Abstract

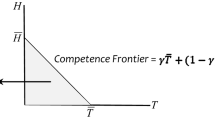

Bureaucratic personnel policy influences agency performance by affecting both the types of bureaucrats who are selected for employment and the actions that bureaucrats take. An effective policy selects intrinsically motivated bureaucrats for promotion or retention and provides incentives for bureaucrats to exert a high level of effort. I investigate a retention and promotion policy used in a number of U.S. government agencies in which only a previously specified percentage of bureaucrats in a cohort are retained after one period. The proportion of bureaucrats retained after a review is referred to as a “selection rate”. Using a formal model, I show that the adoption of a selection rate facilitates the separation of intrinsically motivated and unmotivated bureaucrats where they would otherwise pool, allowing bureaucratic personnel managers to screen out unmotivated bureaucrats. Effective screening by itself, however, is not welfare-enhancing because screening removes unmotivated bureaucrats’ incentives to exert effort. Compared to alternative welfare-reducing screening mechanisms which bring about screening through monitoring or wage policy, selection rates facilitate welfare-enhancing screening by inducing motivated types to exert additional effort in order to distinguish themselves from unmotivated bureaucrats. I find that selection rates are most effective where material or ego rents from government employment are high and where the policy rewards that motivated bureaucrats realize are low. These properties of selection rates explain their adoption in several U.S. government agencies’ personnel systems, most notably the military officer corps.

Similar content being viewed by others

Notes

Throughout the paper I refer to the principal with a female pronoun and the agent with a male pronoun.

A natural extension of the single-agent model presented in this paper is to consider a continuum of agents or a continuous type space.

The results of the model are fundamentally unchanged but less parsimonious if class three and four equilibria are considered.

If the decision to acquire expertise is formally incorporated into the model, this result holds in all equilibria. A similar result obtains in Gailmard and Patty (2007) where only bureaucrats who will be able to benefit from their expertise in the second period acquire expertise.

When \(a_1^m = s(1)\), a difference in payoff prevails if the equilibrium under no selection rate is pooling. If the equilibrium is separating without a selection rate, the principal is no better or worse off when a selection rate is adopted.

References

Ashworth S (2005) Reputational dynamics and political careers. J Law Econ Organ 21(2):441–466

Banks JS, Sundaram RK (1998) Optimal retention in agency problems. J Econ Theory 82(2):293–323

Banuri S, Keefer P (2016) Pro-social motivation, effort, and the call to public service. Eur Econ Rev 83:139–164

Barro R (1973) The control of politicians: an economic model. Public Choice 14(1):19–42

Benabou R, Tirole J (2003) Intrinsic and extrinsic motivation. Rev Econ Stud 70(3):489–520

Besley T (2006) Principled agents? The political economy of good government. Oxford University Press, Oxford

Brehm J, Gates S (1999) Working, shirking, and sabotage: bureaucratic response to a Democratic Public. University of Michigan Press, Ann Arbor

Cho IK, Kreps D (1987) Signaling games and stable equilibria. Q J Econ 102(2):179–222

Coate S, Morris S (1995) On the form of transfers to special interests. J Polit Econ 103(6):1210–1235

Cowen T, Glazer A (1996) More monitoring can induce less effort. J Econ Behav Organ 30(1):113–123

Dal Bo E, Finan F, Rossi M (2013) Strengthening state capabilities: the role of financial incentives in the call to public service. Q J Econ 128(3):1169–1218

Downs A (1967) Inside bureaucracy. Little, Brown, Boston

Fearon J (1999) Electoral accountability and the control of politicians: selecting good types versus sanctioning poor performance. In: Przeworski A, Stokes S, Bernard M (eds) Democracy, accountability, and representation. Cambridge University Press, New York

Ferejohn J (1986) Incumbent performance and electoral control. Public Choice 50(1–3):5–26

Fox J, Van Weelden R (2012) Costly transparency. J Public Econ 96(1–2):142–150

Gailmard S, Patty J (2007) Slackers and zealots: civil service, policy discretion, and bureaucratic expertise. Am J Polit Sci 51(4):873–889

Gailmard S, Patty J (2013) Learning while governing: expertise and accountability in the executive branch. University of Chicago Press, Chicago

Gavazza A, Lizzeri A (2007) The perils of transparency in bureaucracies. Am Econ Rev 97(2):300–305

Ghosh S, Waldman M (2010) Standard promotion practices versus up-or-out contracts. RAND J Econ 41(2):301–325

Gibbons R (1998) Incentives in organizations. J Econ Perspect 12(4):115–132

Golden M (2000) What motivates bureaucrats? Politics and administration during the Reagan Years. Columbia University Press, New York

Kahn C, Huberman G (1988) Two-sided uncertainty and ‘up-or-out’ contracts. J Labor Econ 6(4):423–444

Levy G (2007) Decision making in committees: transparency, reputation, and voting rules. Am Econ Rev 97(1):150–168

Maskin E, Tirole J (2004) The politician and the judge: accountability in government. Am Econ Rev 94(4):1034–1054

Naff K, Crum J (1999) Working for America: does public service motivation make a difference? Rev Public Pers Adm 19(4):5–16

Parcell A, Kraus A (2010) Recommendations from the CNGR implementation plan: exploring the requirements of DOPMA and ROPMA. CNA, Arlington

Perry J (2000) Bringing society in: toward a theory of public service motivation. J Public Adm Res Theory 10(2): 471–488

Prat A (2005) The wrong kind of transparency. Am Econ Rev 95(3):862–877

Prendergast C (1993) The role of promotion in inducing specific human capital aquisition. Q J Econ 108(2):523–534

Prendergast C (2007) The motivation and bias of bureaucrats. Am Econ Rev 97(1):180–196

Rostker B, Thie H, Lact J, Kawata J, Purnell S (1993) The defense officer personnel management act of 1980. RAND Corporation, Santa Monica

Rothstein J (2015) Teacher quality policy when supply matters. Am Econ Rev 105(1):100–130

Schirmer P, Thie H, Harrell M, Tseng M (2006) Challenging time in DOPMA: flexible and contemporary military officer management. RAND Corporation, Santa Monica

Spain E, Mohundro J, Banks B (2015) Intellectual capital: a case for cultural change. US Army War Coll Q Parameters 45(2):77–92

Staiger D, Rockoff J (2010) Searching for effective teachers with imperfect information. J Econ Perspect 24(3):97–117

Vandenabeele W (2007) Toward a public administration theory of public service motivation. Public Manag Rev 9(4):545–556

Visser B, Swank O (2007) On committees of experts. Q J Econ 122(1):337–372

Waldman M (1990) Up-or-out contracts: a signaling perspective. J Labor Econ 8(2):230–250

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Proposition 1

Second-period unique equilibrium bureaucrat actions and the principal’s best response are derived in the main text by backward induction. I first show existence of the class of pooling equilibrium for \(a_1^m \le s\). In the proposed equilibrium, \(a_1^s = a_1^z = a_1^m\). By Bayes’ rule, \(\bar{\lambda } = \lambda \) after \(a_1 = a_1^m\). The bureaucrat is retained given the principal’s best response: \(\frac{v(a_1^m)}{v(a_2^m)} < 1\). The zealot globally maximizes his first-period policy payoff in equilibrium. Therefore there exists no profitable deviation for the zealot for any off-path belief. Moreover, all other levels of effort are equilibrium dominated since any \(a_1 \ne a_1^m\) strictly lowers his policy payoff.

For the slackers, because \(a_1^m \le s\), the slacker cannot profitably deviate to any \(a_1 \ne a_1^m\) that results in his firing. For any \(a_1 > a_1^m\) where \(\bar{\lambda }\) is sufficiently high to ensure retention, the slacker prefers the equilibrium action because this imposes a lower cost of effort on him while still resulting in his retention. Therefore all \(a_1 > a_1^m\) are equilibrium dominated for the slacker. Any \(a_1 < a_1^m\), however, is not equilibrium dominated. Were \(\bar{\lambda }\) sufficiently high following \(a_1 < a_1^m\), the slacker would have a profitable deviation. Because all \(a_1 < a_1^m\) are equilibrium dominated for the zealot but not for the slacker, the intuitive criterion rules out all \(\bar{\lambda } \ne 0\) following \(a_1 < a_1^m\). Therefore there does not exist a profitable deviation for the slacker to \(a_1 < a_1^m\). For \(a_1 > a_1^m\), all \(\bar{\lambda }\) are consistent with equilibrium.

I now show existence of the class of separating equilibrium for \(a_1^m \ge s\). In equilibrium, \(a_1^s = 0\) and \(a_1^z = a_1^m\). After \(a_1 = 0\), \(\bar{\lambda } = 0\) by Bayes’ rule. After \(a_1 = a_1^m\), \(\bar{\lambda } = 1\) by Bayes’ rule. The argument above establishes that there is no profitable deviation for the zealot and that all other \(a_1 \ne a_1^m\) are equilibrium dominated for him. For the slacker, all \(a_1 > s\) are strictly dominated by \(a_1 = 0\). Even if he were to be retained following \(a_1 > s\), the cost of exerting effort exceeds the benefit of second-period employment. He is therefore better off in equilibrium where he does not exert this cost and earns no second-period payoff. If \(a_1^m = s\), his deviation payoff is the same as his equilibrium payoff, yielding him no profitable deviation. All \(a_1 < s\) are not equilibrium dominated for the slacker. By the intuitive criterion, all beliefs other than \(\bar{\lambda } = 0\) are therefore ruled out after \(a_1 < s\). Therefore there does not exist a profitable deviation for the slacker to \(a_1 < s\). For \(a_1 > s\), all \(\bar{\lambda }\) off path are consistent with equilibrium.

There exist two other classes of equilibria under the intuitive criterion. First, if \(a_1^m < s\), there exist equilibria in which \(a_1^z = s\) and \(a_1^s = 0\). The slacker has no profitable deviation to \(a_1 \ge s\) and no profitable deviation to \(a_1 < s\) for sufficiently punishing beliefs of path. The zealot has no profitable deviation to \(a_1 > s\) since \(a_1^m < s\). Both types could profitably deviate to some \(a_1 \in (\tilde{s}, s)\) if there exists a point in the interval where \(\bar{\lambda }\) were sufficiently high to ensure retention. The intuitive criterion therefore does not restrict beliefs on this interval, allowing sufficiently punishing beliefs to sustain these equilibrium first-period actions. All \(a_1 < \tilde{s}\) are equilibrium dominated for the zealot. Since the slacker prefers to exert as little effort as possible, all beliefs other than \(\bar{\lambda } = 0\) after \(a_1 < \tilde{s}\) are ruled out by the intuitive criterion. For \(a_1 = \tilde{s}\), sufficiently punishing off-path beliefs are required to prevent a deviation by the slacker. The intuitive criterion does not restrict beliefs at \(a_1 = \tilde{s}\) because the zealot’s equilibrium payoff and out of equilbrium payoff are the same after \(a_1 = \tilde{s}\) for sufficiently generous beliefs.

Second, if \(a_1^m < s\), there exist equilibria with \(a_1^z \in (a_1^m, s]\) and \(a_1^s = a_1^z\). The slacker has no profitable deviation to \(a_1 > a_1^z\) for any beliefs and no profitable deviation to \(a_1 < a_1^z\) for sufficiently punishing beliefs. The zealot has no profitable deviation to \(a_1 > a_1^z\) since \(a_1^m < a_1^z\). Both types could profitably deviate to some \(a_1 \in (\tilde{a}_1^z, a_1^z)\) if there exists a point in the interval where \(\bar{\lambda }\) were sufficiently high to ensure retention. The intuitive criterion therefore does not restrict out of equilibrium beliefs on this interval. Sufficiently punishing beliefs on the interval are to sustain equilibrium. Since \(a_1 < \tilde{a}_1^z\) are equilibrium dominated for the zealot, the intuitive criterion requires \(\bar{\lambda } = 0\) after \(a_1 < \tilde{a}_1^z\). For \(a_1 = \tilde{s}\), sufficiently punishing off-path beliefs are required to prevent a deviation by the slacker. The intuitive criterion does not restrict beliefs at \(a_1 = \tilde{a}_1^z\) because the zealot’s equilibrium payoff and out of equilbrium payoff are the same after \(a_1 = \tilde{s}\) for sufficiently generous beliefs.

To show that these four classes of equilibria are the only classes of equilibria in pure strategies, consider an equilibrium in which \(a_1^s \notin \lbrace 0, a_1^z \rbrace \). Equilibrium requires that \(\bar{\lambda } = 0\) after \(a_1 = a_1^s\). The slacker is fired in equilibrium. Therefore there is always a profitable deviation to \(a_1 = 0\) even with maximally punishing off-path beliefs: the slacker prefers to exert no effort and be fired rather than exert effort and be fired. Therefore all \(a_1^s \notin \lbrace 0, a_1^z \rbrace \) can be ruled out.

First consider the case in which \(a_1^m > s\). Suppose in equilibrium \(a_1^z \ne a_1^m\) and \(a_1^s = 0\). If \(a_1^z < s\), there exists a profitable deviation by the slacker to \(a_1^z\). If \(a_1^z \in [s, a_1^m)\), then \(a_1^z + \epsilon \) equilibrium dominates \(a_1^z\) for the zealot. Since \(a_1^z + \epsilon \) is equilibrium dominated for the slackers, the intuitive criterion requires that \(\bar{\lambda } = 1\) after \(a_1^z + \epsilon \). Therefore the zealot has a profitable deviation. If \(a_1^z > a_1^m\), then an analogous argument establishes that a profitable deviation exists for the zealot to \(a_1^z - \epsilon \). Now suppose that \(a_1^z \ne a_1^m\) and \(a_1^s = a_1^z\). If \(a_1^z > s\), a profitable deviation for the slacker to 0 exists. If \(a_1^z \le s\), then \(s + \epsilon \) equilibrium dominates \(a_1^z\) for the zealot while \(s+\epsilon \) is equilibrium dominated by \(a_1^z\) for the slacker. The intuitive criterion requires that \(\bar{\lambda } = 1\) after \(s+\epsilon \). The zealot therefore has a profitable deviation.

Now consider the case in which \(a_1^m = s\). Suppose that in equilibrium \(a_1^z \ne a_1^m = s\) and \(a_1^s = 0\). If \(a_1^z < s\), then a profitable deviation exists for the slacker to \(a_1^z\). If \(a_1^z > s\), then \(a_1^z - \epsilon \) equilibrium dominates \(a_1^z\) for the zealot while being equilibrium dominated by 0 for the slacker. By the intuitive criterion, \(\bar{\lambda } = 1\) after \(a_1^z - \epsilon \). Therefore a profitable deviation exists for the zealot. Now suppose that \(a_1^z \ne a_1^m = s\) and \(a_1^s = a_1^z\). If \(a_1^z > s\), a profitable deviation to 0 exists for the slacker. If \(a_1^z < s\), \(a_1^z + \epsilon \) equilibrium dominates \(a_1^z\) for the zealot but is equilibrium dominated by \(a_1^z\) for the slacker. By belief restrictions under the intuitive criterion, a profitable deviation to \(a_1^z +\epsilon \) exists for the zealot.

Finally, consider the case in which \(a_1^m < s\). Suppose that in equilibrium \(a_1^z < a_1^m\) and \(a_1^s = 0\). A profitable deviation exists for the slacker to \(a_1^z\). Now suppose that in equilibrium \(a_1^z < a_1^m\) and \(a_1^s = a_1^z\). In this equilibrium, \(a_1^z + \epsilon \) equilibrium dominates \(a_1^z\) for the zealot but is equilibrium dominated by \(a_1^z\) for the slacker. Therefore this cannot be an equilibrium under the intuitive criterion. The principal must assign \(\bar{\lambda } = 1\) to \(a_1^z + \epsilon \) which gives the zealot a profitable deviation. Finally, suppose that \(a_1^z \in [a_1^m, s)\) and \(a_1^s = 0\) in equilibrium. The slacker has a profitable deviation to \(a_1^z\) which rules out this equilibrium. This exhausts all possible equilibrium actions other than those specified in the equilibria that have been show to exist. \(\square \)

Proof of Corollary 1

Proposition 1 directly establishes existence of class one, three, and four equilibria when \(a_1^m < s\). The zealot is retained in all classes of equilibria. Therefore the difference in payoff to the zealot across equilibria arises only from variation in first-period policy utility. In all class one equilibria, the zealot globally maximizes his policy payoff by selecting his preferred amount of effort. In all class three and four equilibria, he exerts a strictly greater level of effort than his preferred amount. Therefore his payoff in all class one equilibria are greater than any payoff in class three and four equilibria. In all type one equilbria for \(a_1^m < s\), the slacker exerts a level of effort strictly less than that which makes him indifferent between mimicking the zealot to be retained and exerting no effort and being fired. He therefore earns a strictly positive payoff in all class one equilibria for \(a_1^m < s\). In all class three equilibria, he earns a payoff of zero. In all class four equilibria, the zealot achieves a strictly positive payoff but exerts greater effort to be retained than in a class one equilibrium. Therefore when \(a_1^m < s\), the slacker earns a strictly greater payoff in a class one equilibrium than in any class three or four equilibrium. \(\square \)

Proof of Proposition 2

By adopting a monitoring technology, both types myopically optimize in both periods and separate. The principal’s expected payoff from adopting a technology is therefore \(\lambda v(a_1^m) + \lambda v(a_2^m) +(1-\lambda ) \lambda \delta v(a_1^m) - k\). If the principal does not adopt a monitoring technology, equilibrium is characterized by Proposition 1. If \(a_1^m < s\), the initial equilibrium is pooling by Proposition 1. The principal’s ex ante expected payoff in equilibrium is \(v(a_1^m) + \lambda \delta v(a_2^m)\). The difference in payoffs between not adopting and adopting when \(a_1^m < s\) is therefore \((1-\lambda ) (1-\lambda \delta )v(a_1^m) + k > 0\). If \(a_1^m > s\), both types separate without monitoring. The principal’s expected payoff is \(\lambda v(a_1^m) + \lambda \delta v(a_2^m) + (1-\lambda ) \lambda \delta v(a_1^m)\). The difference in payoff to the principal between not adopting and adopting the technology is therefore \(k \ge 0\). If \(a_1^m = s\), then both a separating equilibrium and a pooling equilibrium prevails without a monitoring technology. Her loss from adopting the monitoring technology is smallest when the two types separate in the absence of monitoring, \(k \ge 0\). \(\square \)

Proof of Corollary 2

Suppose there exists an equilibrium in which the principal adopts a selection rate. In equilibrium, her payoff is \(\lambda v(a_1^m) + \lambda \delta v(a_2^m) + (1-\lambda ) \lambda \delta v(a_1^m) - k\). From Propositions 1 and 2, her payoff from adopting a monitoring technology is strictly greater than her payoff from adopting a monitoring technology for all \(k > 0\). A profitable deviation to not adopting therefore exists for the principal. \(\square \)

Proof of Lemma 1

In equilibrium, types cannot pool on any \(a_1^z = a_1^s > s(\rho )\). A profitable deviation exists for the slacker from \(a_1^s\) to 0 for all beliefs by the definition of \(s(\rho )\).

Now consider a pooling equilibrium in which \(a_1^z = a_1^s \le s(\rho )\). In equilibrium, both types are retained only with probability \(\rho \). The slacker’s payoff in equilibrium is \(-c(a_1) + \delta \rho R \ge 0\). Any \(a_1 < a_1^z\) equilibrium dominates \(a_1^z\) for the slacker. Because \(s(\rho ) < s(1)\) for all \(\rho < 1\), \(-c(a_1^z+\epsilon ) + \delta R > -c(a_1^z) + \delta \rho R\). Because \(c(\cdot )\) is continuous and \(-c(s(1)) + \delta R = 0\), there exists some \(a_1^\prime \in [a_1^z, s(1)]\) such that \(-c(a_1^z) + \delta \rho R = -\,c(a_1^\prime ) + \delta R\). All \(a_1 \in (a_1^z, a_1^\prime )\) equilibrium dominate \(a_1^z\) for the slacker. All \(a_1 > a_1^\prime \) are equilibrium dominated by \(a_1^z\) for the slacker.

The zealot’s equilibrium payoff is \(v(a_1^z) - c(a_1^z) + \delta \rho R + \delta \rho W\). Because \(v(\cdot )\) is strictly increasing, \(v(a_1^\prime + \epsilon ) > v(a_1^z)\). For all \(\rho < 1\), \(\delta W > \delta \rho W\). Since \(-c(a_1^z) + \delta \rho R \approx -c(a_1^\prime + \epsilon ) + \delta R\), \(a_1^\prime + \epsilon \) equilibrium dominates \(a_1\) for the zealot. Therefore, by the intuitive criterion, the principal attaches \(\bar{\lambda } = 1\) to \(a_1^\prime + \epsilon \) which gives the zealot a profitable deviation. \(\square \)

Proof of Proposition 3

Lemma 1 establishes that all equilibria must be separating. In any separating equilibrium, the slacker exerts no effort.

First consider \(a_1^m < s(1)\). No \(a_1^z < s(1)\) can be an equilibrium action by the zealot. A profitable deviation exists for the slacker from such an equilibrium from \(a_1^s = 0\) to \(a_1^s = a_1^z\). No \(a_1^z > s(1)\) can be an equilibrium action either. The slacker can never benefit from choosing \(a_1 \in (s(1), a_1^z)\) even if \(\bar{\lambda } = 1\) at every point in the interval. The zealot on the other hand can benefit for sufficiently generous beliefs, as any \(a_1 \in (s(1), a_1^z)\) yields him greater first-period policy utility. By the intuitive criterion, the principal must assign \(\bar{\lambda } = 1\) after \(a_1 \in (s(1), a_1^z)\). Therefore a profitable deviation exists for the zealot to \(a_1^z - \epsilon \).

For \(a_1^z = s(1)\), no beliefs after \(a_1 > s(1)\) allow for a profitable deviation for either type as \(a_1^m < s(1)\). All \(a_1 \in (\tilde{s(1)}, s(1))\) equilibrium dominate for both types. The intuitive criterion therefore does not restrict off-path beliefs on this interval. If beliefs are sufficiently punishing on this interval, neither type has a profitable deviation. All \(a_1 < \tilde{s(1)}\) equilibrium dominate for the slacker and are equilibrium dominated for the zealot. By the intuitive criterion, \(\bar{\lambda } = 0\) after \(a_1 < \tilde{s(1)}\). This precludes a profitable deviation for the slacker. Finally, \(a_1 = \tilde{s(1)}\) equilibrium dominates for the slacker but neither equilibrium dominates nor is equilibrium dominated for the zealot. Sufficiently punishing beliefs after \(a_1 = \tilde{s(1)}\) prevent deviation by the slacker. An equilibrium with \(a_1^z = s(1)\) therefore exists if and only if beliefs are sufficiently punishing on \([\tilde{s(1)}, s(1))\).

For \(a_1^m > s(1)\), consider an equilibrium in which \(a_1^z < s(1)\). In this proposed equilibrium, a profitable deviation exists for the slacker to \(a_1^z\). Now consider an equilibrium in which \(a_1^z \ne a_1^m\) and \(a_1^z \ge s(1)\). No effort strictly dominates \(a_1^m\) for the slacker while \(a_1^m\) equilibrium dominates \(a_1^z\) for the zealot. Therefore by the intuitive criterion, \(\bar{\lambda } = 1\) after \(a_1^m\) which gives the zealot a profitable deviation. Now consider an equilibrium with \(a_1^z = a^1_m\). The zealot’s equilibrium payoff is strictly greater than any possible out-of-equilibrium payoff. Therefore \(a_1^m\) equilibrium dominates all \(a_1 \ne a_1^m\). For the slacker, all \(a_1 \in (0, s(1))\) equilibrium dominate 0 while 0 strictly dominates all \(a_1 > s(1)\). By the intuitive criterion, \(\bar{\lambda } = 0\) after \(a_1 < s(1)\) out of equilibrium and is free after \(a_1 \ge s(1)\). The slacker’s payoff at s(1) is weakly less than his equilibrium payoff for all possible beliefs. Therefore no profitable deviations exist for either type for all off-path beliefs that survive the intuitive criterion. Therefore the proposed equilibrium exists.

Finally, for \(a_1^m = s(1)\), \(a_1^z < s(1)\) cannot be an equilibrium as this allows a profitable deviation by the slacker. For \(a_1^z > s(1)\), \(a_1^z - \epsilon \) equilibrium dominates \(a_1^z\) for the zealot and is strictly dominated by no effort for the slacker. By the intuitive criterion, \(\bar{\lambda } = 1\) after \(a_1^z - \epsilon \). Therefore a profitable deviation to \(a_1^z - \epsilon \) exists for the zealot. For \(a_1^z = a_1^m\), the argument for the case of \(a_1^m > s(1)\) establishes that \(a_1^z = a_1^m\) with specified off-path is an equilibrium.\(\square \)

Proof of Lemma 2

By Propositions 1 and 3, adopting a selection rate leads to no change in the principal’s equilibrium payoff if \(a_1^m > s(1)\). If \(a_1^m \le s(1)\), her ex ante expected payoff without a selection rate in a pooling equilibrium is

by Proposition 1. With a selection rate, her ex ante expected payoff is

by Proposition 3. Rearranging and simplifying yields the condition. \(\square \)

Proof of Lemma 3

For \(a_1^m < s(1)\), \(\frac{v(s(1))}{v(a_1^m)} >1\). Let \(h(\lambda ) \equiv \frac{1-(1-\lambda )\lambda \delta }{\lambda }\). Note that \(\lim _{\lambda \rightarrow 0} h(\lambda ) = \infty \) and \(h(1) = 1\). The function \(h(\lambda )\) is also strictly decreasing on (0, 1) for all \(\delta \in [0,1]\): \(\frac{\partial h(\lambda )}{\partial \lambda } = \frac{\delta \lambda ^2 - 1}{\lambda ^2}\). Because \(h(\lambda )\) is continuous, there exists a unique \(\lambda \in (0,1)\) such that \(\frac{v(s(1))}{v(a_1^m)} = h(\lambda )\). Denote this with \(\hat{\lambda }\). For all \(\lambda > \hat{\lambda }\), the inequality in Lemma 2 is satisfied and for all \(\lambda \le \hat{\lambda }\) the inequality is not satisfied. Therefore the principal benefits from a selection rate only if \(\lambda > \hat{\lambda }\). For \(a_1^m \ge s(1)\), \(\frac{v(s(1))}{v(a_1^m)} \le 1\). Because \(h(\lambda ) > 1\) on (0, 1), there is no \(\lambda \le 1\) such that the inequality in Lemma 2 can be satisfied. \(\square \)

Proof of Proposition 4

By assumption, the principal only adopts a selection rate if it strictly benefits her. By Lemmas 2 and 3, the principal adopts a selection rate only when \(\lambda > \hat{\lambda }\) and \(a_1^m < s(1)\). Equilibrium bureaucrat actions and principal’s beliefs are established by Proposition 3. Also by assumption, class one equilibria in Proposition 1 prevail when \(a_1^m < s(1)\). For \(a_1^m < s(1)\) and \(\lambda \ge \hat{\lambda }\) and \(a_1^m \ge s(1)\), equilibrium bureaucrat actions, principal’s beliefs, and principal’s retention strategy are established by Proposition 1. \(\square \)

Proof of Proposition 5

From the proof of Lemma 3, \(\hat{\lambda }\) solves \(h(\lambda ) = \frac{v(s(1))}{v(a_1^m)}\). Recall that \(s(1) = c_{j=1}^{-1}(\delta R)\) where \(c^{-1}_{j=1}(\cdot )\) is strictly increasing, continuous, and concave. Therefore as R rises, s(1) rises. It was shown it the proof of Lemma 3 that \(h(\lambda )\) is strictly decreasing in \(\lambda \). Therefore as R rises, \(\hat{\lambda }\) must also rise to reestablish equality between \(h(\hat{\lambda })\) and \(\frac{v(s(1))}{v(a_1^m)}\). \(\square \)

Proof of Proposition 6

Follows immediately from Proposition 3. All equilibria in which a selection rate is adopted are separating. Zealots are retained and slackers are fired with probability one. When a selection rate is not adopted, zealots are retained with probability one in both separating and pooling equilibria. In the pooling equilibrium, slackers are retained.

\(\square \)

Rights and permissions

About this article

Cite this article

Gibbs, D. Selection rates and bureaucratic performance. Econ Gov 20, 159–181 (2019). https://doi.org/10.1007/s10101-018-0217-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10101-018-0217-0