Abstract

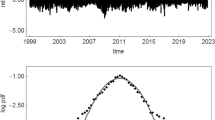

This paper analyzes the stability and fluctuations of the exchange rate with a speculative bubble using the methods of evolutionary finance and stochastic differential equations. It constructs a hybrid stochastic system for the financial market involving a discrete time process and a continuous time process. The discrete process models the bubble and is meant to capture the behavior of less sophisticated investors who trade infrequently. The continuous time process is a stochastic differential equation for monetary policy together with a backward stochastic equation for the exchange rate. Monetary policy is affected by the bubble and in turn affects the exchange rate as well as speculation. The bubble and exchange rate exhibit a form of bifurcation. This means the bubble and exchange rate experience fluctuations as the propensity to chase trends or switch predictors changes.

Similar content being viewed by others

References

Abhyankar A., Sarno L., Valente G.: Exchange rates and fundamentals: evidence on the economic value of predictability. J. Int. Econom. 66, 325–348 (2005)

Antonelli F.: Backward-forward stochastic differential equations. Ann. Appl. Probab. 3, 777–793 (1993)

Arnold L.: Random Dynamical Systems. Springer, New York (1998)

Berglund N., Gentz B.: Pathwise description of dynamic pitchfork bifurcations with additive noise. Probab. Theory Relat. Fields 122, 341–388 (2002)

Brock W., Hommes C.: Heterogeneous beliefs and routes to chaos in a simple asset pricing model. J. Econ. Dyn. Control 22, 1235–1274 (1998)

Brock, W., Hommes, C.: Models of complexity in economics and finance. In: Hanzon, B., Heij, C., Praagman, C., Schumacher, J.M. (eds.) System Dynamics in Economic and Financial Models, pp. 3–34. Wiley, New York

Brock W., Hommes C., Wagener F.: Evolutionary dynamics in markets with many trading types. J. Math. Econom. 41, 7–42 (2005)

Chiarella C., He X.Z., Wang D., Zheng M.: The stochastic bifurcation behaviour of speculative financial markets. Phys. A 387, 3837–3846 (2008)

Chiarella C., He X.Z., Zheng M.: The analysis of the effect of noise in a heterogeneous agent financial market model. J. Econ. Dyn. Control 35, 148–162 (2011)

Clarida R.H., Sarno L., Taylor M.P., Valente G.: The out of sample success of term structure models as exchange rate predictors. J. Int. Econom. 60, 61–83 (2003)

Crauel H., Flandoli F.: Additive noise destroys pitchfork bifurcation. J. Dyn. Differen. Equat. 10, 259–274 (1998)

Flood R., Garber P.: A model of stochastic process switching. Econometrica 51, 537–551 (1983)

Follmer H., Horst U., Kirman A.: Equilibria in financial markets with heterogeneous agents: a probabilistic perspective. J. Math. Econom. 41, 123–155 (2005)

Freidlin M., Wentzell A.: Random Perturbations of Dynamical Systems. Springer, New York (1998)

Gagnon G.: Exchange rate fluctuations in an economy with noise traders. J. Macroeconomics 26, 33–45 (2004)

Golderis B., Ioannidou V.P.: Do high interest rates defend currencies during speculative attacks? New evidence. J. Int. Econom. 69, 158–169 (2008)

Hu Y., Yong J.: Forward-backward stochastic differential equations with nonsmooth coefficients. Stochastic Processes Appl. 87, 93–106 (2000)

Ikeda S., Shibata A.: Fundamentals, uncertainty bubbles and exchange rate dynamics. J. Int. Econom. 38, 199–223 (1995)

Kabanov Y., Pergamenshchikov S.: Two Scale Stochastic Systems. Springer, New York (2003)

Lux T., Schornstein S.: Genetic learning as an explanation of stylized facts of foreign exchange markets. J. Math. Econom. 41, 169–196 (2005)

Mark N.C., Sol D.: Nominal exchange rates and monetary fundamentals: evidence from a small post Bretton Woods sample. J. Int. Econom. 53, 29–52 (2001)

Meese R.A., Rogoff K.: Empirical exchange rate models of the seventies: do they fit out of sample?. J. Int. Econom. 14, 3–24 (1983)

Miller M., Zhang L.: Optimal target zones: how an exchange rate mechanism can improve on discretion. J. Econom. Dyn. Control 20, 164–186 (1996)

Mohammed S.-E.A., Scheutzow M.: Lyapunov exponents of linear stochastic functional differential equations. Part 2. Examples and case studies. Ann. Probab. 25, 1210–1240 (1997)

Peng S., Shi Y.: Infinite horizon forward-backward stochastic differential equations. Stochastic Processes Appl. 85, 75–92 (2000)

Protter P.: Stochastic Integration and Differential Equations: A New Approach. Springer, New York (1990)

Rapach D., Wohar M.: Testing the monetary model of exchange rate determination: new evidence from a century of data. J. Int. Econom. 58, 359–385 (2002)

Schenk-Hoppé K.R.: Bifurcation scenerios of the noisy Duffing-van der Pol oscillator. Nonlinear Dyn. 11, 255–274 (1996)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Gagnon, G. Exchange rate bifurcation in a stochastic evolutionary finance model. Decisions Econ Finan 35, 29–58 (2012). https://doi.org/10.1007/s10203-011-0113-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10203-011-0113-3