Abstract:

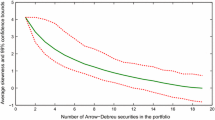

The statistical properties of the total yield are analyzed for an assembly of gamblers in an erratic period on the Budapest stock exchange. Random trading results in a log-normal limit distribution of a surprisingly large width, while the simplest profit realizing strategy narrows down the peak around a positive average value. The effect of transaction costs, the statistics of extremes, and patterns of successful trading are also investigated. In spite of the very simple approach, we present strong indications that large trading activity (e.g. day trading) is a rather risky way of capital investment. A comparison with the yield distribution of 32 public investment funds in the given period does not reflect the presence of a sophisticated investment strategy in the background.

Similar content being viewed by others

Author information

Authors and Affiliations

Additional information

Received 5 May 2000

Rights and permissions

About this article

Cite this article

Jánosi, I. Gambling on the Budapest stock exchange. Eur. Phys. J. B 17, 333–339 (2000). https://doi.org/10.1007/s100510070149

Issue Date:

DOI: https://doi.org/10.1007/s100510070149