Abstract

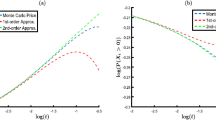

Using the Gärtner–Ellis theorem from large deviations theory, we characterise the leading-order behaviour of call option prices under the Heston model, in a new regime where the maturity is large and the log-moneyness is also proportional to the maturity. Using this result, we then derive the implied volatility in the large-time limit in the new regime, and we find that the large-time smile mimics the large-time smile for the Barndorff–Nielsen normal inverse Gaussian model. This makes precise the sense in which the Heston model tends to an exponential Lévy process for large times. We find that the implied volatility smile does not flatten out as the maturity increases, but rather it spreads out, and the large-time, large-moneyness regime is needed to capture this effect. As a special case, we provide a rigorous proof of the well-known result by Lewis (Option Valuation Under Stochastic Volatility, Finance Press, Newport Beach, 2000) for the implied volatility in the usual large-time, fixed-strike regime, at leading order. We find that there are two critical strike values where there is a qualitative change of behaviour for the call option price, and we use a limiting argument to compute the asymptotic implied volatility in these two cases.

Similar content being viewed by others

References

Andersen, L.B.G., Piterbarg, V.V.: Moment explosions in stochastic volatility models. Finance Stoch. 11, 29–50 (2007)

Atlan, M., Leblanc, B.: Time-changed Bessel processes and credit risk. Working paper (2006). arXiv:math/0604305

Benaim, S., Friz, P.K.: Regular variation and smile asymptotics. Math. Finance 19, 1–12 (2009)

Berestycki, H., Busca, J., Florent, I.: Asymptotics and calibration of local volatility models. Quant. Finance 2, 61–69 (2002)

Berestycki, H., Busca, J., Florent, I.: Computing the implied volatility in stochastic volatility models. Commun. Pure Appl. Math. 57, 1352–1373 (2004)

Bühler, H.: Volatility markets: consistent modelling, hedging and practical implementation. Ph.D. Dissertation, Technical University, Berlin (2006). www.math.tu-berlin.de/~buehler/dl/HansBuehlerDiss.pdf

Carr, P., Madan, D.: Saddlepoint methods for option pricing. J. Comput. Finance 13, 49–61 (2009)

Cont, R., Tankov, P.: Financial Modelling with Jump Processes. Chapman & Hall/CRC Press, London/Boca Raton (2003)

Dembo, A., Zeitouni, O.: Large Deviations Techniques and Applications. Springer, Berlin (1998)

Donsker, M.D., Varadhan, S.R.S.: On a variational formula for the principal eigenvalue for operators with maximum principle. Proc. Natl. Acad. Sci. USA 72(3), 780–783 (1975)

Donsker, M.D., Varadhan, S.R.S.: Asymptotic evaluation of Markov process expectations for large time I. Commun. Pure Appl. Math. 27, 1–47 (1975)

Donsker, M.D., Varadhan, S.R.S.: Asymptotic evaluation of Markov process expectations for large time II. Commun. Pure Appl. Math. 28, 279–301 (1975)

Donsker, M.D., Varadhan, S.R.S.: Asymptotic evaluation of Markov process expectations for large time III. Commun. Pure Appl. Math. 29, 389–461 (1976)

Duffie, D., Filipović, D., Schachermayer, W.: Affine processes and applications in finance. Ann. Appl. Probab. 13, 984–1053 (2003)

Dufresne, D.: The integrated square-root process. Research Collections (UMER). Working paper (2001). http://repository.unimelb.edu.au/10187/1413

Feng, J., Forde, M., Fouque, J.P.: Short maturity asymptotics for a fast mean-reverting Heston stochastic volatility model. SIAM J. Financ. Math. 1, 126–141 (2010)

Forde, M., Jacquier, A.: Small-time asymptotics for implied volatility under the Heston model. Int. J. Theor. Appl. Finance 12, 861–876 (2009)

Forde, M., Jacquier, A.: Small-time asymptotics for implied volatility under a general local-stochastic volatility model. Working paper (2009). www2.imperial.ac.uk/~ajacquie/

Forde, M., Jacquier, A., Mijatović, A.: Asymptotic formulae for implied volatility under the Heston model. Working paper (2009). arXiv:0911.2992

Forde, M., Jacquier, A., Lee, R.W.: Small-time asymptotics for implied volatility under the Heston model: Part 2. Working paper (2010). www2.imperial.ac.uk/~ajacquie/

Freidlin, M.I., Wentzell, A.: Random Perturbations of Dynamical Systems, 2nd edn. Springer, New York (1998)

Friz, P., Gerhold, S., Gulisashvili, A., Sturm, S.: On refined volatility smile expansion in the Heston model. Working paper (2010). arXiv:1001.3003

Gatheral, J.: A parsimonious arbitrage-free implied volatility parameterisation with application to the valuation of volatility derivatives. Presentation at Global Derivatives & Risk Management, Madrid, May 2004. www.math.nyu.edu/fellows_fin_math/gatheral/madrid2004.pdf

Gatheral, J., Jacquier, A.: Convergence of Heston to SVI. Working paper (2010). arXiv:1002.3633

Hagan, P., Kumar, D., Lesniewski, A.S., Woodward, D.E.: Managing smile risk. Wilmott Mag., September issue, 84–108 (2002)

Henry-Labordère, P.: Analysis, Geometry, and Modeling in Finance: Advanced Methods in Option Pricing. Chapman & Hall, London (2009)

Hurd, T.R., Kuznetsov, A.: Explicit formulas for Laplace transforms of stochastic integrals. Markov Process. Relat. Fields 14, 277–290 (2008)

Jourdain, B.: Loss of martingality in asset price models with lognormal stochastic volatility. CERMICS preprint no. 267 (2004). cermics.enpc.fr/reports/CERMICS-2004/CERMICS-2004-267.pdf

Keller-Ressel, M.: Moment explosions and long-term behavior of affine stochastic volatility models. Math. Finance (2010, forthcoming). doi:10.1111/j.1467-9965.2010.00423.x

Lee, R.W.: Option pricing by transform methods: Extensions, unification, and error control. J. Comput. Finance 7(3), 51–86 (2004)

Lewis, A.: Option Valuation Under Stochastic Volatility. Finance Press, Newport Beach (2000)

Lions, P.L., Musiela, M.: Correlations and bounds for stochastic volatility models. Ann. Inst. Henri Poincare C, Non Linear Anal. 24, 1–16 (2007)

Olver, F.W.: Asymptotics and Special Functions. Academic Press, San Diego (1974)

Robertson, S.: Sample path large deviations and optimal importance sampling for stochastic volatility models. Stoch. Process. Appl. 120, 66–83 (2010)

Rockafellar, R.T.: Convex Analysis. Princeton University Press, Princeton (1970)

Tehranchi, M.: Asymptotics of implied volatility far from maturity. J. Appl. Probab. 46, 629–650 (2009)

Varadhan, S.R.S.: On the behavior of the fundamental solution of the heat equation with variable coefficients. Commun. Pure Appl. Math. 20, 431–455 (1967)

Varadhan, S.R.S.: Diffusion processes in a small time interval. Commun. Pure Appl. Math. 20, 659–685 (1967)

Author information

Authors and Affiliations

Corresponding author

Additional information

The work of Forde has been supported by the European Science Foundation, AMaMeF Exchange Grant 2107 and by a SFI grant for the Edgeworth Centre for Financial Mathematics.

Rights and permissions

About this article

Cite this article

Forde, M., Jacquier, A. The large-maturity smile for the Heston model. Finance Stoch 15, 755–780 (2011). https://doi.org/10.1007/s00780-010-0147-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00780-010-0147-3