Abstract

A simple model is used to illustrate the effects of a reduction in (marginal) abatement cost in a two-country setting. It can be shown that a country experiencing a cost reduction can actually be worse off. This holds true for a variety of quantity and price-based emission policies. Under price-based policies, a country with lower abatement costs might engage in additional abatement effort for which it is not compensated. Under a quantity-based policy with a given allocation, a seller of permits can also be negatively affected by a lower carbon price. We also argue that abatement cost shocks to renewable energy and carbon capture and storage (CCS) are different in terms of their effects on international energy markets. A shock to renewable energy benefits energy importers because the value of fossil fuels is reduced. The opposite holds for a shock to CCS which benefits energy exporters. The channels identified in the theoretical model can be confirmed in a more complex global computable general equilibrium model. Some regions are indeed worse off from a shock that lowers their abatement costs.

Similar content being viewed by others

Notes

The result from this overlapping regulation is a decline in emission prices and a thus a reduction in the cost of emission abatement within the emission trading scheme (ETS). The total welfare cost increases because renewable energy requirements constitute an additional constraint in the cost minimizing problem.

In this section we only analyze the impacts of a shock that leads to lower abatement costs in an abatement technology. The results, however, can easily be carried over to the case when costs of abatement technologies are higher than expected.

Note that this model does not explicitly include marginal damages and we assume here an exogenous target for emissions. A comparison of marginal damages and marginal abatement cost would, however, be required to find the optimal policy instrument under uncertainty (Weitzman 1974). The aim of the paper is not to determine an optimal policy, but rather to stress the characteristics of policy instruments under abatement cost uncertainty.

More specifically, the tax is paid by atomistic producers in the country and refunded lump sum to a representative household of the country. Further assuming that the representative household owns the productive capital in the country, there are zero international net payments and tax payments and receipts offset each other from the perspective of the entire country. The country could improve its welfare by adjusting the tax rate in response to the tax, but the second best setting with a locked in tax rate \(\bar{\lambda }\) prevents the country from doing so.

Plugging the expression for \(a_1\) from Eq. (7) into Eq. (6) and differentiating with respect to \(\phi\) yields \(\frac{1}{6}\frac{\bar{\lambda }^\frac{3}{2}}{\sqrt{\beta \phi }}\) which is larger than zero, indicating rising costs for the quadratic case. For other convex functions it is a priori not clear which of the two effect dominates.

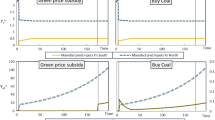

The setup of the figures in this section is similar to Anger (2008) who uses this method to show distributional consequences of linking emission trading systems.

This result is comparable to Peterson and Klepper (2007), who state that under a globally harmonized carbon tax countries with lower marginal abatement costs will face higher total abatement costs.

This setting would be equivalent to an auctioning of permits by a global agency which then redistributed revenues lump sum to those countries which have bought the permits.

In this case it will gain unambiguously because also the cost for the remaining permits it needs to buy declines.

For the interval between \(a_2\) and \(a_2'\) country 2 now prefers to buy additional permits, which is cheaper than own abatement.

Shocks to cost of key abatement technologies are likely to be positively correlated so that all countries will enjoy a cost reduction. However, the benefit will be higher in countries that can make better use of the technology, e.g., because of geographical features.

We assume that the price increases with further demand for fossil fuel (\(\frac{\partial p}{\partial \sum _i f_i} > 0\)) and decreases with additional supply for renewable energy (\(\frac{\partial p}{\partial \sum _i r_i} < 0\)) and renewable energy is not traded.

Here we consider only one type of fossil fuel. In the CGE model in Sect. 3, different kinds of fossil fuels (coal, oil, and gas) with different carbon contents are explicitly modeled.

An alternative interpretation would be that the technology shock improves the capture rate, i.e., the share of CO\(_2\) that is captured and not released into the atmosphere.

This would mean that \(|\frac{\partial (1-\theta _1)f_1}{\partial \phi } |> |\frac{\partial \theta _1 f_2}{\partial \phi } |\), making use of net exports being re-written as \((1-\theta _1)f_1-\theta _1 f_2\).

This follows from \(f_1\) and \(f_2\) changing in the same proportion and the fact that production shares are held constant at \(\theta _1\) and \(\theta _2\).

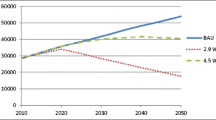

The scenario is not designed to find an optimal policy to exploit learning-by-doing. We are rather interested in the changes of cost induced by a certain shock.

The cost penalties reported here are simple unweighted averages of the model regions.

The LES demand system differentiates between basic demand which is not generating utility and other consumption. The consumption level here only refers to the latter.

All variables referring to levels are in per cent and variables referring to changes are expressed in percentage points, see also Appendix 3 for more details on the variables.

While the coefficient for within region energy trade has a positive sign and thus an opposing effect, most of the variation is between regions. The between region channel thus dominates here, see also Fig. 7.

Both in the case of Tax and Tax*, revenues are returned domestically lump sum, while in the case of a fixed allocation there is a transfer to other countries.

Under Tax* and ntr schemes, Japan, Canada, Europe (WEU and EEU), and Pacific Asia are worse off. Under CDC, only India and Japan are worse off while in the tax scenario all countries, but India, Russia (FSU), Australia (ANZ) and Latin America are worse off.

If payment of taxes and revenue allocation were decoupled, then this effect would no longer hold. This would, however, require an international mechanism for distribution of revenues and would create international transfers. Proponents of a regime with a coordinated tax rate claim that the very absence of international transfers increases the chances for implementation.

References

Anger N (2008) Emissions trading beyond Europe: linking schemes in a post-Kyoto world. Energy Econ 30(4):2028–2049

Bell A, Jones K (2015) Explaining fixed effects: random effects modeling of time-series cross-sectional and panel data. Polit Sci Res Methods 3(1):133–153

Böhringer C, Rutherford TF (2002) Carbon abatement and international spillovers: a decomposition of general equilibrium effects. Environ Resource Econ 22(3):391–417

Blanford GJ, Richels RG, Rutherford TF (2009) Revised emissions growth projections for China: why post-Kyoto climate policy must look east. In: Aldy J, Stavins R (eds) Post-Kyoto international climate policy: implementing architectures for agreement. Cambridge University Press, Cambridge

de Vries BJ, van Vuuren DP, den Elzen MG, Janssen MA (2001) The Targets IMage Energy Regional (TIMER) Model. Technical Documentation. Report 461502024 2001, RIVM

den Elzen MGJ, Lucas PL (2005) The FAIR model: a tool to analyse environmental and costs implications of regimes of future commitments. Environ Model Assess 10:115–134

Dixon PB, Rimmer MT (2013) Validation in computable general equilibrium modeling, chap 19. In: Dixon PB, Jorgenson DW (eds) Handbook of computable general equilibrium modeling, vols 1A and 1B. Elsevier, Amsterdam, pp 1271–1330

Edenhofer O, Knopf B, Barker T, Baumstark L, Bellevrat E, Chateau B, Criqui P, Isaac M, Kitous A, Kypreos S, Leimbach M, Lessmann K, Magne B, Scrieciu S, Turton H, van Vuuren DP (2010) The economics of low stabilization: model comparison of mitigation strategies and costs. Energy J 31:11–48

Eichner T, Pethig R (2014) International carbon emissions trading and strategic incentives to subsidize green energy. Resource Energy Econ 36(2):469–486

Ellerman AD, Marcantonini C, Zaklan A (2014) The EU ETS: eight years and counting. RSCAS Working Papers 2014/04, Robert Schuman Centre for Advanced Studies

EU (2009) Directive 2009/29/EC of the European Parliament and Council of the European Union

Höhne N, den Elzen M, Weiss M (2006) Common but differentiated convergence (CDC): a new conceptual approach to long-term climate policy. Clim Policy 6:181–199

International Energy Agency (2013) World Energy Outlook 2013. OECD/IEA, Paris

IPCC (2007) Summary for policymakers. In: Metz B, Davidson O, Bosch P, Dave R, Meyer L (eds) Climate change 2007: mitigation. Contribution of Working Group III to the Fourth Assessment Report of the Intergovernmental Panel on Climate Change. Cambridge University Press, Cambridge

Johansson DJ, Lucas PL, Weitzel M, Ahlgren EO, Bazaz A, Chen W, Elzen MG, Ghosh J, Grahn M, Liang QM, Peterson S, Pradhan BK, Ruijven BJ, Shukla P, Vuuren DP, Wei YM (2015) Multi-model comparison of the economic and energy implications for China and India in an international climate regime. Mitigation Adapt Strateg Global Chang 20(8):1335–1359

Kalkuhl M, Edenhofer O, Lessmann K (2015) The role of carbon capture and sequestration policies for climate change mitigation. Environ Resource Econ 60(1):55–80

Klepper G (2011) The future of the European emission trading system and the clean development mechanism in a post-Kyoto world. Energy Econ 33(4):687–698

Klepper G, Peterson S (2006) Marginal abatement cost curves in general equilibrium: the influence of world energy prices. Resource Energy Econ 28(1):1–23

Klepper G, Peterson S, Springer K (2003) DART97: A description of the multi-regional, multi-sectoral trade model for the analysis of climate policies. Kiel Working Paper 1149, Kiel Institute for World Economics

Kriegler E, Weyant JP, Blanford GJ, Krey V, Clarke L, Edmonds J, Fawcett A, Luderer G, Riahi K, Richels R, Rose SK, Tavoni M, Vuuren DP (2014) The role of technology for achieving climate policy objectives: overview of the EMF 27 study on global technology and climate policy strategies. Clim Chang 123(3–4):353–367

Lämmle M (2012) Assessment of the global potential for CO\(_2\) mitigation of carbon capture and storage (CCS) until 2050. Diploma thesis, Karlsruhe

Luderer G, DeCian E, Hourcade JC, Leimbach M, Waisman H, Edenhofer O (2012) On the regional distribution of mitigation costs in a global cap-and-trade regime. Clim Chang 114(1):59–78

Lüken M, Edenhofer O, Knopf B, Leimbach M, Luderer G, Bauer N (2011) The role of technological availability for the distributive impacts of climate change mitigation policy. Energy Policy 39(10):6030–6039

McKibbin WJ, Morris AC, Wilcoxen PJ (2008) Expecting the unexpected: Macroeconomic volatility and climate policy. Discussion Paper 2008-16, Harvard Project on International Climate Agreements

Milliman SR, Prince R (1989) Firm incentives to promote technological change in pollution control. J Environ Econ Manag 17(3):247–265

Morris J, Paltsev S, Reilly J (2012) Marginal abatement costs and marginal welfare costs for greenhouse gas emissions reductions: Results from the EPPA model. Environ Model Assess 17(4):325–336

Narayanan B, Aguiar A, McDougall R (2012) Global Trade, Assistance, and Production: The GTAP 8 Data Base. Center for Global Trade Analysis, Purdue University. http://www.gtap.agecon.purdue.edu/databases/v8/v8_doco.asp

Nordhaus WD (2006) After Kyoto: alternative mechanisms to control global warming. Am Econ Rev 96:31–34

Peterson S, Klepper G (2007) Distribution matters. Taxes vs. emissions trading in post Kyoto climate regimes. Kiel Working Paper 1380, Kiel Institute for the World Economy

Peterson S, Weitzel M (2015) Reaching a climate agreement: compensating for energy market effects of climate policy. Clim Policy 10(1080/14693062):1064346

Renz L (2012) Abschätzung des CO\(_2\)-Emissionsminderungspotentials der Photovoltaik bis 2050. Diploma thesis, Karlsruhe

Sorrell S, Dimitropoulos J (2008) The rebound effect: microeconomic definitions, limitations and extensions. Ecol Econ 65(3):636–649

Sorrell S, Dimitropoulos J, Sommerville M (2009) Empirical estimates of the direct rebound effect: a review. Energy Policy 37(4):1356–1371

Weitzel M (2010) Including renewable electricity generation and CCS into the DART model. http://www.ifw-members.ifw-kiel.de/publications/including-renewable-electricity-generation-and-ccs-into-the-dart-model/DART-renewables-ccs

Weitzel M, Hübler M, Peterson S (2012) Fair, optimal or detrimental? Environmental vs. strategic use of border carbon adjustment. Energy Econ 34(Supplement 2):S198–S207

Weitzman ML (1974) Prices vs. quantities. Rev Econ Stud 41(4):477–491

Acknowledgments

I am grateful to Sonja Peterson for very helpful comments. I would like to thank Till Requate for fruitful discussions and Michael Rose for research assistance. Anonymous reviewers provided helpful suggestions that improved the manuscript. Funding was provided by the German Federal Ministry of Education and Research (reference 01LA1127C).

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendices

Appendix 1: Derivation of some equations

Making use of Eqs. (6) and (8), it follows that

with

This leads to

and thus to condition (9).

Analogously, for globally constant emissions equation (11) can be re-written as

which leads to condition (12).

For the emission trading system, the elasticity of cost \(C_i\) for \(\phi\) can be calculated from Eqs. (14) and (15)

with

and

which leads to condition (16).

Appendix 2: Regions and sectors in the DART model

Countries and regions | |||

|---|---|---|---|

WEU | Western Europe | CPA | China, Hong-Kong |

EEU | Eastern Europe | IND | India |

USA | United States of America | LAM | Latin America |

JPN | Japan | PAS | Pacific Asia |

CAN | Canada | MEA | Middle East and Norther Africa |

ANZ | Australia, New Zealand | AFR | Sub-Saharan Africa |

FSU | Former Soviet Union | ||

Production sectors/commodities | |||

|---|---|---|---|

Energy sectors | Non-energy sectors | ||

COL | Coal | AGR | Agricultural production |

CRU | Crude oil | ETS | Energy intensive production |

GAS | Natural gas | OTH | Other manufactures and services |

OIL | Refined oil products | CRP | Chemical products |

ELY | Electricity | MOB | Mobility |

OLI | Other light industries | ||

OHI | Other heavy industries | ||

SVCS | Services | ||

Renewable and advanced electricity technologies | |||

|---|---|---|---|

WIN | Wind | SOL | Solar |

HYD | Hydro | SBIO | Solid biomass |

GASCCS | Advanced gas with CCS | COLCCS | Advanced coal with CCS |

Appendix 3: Variables used in regression analysis

Variable name | Description |

|---|---|

Change in renewables | Change in the share of solar and wind in the electricity mix in percentage points (relative to the scenario without a shock) |

Change in CCS | Change in the share of CCS in the electricity mix in percentage points (relative to the scenario without a shock) |

Pre-shock level of renewables | Share of solar and wind in the electricity mix in percent in the scenario without a shock |

Pre-shock level of CCS | Share of CCS in the electricity mix in percent in the scenario without a shock |

Pre-shock net fossil fuel exports | Value of net fossil fuel export without shock relative to GDP |

Pre-shock net coal exports | Value of net coal export without shock relative to GDP |

Pre-shock net gas exports | Value of net natural gas export without shock relative to GDP |

Pre-shock net oil exports | Value of net export of crude oil and oil products without shock relative to GDP |

Change in emissions | Change in emissions in percent (relative to the scenario without a shock) |

Pre-shock surplus | Value of emission allowances sold on the international carbon market relative to GDP in the scenario without a shock |

About this article

Cite this article

Weitzel, M. Who gains from technological advancement? The role of policy design when cost development for key abatement technologies is uncertain. Environ Econ Policy Stud 19, 151–181 (2017). https://doi.org/10.1007/s10018-016-0142-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10018-016-0142-9