Abstract

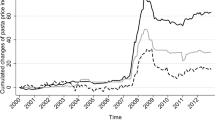

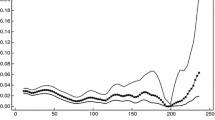

In this short paper, cartel behaviour is analysed with respect to the market shares of cartel members. There is some evidence in previous theoretical and empirical research that market shares under collusion are more stable than in phases of competition. It is shown that this can be an artifact and that market share volatility may not be used by antitrust authorities as an exclusive indicator of tacit collusion. Using the Kolmogorov-Smirnov test, the distribution of market share changes during both the competitive and the collusive phases of ten recently discovered conspiracies is compared. Only in 3 of the 10 cartels were the distributions of market share changes significantly different.

Similar content being viewed by others

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Geist, A., von Blanckenburg, K. Cartel detection — Is market share volatility a significant indicator?. Intereconomics 46, 217–221 (2011). https://doi.org/10.1007/s10272-011-0386-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10272-011-0386-3