Abstract

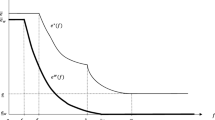

The paper considers a discrete continuous model where consumers choose quality of the product they buy as well as its usage. The product has two quality dimensions, intrinsic quality and environmental quality, that are in conflict with each other. It analyzes a two-stage game in a vertically differentiated duopoly market, where firms choose intrinsic quality in the first stage, and compete in prices in the second stage. It examines the effects of green network, and environmental regulation in the form of an emission tax on equilibrium qualities, market share, and total emissions. It shows that while both green network effect and environmental regulation, individually, improve the overall environmental quality, the effect is stronger when the tax is imposed in the presence of green network effect. Though an increase in green network effect reduces environmental quality of both firms, the market share of the cleaner firm rises at the expense of the other firm, resulting in an overall improvement of the environment. In the presence of green network effect, an emission tax improves environmental quality of both firms with market shares unaltered, thereby resulting in a reduction in total emissions. The green network effect enhances the effect of an emission tax. We also find that the environmental friendly firm benefits from the green network effect. The optimal tax is increasing in the network effect.

Similar content being viewed by others

Notes

Refer to Matsukawa (2012) for further details.

This is the unique solution satisfying the second order conditions.

\(Y_i \equiv y - p_i\) or \(y \equiv Y_i + p_i\) and \(Y_i\) is the amount spent on fuel and composite good which is equal to \((\omega + t_e)x_i + p_z z_i\).

For \(\alpha > 3\gamma \lambda /b(1+4\lambda \gamma )\), the optimal emission tax is positive. This is consistent with the previous assumptions \(\lambda (2\gamma + \omega ) < 2\) and \(\alpha < (9/16b)\).

References

Amacher GS, Koskela E, Ollikainen M (2004) Environmental quality competition and eco-Labeling. J Environm Econom Manag 47:284–306

Amacher GS, Koskela E, Ollikainen M (2005) Quality competition and social welfare in markets with partial coverage: new results. Bull Econom Res 57(4):391–405

Bansal S, Gangopadhyay S (2003) Tax/Subsidy Policies in the Presence of Environmentally Aware Consumers. J Environm Econom Manag 45:333–355

Bansal S (2008) Choice and dsign of regulatory instruments in the presence of green consumers. Resource Energy Econom 30:345–368

Bansal S, Khanna M, Sydlowski J (2021) Incentives for corporate social responsibility in India: Mandate, peer pressure and crowding-out effects. J Environm Econom Manag 105:102382

Birg L, Voßwinkel JS (2018) Minimum quality standards and compulsory labeling when environmental quality is not observable. Resource Energy Econom 53:62–78

Bottega L, Freitas JS (2013) Imperfect eo-labelling signal in a bertrand duopoly. it DEA Working Papers, Department of applied economics, University of Balearic Islands, 1–21

Brecard D (2013) Environmental quality competition and taxation in the presence of green network effect among consumers. Environm Resource Econom 54:1–19

Burtless G, Hausman JA (1978) The efect of taxation on labor supply: evaluating the gary negative income tax experiment. J Polit Econ 86(6):1103–1130

Carlsson F, Garcia JH, Lofgren A (2010) Conformity and the demand for environmental goods. Environm Resource Econom 47:407–421

Conrad K (2006) Price competition and product differentiation when goods have network effects. German Econom Rev 7(3):339–361

De Jong GC (1990) An indirect utility model of car ownership and car use. Eur Econom Rev 34(5):971–985

Dubin JA, McFadden DL (1984) An econometric analysis of residential electric appliance holdings and consumption. Econometrica 52(3):345–362

Farrell J, Klemperer P (2007) Coordination and Lock-in: Com petition with switching costs and network effects. Handbook Indust Organ 3:1967–2072

Falcone PM (2014) Collusion in a Differentiated Market and Environmental Network Externality. Rev Eur Stud 6(3):102–108

Glerum A, Frejinger E, Karlstrom A, Hugosson M.B, Bierlaire M (2014) A dynamic discrete-continuous choice model for car ownership and usage: estimation procedure. Proceedings of the 14th Swiss Transport Research Conference, Switzerland, 1–18

Griva K, Vettas N (2011) Price competition in a differentiated products duopoly under network effects. Inform Econom Policy 23(1):85–97

Greaker M, Midttomme K (2014) Optimal environmental policy with network effects: Will Pigovian taxation lead to excess inertia? CESifo Working Paper No. 4759: 1–38

Grover C, Bansal S (2019) Imperfect certification and eco-labelling of products. Indian Growth Develop Rev 12(3):288–314

Grover C, Bansal S, Martinez Cruz AL (2019) May a regulatory incentive increase WTP for Cars with a fuel efficiency label?. Estimating regulatory costs through a split-sample DCE in New Delhi, India, SSRN Discussion Paper, pp 1–30

Hanemann WM (1984) Discrete/continuous models of consumer demand. Econometrica 52(3):541–562

Hauck D, Ansink E, Bouma J, Soest D.V (2014). Social network effects and green consumerism. Tinbergen Institute Discussion Paper, TI - 150/VIII, 23: 1–27

Hensher DA, Milthorpe FW, Smith NC (1990) The demand for vehicle use in the Urban household sector. J Transport Econom Policy 24(2):119–137

Katz ML, Shapiro C (1985) Network externalities, competition, and compatibility. Am Econom Rev 73(3):424–440

Lambertini L, Orsini R (2005) The eexistence of equilibrium in a differentiated duopoly with network externalities. Japanese Econom Rev 56(1):55–56

Leibenstein H (1950) Bandwagon, snob and veblen effects in the theory of consumers’ demand. Quart J Econom 64(2):183–207

Lombardini-Riipinen C (2005) Optimal tax policy under environmental quality competition. Environm Resource Econom 32:317–336

Mantovani A, Tarola O, Vergari C (2016) Hedonic and environmental quality: a hybrid model of product differentiation. Resource Energy Econom 45:99–123

Marette S, Crespi JM, Schiavina A (1999) The role of common labelling in a context of asymmetric information. Eur Rev Agricul Econom 26(2):167–178

Matsukawa I (2012) The welfare effects of environmental taxation on a green market where consumers emit a pollutant. Environm Resource Econom 52:87–107

Rasouli S, Timmermans H (2016) Influence of social networks on latent choice of electric cars: a mixed logit specification using experimental design data. Netw Spat Econ 16:99–130

Roychowdhury (2019) Peer effects in consumption in Inda: An instrumental variables approach using negative idiosyncratic shocks. World Develop 114:122–137

Zago AM, Pick D (2004) Labeling policies in food markets: private incentives, public intervention, and welfare effects. J Agricul Resource Econom 29(1):150–165

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix

Properties of indirect utility function

The conditional indirect utility function is non-increasing in price of the fuel (\(\omega \)), price of the composite good (\(p_z\)) and non-decreasing in income (y) -

The conditional indirect utility function is quasi-convex in prices. We use expenditure function to calculate diagonal elements of Slutsky matrix. Rearranging terms in equation (8) and using \(Y_i \equiv y - p_i\), we get expenditure function as

The diagonal elements of Slutsky equation, \(s_{11}\) and \(s_{22}\) are given by

Thus all the properties of an indirect utility function are satisfied.

Conditions for fully covered market

For the market to be fully covered, all consumers including the consumer with the lowest preference parameter \(\theta = 0\) should derive a positive utility from buying a unit of the product in equilibrium. Plugging \(\theta = 0\) in equation (8), the utility is

Substituting the equilibrium values from equation (14),(15) in equation (24), we get the utility which consumer with \(\theta =0\) obtains from buying from firm L under the benchmark case (in the absence of regulation and green network effect) -

Assuming \(\delta \) is sufficiently small, the condition \(\lambda (2\gamma + \omega ) < 2\) ensures that market is fully covered.

Similarly, we can derive a condition for the market to be fully covered under environmental regulation in the presence of green network effect. Substituting the equilibrium values from equation (16), (17) in equation (24), we get utility function as

The equation (25) ensures that market is fully covered, i.e., for sufficiently small values of \(\delta \) and \(\lambda (\omega + t_e)\).

Second order conditions for profit maximization

Absence of green network effect and no regulation

The second order conditions at the market equilibrium are given by (using equation (13), (14) and \(\alpha = t_e = 0\))

The second order conditions holds under A2.

Green network effect with environmental regulation

Using equation (13), (16) we get second order conditions at the market equilibrium as

The above condition for high quality firm holds for \(\alpha < 9/16b\). The second order conditions is same for green network with no regulation.

Proof of proposition 1

Impact of green network effect with emission tax

-

(i)

From equation (16), we have \(\frac{ds_i^{**}}{d\alpha } = \frac{3}{(3 - 4 b \alpha )^2} > 0\)

-

(ii)

From equation (17),we have

$$\begin{aligned} \frac{dp_H^{**}}{d\alpha }= & {} -\frac{2}{3} + \frac{3(9 - 8b\alpha )}{4(3 - 4b\alpha )^3} - \frac{3\lambda (2\gamma + \omega + t_e)}{(3 - 4b\alpha )^2}> 0 \\ \frac{dp_L^{**}}{d\alpha }= & {} -\frac{1}{3} + \frac{9}{4(3 - 4b\alpha )^3} - \frac{3\lambda (2\gamma + \omega + t_e)}{(3 - 4b\alpha )^2}> 0 \end{aligned}$$ -

(iii)

From equation (17),we have

$$\begin{aligned} \frac{dq_H^{**}}{d\alpha }= & {} -\frac{2b}{(3 - 4b\alpha )^2} < 0 \\ \frac{dq_L^{**}}{d\alpha }= & {} \frac{2b}{(3 - 4b\alpha )^2} > 0 \end{aligned}$$ -

(iv)

From equation (17),we have

$$\begin{aligned} \frac{d\pi _H^{**}}{d\alpha }= & {} -\frac{(9 - 16b\alpha ) (63 - 108b\alpha + 64 (b\alpha )^2)}{36(3 - 4b\alpha )^3} < 0 \\ \frac{d\pi _L^{**}}{d\alpha }= & {} \frac{(9 -8b\alpha )( 9 + 36b\alpha - 32(b\alpha )^2)}{36(3 - 4b\alpha )^3} > 0 \end{aligned}$$ -

(v)

From equation (16), we have \(\Delta s^{**} = s_H^{**} - s_L^{**} = 3/2b\)

-

(vi)

By substituting \(t_e = 0\) in equation (16) and (17), it can be seen that above results hold for green network effect without environmental regulation.

Proof of proposition 2

Impact of emission tax in the absence of green network effect

The values \(\hat{s_i}\), \(\hat{p_i}\), \(\hat{q_i}\) and \(\hat{\pi _i}\) denote qualities, prices, quantity and profits under absence of green network without environmental regulation. It is calculated by replacing \(\omega \) with \((\omega + t_e)\) in equations (14) and (15).

-

(i)

From equation (14), we have \(\frac{d\hat{s_H}}{dt_e} = -\frac{2\lambda }{3b} < 0\) and \(\frac{d\hat{s_L}}{dt_e} = 0.\)

-

(ii)

From equation (15), we have \(\frac{d\hat{p_H}}{dt_e} = -\frac{20\lambda (2 - \lambda (2\gamma + \omega + t_e))}{27b} < 0\) and \(\frac{d\hat{p_L}}{dt_e} = -\frac{2\lambda (1 + 4\lambda (2\gamma + \omega + t_e))}{27b} < 0\).

-

(iii)

From equation (15), we have \(\frac{d\hat{q_H}}{dt_e} = -\frac{2\lambda }{9} < 0\) and \(\frac{d\hat{q_L}}{dt_e} = \frac{2\lambda }{9} > 0\).

-

(iv)

From equation (15), we have \(\frac{d\hat{\pi _H}}{dt_e} = -\frac{6\lambda (2 - \lambda (2\gamma + \omega + t_e))^2}{2187b} < 0\) and \(\frac{d\hat{\pi _L}}{dt_e} = \frac{\lambda (1 - 2\lambda (2\gamma + \omega + t_e))(5 + 2\lambda (2\gamma + \omega + t_e))}{1458b} \gtrless 0\) for \(\lambda (2\gamma + \omega + t_e) \lessgtr 1/2\)

-

(v)

From equation (14), \(\Delta {\hat{s}} \equiv (\hat{s_H} - \hat{s_L}) = \frac{4 - 2\lambda (2\gamma + \omega + t_e)}{3b}\) and \(\frac{\Delta {\hat{s}}}{dt_e} = -\frac{2\lambda }{3b} < 0\)

Proof of proposition 3

Impact of emission tax under green network

-

(i)

From equation (16),we have \(\frac{ds_H^{**}}{dt_e} = \frac{ds_L^{**}}{dt_e} = -\frac{\lambda }{b} < 0\).

-

(ii)

Change in the prices can be written as

$$\begin{aligned} \frac{dp_i^{**}}{dt_e}= & {} \frac{\partial p_i^{**}}{\partial s_H^{**}} \frac{ds_H^{**}}{dt_e} + \frac{\partial p_i^{**}}{\partial s_L^{**}} \frac{ds_L^{**}}{dt_e} + \frac{\partial p_i^{**}}{\partial t_e}, i = H,L \end{aligned}$$Using equation (10) and \(\frac{ds_H^{**}}{dt_e} = \frac{ds_L^{**}}{dt_e} = -\frac{\lambda }{b}\), we have

$$\begin{aligned} \frac{dp_H^{**}}{dt_e}= & {} \frac{b(2s_H^{**} + s_L^{**})\frac{ds_H^{**}}{dt_e}}{3} - \frac{\lambda \Delta s^{**}}{3} = -\lambda s_H^{**}< 0 \\ \frac{dp_L^{**}}{dt_e}= & {} \frac{b(s_H^{**} + 2s_L^{**})\frac{ds_H^{**}}{dt_e}}{3} + \frac{\lambda \Delta s^{**}}{3} = -\lambda s_L^{**} < 0 \end{aligned}$$ -

(iii)

Change in the quantity can be written as

$$\begin{aligned} \frac{dq_i^{**}}{dt_e}= & {} \frac{\partial q_i^{**}}{\partial s_H^{**}} \frac{ds_H^{**}}{dt_e} + \frac{\partial q_i^{**}}{\partial s_L^{**}} \frac{ds_L^{**}}{dt_e} + \frac{\partial q_i^{**}}{\partial t_e}, i = H,L \end{aligned}$$Using equation (11) and \(\frac{ds_H^{**}}{dt_e} = \frac{ds_L^{**}}{dt_e} = -\frac{\lambda }{b}\), we have

$$\begin{aligned} \frac{dq_H^{**}}{dt_e}= & {} -\frac{b\Delta s^{**}\frac{ds_H^{**}}{dt_e}}{3(\Delta s^{**} - \alpha )} - \frac{\lambda \Delta s^{**}}{3(\Delta s^{**} - \alpha )} = 0 \\ \frac{dq_L^{**}}{dt_e}= & {} \frac{b\Delta s^{**}\frac{ds_H^{**}}{dt_e}}{3(\Delta s^{**} - \alpha )} + \frac{\lambda \Delta s^{**}}{3(\Delta s^{**} - \alpha )} = 0 \end{aligned}$$ -

(iv)

Change in the profits can be written as

$$\begin{aligned} \frac{d\pi _i^{**}}{dt_e}= & {} \frac{\partial \pi _i^{**}}{\partial s_H^{**}} \frac{ds_H^{**}}{dt_e} + \frac{\partial \pi _i^{**}}{\partial s_L^{**}} \frac{ds_L^{**}}{dt_e} + \frac{\partial \pi _i^{**}}{\partial t_e}, i = H,L \end{aligned}$$Using equation (12) and \(\frac{ds_H^{**}}{dt_e} = \frac{ds_L^{**}}{dt_e} = -\frac{\lambda }{b}\), we have

$$\begin{aligned} \frac{d\pi _H^{**}}{dt_e}= & {} \frac{d\pi _L^{**}}{dt_e} = 0 \end{aligned}$$ -

(v)

Using equation (16), \(\Delta {s}^{**} \equiv ({s_H}^{**} - {s_L}^{**}) = \frac{3}{2b}\)

Proof of proposition 4

The total emissions are given by \(E = e_Hq_H + e_Lq_L\). Using \(p_z = 1\) and \(e_i = x_i = \lambda s_i - \beta (\omega + t_e) + \delta \), we get \(E = \lambda (s_H q_H + s_L q_L) - \beta (\omega + t_e) + \delta \). We calculate total emissions by substituting the values of \(s_H\), \(s_L\), \(q_H\) and \(q_L\) for each case discussed below.

Benchmark case- absence of green network effect and no regulation

Using equation (14) and (15) we get total emissions as

Environmental regulation in absence of green network effect

Replacing \(\omega \) with (\(\omega + t_e)\) in benchmark case, we get total emissions as

Green network effect without environmental regulation

Using equations (16), (17) and \(t_e = 0\) we get total emissions as

Green network effect with environmental regulation

Using equations (16) and (17) we get total emissions as

It can be clearly seen that \(E^{*} > \hat{E}\) and \(\widetilde{E} > E^{**}\). For sufficiently small values of \(\beta \) and \(3/8b< \alpha < 9/16b\) we observe that \(\hat{E} > \widetilde{E}\). Thus, \(E^{*}> \hat{E}> \widetilde{E} > E^{**}.\)

Proof of proposition 6

Optimal tax rate under green network effect with environmental regulation

Using equation (22) and substituting the equilibrium values of \(s_H\), \(s_L\) and \(\theta _2 = q_L\) from equation (16, 17) we get -

The optimal tax rate is obtained by setting \(\frac{dW}{dt_e} = 0\), is given by

For \(\alpha > \frac{3\lambda \gamma }{b(1 + 4\lambda \gamma )}\), optimal tax rate is positive, \(t_e^{**} > 0\).

The effect \(\alpha \) and \(\gamma \) on opitmal tax rate is given by

Optimal tax rate under absence of green network effect with environmental Regulation

Using equation (22) and substituting the equilibrium values of \(s_H\), \(s_L\) and \(\theta _2 = q_L\) from equation (14, 15) we get -

The optimum is achieved with a small positive emission tax - \(t_e > 0\) if \(328\lambda ^2(2\gamma + \omega )^2 + 524\lambda (2\gamma + \omega ) > 162\lambda \gamma + 209\) which holds for \(\lambda (2\gamma +\omega )>0.33\).

About this article

Cite this article

Grover, C., Bansal, S. Effect of green network and emission tax on consumer choice under discrete continuous framework. Environ Econ Policy Stud 23, 641–666 (2021). https://doi.org/10.1007/s10018-021-00312-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10018-021-00312-y