Abstract

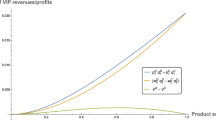

In this paper we analyze the effects of the introduction (by either firms or authorities) of a composite good consisting of a fixed proportion of two imperfectly substitutable stand-alone products. First, we find that such a “cocktail” rises the Bertrand equilibrium prices as it introduces a certain degree of complementarity. It also creates incentives to price discriminate and products can be sold at a discount or at a premium (depending on their degree of substitutability) when they are used as part of the composite good. We consider two distinct forms of price discrimination: a traditional one, in which producers set their prices independently of each other and a coordinated one, in which producers cooperate (collude) when setting the price of the composite good. Composite goods might have either a positive or a negative impact on consumer surplus. The sign of the impact depends on the form of price discrimination and consumers tend to be better off if producers coordinate. The impact is also more likely to be positive if “cocktails are done right”, i.e., if their quality is high compared to the quality of the stand-alone products.

Similar content being viewed by others

Notes

For instance, the Food and Drug Administration follows this procedure. In the market for colorectal cancer chemotherapy drugs, cocktails of two or more substitute drugs are often approved and used in order to treat patients who suffer strong side-effects when treated with one single drug. Organizations like the National Comprehensive Cancer Network (NCCN) also recommend the amount of each drug that doctors should use in each cocktail/regimen, based on the dosages used in clinical trials or in actual practice (Lucarelli et al. 2017).

In Brueckner’s model, the benefits of alliances arise because cooperative pricing of trips by the partners puts downward pressure on fares in the interline city-pair markets. The loss of competition in the interhub market, which connects the hub cites of the partners, however, generates a countervailing effect, tending to raise the fare in that market. While the presence of economies of traffic density complicates these impacts by generating cost links across markets, his simulation shows that the first tendencies typically prevail. Moreover, welfare analysis shows that alliances rise both consumer and total surplus, despite the harm to interhub passengers, suggesting that the positive effects of alliances may outweigh any negative impacts.

This also explains the attention that the Food and Drug Administration pays when approving new therapies in the US.

Their paper clearly inspired ours, as the sale of cocktails at a discount or at a premium is indeed equivalent to the sale of bundles of substitute goods supplied by independent competitors. In their data-set, firms cannot price discriminate because each drug is produced by a different firm and it is a physician who creates the bundle in her practice from the component drugs.

Alvisi and Carbonara (2013) then go on to argue that regulatory policies aimed at introducing asymmetric competition have to be carefully evaluated before being implemented.

A “less obvious” reason for “excessive pricing” could be the existence of fixed-dose combination therapies, which involve combining two or more pharmaceutical drugs in a single tablet. Clarke and Avery (2014) make this important point highlighting the substantial costs arising from a loophole in the Australian price-setting mechanism, allowing multi-brand fixed-dose combinations (FDCs) listed on the Pharmaceutical Benefits Scheme (PBS) to retain price premia long after premia on their individual components have eroded. In Australia, when there are multiple brands of the same combination, even if supplied by the same manufacturer, the drug costs are subject to a mechanism known as “price disclosure“. This mechanism bases future PBS subsidies on the average wholesale cost to pharmacies of individual drugs, so that, over time, the government pays a cost that reflects the market price. When multiple brands are available, price disclosure only takes account the wholesale costs of these drugs, and there is no link to the cost of the separate components.

Second order conditions for utility maximization require \(\gamma <\beta\).

Shubik and Levitan (1980). With this normalization, \(\gamma\) varies in the interval [0, 1).

The latter assumption is with no loss of generality. In case of positive, constant marginal production costs, prices can be interpreted as per-unit margins.

When \(\alpha _{3}=1\), our normalization \(\beta =n-(n-1)\gamma =3-2\gamma\) implies that, at the same prices, the demand size, and then the number of cured patients, remains the same. What is new is simply that a fraction of patients previously cured with either drug 1 or 2 is now treated with the cocktail. When instead \(\alpha _{3}\ge 1,\) the cocktail’s superior efficacy increases demand size, in addition to redistributing patients among the three products. For instance, a set of patients could not be cured with the two existing therapies because of strong negative side effects but can now be treated with the cocktail.

In pharmaceutical markets, the dosage of each single component of a cocktail is not a strategic choice of the firms, but it is established exogenously by researchers and certified, in the US, by the FDA. Our results can however be easily generalized to a different setting in which two producers of imperfectly substitutable goods can strategically coordinate and introduce a new product in the market composed of a fraction \(r_{1}\) of good 1 and a fraction \(r_{2}\) of good 2, \(r_{1}+r_{2}=1\), with the goal of maximizing joint profits. The stages of the problem would then become:

-

1.

Firms decide whether to supply a cocktail;

-

2.

They choose \(r_{i},i=1,2,r_{1}+r_{2}=1\);

-

3.

Firms compete à la Bertrand, setting prices.

In such a more general environment, in which “complementarity” is created artificially, it can be easily proven that when \(0.175<\gamma <1\), the cocktail is profitable for both firms and the joint profit-maximizing fractions of the cocktail are indeed \(r_{1}^{*}=r_{2}^{*}=\frac{1}{2}\), that is the ones used in our paper. When instead \(0<\gamma <0.175\), consistently with Proposition 1 below, cocktails decrease both firms’ profits, so that they would not be created in stage 1.

-

1.

See Sect. 7.2.

As we will see in the next section, however, \(\alpha _{3}^*(\gamma )\) in expression (15) is not the smallest value that \(\alpha _{3}(\gamma )\) can take in our model. Specifically, for given values of \(\gamma\), \(\alpha _{3}(\gamma )\) can be lower in a monopoly. The welfare impact of corner solutions appearing when one assumes greater values for \(\alpha _{3}\) will be studied in one of our extensions of Sect. 7.

The value \(\alpha _{3i}^{*M}\) is found using expression (13).

Price competition with complementary goods is characterized by downward sloping reaction functions (Alvisi and Carbonara 2013).

One might in fact object that in our standard model of nonlocalized oligopolistic competition with product differentiation in the tradition of Chamberlin (1933), where each firm competes against a given market size and consumer preferences depend on the number of products available, the entry of a third product (the cocktail) affects the impact that each product price has on its demand, so that comparisons should be performed between market structures characterized by the same number of firms.

If the third firm purchased goods 1 and 2 from firms 1 and 2 to combine them in the cocktail, we would get exactly the same prices obtained when firm 1 and firm 2 directly combine and market the cocktail (see Alvisi and Carbonara 2013).

We thank an anonymous referee for suggesting this alternative modeling approach.

One obvious question about price-discriminating practices under a cocktail regimen concerns its feasibility, especially in the presence of a premium. Consumers might have no incentive to reveal that the product they are purchasing will be used as a component of a cocktail and firms might not be able to extract this information. Although this might render price discrimination difficult, it is often possible to adopt second—degree price—discrimination mechanisms. For instance, premia are often imposed indirectly, either through packaging or through “strategic dosage”. To illustrate these practice, consider the following numerical example. Therapy 1 and therapy 2 consist of a single 10 mg-tablet per day of drug 1 and drug 2, respectively, produced by two independent firms and to be consumed for N days. Therapy 3 consists of 5 mg-per day of drug 1 and 5 mg-per day of drug 2, also for N days. Suppose that a box of drug 1 and 2 contains N/3 10 mg-tablets. Then, both therapies 1 and 2 need three boxes of the corresponding drug. However, in order to consume N doses of the cocktail, that is N/2 10 mg-tablets of drug 1 and N/2 10 mg-tablets of drug 2, 2 boxes of drug 1 and two boxes of drug 2 would need to be purchased, so that the effective per-dose price would be higher under a cocktail therapy. The same logic would also apply if each firm could sell two different packages in the market, one containing 10 mg-tablets and the other 5 mg-tables, choosing the number of tablets per box appropriately, while keeping the per-tablet price the same.

Even if the 5 mg-tablet boxes contained N/2 tablets, premia might arise if the 5 mg boxes cost more that half of the price of the 10 mg boxes and a group of consumers treated with the cocktail exhibits some aversion to the risk of preparing wrong dosages on their own or of wasting some tablets in the attempt of dividing them in two exact parts. In fact, it often happens that firms charge the same price per tablet, irrespective of the quantity of the active substance. So, a box with N 10 mg-tablets could cost the same as a box with N 5 mg-tablets.

This case occurs when \(\alpha _3^*(\gamma )<\alpha _3<\alpha _{3i}^{*Dd}\). See the proof of Proposition 5.

It is possible to show that \(k=\frac{1}{2}\) is the optimal k when \(r_1=r_2=\frac{1}{2}\). However, generally \(k^*\ne r_1\) when \(r_1\ne \frac{1}{2}\) (see Sect. 7.1).

Computations are tedious and lengthy and follow the same procedures illustrated in the proofs of the propositions. They are therefore omitted for the sake of brevity, but are available upon request.

With price discrimination, the duopolists’ aggregate profit is lower than the one obtained by a monopolist operating in the same conditions. When \(\alpha _3=1\), a monopolist has no incentive to price discriminate and its profits are equal to \(\varPi _M=\frac{1}{4}\), while in a duopoly each firm obtains a profit equal to \(\varPi _i^d=((1 - \gamma ) (39 - 25 \gamma ))/(9 (6 - 5 \gamma )^2)\) (where \(\varPi _i^d\) has been obtained substituting \(\alpha _3=1\) into the expressions provided in the proof of Proposition 5). It can be checked that \(\varPi _M>\varPi _1^d + \varPi _2^d\). When \(\alpha _3>1\), results are qualitatively the same. Finally, and quite obviously, the monopolist profit is higher than the aggregate profit in duopoly also when price discrimination is not feasible.

When \(\gamma =\frac{1}{3}\) the duopolists’ reaction functions do not depend on the competitor’s price.

The two firms are symmetric but for \(r_1\) and \(r_2\), thus when \(r_1>\frac{1}{2}\), firm 1 and firm 2 simply switch roles.

Calculations available upon request.

Specifically, there exists a value \({\hat{\gamma }}<\frac{1}{3}\), such that \(\delta \ge 0\) (discount) for \(\gamma \le {\hat{\gamma }}\) and \(\delta <0\) (premium) for \(\gamma >{\hat{\gamma }}\). The threshold \({\hat{\gamma }}\) increases with \(r_1\) and is equal to \(\frac{1}{3}\) when \(r_1=\frac{1}{2}\), which is exactly the case studied in Proposition 7.

We have dealt with this case in Proposition 4.

The proofs of the results illustrated in this Section are available upon request.

The threshold \(\gamma =0.175\) is the approximation of the solution of the second-degree equation resulting from \(\varPi _i^{c}-\varPi _i^{nc}=0\), i.e., \(\gamma =\frac{13-\sqrt{97}}{18}\).

Profits are computed using Mathematica and are very long polynomials in \(\gamma\) and \(\alpha _3\). We omit their algebraic expressions here, since they do not add much to the argument. Full calculations are available upon request.

Now, \(CS ^d_{\alpha _3>1}\) is increasing in \(\alpha _3\) if \(\alpha _3>\frac{2\gamma }{3-\gamma }\), which is always true since \(\frac{2\gamma }{3-\gamma }<1\).

References

Adams W, Yellen J (1976) Commodity bundling and the burden of monopoly. Q J Econ 90(3):475–498

AGCM (2017) Annual report on competition policy developments in Italy. Directorate for Financial and Enterprise Affairs, Competition Committee, DAF/COMP/AR(2017)33

Alvisi M, Carbonara E (2013) Imperfect substitutes for perfect complements: solving the anticommons problem. Bull Econ Res 65(3):256–279

Alvisi M, Carbonara E, Parisi F (2011) Separating complements: the effects of competition and quality leadership. J Econ 130(2):107–131

Armstrong M (2013) A more general theory of commodity bundling. J Econ Theory 148(2):448–472

Blume-Kohout M, Sood N (2013) Market size and innovation: effects of medicare part D on pharmaceutical research and development. J Public Econ 97(1):327–336

Brito D, Vasconcelos H (2015) Inter-firm bundling and vertical product differentiation. Scand J Econ 117(1):1–27

Brueckner J (2001) The economics of international codesharing: an analysis of airline alliances. Int J Ind Organ 19(10):1475–1498

Chamberlin E (1933) The theory of monopolistic competition. Harvard University Press, Cambridge

Chen Y (1997) Equilibrium product bundling. J Bus 70:85–103

Chen Y, Riordan MH (2007) Price and variety in the spokes model. Econ J 117(522):897–921

Clarke PM, Avery AB (2014) Evaluating the costs and benefits of using combination therapies. Med J Aust 200(9):518–520

Dixit A (1979) Quality and quantity competition. Rev Econ Stud 46(4):587–599

Gans JS, King SP (2006) Paying for loyalty: product bundling in oligopoly. J Ind Econ 54(1):43–62

Kumbar S, Mirje M, Moharir G, Bharatha A (2015) Cost analysis of commonly used combination of drugs in primary open angle glaucoma. J Clin Diagn Res 9(5):EC5–EC8

Lewbel A (1985) Bundling of substitutes or complements. Int J Ind Organ 3(1):101–107

Lucarelli C, Nicholson S, Song M (2017) Merger with inter-firm bundling: a case of pharmaceutical cocktails. RAND J Econ 48(3):810–834

MacAfee R, MacMillan J, Whinston M (1989) Merger with inter-firm bundling: a case of pharmaceutical cocktails. Q J Econ 104:371–383

Morschhauser F, Fowler N, Feugier P, Bouabdallah R, Tilly H, Palomba M, Fruchart C, Libby E, Casasnovas R, Flinn I (2018) Rituximab plus lenalidomide in advanced untreated follicular lymphoma. N Engl J Med 379(10):934–947

Nalebuff B (2004) Bundling as an entry barrier. Q J Econ 119(1):159–187

Shubik M, Levitan R (1980) Market structure and behavior. Harvard University Press, Cambridge

Sonnenschein H (1968) The dual of duopoly is complementary monopoly: or, two of cournot’s theories are one. J Polit Econ 76(2):316–318

Veiga A (2018) A note on how to sell a network good. Int J Ind Organ 59:114–126

Whinston M (1990) Tying, foreclosure and exclusion. Am Econ Rev 80:837–859

Acknowledgements

We thank Giacomo Calzolari, Enrico Santarelli and participants to the XXI National Conference of the Italian Association of Health Economics (AIES), Bologna, for helpful comments.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Proof of Proposition 1

From straightforward profit maximization, we have the following:

-

If\(\alpha _\mathbf {3}=\mathbf {1}\), the monopolist chooses in equilibrium the same prices it would choose without a cocktail, namely \(p_{Mi}^{*}=\frac{1}{2}\). Each treatment serves a demand equal to \(q_{M1}^*=q_{M2}^*=q_{M3}^*=\frac{1}{6}\). Thus, the total quantity sold of good i is \(q_i^*=\frac{1}{6}+r_i\,\frac{1}{6}=\frac{1}{4}\), \(i=1,2\), whereas the total number of treated patients is \(q_{M1}^*+q_{M2}^*+q_{M3}^*=\frac{1}{2}\), \(\frac{1}{3}\) of it is cured with the cocktail. Quantities thus are \(q_{Mi}^{*}=\frac{1}{4}\), \(i=1,2\), while profits equal \(\varPi _M^*=\frac{1}{4}\).

-

If\(\alpha _\mathbf {3}>\mathbf {1}\), according to Eq. (13), \(q_1\) and \(q_2\) are sold both as stand-alone drugs and in a cocktail if \(\alpha _3<\alpha _{3}(\gamma )\). Define \(\alpha _{3i}^{*M}\) the value taken by \(\alpha _{3}(\gamma )\) in this case, where the superscript M stands for “monopolist”. We shall determine the exact value of \(\alpha _{3i}^{*M}\) below. Assume first that \(\alpha _3<\alpha _{3i}^{*M}\).

The two prices are set at \(p_{M1}^{\alpha<\alpha _{3i}^{*}}=p_{M2}^{\alpha <\alpha _{3i}^{*}}=\frac{2+\alpha _{3}}{6}\) (where \(p_{Mi}^{\alpha <\alpha _{3i}^{*}}>p_{Mi}^{*}\): the prices the monopolist charges are higher with the cocktail). Monopoly profits are \(\varPi _M^{\alpha <\alpha _{3}^{*M}}=\frac{(2+\alpha _3)^2}{36}\), which are always greater than \(\varPi _M^*\), the profits obtained in the absence of the cocktail.

Substituting \(p_{M1}^{\alpha <\alpha _{3i}^{*}}\) and \(p_{M2}^{\alpha <\alpha _{3i}^{*}}\) into either the expression for \(q_1\) in (9) or for \(q_2\) in (10)

$$\begin{aligned} \alpha _{3}(\gamma )=\frac{2(2-\gamma )}{(1+\gamma )}=\alpha _{3i}^{*M} \end{aligned}$$(22)Comparing \(\alpha _{3i}^{*M}\) with \(\alpha _3^*(\gamma )\) in Eq. (15), \(\alpha _{3i}^{*M}\ge \alpha _3^*(\gamma )\) if \(\gamma \le \frac{1}{3}\). In such a case, our restriction \(\alpha _3\in [1,\alpha _3^*(\gamma ))\) ensures that \(q_1\) and \(q_2\) are always sold both as stand-alone drug and in the cocktail.

If \(\gamma \ge \frac{1}{3}\) and \(\alpha _{3} \in [\alpha _{3i}^{M}, \alpha _{3}^{*}(\gamma )]\), we have a corner solution where \(q_1=q_2=0\) and \(q_3\) is given by (14).

Maximizing profits in such case, the equilibrium cocktail price is \(p_{M3}^{\alpha _3 > \alpha _{3i}^{*M}}=\frac{\alpha _3}{2}\), so that \(q_{M3}^{\alpha _3 > \alpha _{3i}^{*M}}=\frac{\alpha _3}{2(3-2\gamma )}\) and \(\varPi _M^{\alpha _3 > \alpha _{3i}^{*M}}=\frac{\alpha _3^2}{4(3-2\gamma )}\). Prices are higher than in the case with \(\alpha _{\mathbf {3}}<\alpha _{\mathbf {3i}}^{*M}\) and without a cocktail. Profits are also higher.

We now consider the impact of a cocktail on consumer surplus. Consumer surplus is defined as

Substituting equilibrium quantities and prices, in a multi-product monopoly, consumer surplus when the cocktail is not sold is

When \(\alpha _3=1\), the introduction of the cocktail has no effect on consumer surplus, so that

Both when \(\gamma <\frac{1}{3}\) and when \(\gamma \ge \frac{1}{3}\) but \(\alpha _{3} \in (1, \alpha _{3i}^{*M})\) consumer surplus is

which is always greater than \(\frac{1}{8}\).

Finally, when \(\gamma \ge \frac{1}{3}\) and \(\alpha _{3} \in [\alpha _{3}^{*M}, \alpha _{3}^{*}(\gamma )]\), consumer surplus is

Notice that in this case \(CS _M^{\alpha _3>\alpha _{3}^{*M}}>\frac{1}{8}\), as well. Quite intuitively, when \(\alpha _3\) is high, consumers benefit from the presence of the cocktail. \(\square\)

1.2 Proof of Proposition 2

Without the cocktail, the two firms charge prices \(p_i^{nc}=\frac{2(1-\gamma )}{4-3\gamma }\), \(i=1,2\), while the demands of the two drugs are \(q_{i}^{nc}=\frac{(2-\gamma )}{8-6\gamma }\), \(i=1,2\). This yields profits \(\varPi _i^{nc}=\frac{(2-\gamma )(1-\gamma )}{(4-3\gamma )^2}\). Using the general expression in (23), consumer surplus in this case

With the cocktail, the equilibrium prices are \(p_{1}^{c}=p_{2}^{c}=\frac{6(1-\gamma )}{11-9\gamma }\), while the quantities sold of each regimen (i.e., the demands of the two separate drugs, \(q_{1}^{c}\), \(q_{2}^{c}\) and that of the cocktail \(q_{3}^{c}\)) are \(q_{i}^{c}= \frac{(5-3\gamma )}{33-27\gamma }\), \(i=1,2,3\). Profits are \(\varPi _i^c=\frac{3(1-\gamma )(5-3\gamma )}{(11-9\gamma )^2}\), \(i=1,2\). Consumer surplus is

Comparison between prices, quantities, profits and consumer surplus yields the results.Footnote 32\(\square\)

1.3 Proof of Proposition 3

Assume that \(\alpha _3 \in (1,\alpha _{3}^{*}(\gamma ))\), so that all demands in (9)–(11) are positive.

-

a.

In such case, the Bertrand equilibrium prices are: \(p_{i}^{c}=\frac{2(2+\alpha _{3})(1-\gamma )}{11-9\gamma },\; i=1,2\). The equilibrium quantities of the two goods, including both the quantities consumed as stand -alone products and that included in cocktails, is \(q_{i}^{c}=\frac{\alpha _3 \left( 3 \gamma ^2+\gamma -6\right) +6 \gamma ^2-25 \gamma +21}{9 \left( 9 \gamma ^2-20 \gamma +11\right) },\; i=1,2\). The quantity of the cocktail consumed in equilibrium is \(q_3^c=\frac{\alpha _3 \left( 3 \gamma ^2-26 \gamma +27\right) +2 \left( 3 \gamma ^2+\gamma -6\right) }{9 (\gamma -1) (9 \gamma -11)}\), which is greater than \(q_{i}^{c},\; i=1,2\), since the prices of the three products are the same and \(\alpha _3>1\). The equilibrium profits are \(\varPi _{i}^{c}=\frac{(2+\alpha _{3})^{2}(1-\gamma )(5-3\gamma )}{3(11-9\gamma )^{2}},\)\(i=1,2\). It is straightforward to check that \(p_{\grave{\imath }}^{c}>p_{i}^{nc}\) and \(q_{\grave{\imath }}^{c}<q_{i}^{nc}\), for any \(\gamma \in [0,1)\).

-

b.

Profits \(\varPi _{i}^{c}\) are increasing in \(\alpha _{3}\), whereas \(\varPi _{i}^{nc}\) is obviously invariant with respect to \(\alpha _3\). It is immediate to show that \(\varPi _{i}^{c}>\varPi _{i}^{nc}\) if \(\alpha _3=1\) and \(\gamma \ge 0.175\). Being \(\varPi _i^{c}\) increasing in \(\alpha _3\), this means that, for \(\gamma \ge 0.175\), \(\varPi _{i}^{c}\ge \varPi _{i}^{nc}\)\(\forall \alpha _3 \in (1,\alpha _{3}(\gamma ))\).

If \(\gamma < 0.175\), \(\varPi _{i}^{c}< \varPi _{i}^{nc}\) at \(\alpha _3=1\), whereas \(\varPi _{i}^{c}> \varPi _{i}^{nc}\) at \(\alpha _3= \alpha _{3}(\gamma )\). Hence, there exists \({\bar{\alpha }}_3 \in (1,\alpha _{3}^{*}(\gamma ))\) such that \(\varPi _{i}^{c}\gtrless \varPi _{i}^{nc}\) if \(\alpha _3\gtrless {\bar{\alpha }}_3\).

-

c.

We turn now to consumer surplus, again defined by Eq. (23). Substituting prices and quantities, consumer surplus in a duopoly without a cocktail is given by Eq. (28), whereas consumer surplus with the cocktail is

$$\begin{aligned} CS _d^{\alpha _3}& {}= \frac{\alpha _3^2 \left( 9 \gamma ^3-201 \gamma ^2+451 \gamma -267\right) +4 \alpha _3 \left( 9 \gamma ^3+42 \gamma ^2-143 \gamma +96\right) }{18 (11-9 \gamma )^2 (\gamma -1)}\nonumber \\ & \quad +\,\frac{36 \gamma ^3-318 \gamma ^2+616 \gamma -342}{18 (11-9 \gamma )^2 (\gamma -1)}\ \end{aligned}$$(30)Given \(\alpha _3 \in (1,\alpha _{3}(\gamma ))\), there exists \(1<{\tilde{\alpha }}_3<\alpha _{3}(\gamma )\) such that \(CS _d^{\alpha _3}\gtrless CS _d^{nc}\) if \(\alpha _3\gtrless {\tilde{\alpha }}_3\).

In fact, \(CS _d^{\alpha _3}\) is increasing in \(\alpha _3\) and \(CS _d^{nc}\) does not depend on \(\alpha _3\). \(CS _d^{\alpha _3}< CS _d^{nc}\) at \(\alpha _3=1\), whereas \(CS _d^{\alpha _3}> CS _d^{nc}\) at \(\alpha _3=\alpha _{3i}^{*D}\).

It is worth mentioning that numerical simulations indicate that, when \(\gamma <0.175\), \({\tilde{\alpha }}_3>{\bar{\alpha }}_3\). The cutoff \({\tilde{\alpha }}_3\) is decreasing in \(\gamma\).

Finally, at the equilibrium prices

$$\begin{aligned} \alpha _3(\gamma )=\frac{6\gamma ^2-25\gamma +21}{6-\gamma -3\gamma ^2}=\alpha _{3i}^{*D} \end{aligned}$$(31)which is exactly the value chosen for our cutoff \(\alpha _3^*(\gamma )\) in Eq. (15). We will show in Sect. 7.2 that \(\alpha _{3i}^{*D}\) is the value that guarantees that the standalone treatments are always sold in duopoly.

1.4 Proof of Proposition 4

If the monopolist price discriminates, it maximizes profits with respect to \(p_1\), \(p_2\) and \(p_3\). Substituting the expressions for demands \(q_1\), \(q_2\) and \(q_3\) from (9), (10) and (11), equilibrium prices are \(p_{Mi}^d=\frac{1}{2}\) (\(i=1,2\), where the superscript d stands for “discrimination ”), and \(p_{M3}^d=\frac{\alpha _3}{2}\). Equilibrium quantities are \(q_{Mi}^d=\frac{3-(2+\alpha _3)\gamma }{18(1-\gamma )}\), \(i=1,2\) and \(q_{M3}^d=\frac{(3-\gamma )\alpha _3-2\gamma }{18(1-\gamma )}\). Equilibrium profits are \(\varPi _{M}^{d}=\frac{6+(3-\gamma )\alpha _3^2 -4\gamma (1+\alpha _3)}{36(1-\gamma )}\).

Notice first that, given the equilibrium prices, \(q_1\) and \(q_2\) are positive iff

However, it is easy to check that \(\alpha _{3i}^{*Md}>\alpha _{3}(\gamma )\). Differently from uniform pricing, then, the possibility to price discriminate always implies that goods 1 and 2 will be sold both as stand-alone treatments and as parts of the cocktail. In such parameter’s range the monopolist charges a premium on the goods sold in the cocktail, since \(p_{M3}^{d}=\frac{\alpha _3}{2}>r_1 p_{M1}^{d}+r_2 p_{M2}^{d}=\frac{1}{2}\). Particularly, the premium is equal to \(\delta _M=p_{M3}^{d}-\frac{1}{2}=\frac{\alpha _3-1}{2}\).

Finally, it can be proven both that \(\varPi _{M}^{d}>\varPi _M^{\alpha _3<\alpha _{3}^{*M}}\) and that \(\varPi _{M}^{d}>\varPi _M^{\alpha _3>\alpha _{3}^{*M}}\). Thus, the monopolist always finds it profitable to price discriminate.

Using expression (23), consumer surplus with price discrimination when \(\alpha _3<\alpha _{3}(\gamma )\) and goods are sold both as stand alone and in the cocktail is

Under uniform pricing, both when \(\gamma <\frac{1}{3}\) and when \(\gamma \ge \frac{1}{3}\) but \(\alpha _{3} \in (1, \alpha _{3}^{*M})\), consumer surplus is given by \(CS _M^{\alpha _3<\alpha _{3}^{*M}}\) in expression (26) in the proof of Proposition 1, while when \(\gamma \ge \frac{1}{3}\) and \(\alpha _3 \in [{\alpha _{3}^{*M},\alpha _{3}(\gamma )}]\) the monopolist sells the cocktail only and consumer surplus is given by the expression (27)

Comparing consumer surplus with and without discrimination when \(\gamma <\frac{1}{3}\) and when \(\gamma \ge \frac{1}{3}\) but \(\alpha _{3} \in (1, \alpha _{3}^{*M})\) so that in both cases drugs are sold as stand-alone treatments and in a cocktail, we see that

Thus, in this case discrimination entails a reduction in consumer surplus when \(\gamma <\frac{1}{3}\) and \(1<\alpha _3<\alpha _{3}^{*M}\).

Comparing consumer surplus with and without discrimination when \(\gamma \ge \frac{1}{3}\) and \(\alpha _3 \in [{\alpha _{3}^{*M},\alpha _{3}(\gamma )}]\) entails comparing a situation in which the consumer sells the cocktail only (with uniform pricing) and a situation in which the consumer sells the stand-alone treatments and the cocktail (with discrimination). We thus need to compare expression (27) to expression (33).

We see that

since

\(\square\)

Thus, discrimination entails a reduction in consumer surplus, for all \(\gamma \in [0,1]\).

1.5 Proof of Proposition 5

Define \(p_i^d\) and \(p_{ic}^d\) (\(i=1,2\)) the price of drug i when it is sold as a stand-alone treatment and when it is a cocktail component, respectively. Conditional on both firms deciding to price discriminate, profits in the second stage would be \(\varPi _{i}=p_{i}^d\,q_{i}+\frac{1}{2}\,p_{ic}^d\,q_{c}\), \(i=1,2\).

Bertrand equilibrium prices are \(p_{i}^{d}=\frac{3(1-\gamma )}{(6-5\gamma )}\), \(p_{ic}^{d}=\frac{2}{3}\left( \alpha _3-\frac{\gamma }{6-5\gamma }\right)\). Quantities are \(q_i^d=\frac{5 (\alpha _3+2) \gamma ^2-6 (\alpha _3+6) \gamma +27}{27 (\gamma -1) (5 \gamma -6)}\), \(i=1,2\), \(q_{c}^d=\frac{\alpha _3 (\gamma -3)+2 \gamma }{27 (\gamma -1)}\).

Demanded quantities of the stand-alone treatments are positive (\(q_i^d>0\)) if

However, it is easy to check that \(\alpha _{3i}^{*Dd}>\alpha _3^*(\gamma )\), so that such quantities are always positive in our parameters’ range. Moreover, the demanded quantity of the cocktail is always positive under this pricing scheme, as well. In fact, we have \(q_3^d>0\) if \(\alpha _3>\frac{2\gamma }{3-\gamma }\le 1\) for all \(\gamma \in [0,1]\).

Comparing prices, it can be seen that the cocktail will be sold at a premium \(\delta ^{d}\), where \(\delta ^{d}=p_{ic}^{d}-\{r_1 p_{1}^{d}+r_2 p_{1}\} =\frac{2}{3}\,\alpha _3-\frac{9-7\gamma }{3(6-5\gamma )}>0\).

Equilibrium profits are \(\varPi _{i}^d=\frac{1}{81} \left( \frac{9 \left( 5 (\alpha _3+2) \gamma ^2-6 (\alpha _3+6) \gamma +27\right) }{(6-5 \gamma )^2}+\frac{(\alpha _3 (\gamma -3)+2 \gamma ) \left( \alpha _3+\frac{\gamma }{5 \gamma -6}\right) }{\gamma -1}\right)\), \(i=1,2\).

We now compare \(\varPi _{i}^{c}\), the profits without price discrimination we found in the proof of Proposition 3, with \(\varPi _{i}^d\).

Particularly, we notice that \(\varPi _{i}^{d}- \varPi _{i}^{c}>0\) if \(\alpha _3>{\bar{\alpha }}_3(\gamma )=\frac{-738 \gamma ^3+2527 \gamma ^2-2892 \gamma +1107}{-360 \gamma ^3+1342 \gamma ^2-1662 \gamma +684}<\alpha _3(\gamma )\) so that both firms would engage in price discrimination if \(\alpha _3\) is sufficiently high.

Also, \({\bar{\alpha }}_3(\gamma )\le 1\) if and only if \(\gamma \ge 0.92\), which implies that, when the two stand-alone products are highly substitutable, price discrimination is profitable for any \(\alpha _3 \ge 1\).

However, when \(\gamma <0.92\), \(\frac{d{\bar{\alpha }}_3}{d\gamma } < 0\), meaning that the less substitutable products are, the more likely it is that uniform pricing yields higher profits than price discrimination.

We now show that the ability to price discriminate might lead to a Prisoner’s dilemma, that is, to a situation in which both firms price discriminate even if they would be better off if they both did not and this because price discrimination is a dominant strategy.

If firm 1 decides to engage in price discrimination while firm 2 chooses uniform pricing, profits would be

Bertrand equilibrium prices are \(p_{1}^{d^\prime }=\frac{(1-\gamma ) ((2 \alpha _3-23) \gamma +57)}{6 \left( 6 \gamma ^2-23 \gamma +19\right) }\), \(p_{2}^{d^{\prime }}=\frac{2 (1-\gamma ) (\alpha _3 (3-2 \gamma )+4 (3-\gamma ))}{18 \gamma ^2-69 \gamma +57}\) and \(p_{1c}^{d^\prime }=\frac{2 \alpha _3 \left( 7 \gamma ^2-31 \gamma +27\right) +\gamma ^2+5 \gamma -12}{18 \gamma ^2-69 \gamma +57}\), where the latter is the price firm 1 sets for a unit of its product purchased to be used in the cocktail.

Equilibrium quantities are \(q_{1}^{d^{\prime }}=\frac{-4 (\alpha _3+2) \gamma ^3+6 (3 \alpha _3+8) \gamma ^2-(16 \alpha _3+95) \gamma +57}{18 (1-\gamma ) \left( 6 \gamma ^2-23 \gamma +19\right) }\), \(q_{2}^{d^{\prime }}=\frac{(2-\gamma ) \left( \alpha _3 \left( 4 \gamma ^2-6\right) +8 \gamma ^2-39 \gamma +33\right) }{18 (1-\gamma ) \left( 6 \gamma ^2-23 \gamma +19\right) }\) for the stand-alone treatments and \(q_{3}^{d^{\prime }}=\frac{\alpha _3 \left( -2 \gamma ^3+17 \gamma ^2-40 \gamma +27\right) -4 \gamma ^3+13 \gamma ^2-5 \gamma -6}{9 (1-\gamma ) \left( 6 \gamma ^2-23 \gamma +19\right) }\) for the cocktail.

It can be checked that \(p_{i}^{d^{\prime }}>p_{i}^{d}\), \((i=1,2)\) and \(p_{1c}^{d^{\prime }}>p_{ic}^{d}\), indicating that firm 1 would charge higher prices on both its stand-alone treatment and its cocktail component compared to the case in which both competitors price discriminate.

Substituting equilibrium prices and quantities into profits in (35), we can see thatFootnote 33

When \(\gamma <0.92\) and \(\alpha _3<{\bar{\alpha }}_3(\gamma )\), we know that \(\varPi _{i}^{c}>\varPi _{i}^{d}\), so that the following holds:

Choosing to price discriminate in the first stage is a dominant strategy for both firms, given the symmetry of the game. The resulting equilibrium outcome is not Pareto-Efficient, though, given that \(\varPi _{1}^{c}>\varPi _{i}^{d},i=1,2\). \(\square\)

1.6 Proof of Proposition 6

Consider first the case \(\alpha _3=1\). Without price discrimination, consumer surplus is given by expression (29) in the proof of Proposition 2.

With non-coordinated price discrimination, using the definition of consumer surplus in expression (23), we find:

A direct comparison of expressions (29) and (38) shows that \(CS ^c_{\alpha _3=1}> CS ^d_{\alpha _3=1}\) for all \(\gamma \in [0,1)\). Surplus with and without price discrimination is the same only if \(\gamma =1\), that is, when the two treatments are perfect substitutes. That is, however, a limit case, in which prices are set equal to marginal costs (here zero).

We then turn to the case in which \(\alpha _3>1\).

Using again expression (23), when \(1<\alpha _3<\alpha _3^*(\gamma )\), consumer surplus under uniform pricing equals expression (30) in the proof of Proposition 3.

With price discrimination, consumer surplus equals

Computing the difference between (30) and (39) we find

The denominator in expression (40) is always positive. We thus focus on the sign of the numerator. First of all, notice that (40) is increasing in \(\alpha _3\) iff:

Since the right-hand-side of (41) is always smaller than 1, this condition is always satisfied, given our assumptions (\(\alpha _3>1\)). Thus, the difference \(CS ^c_{\alpha _3>1}- CS ^d_{\alpha _3>1}\) is always increasing in \(\alpha _3\) and to prove that \(CS ^c_{\alpha _3>1}- CS ^d_{\alpha _3>1}>0\) it suffices that \(CS ^c_{\alpha _3>1}- CS ^d_{\alpha _3>1}>0\) for \(\alpha _3=1\). In fact, we have shown before that, for \(\alpha _3=1\), \(CS ^c_{\alpha _3=1}> CS ^d_{\alpha _3=1}\) always. Thus, \(CS ^c_{\alpha _3>1}> CS ^d_{\alpha _3>1}\) for all \(\gamma \in [0,1)\) and for all \(1<\alpha _3<\alpha _3^*(\gamma )\).

1.7 Proof of Lemma 3

When \(1<\alpha _3 <\alpha _3^*(\gamma )\), we need to compare expression (39) with the amount of consumer surplus without the cocktail (28).

\(CS ^d_{\alpha _3>1}\) is an increasing function of \(\alpha _3\), whereas \(CS ^{nc}\) is invariant with respect to \(\alpha _3\).Footnote 34

At \(\alpha _3=1\), \(CS ^d_{\alpha _3>1}< CS ^{nc}\).

At \(\alpha _3=\alpha _3^*(\gamma )\), \(CS ^d_{\alpha _3>1}> CS ^{nc}\) if \(\gamma <0.69\).

Thus, if \(\gamma \ge 0.69\), \(CS ^d_{\alpha _3>1}\le CS ^{nc}\) at \(\alpha _3=\alpha _3^*(\gamma )\).

If \(\gamma <0.69\), there exists \({\hat{\alpha }}_3\), such that \(CS ^d_{\alpha _3>1}> CS ^{nc}\) if and only if \(\alpha _3>{\hat{\alpha }}_3\) and \(CS ^d_{\alpha _3>1}< CS ^{nc}\) if and only if \(\alpha _3<{\hat{\alpha }}_3\). \(\square\)

1.8 Proof of Proposition 7

We solve the game by backward induction. Given \(\delta\) and k, each firm maximizes \(\varPi _i\) (\(i=1,2\)) after substituting demand expressions from (9) to (11). We thus obtain the Bertrand equilibrium prices:

Using these equilibrium prices, and assuming \(k=\frac{1}{2}\) we obtain the equilibrium quantities:

Finally, substituting these equilibrium values in the profit functions (20) and (21), we obtain the equilibrium profits as a function of \(\delta\):

Maximizing joint profits \(\varPi _{1}^{\delta }+\varPi _{2}^{\delta }\) with respect to \(\delta\), we obtain

from which it is immediate to see that \(\delta ^{*}>0\) when \(\gamma <\frac{1}{3}\) and \(\delta ^{*}<0\) when \(\gamma >\frac{1}{3}\). \(\square\)

1.9 Proof of Lemma 4

Substituting \(\delta ^{*}\) in the Bertrand–Nash equilibrium prices, quantities and profits we obtain

and

-

a.

Comparing the price in (48) to the price set absent price discrimination (obtained in Proposition 2), \(p_i^c=\frac{6(1-\gamma )}{11-9\gamma }\), we can see that \(p_{i}^{\delta *}>p_i^c\) if and only if \(\gamma <\frac{1}{3}\).

Comparing the price of the cocktail with coordinated price discrimination [in expression (49)], with the cocktail price without discrimination (obtained in Proposition 2 and equal to \(p_3^c=r_1 p_1^c+r_2 p_2^c\)), we can see that \(p_{3}^{\delta *}<p_3^c\) if and only if \(\gamma <\frac{1}{3}\).

-

b.

Similarly, comparing (48) and (49) to the prices set with non-cooperative price discrimination (obtained in Proposition 5), \(p_i^d=\frac{3(1-\gamma )}{6-5\gamma }\) (\(i=1,2\)), and \(p_{3c}^{d}=\frac{2}{3}\left( \alpha _3-\frac{\gamma }{6-5\gamma }\right)\) it is possible to prove that \(p_{i}^{\delta *}>p_i^d\) (\(i=1,2\)) and \(p_{3}^{\delta *}<p_3^d\) for all \(\gamma \in [0,1)\).

-

c.

Comparing profits, it is possible to check that \(\varPi _{i}^{\delta *}>\varPi _{i}^{cd}>\varPi _{i}^{c}\), that is, the profits under coordinated price discrimination are always higher than those under non-coordinated price discrimination, which, in turn, are higher than profits without discrimination, and this for all \(\gamma \in [0,1)\)\(\square\)

1.10 Proof of Proposition 8

Substituting equilibrium prices and quantities into the general expression for consumer surplus (23), consumer surplus with coordinated price discrimination is

-

a.

Comparing Eq. (53) with the expression for consumer surplus under uniform pricing, \(CS ^c\) (obtained in Proposition 2) we find that \(CS ^{\delta *}\ge CS ^c\) if \(\gamma \le \frac{1}{3}\).

-

b.

Similarly, comparing Eq. (53) with the expression for consumer surplus under non-coordinated price discrimination \(CS ^d_{\alpha _3=1}\) found in expression (38) in the proof of Proposition 6, we find that \(CS ^{\delta *} > CS ^d_{\alpha _3=1}\) for all \(\gamma \in [0,1)\).

\(\square\)

1.11 Proof of Proposition 9

Following the same steps described in the proof of Proposition 7, the value of \(\delta\) that maximizes joint profits is \(\delta ^{*}=\frac{12-206\gamma +87\gamma ^{2}-2a_{3}(60-97\gamma +39\gamma ^{2})}{(246-400\gamma +162\gamma ^{2})}\). Notice that \(\frac{ \partial \delta ^{*}}{\partial \alpha _{3}}<0\) for any \(\gamma \in [0,1)\), and that \(\delta ^{*}\lesseqgtr 0\) iff \(\gamma \gtreqless {\widetilde{\gamma }}(\alpha _{3})=\frac{97a_{3}-103+\sqrt{ 49a_{3}^{2}+52a_{3}-92}}{3(26a_{3}-29)}\), where \(\frac{d{\widetilde{\gamma }} (\alpha _{3})}{d\alpha _{3}}<0\). Finally, \({\widetilde{\gamma }}(\alpha _{3})=0\) when \(\alpha _{3}=1.025\), so that for any \(\alpha _{3}\ge 1.025\), firms would only coordinate on a premium no matter the degree of substitutability across single products.

Notice that, in this case,

\(\square\)

Rights and permissions

About this article

Cite this article

Alvisi, M., Carbonara, E. Cocktails done right: price competition and welfare when substitutes become complements. J Econ 131, 1–38 (2020). https://doi.org/10.1007/s00712-020-00690-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-020-00690-z

Keywords

- Complements

- Vertical differentiation

- Price discounts and premia

- Price discrimination

- Excessive pricing

- Pharmaceutical markets