Abstract

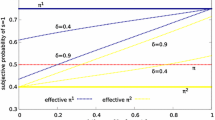

We prove that, in a heterogeneous economy with scale-invariant utilities, the yield of a long term bond is determined by the agent with maximal expected marginal utility. We also prove that the same result holds for the long term forward rates.

Furthermore, we apply Cramér’s large deviations theorem to calculate the yield of a long term European call option. It turns out that there is a threshold risk aversion such that the option yield is independent of the risk aversion when the latter is above the threshold. Surprisingly, the long term option yield is always greater than or equal to the corresponding equity return. That is, in the long run, it is more profitable to buy a long maturity call option on equity than the equity itself.

Similar content being viewed by others

References

Abel, A.B.: Asset pricing under habit formation and catching up with the Joneses. Am. Econ. Rev. (Papers and Proceedings) 80(2), 38–42 (1990)

Alvarez, F., Jermann, U.: Using asset prices to measure the persistence of the marginal utility of wealth. Econometrica 73, 1977–2016 (2005)

Benninga, S., Mayshar, J.: Heterogeneity and option pricing. Rev. Deriv. Res. 4, 7–27 (2000)

Constantinides, G.M.: Habit formation: a resolution of the equity premium puzzle. J. Political Econ. 98, 519–543 (1990)

Constantinides, G.M., Duffie, D.: Asset pricing with heterogeneous consumers. J. Political Econ. 104, 219–240 (1996)

Dana, R.-A.: Existence and uniqueness of equilibria when preferences are additively separable. Econometrica 61, 953–957 (1993)

Deuschel, J., Stroock, D.: Large Deviations. AMS Chelsea Publishing, New York (1989)

Duffie, D., Huang, C.-F.: Implementing Arrow–Debreu equilibria by continuous trading of few long-lived securities. Econometrica 53, 1337–1356 (1985)

Dumas, B.: Two-person dynamic equilibrium in the capital market. Rev. Financial Stud. 2, 157–188 (1989)

Dybvig, P.H., Ingersoll, J.E., Ross, S.A.: Long forward and zero-coupon rates can never fall. J. Bus. 69, 1–25 (1996)

Gollier, C., Zeckhauser, R.J.: Aggregation of heterogeneous time preferences. J. Political Econ. 113, 878–896 (2005)

Hubalek, F., Klein, I., Teichmann, J.: A general proof of the Dybvig–Ingersoll–Ross theorem: long forward rates can never fall. Math. Finance 12, 447–451 (2002)

Karatzas, I., Lehoczky, J.P., Shreve, S.E.: Existence and uniqueness of multi-agent equilibria in a stochastic, dynamic consumption/investment model. Math. Oper. Res. 15, 80–128 (1990)

Lengwiler, Y.: Heterogeneous patience and the term structure of real interest rates. Am. Econ. Rev. 95, 890–896 (2005)

Malamud, S.: Universal bounds for asset prices in heterogeneous economies. Working paper, SSRN (2007). http://ssrn.com/abstract=1002854

Malamud, S., Trubowitz, E.: Rational factor analysis, Working paper, SSRN (2006). http://ssrn.com/abstract=928132

Mas-Colell, A., Whinston, M.D., Green, J.R.: Microeconomic Theory. Oxford University Press, Oxford (1995)

Ross, S.: Intertemporal asset pricing. In: Bhattachariya, S., Constantinides, G.M. (eds.) Theory of Valuation, Frontiers of Modern Financial Theory, vol. 1, pp. 85–96 (1989)

Rubinstein, M.: An aggregation theorem for securities markets. J. Financial Econ. 1, 225–244 (1974)

Wang, J.: A model of intertemporal asset pricing under asymmetric information. Rev. Financial Stud. 60, 249–282 (1993)

Wang, J.: A model of competitive stock trading volume. J. Political Econ. 102, 127–168 (1994)

Wang, J.: The term structure of interest rates in a pure exchange economy with heterogeneous investors. J. Financial Econ. 41, 75–110 (1996)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Malamud, S. Long run forward rates and long yields of bonds and options in heterogeneous equilibria. Finance Stoch 12, 245–264 (2008). https://doi.org/10.1007/s00780-007-0058-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00780-007-0058-0