Abstract

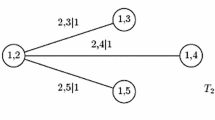

This paper investigates the structure of dependence among twelve European markets and among twelve Asian-Pacific markets. The dynamic of the dependence structure is described by a two-state regime switching model. The dependence structure during a bull phase is modelled by the Gaussian copula, while dependence during a bear phase is modelled by the regular vine copula. We analyze the regular vine structure in the second regime precisely. We perform a simplification procedure using a likelihood-ratio test and discuss the substitution of general regular vines by canonical vines or drawable vines. The analysis confirms the two-state nature of financial markets in addition to asymmetric and heavy-tailed dependences. Additionally, the European market has proven to be more strongly connected than the Asian-Pacific market, and European dependences are deeper in terms of conditional dependences. The results can be used by international investors by taking into account differences of both analyzed regions. Additionally, the analysis may help with the crisis prediction. The shift time to the market phase describing crisis times occurs significantly before the crisis itself.

Similar content being viewed by others

References

Aas K, Czado C, Frigessi A, Bakken H (2009) Pair-copula construction of multiple dependence. Insur Math Econ 44:182–198

Bedford T, Cooke R (2001) Probability density decomposition for conditionally dependent random variables modeled by vines. Ann Math Artif Intell 32:245–268

Bedford T, Cooke R (2002) Vines—a new graphical model for dependent random variables. Ann Stat 30:1031–1068

Billio N, Pelizzon L (2000) Value at risk: a multivariate switching regime approach. J Empir Finance 7:531–554

Brechmann EC, Czado C, Aas K (2012) Truncated regular vines in high dimensions with application to financial data. Can J Stat 40(1):68–85

Chollete L, Heinen A, Valdesogo A (2009) Modeling international financial returns with a multivariate regime-switching copula. J Financ Econom 7(4):437–480

Chollete L, Peña V, Luc C-C (2011) International diversification: a copula approach. J Bank Finance 35(2):403–417

Czado C, Jeske S, Hofmann M (2013) Selection strategies for regular vine copulae. J Soc Fr Stat 154(1):174–191

Föllmer H, Schied A (2011) Stochastic finance: an introduction in discrete time. Walter de Gruyter Berlin, New York

Ghalanos A (2014) rugarch: Univariate GARCH models, R package version 1.3-3. http://cran.r-project.org/web/packages/rugarch/index.html

Hamilton JD (1994) Time series analysis. Princeton Press, Princeton

Heinen A, Valdesogo A (2009) Asymmetric CAPM dependence for large dimensions: the canonical vine autoregressive model. CORE discussion papers 009069, Universite catholique de Louvain, Center for Operations Research and Econometrics (CORE)

Hobæk Haff I (2012) Comparison of estimators for pair-copula constructions. J Multivar Anal 110:91–105

Hobæk Haff I, Aas K, Frigessi A (2010) On the simplified pair-copula construction—simple useful or too simplistic? J Multivar Anal 101(5):1296–1310

Joe H (1996) Families of m-variate distributions with given margins and \(\text{ m }(\text{ m }-1)/2\) bivariate dependence parameters. In: Rueschendorf L, Schweizer B, Taylor MD (eds) Distributions with fixed marginals and related topics. Institute of Mathematical Statistics, Hayward, pp 120–141

Joe H (1997) Multivariate models and dependence concepts. Monogra Stat Appl Probab, vol 73. Chapman and Hall, London

Joe H (2005) Asymptotic efficiency of the two-stage estimation method for copula-based models. J Multivar Anal 94:401–419

Joe H, Xu J (1996) The estimation method of inference functions for margins for multivariate models. Tech Rep 166, Department of Statistics, University of British Columbia

Kawata R, Kijima M (2007) Value at risk in a market subject to regime switching. Quant Finance 7:609–619

Kurowicka D, Cooke RM (2006) Uncertainty analysis with high dimensional dependence modelling. Wiley, Chichester

Kurowicka D (2011) Optimal truncation of vines. In: Kurowicka D, Joe H (eds) Dependence modeling: vine copula handbook. World Scientific, Singapore

Morales-Napoles O (2010) Counting vines. In: Kurowicka D, Joe H (eds) Dependence modeling: vine copula handbook. World Scientific, Singapore

Nelsen RB (2006) An introduction to copulae, 2nd edn. Springer, Berlin

Ning C (2008) Extreme dependence of international stock market. Tech Rep Ryerson University

Okimoto T (2008) New evidence on asymmetric dependence structures in international equity markets. J Financ Quant Anal 48:787–815

Sklar A (1959) Fonctions de répartition à n dimensions et leurs marge. Publ Inst Stat Univ Paris 8:229–231

Vuong QH (1989) Ratio tests for model selection and non-nested hypotheses. Econometrica 57(2):307–333

Acknowledgments

Financial support for this paper from the National Science Centre of Poland (Research Grant DEC-2012/05/B/HS4/00810) is gratefully by Henryk Gurgul acknowledged. Financial support for this paper from the Dean of Faculty of Management, AGH University (Statutory Activity No. 15/11.200.296) is gratefully by Artur Machno acknowledged. We would like to thank the three anonymous referees for their valuable comments on an earlier version of the paper.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

One may choose different weights in line 1. We have chosen Prim’s algorithm in lines 2 and 8, although it is possible to perform a different algorithm e.g. Kruskal’s algorithm. Note that the constructed graph is not necessarily a tree in line 6. It is possible that in a single step during the stepwise procedure conditional variables \({\varvec{x}}_{i\left( {e_1 } \right) |D\left( {e_1 } \right) } \)and \({\varvec{x}}_{i\left( {e_2 } \right) |D\left( {e_2 } \right) } \) occur, for which \(i\left( {e_1 } \right) =i\left( {e_2 } \right) \) and \(D\left( {e_1 } \right) \ne D\left( {e_2 } \right) \). So the operations in lines 2 and 7 are not the same. It is not possible to simply perform operation in line 2 and in line 7 for transformed observations. Additionally, the operations in lines 3 and 9 are not the same. In line 9, the use of Algorithm 1 is not straightforward, as with Kendall’s tau calculations, the pseudo-observations obtained by formula (5) might be different in different pairs. In fact, in the case of a D-vine structure, each variable at each level is transformed differently in each pair (there are at most two pairs in which a single variable is involved), while in the case of a C-vine, at each level all conditioning sets are the same. Thus, essentially procedures in lines 2 and 7 are the same as are procedures in lines 3 and 9 in the case of C-vines.

Algorithm 4 can be modified in such a way that in line 1, initial copulae may be set with parameters in place of probabilities. In this case lines 3, 4 and lines 5, 6 are interchanged. One may choose smoothed probabilities in line 1 of Algorithm 4 diversely.

Rights and permissions

About this article

Cite this article

Gurgul, H., Machno, A. Modeling dependence structure among European markets and among Asian-Pacific markets: a regime switching regular vine copula approach. Cent Eur J Oper Res 24, 763–786 (2016). https://doi.org/10.1007/s10100-015-0411-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10100-015-0411-x