Abstract

This paper studies local and global indeterminacy and transition dynamics in an endogenous growth model where public goods increase production and the household’s utility. We study the impact on economic growth in the face of valuing public goods and socially conscious economic agents. When public goods are undervalued, the economy steadily converges to a unique low-growth equilibrium. As the utility share of public goods increases, another equilibrium emerges, but the difference between the two growth rates, “low” and “high”, narrows until both equilibria coalesce and disappear, producing a scenario with no convergence on a balanced growth path (BGP). The low-growth equilibrium is stable, and there may be monotonic convergence toward a broadly stable high-growth equilibrium. The economy may also oscillate between growth rates before reaching the high-growth BGP, or may diverge from it. In addition, before the high-growth BGP becomes unstable, the model may exhibit an unstable limit cycle that surrounds it. Moreover, if social consciousness co-varies with the weight of public goods on utility, a homoclinic orbit may emerge that links the low-growth equilibrium to itself.

Similar content being viewed by others

Notes

Our model is thus akin to an extension of the Romer (1986) model, with three changes: (i) public capital is imperfectly substitutable with physical capital and is financed by taxes (in a balanced budget context); (ii) there is “social awareness”, through a parameter, affecting both the rate of discount of the household and the rate of depreciation of capital, and (iii) the utility is non-separable between consumption and public goods.

This is suggested by our numerical simulations but we were unable to capture this orbit neither numerically nor analytically.

In order to avoid confusion between public goods and the Euler number, we use \(\exp (x)\) to denote the exponential of x.

Unlike Acemoglu et al. (2012), we do not need an assumption of joint concavity of utility in \(\left( c(t),e(t)\right)\) since agents take the public good as given (it acts as an externality in the model).

Although in Yanase (2011) considers that the time preference rate is endogenous. Such an application would also be interesting to apply in the present framework.

For simplicity, we shall omit the subscript denoting time dependence whenever convenient unless needed for clarity.

It could also be interesting to let the depreciation of public goods be endogenously determined by assuming it is a fraction of the stock public goods, as in the case of capacity utilization in the work by Wen (1998).

The empirical soundness of the functional form underlying the creation of public goods may of course vary according to their specific type and nature.

In all of our simulations, \(\lambda (t)\) converges to zero.

Indeed, we have \(\lim _{g\rightarrow \infty }x^{*}(g)=-\infty\).

Recall that k includes both physical and human capital.

Based on the literature, emissions are likely to range from 1% to 5% of GDP, whereas abatement expenses are likely to lie between 1% and 10%.

This is done by calibrating \(1-\gamma +\tau\) according to the fraction of public expenditures in creation of public goods in these works by fixing either \(\tau\) or \(\gamma\).

See Appendix 1 for a more detailed derivation of the Jacobian matrix.

Numerical computations indicate that the determinant (the value of the real part of the positive eigenvalue) approaches zero the closer we get to violate the additional condition, \(x^*\ge 0\), imposed on the existence of equilibria. This further adds to the importance of such a condition, as a change in the local stability of an equilibrium probably relates to a change in the sign of consumption at the BGP.

We note again that the qualitative properties under scenario (ii) are preserved over a wider range of parameter values. This robustness carries over to the numerical results shown throughout Sect. 4.

This is illustrated graphically in Sect. 4 and by computation of all conditions, including the first Lyapunov exponent which is calculated both algebraically and numerically through a Mathematica package “LCE.m” by Sandri (1996). We do not however exclude the possibility that it may be zero, under some specific parametrization. In this case the non-degeneracy condition fails, and the Hopf bifurcation is called degenerate (Gaspar 2018). We do not pursue this case in the present work.

Of course, further increases imply that the low-growth and the high-growth eventually coalesce and disappear via a saddle-node bifurcation and there is no long-run steady state.

The determinant is not discernible in Fig. 11 because it is very low, but it is always positive for \(\gamma < \gamma _c\).

If conditions (BT1)–(BT3) of Theorem 8.4 in Kuznetsov (2004) are not met, then we say that the bifurcation is degenerate.

As noted previously, an additional requirement is that the elasticity of substitution lies below unity.

We thank a reviewer for the suggestion of this natural interpretation.

The same occurs when \(\theta\) decreases as depicted in Fig. 1b–d.

However, one should notice that, for very high levels of \(\tau ,\) a solution to (18) may not exist.

References

Acemoglu D, Aghion P, Bursztyn L, Hemous D (2012) The environment and directed technical change. Am Econ Rev 102(1):131–166

Alonso-Carrera J, Freire-Serén MJ (2004) Multiple equilibria, fiscal policy, and human capital accumulation. J Econ Dyn Control 28(4):841–856

Aschauer DA (1989) Is public expenditure productive? J Monet Econ 23(2):177–200

Barro RJ (1990) Government spending in a simple model of endogeneous growth. J Polit Econ 98(5, Part 2):S103–S125

Barro RJ, Becker GS (1989) Fertility choice in a model of economic growth. Econometrica 57(2):481–501

Barro RJ, Sala-i Martin X (2004) Economic growth. McGraw-Hill Advanced Series in Economics. MIT Press

Baxter M, King RG (1993) Fiscal policy in general equilibrium. Am Econ Rev 83(3):315–334

Besley T, Ghatak M (2006) Public goods and economic development. Understanding Poverty 19:285–303

Bovenberg L, Smulders S (1996) Transitional impacts of environmental policy in an endogenous growth model. Int Econ Rev 37(4):861–93

Brito P, Venditti A (2010) Local and global indeterminacy in two-sector models of endogenous growth. J Math Econ 46(5):893–911

Cazzavillan G (1996) Public spending, endogenous growth, and endogenous fluctuations. J Econ Theory 71(2):394–415

Chaudhry A, Tanveer H, Naz R (2017) Unique and multiple equilibria in a macroeconomic model with environmental quality: An analysis of local stability. Econ Model 63:206–214

Chen B-L, Lee S-F (2007) Congestible public goods and local indeterminacy: a two-sector endogenous growth model. J Econ Dyn Control 31(7):2486–2518

Dinda S (2005) A theoretical basis for the environmental kuznets curve. Ecol Econ 53(3):403–413

Fernández E, Pérez R, Ruiz J (2012) The environmental kuznets curve and equilibrium indeterminacy. J Econ Dyn Control 36(11):1700–1717

García-Belenguer F (2007) Stability, global dynamics and markov equilibrium in models of endogenous economic growth. J Econ Theory 136(1):392–416

Gaspar J, Vasconcelos P, Afonso O (2014) Economic growth and multiple equilibria: a critical note. Econ Model 36:157–160

Gaspar JM (2018) Bridging the gap between economic modelling and simulation: a simple dynamic aggregate demand-aggregate supply model with Matlab. J Appl Math 2018(3193068):1–13

Golosov M, Hassler J, Krusell P, Tsyvinski A (2014) Optimal taxes on fossil fuel in general equilibrium. Econometrica 82(1):41–88

Guckenheimer J, Holmes PJ (2002) Nonlinear oscillations, dynamical systems, and bifurcations of vector fields, vol 42. Springer Science & Business Media

Hosoya K (2012) Growth and multiple equilibria: a unique local dynamics. Econ Model 29(5):1662–1665

Hosoya K (2014) Public health infrastructure and growth: ways to improve the inferior equilibrium under multiple equilibria. Res Econ 68(3):194–207

Itaya J-I (2008) Can environmental taxation stimulate growth? The role of indeterminacy in endogenous growth models with environmental externalities. J Econ Dyn Control 32(4):1156–1180

Kuhn M, Prettner K (2016) Growth and welfare effects of health care in knowledge-based economies. J Health Econ 46:100–119

Kuznetsov Y (2004) Elements of applied bifurcation theory. Springer New York, 3rd edn

Marsden JE, McCracken M (1976) The Hopf bifurcation and its applications. Appl Math Sci 19

Mino K (2004) Human capital formation and patterns of growth with multiple equilibria. Human capital, trade, and public policy in rapidly growing economies: from theory to empirics. In: Boldrin M, Chen B, Wang P (eds) Academia Studies in Asian Economies. Edward Elgar, Cheltenham, UK, p 42–64

Mino K (2016) Growth and business cycles with equilibrium indeterminacy. Springer Verlag, Japan

Park H, Philippopoulos A (2004) Indeterminacy and fiscal policies in a growing economy. J Econ Dyn Control 28(4):645–660

Raurich X (2003) Government spending, local indeterminacy and tax structure. Economica 70(280):639–653

Robinson JA, Acemoglu D, Johnson S (2005) Institutions as a fundamental cause of long-run growth. Handbook of Economic Growth 1A:386–472

Romer PM (1986) Increasing returns and long-run growth. J Polit Econ 94(5):1002–1037

Sandri M (1996) Numerical calculation of Lyapunov exponents. Mathematica Journal 6(3):78–84

van der Zwaan BC, Gerlagh R, Schrattenholzer L et al (2002) Endogenous technological change in climate change modelling. Energy Econ 24(1):1–19

Wen Y (1998) Capacity utilization under increasing returns to scale. J Econ Theory 81(1):7–36

Yanase A (2011) Impatience, pollution, and indeterminacy. J Econ Dyn Control 35(10):1789–1799

Acknowledgements

We are thankful to the two anonymous referees for very useful comments and suggestions, and to Sofia Castro and Giovanni Bella for the fruitfull discussions. This research has been partially supported by CEFUP (UIDB/ 04105/ 2020), CEGE (UIDB/ 00731/ 2020), and CMUP (UIDB/ 00144/ 2020), which are funded by Fundação para a Ciência e Tecnologia (FCT, Portugal). The first author acknowledges the support from FCT through the Project CEECIND/ 02741/ 2017, the second author acknowledges the support from FCT through the Project PTDC/ EGE-ECO/ 30080/ 2017, and the third author acknowledges the support from FCT through the sabbatical fellowship SFRH/ BSAB/ 142986/ 2018.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

1.1 Mathematical proofs

Derivation of the Jacobian matrix in (22): The two-dimensional system (14) is equivalent to

The Jacobian matrix of the system is given by

where

From the Jacobian matrix evaluated at the BGP, we have \(\frac{\dot{x}}{x} \big |_{ss} = \frac{\dot{z}}{z} \big |_{ss} =0\) in (12) and (13). It follows that

Since

we rewrite

Accordingly,

\(\square\)

Proof of lemma 1

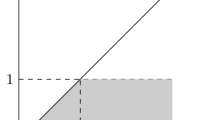

Consumption is non-negative if and only if \(x=c/k\ge 0\). The function \(x^{*}\) in (17) is continuous and strictly decreasing in g:

We conclude that \(x^{*}\) is either always negative or becomes negative for \(g > g_{\max }\) such that

The latter case holds whenever \(g_{\max }>0\), and thus \(\eta <(1-\tau )^{\alpha } / (\gamma +\tau -1)^{\alpha -1}\)

On the other hand, the function \(z^{*}\) in (17) is continuous and strictly increasing in g:

It is easily seen that \(x^* \in \left[ x^*(g_{\max }), x^*(0) \right)\) and \(z^* \in \left[ z^*(0), z^*(g_{\max })\right)\) where:

\(\square\)

Proof of proposition 1

For scenario (i), we have \(\beta (\theta -1) + \theta \ge 0 \ \Leftrightarrow \ \beta (1-\theta ) \le \theta .\) Applying this inequality to the determinant of \(J (x^*,z^*)\) leads to

Now \(\text {det}[J (x^*,z^*)]<0\) and so the equilibrium is saddle-path stable. \(\square\)

Proof of proposition 2

Suppose that \(g\in \mathcal {G}\). We can rewrite (27) as

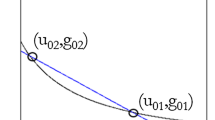

Let \(\beta >\theta /(1-\theta )\). We measure the rate of change of g with respect to a change in \(\beta\) through the functions \(\Gamma\) and \(\Psi\) in (19)–(20). Note that in the case where \(\Gamma\) and \(\Psi\) intersect twice, say at \(g_h<g_l\), we must have \(\beta (g_l) = \beta (g_h)\). Reciprocally, the variations of \(g_l\) and \(g_h\) with respect to \(\beta\) are in opposite directions.

When \(\beta\) increases, the slope of \(\Psi\) is larger in absolute value, which means a steeper downward tilt to the line. From Fig. 13 this corresponds to going from one long-run equilibrium solution to two equilibria that further collide and disappear.Footnote 25 We find that the value of \(g_l\) [resp. \(g_h\)] is increasing [resp. decreasing] as the slope of \(\Psi\) becomes more negative, i.e., \(\beta\) increases. From Lemma 1 the system admits a unique relevant equilibrium whenever \(g_l< g_{\max } < g_h\), and so \(\beta (g_l)=\beta (g_h)<\beta (g_{\max })\). Set \(\check{\beta } = \beta (g_{\max })\). Plugging (21) and \(x^*(g_{\max })=0\) into (33), we get

Illustration of scenario (ii) with \(\beta _1< \beta _2< \beta _3 < \beta _4\): the value of \(\beta _1\) produces only one relevant equilibrium; the value of \(\beta _2\) produces multiple equilibria; the value of \(\beta _3\) produces two coincident equilibria; and the value of \(\beta _4\) produces no equilibria

Now the critical value of \(\beta\) giving rise to the coalescence equilibrium for some \(\widetilde{g} \equiv g_l= g_h \in \mathcal {G}\) satisfies simultaneously \(\frac{d \beta }{d g} \big |_{g=\tilde{g}}=0\) and \(\text {det}[J(x^*,z^*)] = 0\). Given (27) it follows that

From (25) we obtain

Of course \(\widetilde{g} \ne g_{\max }\) and the required solution is

We replace the latter into \(\frac{\dot{z}}{z}\big |_{ss}=0\) yielding

\(\square\)

Proof of proposition 5

The saddle-node bifurcation requires three conditions on the system, see Guckenheimer and Holmes (2002, Theorem 3.4.1). When \(\beta =\widetilde{\beta }\), there is an equilibrium \((x^*,z^*)=(\widetilde{x}^*,\widetilde{z}^*)\) for which the following hypotheses are satisfied:

-

(SN1)

\(J(\widetilde{x}^*,\widetilde{z}^*) \big |_{\beta =\widetilde{\beta }}\) has a simple eigenvalue \(\lambda =0\) with right eigenvector \(\mathbf {v}^\text {T}=(v_1,v_2)\) and left eigenvector \(\mathbf {w}^\text {T}=(w_1,w_2)\);

-

(SN2)

\(\mathbf {w}^\text {T} F_{\beta } (\widetilde{x}^*;\widetilde{z}^*;\widetilde{\beta }) \ne 0\), where \(F_{\beta }\) is the vector of partial derivatives with respect to \(\beta\);

-

(SN3)

\(\mathbf {w}^\text {T} \left[ D^2 F (\widetilde{x}^*,\widetilde{z}^*;\widetilde{\beta }) (\mathbf {v},\mathbf {v})\right] \ne 0\).

Condition (SN1) is equivalent to \(\text {det}[J(\widetilde{x}^*,\widetilde{z}^*)]\big |_{\beta =\widetilde{\beta }} =0\), which is immediate from the proof of Proposition 2 with \(\widetilde{x}= \frac{\widetilde{\beta }(1-\theta )-1}{1-\theta } (\gamma +\tau -1)(\widetilde{z}^*)^{\theta }\). We find that:

Moreover,

and

Lemma 2 in Appendix 2 guarantees that \(\widetilde{g}\ne 0\) and \(\widetilde{z}^*\ne 0\) and hence (SN2) holds true. In addition, given (29), it follows easily that conditions (SN3) also holds true.

Proof of proposition 6

Suppose that the Jacobian matrix in (22) admits a pair of conjugate complex eigenvalues \(v(\beta )\pm i \omega (\beta )\) for the high-growth equilibrium \((x_h, z_h)\). We thus get

If, for some \(\beta =\beta _f\), we verify the following hypotheses:

then the pair of eigenvalues cross the imaginary axis at non-zero speed, see Guckenheimer and Holmes (2002, Theorem 3.4.2).

-

1.

Condition (H1) is automatically satisfied by imposition of condition (H2). Condition (H2) holds when:

$$\begin{aligned} v(\beta ) =0 \ \Leftrightarrow \ \text {tr}[J(x_h,z_h)]=0 \ \Leftrightarrow \ x_h = \frac{\gamma +\tau -1}{\theta } z_h^{\theta }. \end{aligned}$$(34)Taking \(x_h\) replaced by (34) into \(\frac{\dot{z}}{z}\big |_{ss}=0\) in (13) yields

$$x_h = \frac{\gamma +\tau -1}{\theta } \left( \frac{\theta }{1+\theta } \frac{1-\tau }{\gamma +\tau -1}\right) ^{\theta } \quad \text { and } \quad z_h = \frac{\theta }{1+\theta } \frac{1-\tau }{\gamma +\tau -1}.$$From \(\frac{\dot{x}}{x}\big |_{ss}=0\) in (12) we can write

$$\begin{aligned}x_h &= (1-\tau ) z_h^{\theta -1} - \eta - \frac{1}{\theta } [ \beta (1-\theta )\left[ (\gamma +\tau -1)z_h^{\theta }-\eta \right] \\&\quad+\theta (1-\tau )z^{\theta -1}-\rho -(2-\gamma )\eta ] .\end{aligned}$$Substituting \(x_h\) into (34) leads to

$$- \theta \eta - \beta (1-\theta )\left[ (\gamma +\tau -1)z_h^{\theta }-\eta \right] + \rho + (2-\gamma )\eta = (\gamma +\tau -1) z_h^{\theta }.$$Together with \(z_h\) in (17) we obtain

$$\beta _f \equiv \beta = \frac{\rho + (2-\gamma -\theta ) \eta - (\gamma +\tau -1) z_h^{\theta }}{(1-\theta )\left[ (\gamma +\tau -1)z_h^{\theta } - \eta \right] } = \frac{\rho + (1-\gamma -\theta ) \eta - g_h}{(1-\theta )g_h} .$$ -

2.

Next, we differentiate \(v(\beta )\) with respect to \(\beta\), where

$$\begin{aligned} v(\beta ) \ \underset{}{=}&\ \frac{1}{2} \left[ \theta x_h -(\gamma +\tau -1) z_h\right] \ \\ \underset{}{=}&\ \frac{1}{2} \left[ \theta (1-\tau ) \left( \frac{g_h+\eta }{\gamma +\tau -1} \right) ^{\tfrac{\theta -1}{\theta }}-(1+\theta )(g_h+\eta ) \right] . \end{aligned}$$Recall that \(g_h \equiv g_h(\beta )\) follows from (18) such that

$$\theta (1-\tau )\left( \dfrac{g_h+\eta }{\gamma +\tau -1}\right) ^{\tfrac{\theta -1}{\theta }} = g_h\left[ -\beta (1-\theta )+\theta \right] +\left( 2-\gamma \right) \eta +\rho .$$By differentiating the latter with respect to \(\beta\) we find \(\frac{dg_h}{d\beta }\):

$$\begin{aligned} -\frac{(1-\tau )(1-\theta )}{\gamma +\tau -1}\left( \frac{g_h+\eta }{\gamma +\tau -1}\right) ^{-\tfrac{1}{\theta }} \frac{dg_h}{d\beta }&= \frac{dg_h}{d\beta } \left[ -\beta (1-\theta )+\theta \right] - g_h(1-\theta ) \\ \Leftrightarrow \ \frac{dg_h}{d\beta }&= \frac{g_h(1-\theta )}{- \beta (1-\theta ) + \theta +\frac{(1-\tau )(1-\theta )}{\gamma +\tau -1}\left( \frac{g_h+\eta }{\gamma +\tau -1}\right) ^{-\frac{1}{\theta }}}. \end{aligned}$$Therefore,

$$\frac{d v}{d \beta } = \frac{1}{2} \left[ - \frac{(1-\theta ) (1-\tau )}{\gamma +\tau -1} \left( \frac{g_h+\eta }{\gamma +\tau -1} \right) ^{-\tfrac{1}{\theta }} -(1+\theta ) \right] \frac{d g_h}{d \beta }.$$Since \(\theta \in (0,1)\) and \(g_h>0\), we have for all \(\beta >0\):

$$\frac{d g_h}{d \beta } \ne 0, \qquad - \frac{(1-\theta ) (1-\tau )}{\gamma +\tau -1} \left( \frac{g_h+\eta }{\gamma +\tau -1} \right) ^{-\tfrac{1}{\theta }} -(1+\theta )<0.$$Consequently \(\frac{d v}{d \beta } \ne 0\). We conclude that in an open neighbourhood of \(\beta _f\) the eigenvalues of the Jacobian matrix at \((x_{h},z_{h})\) cross the imaginary axis at non-zero speed and a bifurcation occurs at \(\beta _f\).

-

3.

If an additional genericity condition is satisfied, then the model undergoes a Hopf bifurcation at \(\beta =\beta _f\) (Marsden and McCracken 1976; Guckenheimer and Holmes 2002). Let us rewrite the two-dimensional system underlying (14) as:

$$\begin{aligned} \dot{x}&= f(x,z;\beta )\\ \dot{z}&= g(x,z;\beta ). \end{aligned}$$The first Lyapunov coefficient from the third Taylor expansion on the centre manifold of the linearised system is given by:

$$\begin{aligned} a =&\ \frac{1}{16}(f_{xxx}+f_{xzz}+g_{xxz}+g_{zzz})\\&+ \dfrac{1}{16\omega _0}\left[ f_{xz}\left( f_{xx}+f_{zz}\right) -g_{xz}\left( g_{xx}+g_{zz}\right) -f_{xx}g_{xx}+f_{zz}g_{zz}\right] \end{aligned}$$where \(\omega _0 \equiv \omega (\beta _f)\) and \(f_{xz} = \frac{\partial ^2 f}{\partial x y} \big |_{\beta =\beta _f}(x_h,z_h)\), etc. Then, a simplifies to:

$$\begin{aligned} a= &\frac{1}{16} \left\{ (\gamma +\tau -1)[\theta ^2+\theta -\beta _f(1-\theta )]z_h^{\theta -2}+\theta (2-\theta )(1-\tau ) z_h^{\theta -3}\right\} (1-\theta ) \\ &+\frac{1}{16 \omega _0} \big \{\beta _f (1-\theta )^2 (\gamma +\tau -1)^2 [\theta ^2+\theta -\beta _f(1-\theta )] x_h z_h^{2\theta -3} \\&+ \theta \beta _f (1-\theta )^3 (1-\tau )(\gamma +\tau -1) x_h z_h^{2\theta -4} - (\gamma +\tau -1) [\theta ^2+\theta \\&-\beta _f(1-2\theta )] z_h^{\theta -1}-\theta (1-\theta )(1-\tau )z_h^{\theta -2} \big \}. \end{aligned}$$According to Guckenheimer and Holmes (2002), a small amplitude limit cycle exists if the genericity condition holds, i.e., \(a\ne 0\). Otherwise, we say that the bifurcation is degenerate, which concludes the proof. \(\square\)

Proof of proposition 7

We are required to show that there exists a region in the \((\beta ,\gamma )\)-parameter space such that the system (14) admits an equilibrium \((x^*,z^*)\) for which the Bogdanov-Takens condition is satisfied:

-

(BT)

\(\text {tr}[J(x^*,z^*)]=\text {det}[J(x^*,z^*)]=0\).

Parameters combinations in Propositions 2 and 6 ensure that this can happen at a coalescence equilibrium such that

implies

On the other hand, we have \(\beta _f= \beta _\text {BT}\) in (30) and hence \(\gamma _\text {BT}\equiv \gamma\) is implicitly determined from

Appendix 2

1.1 Properties

By Lemma 1, we have \(g\in \mathcal {D}_{g^*} = (0,g_{\max }]\), \(x^* \in \mathcal {D}_{x^*} =\left[ 0,x^*_{\max }\right)\) and \(z^*\in \mathcal {D}_{z^*} =\left( z^*_{\min },z^*_{\max } \right]\). For each value of \(z^*\) it is convenient to think of \(\text {tr}[J (x^*,z^*)]\), \(\text {det}[J (x^*,z^*) ]\) and \(\Delta (x^*,z^*)\) as functions of \(x^*\). We list the properties of these functions.

Properties of \(\text {tr}[J(x^*,z^*)]\): We see that \(\text {tr}[J (x^*,z^*)]\) is linear in \(x^*\) and

-

\(\dfrac{\partial \text {tr}[J(x^*,z^*)]}{\partial x^*} = \theta >0\) for all \(x^* \in \mathcal {D}_{x^*}\);

-

\(\text {tr}[J (x^*,z^*) ] =0 \ \Leftrightarrow \ \widehat{x}^* \equiv x^* = \dfrac{\gamma +\tau -1}{\theta } (z^*)^{\theta }\);

-

\(\text {tr}[J (x^*,z^*) ] < 0\) for all \(x^* \in [0,\widehat{x}^*)\) and \(\text {tr}[J (x^*,z^*) ] > 0\) for all \(x^* \in (\widehat{x}^*,x^*_{\max })\).

Properties of \(\text {det}[J (x^*,z^*)]\): We see that \(\text {det}[J (x^*,z^*)]\) is a real quadratic polynomial in \(x^*\) and

-

\(\begin{aligned}\dfrac{\partial \text {det}[J (x^*,z^*)]}{{\partial x^*}} = 0 & \Leftrightarrow -2(1-\theta ) x^*+[\beta (1-\theta )-1] (\gamma +\tau -1)(z^*)^{\theta }=0 \\ &\Leftrightarrow \bar{x}^* \equiv x^* = \frac{\beta (1-\theta )-1}{2(1-\theta )} (\gamma +\tau -1)(z^*)^{\theta };\end{aligned}\)

-

\(\dfrac{\partial \text {det}[J (x^*,z^*)]}{{\partial x^*}} > 0\) for all \(x^* \in [0,\bar{x}^*)\) and \(\dfrac{\partial \text {det}[J (x^*,z^*)]}{{\partial x^*}} < 0\) for all \(x^* \in (\bar{x}^*, x^*_{\max })\);

-

\(\begin{aligned}\text {det}[J (x^*,z^*) ] =0 & \Leftrightarrow x^* \left\{ -(1-\theta )x^* + [\beta (1-\theta )-1] (\gamma +\tau -1)(z^*)^{\theta }\right\} =0 \\& \Leftrightarrow x^*=0 \ \vee \ \widetilde{x}^* \equiv x^* = \frac{\beta (1-\theta )-1}{1-\theta } (\gamma +\tau -1)(z^*)^{\theta }; \end{aligned}\)

-

\(\text {det}[J (x^*,z^*) ] > 0\) for all \(x^* \in (0,\widetilde{x}^*)\) and \(\text {det}[J (x^*,z^*) ] < 0\) for all \(x^* \in (\widetilde{x}^*,x^*_{\max })\).

Properties of \(\Delta (x^*,z^*)\): We see that \(\Delta (x^*,z^*)\) is a real quadratic polynomial in \(x^*\) and

-

\(\begin{aligned} \dfrac{\partial \Delta (x^*,z^*)}{{\partial x^*}}&= 0 \\ &\Leftrightarrow 2(2-\theta )\left[ (2-\theta )x^* + (\gamma +\tau -1) (z^*)^{\theta } \right] \\&\quad- 4\beta (1-\theta )(\gamma +\tau -1)(z^*)^{\theta } =0 \\& \Leftrightarrow (2-\theta )^2 x^* - [ 2\beta (1-\theta ) - 2 + \theta ] (\gamma + \tau -1)(z^*)^{\theta } =0 \\ &\Leftrightarrow \bar{\bar{x}}^* \equiv x^* =\frac{2\beta (1-\theta ) - 2 + \theta }{(2-\theta )^2} (\gamma + \tau -1)(z^*)^{\theta }; \end{aligned}\)

-

\(\dfrac{\partial \Delta (x^*,z^*)}{{\partial x^*}} < 0\) for all \(x^* \in [0,\bar{\bar{x}}^*)\) and \(\dfrac{\partial \Delta (x^*,z^*)}{{\partial x^*}} > 0\) for all \(x^* \in (\bar{\bar{x}}^*, x^*_{\max })\);

-

\(\begin{aligned} \Delta (x^*,z^*)&=0 \Leftrightarrow \left[ (2-\theta )x^* + (\gamma +\tau -1) (z^*)^{\theta } \right] ^2\\& \quad- 4\beta (1-\theta )(\gamma +\tau -1) x^*(z^*)^{\theta } = 0 \\ &\Leftrightarrow (2-\theta )^2 (x^*)^2 - 2 \left[ 2\beta (1-\theta ) - 2 +\theta \right] (\gamma + \tau -1) x^* (z^*)^\theta \\&\quad+ (\gamma + \tau -1)^2 (z^*)^{2\theta } = 0. \end{aligned}\)

This yields a quadratic equation in \(x^*\) whose discriminant is:

$$16 \beta [\beta (1-\theta ) - 2 + \theta ](1-\theta ) (\gamma +\tau -1)^2(z^*)^{2\theta } \gtreqqless 0 \ \Leftrightarrow \ \beta \gtreqqless \frac{2-\theta }{1-\theta };$$ -

If \(\dfrac{1}{1-\theta }<\beta < \dfrac{2-\theta }{1-\theta }\), then \(\Delta (x^*,z^*) > 0\) for all \(x^* \in \mathcal {D}_{x^*}\);

-

If \(\beta> \dfrac{2-\theta }{1-\theta } = 1 +\dfrac{1}{1-\theta }> \dfrac{1}{1-\theta }\), then

$$\begin{aligned} \Delta (x^*,z^*)& = 0 \\ \Leftrightarrow x^*_{\pm } &= \frac{2\beta (1-\theta ) - 2 +\theta \pm 2\sqrt{\beta [\beta (1-\theta ) - 2 + \theta ](1-\theta )} }{(2-\theta )^2}(\gamma +\tau -1) (z^*)^\theta \end{aligned}$$and

$$\begin{aligned} \Delta (x^*,z^*) > 0&\text { for all } x^* \in [0,x^*_-) \cup (x^*_+,x^*_{\max }), \\ \Delta (x^*,z^*) < 0&\text { for all } x^* \in (x^*_-,x^*_+). \end{aligned}$$

From the relation between \(x^*\) and g (hence \(z^*\) and g) we can draw the graph of \(\text {tr}[J (x^*,z^*)]\), \(\text {det}[J (x^*,z^*) ]\) and \(\Delta (x^*,z^*)\) as functions of g, see Fig. 14, and the following statements are immediate.

Lemma 2

If \(\beta >\frac{1}{1-\theta }\), then \(0< \widehat{x}^*< \widetilde{x}^*< \check{x}^* < x^*_{\max }\), and \(g_{\max }> \widehat{g}> \widetilde{g}> \check{g} > 0\), and \(z^*_{\max }> \widehat{z}^*> \widetilde{z}^*> \check{z}^* > z^*_{\min }\). If \(\beta > 1+\frac{1}{1-\theta }\), then \(0< x^*_{-}< x^*_{+}< \widehat{x}^*< \widetilde{x}^*< \check{x}^* < x_{\max }\), and \(g_{\max }> g_{+}> g_{-}> \widehat{g}> \widetilde{g}> \check{g} > 0\), and \(z^*_{\max }> z^*_{+}> z^*_{-}> \widehat{z}^*> \widetilde{z}^*> \check{z}^* > z^*_{\min }.\)

Appendix 3

1.1 Government and taxes

Governments may compensate for low social awareness or a low weight of public goods in utility by increasing taxes \(\tau\) and thus promoting the creation of more public goods. Suppose again that households care little about public goods such that \(\beta\) is low and there is a unique long-run equilibrium. Differentiating \(\Gamma\)(g) with respect to \(\tau\) yields:

which is positive if \(\alpha \in \left( 0,\bar{\alpha }\right)\), where \(\bar{\alpha }=\tfrac{1-\tau }{\gamma }\) and negative if \(\alpha \in \left( \bar{\alpha },1\right)\). In other words, the government can increase long-run growth by raising taxes, provided that the share of capital in production is not exceedingly high. Since \(d\bar{\alpha }/d\tau >0\), \(\bar{\alpha }\) also sets an upper bound for taxes above which more taxes will be detrimental to growth.

Let us assume now that there exist two equilibria. In this scenario, a higher \(\tau\) shifts \(\Gamma (g)\) rightwards if \(\alpha <\bar{\alpha }\). This yields a lower high-growth BGP rate, which is compensated by an increase in the BGP growth rate at the low-growth equilibrium.Footnote 26 Therefore, the government may play an important role in stabilizing growth rates under multiple equilibria.

Change in the stability of the high-growth equilibrium along a smooth path where \(\tau\) increases. Parameter values are reported in Table 1 and \(\beta =5\). The vertical dashed lines delimit different stability regions of the equilibrium

From Fig. 15, we observe that a smooth increase in taxes bears the same qualitative implications as increases in \(\beta\) or \(\gamma\). First, it would shift the economy from a monotonic path (region 1) converging on high-growth (recall Table 1) towards an oscillating one (region 2), with a lower high-growth rate at the BGP. If the government increases taxes further, it may lead to a point where high-growth becomes unstable and the economy converges along the stable-arm towards a low growth equilibrium (region 3) that is higher than the initial one. Finally, if \(\tau >\tau _c\), the two equilibria collide and disappear and there is no BGP.

We thus conclude that, under multiple equilibria, governments may be effective at stabilizing growth through the creation of public goods. As mentioned before, stabilizing growth in the present context corresponds either to reducing the gap between growth rates or placing the economy on monotonic instead of oscillatory convergence. From a social point of view, such stabilization may or may not be desirable. For a normative analysis, a criterion would have to be defined to analyze social welfare along the different transition paths.

About this article

Cite this article

Gaspar, J., Garrido-da-Silva, L., Vasconcelos, P.B. et al. Local and global indeterminacy and transition dynamics in a growth model with public goods. Port Econ J 22, 271–314 (2023). https://doi.org/10.1007/s10258-022-00216-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10258-022-00216-z

Keywords

- Growth

- Public goods

- Local and global indeterminacy

- Local and global transition dynamics

- Non-separable utility