Abstract

Stochastic growth models are often solved numerically, because they are not tractable in general. However, recent several studies find the closed-form solution to the stochastic Uzawa–Lucas model in which technological progress or population dynamics follow a Brownian motion process with one or two parameter restriction(s). However, they assume that the return on the accumulation of human capital is deterministic, which is inconsistent with empirical evidence. Therefore, I develop the Uzawa–Lucas model in which the accumulation of human capital follows a mixture of a Brownian motion process and many Poisson jump processes, and obtain the closed-form solution. Moreover, I use it to examine the nexus between human capital uncertainty, technological progress, expected growth rate of human capital, and welfare.

Similar content being viewed by others

Notes

An explicit incorporation of leisure makes it extremely difficult to obtain the analytical solution. Therefore, I abstract from it. See Ladrón-De-Guevara et al. (1999) for the deterministic Uzawa–Lucas model with leisure. No study has found the closed-form solution to the stochastic Uzawa–Lucas model with leisure.

We can be sure that \(u\in (0,1)\) as long as the inequality

$$\begin{aligned} \alpha b-\alpha \delta _h-\frac{\sigma _h^2}{2}\alpha (1-\alpha )+\mu \gamma<\rho <b-\alpha \delta _h-\frac{\sigma _h^2}{2}\alpha (1-\alpha )+\mu \gamma \end{aligned}$$holds. Moreover, one can establish that the TVC

$$\begin{aligned} \lim _{t\rightarrow \infty } E[e^{-\rho t}K^{\alpha +\gamma }] = \lim _{t\rightarrow \infty } E[e^{-\rho t}A^{\gamma }H^\alpha ] = 0 \end{aligned}$$is satisfied. The proof requires the verification theorem. See Chang (2004, Ch. 4) for details of this theorem. Hiraguchi (2013, Appendix B) provides an excellent proof of the TVC for the stochastic Uzawa–Lucas model in which technology follows a geometric Brownian motion process. To save space, I will not mention the proof of TVC in what follows.

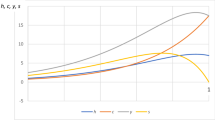

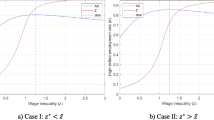

Following the seminal paper of Mankiw et al. (1992, p. 432), I set the human capital share \(\alpha =1/3\). For physical capital share, it has been commonplace in macroeconomics to assume that it is also 1/3. However, as Karabarbounis and Neiman (2014) document, the labor share is declining (or, put differently, physical capital share is rising) globally. Therefore, I set \(\gamma =0.27\) so that the physical capital share roughly equals 0.40, the value used by Ahn et al. (2017). \(b=0.11\) is used when Barro and Sala-i-Martin (2004) simulate the Uzawa–Lucas model. I choose \(\mu =0.02\) and \(\delta _k=\delta _h=0.03\), again following Mankiw et al. (1992). Finally, following Caballé and Santos (1993) and Moll (2014), I set \(\rho =0.05\). In Fig. 1, I use \(K=10\) to make it transparent.

I thank one anonymous referee for pointing out this property.

One more marginal channel through which \(\mu \) increases A can be seen by solving the differential equation (3). However, this somewhat overlaps the first channel.

I thank one anonymous referee for encouraging me to pursue this.

Specifically, I use the solution to (1)

$$\begin{aligned} H(t)=H(0)e^{\left( b(1-u)-\delta _h-\frac{\sigma _h^2}{2}\right) t}e^{\sigma _h z_h} \end{aligned}$$for simulation. Higham (2001) provides a concise explanation of simulation technique for stochastic differential equation driven by a Brownian motion process.

According to Lee and Lee (2016) data set on human capital stock, we can also see the “bell-shaped” pattern in US between 2000 and 2005. During this period, the number declined from 3.708 (in 2000) to 3.673 (in 2005). In fact, this phenomenon is not unique in US. For instance, in Switzerland between 1980 and 2000, the number consecutively declined from 3.103 (in 1980) to 2.758 (in 2000); in Spain between 1915 and 1920, the number declined from 1.403 (in 1915) to 1.389 (in 1920); in Portugal between 2000 and 2005, the number declined from 2.318 (in 2000) to 2.253 (in 2005). These evidence suggests that the above exercise can be applied not only to the period of unprecedentedly big events (such as World War II) or to the specific country, but also to other (possibly) disruptive events across time and space.

I thank one anonymous referee for pointing out this possibility.

Steger (2005) compares a Brownian motion process with a Poisson jump process in the AK model. He shows that, to conduct a sensible comparison between these requires some unrealistic restrictions. Furthermore, even when they are imposed, he finds that insights from the comparison is quantitatively negligible. Following his findings, I will not do empirical simulation in what follows. In principle, with Poisson jump processes, we would see occasional jumps in Fig. 3, in addition to random fluctuations driven by a Brownian motion process.

We can be sure that \(u\in (0,1)\) as long as the inequality

$$\begin{aligned}&\alpha b-\alpha \delta _h-\frac{\sigma _h^2}{2}\alpha (1-\alpha )+\mu \gamma +\sum _{i=1}^N \lambda _i\left( (1+\beta _i)^{\alpha }-1\right)<\rho <b-\alpha \delta _h \end{aligned}$$$$\begin{aligned}&\quad -\frac{\sigma _h^2}{2}\alpha (1-\alpha )+\mu \gamma +\sum _{i=1}^N \lambda _i\left( (1+\beta _i)^{\alpha }-1\right) \end{aligned}$$(19)holds. Moreover, one can establish that the appropriate TVC is satisfied. Sennewald (2007) provides the proof of the TVC for the Poisson jump case.

To be precise, as \(\mathcal {B}_X\) is contained in \(\mathcal {B}_Y\), shock terms in (22) affect both A and H, and hence welfare J. However, this channel would be too obvious to explain in detail.

References

Aghion P, Howitt P (1992) A model of growth through creative destruction. Econometrica 60(2):323–352

Ahn S, Kaplan G, Moll B, Winberry T, Wolf C (2017) When inequality matters for macro and macro matters for inequality. In: Eichenbaum MS, Parker J (eds) NBER macroeconomics annual 2017, vol 32. University of Chicago Press, Chicago

Barro RJ, Sala-i-Martin X (2004) Economic growth, 2nd edn. MIT Press, Cambridge

Bilkic N, Gries T, Pilichowski M (2012) Stay in school or start working? The human capital investment decision under uncertainty and irreversibility. Lab Econ 19:706–717

Brock WA, Mirman LJ (1972) Optimal economic growth and uncertainty: the discounted case. J Econ Theory 4(3):479–513

Brunnermeier MK, Sannikov Y (2014) A macroeconomic model with a financial sector. Am Econ Rev 104(2):379–421

Bucci A, Colapinto C, Forster M, La Torre D (2011) Stochastic technology shocks in an extended Uzawa–Lucas model: closed-form solution and long-run dynamics. J Econ 103(1):83–99

Caballé J, Santos MS (1993) On endogenous growth with physical and human capital. J Polit Econ 101(6):1042–1067

Chang F-R (2004) Stochastic optimization in continuous time. Cambridge University Press, New York

Chaudhry A, Naz R (2018) Closed-form solutions for the Lucas–Uzawa growth model with logarithmic utility preferences via the partial hamiltonian approach. Discret Contin Dyn Syst Ser S 11(4):643–654

Cho J, Cooley TF, Kim SH (2015) Business cycle uncertainty and economic welfare. Rev Econ Dyn 18(2):185–200

Cinnirella F, Streb J (2017) The role of human capital and innovation in economic development: evidence from post-Malthusian Prussia. J Econ Growth 22(2):193–227

Duffie D, Epstein LG (1992) Stochastic differential utility. Econometrica 60(2):353–394

Eaton J (1981) Fiscal policy, inflation and the accumulation of risky capital. Rev Econ Stud 48(3):435–445

Hartog J, Ophem HV, Bajdechi SM (2007) Simulating the risk of investment in human capital. Educ Econ 15(3):259–275

Higham DJ (2001) An algorithmic introduction to numerical simulation of stochastic differential equations. SIAM Rev 43(3):525–546

Hiraguchi R (2009) A note on the closed-form solution to the Lucas–Uzawa model with externality. J Econ Dyn Control 33:1757–1760

Hiraguchi R (2013) On a closed-form solution to the stochastic Lucas–Uzawa model. J Econ 108(2):131–144

Hiraguchi R (2014) A note on the analytical solution to the neoclassical growth model with leisure. Macroecon Dyn 18(2):473–479

Hojo M (2003) An indirect effect of education on growth. Econ Lett 80:31–34

Karabarbounis L, Neiman B (2014) The global decline of the labor share. Q J Econ 129(1):61–103

Krebs T (2003) Human capital risk and economic growth. Q J Econ 118(3):709–744

Kuwahara S (2017) Multiple steady states and indeterminacy in the Uzawa–Lucas model with educational externalities. J Econ 122(2):173–190

Ladrón-De-Guevara A, Ortigueira S, Santos MS (1999) A two-sector model of endogenous growth with leisure. Rev Econ Stud 66(3):609–631

Lee JW, Lee H (2016) Human capital in the long run. J Dev Econ 122:147–169

Lester R, Pries M, Sims E (2014) Volatility and welfare. J Econ Dyn Control 38:17–36

Levhari D, Weiss Y (1974) The effect of risk on the investment in human capital. Am Econ Rev 64(6):950–963

Lucas RE (1988) On the mechanics of economic development. J Monet Econ 22(1):3–42

Lucas RE (2003) Macroeconomic priorities. Am Econ Rev 93(1):1–14

Madsen JB (2014) Human capital and the world technology frontier. Rev Econ Stat 96(4):676–692

Mankiw NG, Romer D, Weil DN (1992) A contribution to the empirics of economic growth. Q J Econ 107(2):407–437

Marsiglio S, La Torre D (2012a) A note on demographic shocks in a multi-sector growth model. Econ Bull 32(3):2293–2299

Marsiglio S, La Torre D (2012b) Population dynamics and utilitarian criteria in the Lucas–Uzawa model. Econ Model 29(4):1197–1204

Moll B (2014) Productivity losses from financial frictions: can self-financing undo capital misallocation? Am Econ Rev 104(10):3186–3221

Naz R, Chaudhry A, Mahomed FM (2016) Closed-form solutions for the Lucas–Uzawa model of economic growth via the partial Hamiltonian approach. Commun Nonlinear Sci Numer Simul 30:299–306

Rebelo S, Xie D (1999) On the optimality of interest rate smoothing. J Monet Econ 43(2):263–282

Sennewald K (2007) Controlled stochastic differential equations under Poisson uncertainty and with unbounded utility. J Econ Dyn Control 31(4):1106–1131

Sennewald K, Wälde K (2006) “Itô’s Lemma” and the Bellman equation for Poisson processes: an applied view. J Econ 89(1):1–36

Smith WT (2007) Inspecting the mechanism exactly: a closed-form solution to a stochastic growth model. BE J Macroecon 7(1):1–31

Steger TM (2005) Stochastic growth under Wiener and Poisson uncertainty. Econ Lett 86:311–316

Turnovsky SJ (1997) International macroeconomic dynamics. MIT Press, Cambridge

Turnovsky SJ (2000) Methods of macroeconomic dynamics, 2nd edn. MIT Press, Cambridge

Uzawa H (1965) Optimum technical change in an aggregative model of economic growth. Int Econ Rev 6(1):18–31

Wälde K (2011a) Production technologies in stochastic continuous time models. J Econ Dyn Control 35(4):616–622

Wälde K (2011b) Applied intertemporal optimization. Mainz University Gutenberg Press, Mainz

Xie D (1991) Increasing returns and increasing rates of growth. J Polit Econ 99(2):429–435

Xie D (1994) Divergence in economic performance: transitional dynamics with multiple equilibria. J Econ Theory 63(1):97–112

Xu S (2017) Volatility risk and economic welfare. J Econ Dyn Control 80:17–33

Acknowledgements

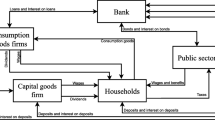

I thank Prof. Noritsugu Nakanishi, Assoc. Prof. Quoc Hung Nguyen, Prof. Hiroyuki Nishiyama, Prof. Masao Oda, Prof. Yoshifumi Okawa and seminar participants at the summer 2017 JSIE Kansai Branch Meeting for their many extensive and thoughtful comments. I would particularly like to thank Assoc. Prof. Shiro Kuwahara for his encouragement, pointing out troublesome typos, and constructive comments, “from the cradle to completion” of this paper. I am especially grateful to Prof. Yoichi Gokan, my discussant, and two anonymous referees of this journal for their detailed and exceptionally helpful comments that lead to the unthinkably substantial improvement of the earlier version of the manuscript. All remaining mistakes are my own. This paper was accepted to the J Econ under the guidance of Prof. Giacomo Corneo (Editor). Figure 2 is created with Eviews 9.5 Student Version, while the others are with MATLAB R2016b (Version 9.1, MATLAB and Simulink Student Suite). This research does not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendix: Analytical solution

Appendix: Analytical solution

This appendix briefly describes how to find the closed-form representation of the value function in Theorems 1, 2, and 3. For this purpose, postulate the tentative value function of the form

where x, y, z, \(\theta _1\), \(\theta _2\), and \(\theta _3\) are all unknown constants to be determined. The relevant partials are \(J_K = x\theta _1 K^{\theta _1 -1}\), \(J_{KK} = x \theta _1(\theta _1 -1) K^{\theta _1-2}\), \(J_A = y \theta _2 A^{\theta _2 -1} H^{\theta _3}\), \(J_H = y \theta _3 A^{\theta _2} H^{\theta _3 -1}\), and \(J_{HH} = y \theta _3 (\theta _3-1) A^{\theta _2} H^{\theta _3 -2}\).

To obtain the explicit expression, substitute these partials into the maximized HJB equation (21). Then, set \(\theta _1=\alpha +\gamma \), \(\theta _2=\gamma \), and \(\theta _3=\alpha \). Finally, by imposing the parameter restriction (8), you can find the explicit expressions for x, y, and z, and consequently, those for control variables C and u and for the value function J(K, A, H) in Theorem 3. Expressions in Theorem 2 are available by abstracting from the shock terms associated with the stochastic depreciation of physical capital, while those in Theorem 1 are obtained by abstracting from many Poisson jump processes in Eq. (16).

Rights and permissions

About this article

Cite this article

Tsuboi, M. Stochastic accumulation of human capital and welfare in the Uzawa–Lucas model: an analytical characterization. J Econ 125, 239–261 (2018). https://doi.org/10.1007/s00712-018-0604-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-018-0604-6