Abstract.

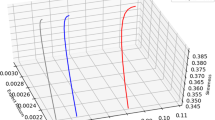

We extend the Large Homogeneous Portfolio (LHP) approximation to the case of the Student-t copula, and provide analytic formulae for the density and the cdf of the portfolio loss distribution. We compare the Value-at-Risk implied by the Student-t copula to that obtained using the Gaussian as well as two prominent members of the Archimedean family, namely the Clayton and the Gumbel copulae.

Similar content being viewed by others

Author information

Authors and Affiliations

Additional information

Mathematics Subject Classification:

91B28, 62E20

JEL Classification:

G13, C63, C16

The authors would like to thank Stuart Turnbull for valuable comments, as well as Philipp Schönbucher for discussing his related work. All remaining errors are our own. The contents of this paper reflect the personal views of the authors and not the opinion of Lehman Brothers.

Manuscript received: July 2003; final version received: June 2004

Rights and permissions

About this article

Cite this article

Schloegl, L., O’Kane, D. A note on the large homogeneous portfolio approximation with the Student-t copula. Finance Stochast. 9, 577–584 (2005). https://doi.org/10.1007/s00780-004-0142-7

Issue Date:

DOI: https://doi.org/10.1007/s00780-004-0142-7