Abstract

We describe a general framework for measuring risks, where the risk measure takes values in an abstract cone. It is shown that this approach naturally includes the classical risk measures and set-valued risk measures and yields a natural definition of vector-valued risk measures. Several main constructions of risk measures are described in this axiomatic framework.

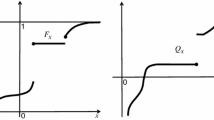

It is shown that the concept of depth-trimmed (or central) regions from multivariate statistics is closely related to the definition of risk measures. In particular, the halfspace trimming corresponds to the Value-at-Risk, while the zonoid trimming yields the expected shortfall. In the abstract framework, it is shown how to establish a both-ways correspondence between risk measures and depth-trimmed regions. It is also demonstrated how the lattice structure of the space of risk values influences this relationship.

Similar content being viewed by others

References

Acerbi, C.: Spectral measures of risk: A coherent representation of subjective risk aversion. J. Bank. Finance 26, 1505–1518 (2002)

Artzner, P., Delbaen, F., Eber, J.M., Heath, D.: Coherent measures of risk. Math. Finance 9, 203–228 (1999)

Bäuerle, N., Müller, A.: Stochastic orders and risk measures: consistency and bounds. Insur. Math. Econ. 38, 132–148 (2006)

Burgert, C., Rüschendorf, L.: Consistent risk measures for portfolio vectors. Insur. Math. Econ. 38, 289–297 (2006)

Cascos, I.: Depth functions based on a number of observations of a random vector. Working paper 07-29. Statistics and Econometrics Series, Universidad Carlos III de Madrid (2007). Available from http://econpapers.repec.org/paper/ctewsrepe/

Cascos, I., López-Díaz, M.: Integral trimmed regions. J. Multivar. Anal. 96, 404–424 (2005)

Cherny, A.S., Madan, D.B.: CAPM, rewards, and empirical asset pricing with coherent risk. Arxiv:math.PR/0605065 (2006)

Davydov, Y., Molchanov, I., Zuyev, S.: Strictly stable distributions on convex cones. ArXiv math.PR/0512196 (2005)

Delbaen, F.: Coherent risk measures on general probability spaces. In: Sandmann, K., Schönbucher, P.J. (eds.) Advances in Finance and Stochastics, pp. 1–37. Springer, Berlin (2002)

Embrechts, P., Puccetti, G.: Bounds for functions of multivariate risks. J. Multivar. Anal. 97, 526–547 (2006)

Föllmer, H., Schied, A.: Convex measures of risk and trading constraints. Finance Stochastics 6, 429–447 (2002)

Hamel, A.H.: Translative sets and functions and their applications to risk measure theory and nonlinear separation. Available from http://www.gloriamundi.org (2006)

Heijmans, H.J.A.M.: Morphological Image Operators. Academic, Boston (1994)

Jarrow, R.: Put option premiums and coherent risk measures. Math. Finance 12, 135–142 (2002)

Jaschke, S., Küchler, U.: Coherent risk measures and good-deal bounds. Finance Stochastics 5, 181–200 (2001)

Jouini, E., Meddeb, M., Touzi, N.: Vector-valued coherent risk measures. Finance Stochastics 8, 531–552 (2004)

Kabanov, Y.M.: Hedging and liquidation under transaction costs in currency markets. Finance Stochastics 3, 237–248 (1999)

Koshevoy, G.A., Mosler, K.: Zonoid trimming for multivariate distributions. Ann. Stat. 25, 1998–2017 (1997)

Luxemburg, W.A.J., Zaanen, A.C.: Riesz Spaces, vol. 1. North-Holland, Amsterdam (1971)

Massé, J.C., Theodorescu, R.: Halfplane trimming for bivariate distribution. J. Multivar. Anal. 48, 188–202 (1994)

Molchanov, I.: Theory of Random Sets. Springer, London (2005)

Mosler, K.: Multivariate Dispersion, Central Regions and Depth. The Lift Zonoid Approach. Lecture Notes in Statistics, vol. 165. Springer, Berlin (2002)

Rousseeuw, P.J., Ruts, I.: The depth function of a population distribution. Metrika 49, 213–244 (1999)

Zuo, Y., Serfling, R.: General notions of statistical depth function. Ann. Stat. 28, 461–482 (2000)

Zuo, Y., Serfling, R.: Structural properties and convergence results for contours of sample statistical depth functions. Ann. Stat. 28, 483–499 (2000)

Author information

Authors and Affiliations

Corresponding author

Additional information

I. Cascos supported by the Spanish Ministry of Education and Science Grant MTM2005-02254.

I. Molchanov supported by Swiss National Science Foundation Grant 200020-109217.

Rights and permissions

About this article

Cite this article

Cascos, I., Molchanov, I. Multivariate risks and depth-trimmed regions. Finance Stoch 11, 373–397 (2007). https://doi.org/10.1007/s00780-007-0043-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00780-007-0043-7