Abstract

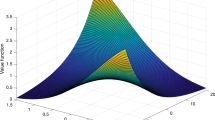

Sharp asymptotic lower bounds on the expected quadratic variation of the discretization error in stochastic integration are given when the integrator admits a predictable quadratic variation and the integrand is a continuous semimartingale with nondegenerate local martingale part. The theory relies on inequalities for the kurtosis and skewness of a general random variable which are themselves seemingly new. Asymptotically efficient schemes which attain the lower bounds are constructed explicitly. The result is directly applicable to a practical hedging problem in mathematical finance; for hedging a payoff which is replicated by a continuous-time trading strategy, it gives an asymptotically optimal way to choose discrete rebalancing dates and portfolios with respect to transaction costs. The asymptotically efficient strategies in fact reflect the structure of the transaction costs. In particular, a specific biased rebalancing scheme is shown to be superior to unbiased schemes if the transaction costs follow a convex model. The problem is discussed also in terms of exponential utility maximization.

Similar content being viewed by others

References

Ansel, J.P., Stricker, C.: Lois de martingale, densité et décomposition de Föllmer Schweizer. Ann. Inst. Henri Poincaré 28, 375–392 (1992)

Bertsimas, D., Kogan, L., Lo, A.W.: When is time continuous? J. Financ. Econ. 55, 173–204 (2000)

Çetin, U., Jarrow, R.A., Protter, P.: Liquidity risk and arbitrage pricing theory. Finance Stoch. 8, 311–341 (2004)

Davis, M.H.A., Panas, V.G., Zariphopoulou, T.: European option pricing with transaction costs. SIAM J. Control Optim. 31, 470–493 (1993)

Denis, E., Kabanov, Y.: Mean square error for the Leland–Lott hedging strategy: convex payoffs. Finance Stoch. 14, 625–667 (2010)

El Karoui, N., Jeanblanc-Picqué, M., Shreve, S.E.: Robustness of the Black and Scholes formula. Math. Finance 8, 93–126 (1998)

Fukasawa, M.: Asymptotic efficiency for discrete hedging strategies. Selected Papers for the 10th Anniversary of Financial Technology Research Institute, Inc. (2009) (in Japanese). Available online at http://www-csfi.sigmath.es.osaka-u.ac.jp/database/technicalreport/9_14.pdf

Fukasawa, M.: Realized volatility with stochastic sampling. Stoch. Process. Appl. 120, 829–852 (2010)

Fukasawa, M.: Discretization error of stochastic integrals. Ann. Appl. Probab. 21, 1436–1465 (2011)

Fukasawa, M.: Asymptotically efficient discrete hedging. In: Kohatsu-Higa, A., Privault, N., Sheu, S.-J. (eds.) Stochastic Analysis with Financial Applications. Progress in Probability, vol. 65, pp. 331–346. Birkhäuser, Basel (2011)

Fukasawa, M.: Conservative delta hedging under transaction costs. In: Takahashi, A., Muromachi, Y., Nakaoka, H. (eds.) Recent Advances in Financial Engineering, pp. 55–72. World Scientific, Singapore (2012)

Geiss, C., Geiss, S.: On an approximation problem for stochastic integrals where random time nets do not help. Stoch. Process. Appl. 116, 407–422 (2006)

Geiss, S., Toivola, A.: Weak convergence of error processes in discretizations of stochastic integrals and Besov spaces. Bernoulli 15, 925–954 (2009)

Genon-Catalot, V., Jacod, J.: Estimation of the diffusion coefficient for diffusion processes: random sampling. Scand. J. Stat. 21, 193–221 (1994)

Gobet, E., Landon, N.: Almost sure optimal hedging strategy (2012). Preprint, available online at HAL, hal-00657153

Gobet, E., Temam, E.: Discrete time hedging errors for options with irregular payoffs. Finance Stoch. 5, 357–367 (2001)

Hayashi, T., Mykland, P.A.: Evaluating hedging errors: an asymptotic approach. Math. Finance 15, 309–343 (2005)

Jacod, J., Shiryaev, A.N.: Limit Theorems for Stochastic Processes, 2nd edn. Springer, Berlin (2002)

Karandikar, R.L.: On pathwise stochastic integration. Stoch. Process. Appl. 57, 11–18 (1995)

Karatzas, I., Shreve, S.E.: Brownian Motion and Stochastic Calculus. Springer, New York (1991)

Leland, H.E.: Option pricing and replication with transaction costs. J. Finance 40, 1283–1301 (1985)

Milstein, G.N., Tretyakov, M.V.: Simulation of a space-time bounded diffusion. Ann. Appl. Probab. 9, 732–779 (1999)

Rootzén, H.: Limit distributions for the error in approximations of stochastic integrals. Ann. Probab. 8, 241–251 (1980)

Rosenbaum, M., Tankov, P.: Asymptotically optimal discretization of hedging strategies with jumps. Ann. Appl. Probab. (2013, to appear). http://www.imstat.org/aap/future_papers.html

Tankov, P., Voltchkova, E.: Asymptotic analysis of hedging errors in models with jumps. Stoch. Process. Appl. 119, 2004–2027 (2009)

Whalley, A.E., Wilmott, P.: An asymptotic analysis of an option hedging model for option pricing with transaction costs. Math. Finance 7, 307–324 (1997)

Whalley, A.E., Wilmott, P.: Optimal hedging of options with small but arbitrary transaction cost structure. Eur. J. Appl. Math. 10, 117–139 (1999)

Acknowledgements

The author is grateful to the anonymous referees for their careful reading and helpful comments. This work is supported by Japan Society for the Promotion of Science, KAKENHI Grant Numbers 24684006, 24300107 and 22243021.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Fukasawa, M. Efficient discretization of stochastic integrals. Finance Stoch 18, 175–208 (2014). https://doi.org/10.1007/s00780-013-0215-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00780-013-0215-6