms’ output is pooled and re-sold under a new private label brand created by the intermediary. This paper shows that these private label arrangements result in greater total export and import volumes and lower average prices for consumers, but fewer independent varieties available to consumers in equilibrium. Normative implications are mixed: consumers trade variety for volume, independent exporters face greater competition from the new private label products, and intermediary firms can capture more of the gains from trade. We explore the implications of competition at the intermediary level and trade costs for the equilibrium pattern of private label and direct exporting and importing activities.

Similar content being viewed by others

Notes

Hereafter, we use the term ‘private label’ to indicate any pooled product, which need not be a store brand and is not necessarily associated with a particular retailer.

In the interest of tractability, the theory part of this paper abstracts from brand-preserving trade intermediation (or interpreted differently, subsumes it as a form of direct exporting).

Surveyed retailers included supermarkets, hypermarkets, mass merchandizers and some drug- and convenience stores. A separate 2011 study in ‘Private Label Magazine’ reported similar figures for individual retailers: in 2010, private label sales made up 18% of revenue at Wal-Mart, 24% at Costco, and 30% at Target Corp. stores (cf. Private.Label.Magazine 2011).

According to the same ACNielsen (2005) study, the highest private label market shares are in refrigerated food (32%) and paper, plastic and wraps (31%), and lowest in cosmetics (2%). There is also substantial variation in the price differential between private label and manufacturer-branded products ranging from personal care products (where private labels sell for 46% less on average) to refrigerated food (with a price differential of 16%) (ibid).

See Gereffi (1999).

From 2001 to 2011, the share of wine exports in bulk increased from 20% to almost 50% in new world countries. See Rabobank (2012).

See ANZ (2012) report.

As cited in PPB (2012) report.

Given our set up with quasi-linear preferences and a numéraire good, it would be a relatively simple matter to close the model, but the extra modeling apparatus required to add a domestic market and impose balanced trade does not yield enough additional insight to warrant the additional complexity.

While we focus attention on the export side in our partial equilibrium approach, the numéraire conceptually allows for balanced trade.

We assume that every consumers’ income is sufficient to ensure positive consumption of each differentiated product, i.

Demidova et al. (2012) offer an empirical basis for using firm specific demand shocks, based on evidence from Bangladeshi apparel exporters.

We assume that neither of these costs is prohibitive.

Note that consumer’s utility function is linear in \(\lambda _{i}\), hence consumers are risk-neutral with respect to \(\lambda _{k}.\)

Equivalently, these fees can be interpreted as lower pass through prices for exporters, where the IR gets its ‘cut’ by offering exporters lower prices for products sourced under the private label.

The revenue that arises from a tariff does not affect our analysis as it accrues to the importing country, whereas the effects we analyze below play out in the exporting country.

Note that they are still monopolists in those submarkets, and therefore no pro-competitive effect arises.

Alternatively, we could consider a model with an explicit oligopolistic market structure for intermediaries which would also lead to a lower, yet endogenously determined fixed fee. Such analysis is interesting but beyond the scope of the present paper.

Formally, an upper bound on the fixed fee might lead to a higher variable component, but we abstract from this aspect here, implicitly assuming that the same competitive (or regulatory) pressure prevents such evasive action on part of the retailer.

We continue to assume that the fixed fee f is sufficiently high so that there are some Home firms who do not export at all.

As f decreases, the quality of the lowest quality private label exporter also falls, and for sufficiently low f all Home producers start to export, that is \(\underline{\lambda }=0.\)

Note that \({\widetilde{f}}<\frac{L}{\gamma }\left( \frac{2}{3}\sqrt{\frac{ \gamma F^{DE}}{L}}+\frac{1}{3}c^{DE}-\frac{1}{3}c_{r}\right) ^{2}\).

References

ACNielsen. (2005). The power of private label. Executive News Report from ACNielsen Global Services, September 2005.

Ahn, J., Khandelwal, A., & Wei, S.-J. (2011). The role of intermediaries in facilitating trade. Journal of International Economics, 81(1), 73–85.

Akerman, A. (2010). A theory on the role of wholesalers in international trade based on economies of scope. Research papers in economics 2010:1 Stockholm University Department of Economics.

Antràs, P., & Costinot, A. (2011). Intermediated trade. The Quarterly Journal of Economics, 126, 1319–1374.

ANZ, (2012). Turning Water into Wine, ANZ Research, ANZ Agri Focus. https://www.anz.co.nz/resources/3/0/309e22004ab1bf7ab62afe415e15c706/ANZ-AgriFocus-20120330.pdf.

Bai, X., Krishna, K., & Ma, H.(2015). How you export matters: Export mode, learning and productivity in China (NBER working paper no. 21164).

Bair, J. (2002). Beyond the maquila model? NAFTA and the Mexican apparel industry. Industry and Innovation, 9(3), 203–25.

Bair, J., & Gereffi, G. (2003). Upgrading, uneven development and jobs in the North American apparel industry. Global Networks, 3(2), 143–69.

Basker, E., & Van, P. H. (2010a). Imports r us: Retail chains as platforms for developing country imports. American Economic Review, Papers & Proceedings, 100(2), 414–418.

Basker, E., & Van, P. H. (2010b). Putting a smiley face on the dragon: Walmart as catalyst to U.S.-China trade. http://emekbasker.org/docs/Dragon.pdf. Unpublished manuscript.

Bergès-Sennou, F., Bontems, P., & Réquillart, V. (2004). Economics of private labels: A survey of literature. Journal of Agricultural and Food Industrial Organization, 2, 3.

Bernard, A. B., Jensen, J. B., Redding, S. J., & Schott, P. K. (2010). Wholesalers and retailers in U.S. trade (long version) (NBER working paper 15660).

Blum, B., Claro, S., & Horstmann, I. (2009). Intermediation and the nature of trade costs: Theory and evidence. http://economics.uwaterloo.ca/documents/Horstmann23-10.pdf. Unpublished manuscript.

Blum, B., Claro, S., & Horstmann, I. (2010). Facts and figures on intermediated trade. American Economic Review, Papers & Proceedings, 100, 419–423.

Dasgupta, K., & Mondria, J. (2016). Quality uncertainty and intermediation in international trade. http://individual.utoronto.ca/jmondria/intermediaries_july_2014.pdf. Unpublished manuscript.

Demidova, S., Kee, H. L., & Krishna, K. (2012). Do trade policy differences induce sorting? Theory and evidence from Bangladeshi apparel exporters. Journal of International Economics, 87(2), 247–261.

Feenstra, R., & Hanson, G. (2004). Intermediaries and entrepôt trade: Hong Kong re-export of Chinese goods. Journal of Economics and Management Strategy, 13(1), 3–35.

Felbermayr, G., & Jung, B. (2008). Trade intermediaries, incomplete contracts, and the choice of export modes. Tübinger Diskussionsbeitrag no. 317.

Felbermayr, G., & Jung, B. (2011). Trade intermediation and the organization of exporters. Review of International Economics, 19, 634–648.

Gabrielsen, T., & Staahl, L. Sörgard. (2007). Private labels, price rivalry, and public policy. European Economic Review, 51, 403–424.

Gereffi, G. (1999). International trade and industrial upgrading in the apparel commodity chain. Journal of International Economics, 48(1), 37–70.

Head, K., Jing, R., & Swenson, D. (2014). From Beijing to Bentonville: Do multinational retailers link markets. Journal of Development Economics, 110, 79–92.

Iacovone, L., Javorcik, B., Javorcik, W., & Tybout, J. (2015). Supplier responses to Wal-Mart’s invasion in Mexico. Journal of International Economics, 95(1), 1–15.

Mills, D. E. (1995). Why retailers sell private labels. Journal of Economics and Management Strategy, 4, 509–528.

Ottaviano, G., Tabuchi, T., & Thisse, J.-F. (2002). Agglomeration and trade revisited. International Economic Review, 43(2), 409–435.

Private.Label.Magazine. (2011). Top 50 retailers and wholesalers. (March) E.W. Williams Publication Company, Fort Lee, NJ.

PPB, (2012). New Zealand Wine, The State of Play, PPB Advisory Insights. https://www.ppbadvisory.com/uploads/a258-00286INS-New-Zealand-wine-the-state-of-play.pdf.

Raff, H., & Schmitt, N. (2009). Buyer power in international markets. Journal of International Economics, 79(2), 222–229.

Raff, H., & Schmitt, N. (2012). Imports and the structure of retail markets. Canadian Journal of Economics, 45(4), 1431–1455.

Rabobank, (2012). The Incredible Bulk, Rabobank Industry Note No 296. http://www.vsnews.fr/images/etudes/Rabobank_IN296_The_Incredible_Bulk_January2012.pdf.

Rauch, J., & Watson, J. (2004). Network intermediaries in international trade. Journal of Economics and Management Strategy, 13(1), 69–93.

Timmor, Y., & Zif, J. (2008). Exporting under private labels: Conditions and influencing factors. Global Business and Economics Review, 10(1), 35–57.

Acknowledgements

We thank the editor and two anonymous referees for suggestions that have greatly improved the paper.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Direct exports only

In this Appendix we solve for equilibrium in the basic case when firms can export directly or not at all. In this scenario, a \(\lambda\)-type firm solves the following profit-maximization problem:

where \(Q=Q^{W}+Q^{H,DE}\) is the aggregate output sold in the Foreign market. The profit-maximizing output of a \(\lambda\)-type firm is then:

with associated profit:

Then the threshold \(\lambda ^{DE}\) implicitly equals to:

Aggregating over the set of exporting firms, \(\lambda \in [\lambda ^{DE},1]\), per capita output sold in the Foreign market equals:

Using Eqs. (5) and (6) we can derive the equilibrium level of \(\lambda ^{DE}\):

where we use the term D simply as a placeholder for the (somewhat messy) expression:

In words, the expression in (7) tells us that when the only way to reach Foreign consumers is via direct exporting, more exporters will undertake the direct export channel when the (fixed and variable) trade costs are lower, consumers value product diversity more, the Foreign market is larger, and there is less competition from the rest of the world.

1.2 Private labels

In this Appendix we first solve for equilibrium in the case of private label trade intermediation and then derive the effects of private label intermediation on Home exporting firms.

First, we find the contract offered by the IR in equilibrium. The inverse demand for private label k product is:

where \(Q=Q^{W}+Q^{H,DE}+Q_{k}^{H,PL}\). The profit of a Home firm that accepts the private label contract is thus:

Solving, the profit-maximizing output equals:

so that the profit of a Home firm exporting under a private label contract is:

It is straightforward to see that the profit of a direct exporter is the same as in (4) with the only difference that now total demand Q includes output of the private label product channeled through IR, \(Q_{k}^{H,PL}\).

We focus on the case in which some firms choose not to export at all, so that \(\underline{\lambda }>0.\) In this case, using (2) we have that the output of a Home firm exporting under the private label contract is:

To find \({\overline{\lambda }}\) we use conditions (1) and (2) to get \(\pi ^{DE}({\overline{\lambda }}) =0\). We then have:

Then using condition (2) we can find \(\lambda _{k}\):

Finally, using \(\lambda _{k}=\dfrac{\underline{\lambda }+{\overline{\lambda }} }{2}\), we derive the value of the measure of Home firms exporting under the private label:

As one would expect, a higher per unit fee \(\Delta\) or a higher fixed fee f charged by the IR decrease the measure of firms that accept a private label contract.

We are now ready to characterize the contract that maximizes the retailer’s profit:

Using (10), we have that:

Maximizing the IR’s profit gives us the equilibrium contact:

Next, we can solve for the thresholds \({\overline{\lambda }},\underline{\lambda }\) and the average value of brand equity of the private label product \(\lambda _{k}.\) First, the per capita output sold in the target Foreign market is equal to

We can now use (11), (9), and \(\underline{\lambda }={\overline{\lambda }}-K,\) to solve for the lower threshold \(\underline{\lambda }\):

The upper threshold and average then follow immediately.

Next, we analyze how the availability of the private label export channel affects the exporting firms. We already know that total Home exports rise and there are fewer Home direct exporters. Next, we find the effect on total number of Home exporters. Using (7) and (12) we can derive the following:

We see that \(\underline{\lambda }>\lambda ^{DE}\) if and only if

or, substituting for K and D, the mass of exporting firms decreases iff:

which is generally ambiguous as it depends on parametric assumptions. Condition (13) will be satisfied when the international retailer’s cost advantage, \((c^{DE}-c_{r})\) is sufficiently high, substitutability between varieties, \(\eta\), is sufficiently high, and/or the rest of the world’s exports per foreign consumer, \(\frac{ Q^{W}}{L}\) are sufficiently high.

1.3 Variation in variable trade cost

In this Appendix we show that in the case of a uniform increase in the variable trade costs for both direct and intermediated trade, the negative extensive margin effect dominates and the aggregate Home exports fall while the output of a direct exporter rises.

First, using (11) and (12), and then differentiating Q with respect to t we get that the effect on total exports is negative:

Next using (3) and differentiating with respect to t we can also show that the effect on the quantity of a direct exporter is positive

1.4 Variation in fixed trade cost

In this Appendix we show that the effects of an increase in fixed cost of direct exporting on aggregate Home exports and individual output of a direct exporter are of opposite sign and the direction of each effect depends on the parameter’s values.

Using (11) and differentiating with respect to \(F^{DE}\) we have that the effect on aggregate exports is

Hence the sign of \(\dfrac{dQ}{dF^{DE}}\gtrless 0\) depends on the sign of the following term

If \(\alpha , \gamma F^{DE}/L\) or \(\left( c^{DE}-c_{r}\right)\) are high then we see higher aggregate exports in response to an increase in the fixed cost of direct exports. And since

we have the opposite effect on the individual quantity of each direct exporter.

1.5 Reducing monopoly power

In this Appendix we solve for the effects on outputs and the measure of Home exporters in the case of an exogenous reduction in the monopoly power of the retailer, i.e. a decrease in fixed retailing fee f.

First, we note that as previously the profit of private label exporters must be equal to zero:

Hence, each private label exporter’s output equals

Note that as the monopoly power of the retailer is reduced, the fixed fee f decreases, and each private label exporter will export less—that is, \(q_{k}\) decreases.

Next, we determine the measure of private label exporters and their total exports. Since profits have to be equal at the threshold, and private label exporters make zero profit, i.e. \(\pi ^{DE}({\overline{\lambda }}) =\pi ^{PL}=0\), it follows that

and

The measure of Home firms exporting under the private label then equals:

As f decreases, K increases and there will be more private label exporters compared to the monopoly case.

The net effects on the total volume of intermediated exports takes some work. Given the mass of private label exporters, total private label exports amount to:

and this quantity varies with the fixed retailing fee according to:

In order to sign this derivative it proves convenient to define the following critical value of the fee:Footnote 27

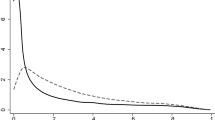

Regarding the effect on the total quantity of private label exports, we have that for \(f>{\widetilde{f}}\) the quantity increases as f falls, and then, once \(f<{\widetilde{f}}\), starts to decrease as the fee falls even further.

The resulting equilibrium is determined by two conditions:

and

We want to understand how these equilibrium values change when f falls. Consider first the case where \(f>{\widetilde{f}}\). For this range of market power we have that \(\frac{Q}{L}\) and \({\overline{\lambda }}\) increase as f falls. To see this, suppose that \(\frac{Q}{L}\) decreases. Then \({\overline{\lambda }}\) decreases as well, which results in higher \(Q^{H,DE}\). As \(Q^{H,PL}\) also increases, \(\frac{Q}{L}\) would rise, which is a contradiction. Now consider the case where \(f<{\widetilde{f}}\). In this range, \(Q^{H,PL}\) decreases as f falls and \({\overline{\lambda }}\) decreases as well. The argument is the same as before, only with opposite signs.

About this article

Cite this article

Blanchard, E., Chesnokova, T. & Willmann, G. Private labels and exports: trading variety for volume. Rev World Econ 153, 545–572 (2017). https://doi.org/10.1007/s10290-017-0284-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-017-0284-2