Abstract

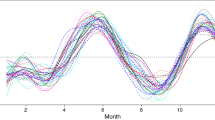

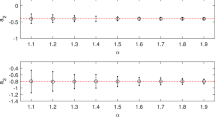

We show that the ordinary least squares (OLS) estimates of population parameters for Markov switching vector autoregressive (MS VAR) models coincide with the maximum likelihood estimates. Then, we propose an algorithm in matrix form for the estimation of model parameters, and derive an explicit expression in closed-form for the asymptotic covariance matrix of the OLS estimator of such models. The obtained characterization of the asymptotic variance is new to our knowledge. It is easier to program than the usual approach based on second derivatives, and more accurate. Our theorems generalize the classical results known for a linear VAR process, and complete those existing in the literature on the estimation of the asymptotic covariance matrix for multivariate stationary time series. Numerical simulations are provided to illustrate the obtained theoretical results. Finally, an application on energy use and economic growth in the Euro area gives some insights on the nonlinear nature of the corresponding time series, and reproduces the major stylized facts.

Similar content being viewed by others

References

Albert, J.H., Chib, S.: Bayes inference via Gibbs sampling of autoregressive time series subject to Markov mean and variance shifts. J. Bus. Econ. Stat. 11(1), 1–15 (1993)

Baggenstoss, P.M.: A modified Baum-Welch algorithm for hidden Markov models with multiple observation spaces. IEEE Trans. Speech Audio Process. 9(4), 411–416 (2001)

Bao, Y., Hua, Y.: On the Fisher information matrix of a vector ARMA process. Econ. Lett. 123, 14–16 (2014)

Billio, M., Monfort, A., Robert, C.P.: Bayesian estimation of switching ARMA models. J. Econom. 93, 229–255 (1999)

Cavicchioli, M.: Spectral density of Markov-switching VARMA models. Econ. Lett. 121, 218–220 (2013)

Cavicchioli, M.: Determining the number of regimes in Markov-switching VAR and VMA models. J. Time Ser. Anal. 35(2), 173–186 (2014a)

Cavicchioli, M.: Analysis of the likelihood function for Markov switching VAR(CH) models. J. Time Ser. Anal. 35(6), 624–639 (2014b)

Cavicchioli, M.: Higher order moments of Markov switching VARMA models. Econom. Theory 33(6), 1502–1515 (2017a)

Cavicchioli, M.: Asymptotic Fisher information matrix of Markov switching VARMA models. J. Multivar. Anal. 157, 124–135 (2017b)

Cheng, J.: Spectral density of Markov switching models: derivation, simulation studies and application. Model Assist. Stat. Appl. 11(4), 277–291 (2016)

Chib, S.: Calculating posterior distributions and model estimates in Markov mixture models. J. Econom. 75, 79–97 (1996)

Douc, R., Moulines, É., Ryden, T.: Asymptotic properties of the maximum likelihood estimator in autoregressive models with Markov regime. Ann. Stat. 32(5), 2254–2304 (2004)

Fernández-Villaverde, J., Rubio-Ramirez, J., Sargent, T., Watson, M.: ABCs (and Ds) of understanding VARs. Am. Econ. Rev. 97, 1021–1026 (2007)

Filardo, A.J.: Business-cycle phases and their transitional dynamics. J. Bus. Econ. Stat. 12(3), 299–308 (1994)

Francq, C., Zakoïan, J.M.: Stationarity of multivariate Markov switching ARMA models. J. Econom. 102, 339–364 (2001)

Goldfeld, S.M., Quandt, R.E.: A Markov model for switching regressions. J. Econom. 1, 3–16 (1973)

Hahn, M., Frühwirth-Schnatter, S., Sass, J.: Estimating models based on Markov jump processes given fragmented observation series. AStA Adv. Stat. Anal. 93(4), 403–425 (2009)

Hamilton, J.D.: A new approach to the economic analysis of nonstationary time series and the business cycle. Econometrica 57, 357–384 (1989)

Hamilton, J.D.: Analysis of time series subject to changes in regime. J. Econom. 45, 39–70 (1990)

Hamilton, J.D.: Time Series Analysis. Princeton University Press, Princeton, N.J. (1994)

Hamilton, J.D.: Specification testing in Markov switching time series models. J. Econom. 70, 127–157 (1996)

Hamilton, J.D.: Macroeconomic regimes and regime shifts. In: Taylor, J.B., Uhlig, H. (eds) Handbook of Macroeconomics, Elsevier vol. 2, pp. 163–201 (2016)

Ioannidis, E.E.: Spectra of bivariate VAR(p) models. J. Stat. Plan. Inference 137, 554–566 (2007)

Karamé, F.: Asymmetries and Markov-switching structural VAR. J. Econ. Dyn. Control 53, 85–102 (2015)

Kim, C.J.: Dynamic linear models with Markov switching. J. Econom. 60, 1–22 (1994)

Kim, C.J., Nelson, C.R.: Has the U.S. economy become more stable? A Bayesian approach based on a Markov-switching model of the Business Cycle. Rev. Econ. Stat. 81(4), 608–619 (1999)

Kim, C.J., Piger, J., Startz, R.: Estimation of Markov regime-switching regression models with endogenous switching. J. Econom. 143, 263–273 (2008)

Krolzig, H.M.: Markov-switching Vector Autoregressions: Modelling, Statistical Inference and Application to Business Cycle Analysis. Springer–Verlag, Berlin–Heidelberg–New York. (1997)

Janczura, J., Weron, R.: Efficient estimation of Markov regime-switching models: An application to electricity spot prices. AStA Adv. Stat. Anal. 96(3), 385–407 (2012)

Janczura, J., Weron, R.: Goodness-of-fit testing for the marginal distribution of regime-switching models with an application to electricity spot prices. AStA Adv. Stat. Anal. 97(3), 239–270 (2013)

Lanne, M., Lütkepohl, H., Maciejowska, K.: Structural vector autoregressions with Markov switching. J. Econ. Dyn. Control 34(2), 121–131 (2010)

Lee, C.C., Chang, C.P.: The impact of energy consumption on economic growth: evidence from linear and nonlinear models in Taiwan. Energy 32, 2282–2294 (2007)

Lütkepohl, H.: New Introduction to Multiple Time Series Analysis. Springer Verlag, Berlin-Heidelberg-New York (2007)

Newton, H.J.: The information matrices of the parameters of multiple mixed time series. J. Multivar. Anal. 8, 317–323 (1978)

Pataracchia, B.: The Spectral Representation of Markov Switching ARMA Models. Econ. Lett. 112, 11–15 (2011)

Seifritz, W., Hodgkin, J.: Nonlinear dynamics of the per capita energy consumption. Energy 16, 615–620 (1991)

Sims, C.A.: Macroeconomics and reality. Econometrica 48, 1–48 (1980)

Sims, C.A., Waggoner, D.F., Zha, T.: Methods for inference in large multiple-equation Markov-switching models. J. Econom. 146, 255–274 (2008)

Sims, C.A., Zha, T.: Were there regime switches in U.S. Monetary Policy? Am. Econ. Rev. 96, 54–81 (2006)

Stelzer, R.: On Markov-switching ARMA processes-stationarity, existence of moments and geometric ergodicity. Econom. Theory 25(1), 43–62 (2009)

Ubierna, A., Velilla, S.: A goodness-of-fit process for ARMA(p, q) models based on a modified residual autocorrelation sequence. J. Stat. Plan. Inference 137, 2903–2919 (2007)

Velilla, S., Thu, H.N.: A goodness-of-fit test for VARMA(p, q) models. J. Stat. Plan. Inference 197, 126–140 (2018)

Wang, J., Zivot, E.: A Bayesian time series model of multiple structural changes in level, trend, and variance. J. Bus. Econ. Stat. 18(3), 374–386 (2000)

Whittle, P.: The analysis of multiple stationary time series. J. R. Stat. Soc. Ser. B 15, 125–139 (1953)

Wong, C.S., Li, W.K.: On a mixture autoregressive model. J. R. Stat. Soc. B62, 95–115 (2000)

Yang, M.: Some properties of vector autoregressive processes with Markov-switching coefficients. Econom. Theory 16, 23–43 (2000)

Yang, H., He, G.: Some properties of matrix product and its applications in nonnegative tensor decomposition. J. Inform. Comput. Sci. 3(4), 269–280 (2008)

Acknowledgements

Work financially supported by FAR research Grant (2019) of the University of Modena and Reggio Emilia, Italy. The author would like to thank the Editor-in-Chief of the journal, Professor Yarema Okhrin, and two anonymous reviewers for their valuable and constructive comments which improved the final version of the paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Derivation of (3).

Derivation of (7).

The first derivative of \(J({{\varvec{\theta }}})\) with respect to \(\pi _m\) gives

hence

Summing up over \(m = 1, \dots , M\), produces

Now Equation (7) follows. Finally, we have \( {\text {plim}}_{T \rightarrow \infty } \, {{\hat{\pi }}}_m \, = \, E(\xi _{m t | T}) \, = \, \pi _m, \) for all \(m \in \Xi \). This proves the consistency of \({\hat{\pi }}_m\).

Derivation of (9).

Taking the first derivative of \({\text {SSE}}_T\) with respect to \({\varvec{\beta }}_m\) gives

hence

or equivalently

Since \({\mathbf{X}}_{m T}\) is invertible, we get

which gives (9). Since

is positive definite, the OLS estimates \({\hat{\varvec{\beta }}}_m \) is a minimizer of the function \({\text {SSE}}_T\) for every \(m = 1, \dots , M\).

Derivation of (10).

Derivation of (11).

Using (2) for \(s_t = m\) with \({{\varvec{\epsilon }}}_{t m} \, = \, {\varvec{\Sigma }}_m \, {\mathbf{u}}_t\), we get

Proof of Theorem 2

Consistency of \({\hat{\varvec{\beta }}}_m \).

where \( {\mathbf{Q}}_{m}^{- 1} \otimes {\mathbf{I}}_K\) is finite by (12). Now, the second summand vanishes. In fact, we have

as \(E({\mathbf{u}}_t) = {{\varvec{0}}}\). Here, we use the fact that \({\mathbf{u}}_t\) is independent of \(s_t\), and hence \({\varvec{\xi }}_{t | T}\). The claim follows.

Consistency of \({\hat{\varvec{\Omega }}}_m \).

Since \({\text {plim}}_{T \rightarrow \infty } \, {\hat{\varvec{\beta }}}_m \, = \, {{\varvec{\beta }}}_m \), it follows that

as \({\mathbf{u}}_t\) is independent of \(s_t\) (and hence \({\varvec{\xi }}_{t | T})\), \(E({\mathbf{u}}_t \, {\mathbf{u}}_{t}^{'}) = {\mathbf{I}}_K\), and \(E(\xi _{m t}) = \pi _m\), for every \(m = 1, \dots , M\).

Derivation of (13).

We have to prove that the process \(\{({\mathbf{x}}_t \otimes {\mathbf{I}}_K)\, {\varvec{\Sigma }}_m \, {\mathbf{u}}_t \, \xi _{m t | T}\}\) has zero mean and asymptotic covariance matrix \({\mathbf{Q}}_m \otimes {\varvec{\Omega }}_m\). For the mean, see the proof of consistency of \({\hat{\varvec{\beta }}}_m \) given above. For the variance, we have

Here, we use the fact that \({\mathbf{u}}_t\) is independent of \(s_t\), and hence \(\xi ^{2}_{m t | T}\). Furthermore, \(E({\mathbf{u}}_t \, {\mathbf{u}}^{'}_{t}) = {\mathbf{I}}_K\) and \(E(\xi ^{2}_{m t | T} | {\mathbf{Y}}_T) = E(\xi _{m t | T}| {\mathbf{Y}}_T)\) as \(E(\xi ^{2}_{m t}) = E(\xi _{m t}) = \pi _m\), for every \(m = 1, \dots , M\). \(\square \)

Rights and permissions

About this article

Cite this article

Cavicchioli, M. OLS Estimation of Markov switching VAR models: asymptotics and application to energy use. AStA Adv Stat Anal 105, 431–449 (2021). https://doi.org/10.1007/s10182-020-00383-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10182-020-00383-4