Abstract

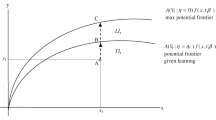

We develop a model of learning-by-doing in human capital formation in the presence of allocative inefficiencies. The inefficiencies are a result of lobbying by firms to establish, or prevent, barriers to the perfectly competitive allocation of factors of production (labor). It is shown that lobbying may lead to a static welfare loss depending upon the elasticity of substitution between goods, and the relative lobbying power of firms. Further, productivity growth, via learning by doing, changes the relative lobbying power over time. This may magnify or diminish the static welfare loss in the long-run depending on the level of initial misallocation. Therefore, differences in initial lobbying power and rate of productivity growth between sectors determine the long-run effects of lobbying.

Similar content being viewed by others

Notes

All data on lobbying expenses have been obtained from https://www.opensecrets.org/lobby/.

The debate is centered around a regulation that would allow internet service providers to charge different internet content providers different rates depending on the speed of data transfer they desire. It is argued that this move goes against the principle of “net-neutrality” as it would mean that content of some providers is more important than others. The proposal led to intense lobbying activity by firms in favor of net neutrality and those against. AT&T, Comcast and Verizon were the big three firms against neutrality and spent a combined $ 44.2million dollars in 2013 lobbying against it. Google, Facebook, and Microsoft were the major pro net neutrality firms and they spent a combined $ 31.5 million lobbying for it in the same year. The FCC has ruled in favor of preserving net neutrality for the time being.

Arrow (1962), and Lucas (1988) have demonstrated the importance of learning by doing as source of TFP growth. There is also considerable empirical evidence to support this fact; for example, in a recent study, Levitt et al. (2013) uses data for production of 190,000 cars produced over a year from a major auto manufacturer to find that both the defect rates and the amount of time required to assemble a car drops by about 70 per cent during the first eight weeks of production. The study goes on to conclude that there is “considerable evidence of learning by doing in quality and quantity productivity performance.”

We assume that the set of blue widget producing firms act collectively and allocate resources to determine optimally their share of the labor force, which share is allocated equally among the type 1 firms. The red widget producing firms behave in similar fashion. As implied, we assume the “free-rider” problem in each industry has been overcome.

There are several papers in the contest literature where players expend resources sequentially in a Stackelberg contest. Linster (1993), Glazer and Hassin (2000) derive the sub-game perfect Nash equilibria of a Stackeberg rent seeking contest when the order of contribution is exogenously given. Baik and Shogren (1992), Leininger (1993) endogenize the order of the move by allowing firms to choose the timing of their contribution. In our paper, the choice of leader is motivated by the assumption that perfect competition is the status-quo, which the type B firms are defending and therefore move first. Le Breton et al. (2012) employ this type of set up in a model of legislative lobbying where the leader is a pro-reform lobby and the follower wants to maintain status-quo.

References

Acemoglu D, Johnson S, Robinson JA (2002) Reversal of fortune: geography and institutions in the making of the modern world income distribution. Q J Econ 117(4):1231–1294

Acemoglu D, Robinson JA (2006) Economic backwardness in political perspective. Am Polit Sci Rev 100(1):115–131

Acemoglu D, Robinson JA (2012) Why nations fail: the origins of power, Prosperity and Poverty., Vol. 1, 1st ed. 115-131. New York: Crown

Acemoglu D, Aghion P, Zilibotti F (2006) Distance to frontier, selection, and economic growth. J Eur Econ Assoc 4(1):37–74

Arrow KJ (1962) The economic implications of learning by doing. Rev Econ Stud 29(3):155–173

Baik KH, Shogren Jason F (1992) Strategic behavior in contests: comment. Am Econ Rev 82(1):359–362

Banerjee AV, Moll B (2010) Why does misallocation persist? Am Econ J Macroecon 2(1):189–206

Bartelsman E, Haltiwanger J, Scarpetta S (2013) Cross-country differences in productivity: the role of allocation and selection. Am Econ Rev 103(1):305–334

Buera FJ, Kaboski JP, Shin Y (2011) Finance and development: a tale of two sectors. Am Econ Rev 101(5):1964–2002

Candel-Sánchez F, Perote-Peña J (2017) Endogenous market regulation in a signaling model of lobby formation. J Econ. doi:10.1007/s00712-017-0547-3

Cothren R, Radhakrishnan R (2017) Trade and growth in a model of allocative inefficiency. BE J Macroecon. doi:10.1515/bejm-2014-0169

Di Gioacchino D, Profeta P (2014) Lobbying for education in a two-sector model. Econ Polit 26(2):212–236

Glazer A, Hassin R (2000) Sequential rent seeking. Publ Choice 102(3–4):219–228

Goldberg PK, Maggi G (1999) Protection for sale: an empirical investigation. Am Econ Rev 89(5):1135–1155

Grossman GM, Helpman E (1994) Protection for sale. Am Econ Rev 84(4):833–850

Heckelman JC, Wilson B (2013) Institutions, lobbying, and economic performance. Econ Polit 25(3):360–386

Hseih C-T, Klenow PJ (2009) Misallocation and manufacturing TFP in China and India. Q J Econ 124(4):1403–1448

Jeong H, Townsend RM (2007) Sources of TFP growth: occupational choice and financial deepening. Econ Theory 32(1):179–221

Lagerlöf J (1997) Lobbying, information, and private and social welfare. Eur J Polit Econ 13(3):615–637

Le Breton M, Sudhlter P, Zaporozhets V (2012) Sequential legislative lobbying. Soc Choice Welf 39(2):491–520

Leininger W (1993) More efficient rent-seeking a Münchhausen solution. Publ Choice 75(1):43–62

Levitt SD, List JA, Syverson C (2013) Toward an understanding of learning by doing: evidence from an automobile assembly plant. J Polit Econ 121(4):643–681

Linster BG (1993) Stackelberg rent-seeking. Publ Choice 77(121):307–321

Lucas RE Jr (1988) On the mechanics of economic development. J Monet Econ 22(1):3–42

Mohtadi H, Roe T (1998) Growth, lobbying and public goods. Eur J Polit Econ 14(3):453–473

Polk A, Schmutzler A (2005) Lobbying against environmental regulation versus lobbying for loopholes. Eur J Polit Econ 21(4):915–931

Potters J, Van Winden F (1992) Lobbying and asymmetric information. Publ Choice 74(3):269–292

Ray D (2010) Uneven growth: a framework for research in development economics. J Econ Perspect 24(3):45–60

Restuccia D, Rogerson R (2008) Policy distortions and aggregate productivity with heterogeneous establishments. Rev Econ Dyn 11(4):707–720

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof

Proposition 1 Since the model features no physical capital, and maintaining Lucas’ assumption that human capital accumulation is external, the consumers in the model do not face any intertemporal trade-offs. Therefore, the consumer’s problem simplifies to maximizing utility given by

subject to a static income constraint. If P is the blue price of the red widgets, then utility maximization by an individual requires that P equals the marginal rate of substitution of reds for blue. Therefore, the optimality condition for the consumer’s maximization problem is

This yields the optimal consumption ratio as

We have assumed that labor is free to move between the two types of firms, there is free entry into the production process, and learning effects are external to firms. In this case, all firms in the economy earn zero economic profits and all proceeds from production flow to labor. Under these assumptions profit maximization implies that the relative price under perfect competition is equal to the marginal rate of transformation. That is,

Imposing the condition that at \(P_{C}\), market for blue and red widget clears, Eq. (16) becomes

which combined with Eq. (17) yields

\(\square \)

Proof

Proposition 2 We solve this problem using backward induction wherein type R firms decide on the optimal \(\rho \) for a given \(\beta \). Type B firms use this information to decide their optimal contribution of resources. As is clear from (10), in the interval \([0, \theta \beta ]\) the output of type R firms is constant and therefore the payoff decreases in \(\rho \). Therefore, over this interval the optimal contribution of type R firms is \(\rho ^{*} = 0\). Thus for an interior solution with \(\rho > 0\), we must have \(\rho \in (\theta \beta , \infty )\). The necessary condition for type R firms to expend an amount \(\rho > \theta \beta \) is that the payoff must be rising at the the cutoff point \(\theta \beta \). That is, the first derivative of the payoff function with respect to \(\rho \) evaluated at \(\theta \beta \) must be positive. This requires that

Assuming this condition holds, one finds that the payoff function of type R firms in the interval \((\theta \beta , \infty )\) is \([ 1 - (\theta \beta / \rho )\lambda _{C}]h_{R} - \rho \), which is maximized at

However, this value of \(\rho \) is optimal if and only if the payoff at \(\rho = (\theta \beta \lambda _{C}h_{R})^{1/2}\) is greater than the payoff obtained when \(\rho = 0\). This requires

Note that if (20) is satisfied then (18) also holds, since \(\tilde{\beta } < \hat{\beta }\). This establishes that the optimal value for \(\rho \), \(\rho ^{*}\), is

Given the values for \(\rho ^{*}\) in Eq. (21), we can now determine the optimal allocation for the type B leader. As apparent from Eq. (21), the optimal value for \(\beta \) lies in the interval \([0, \hat{\beta }\equiv (\lambda _{C}h_{R})/4\theta ]\). Given Eq. (21), the payoff function for the type B firms is

Let \(f(\beta ) \equiv (\theta \beta \lambda _{C})^{1/2} h_{B}/ h_{R}^{1/2} - \beta \) and note that \(f'(\beta ) >,<\), or \(= 0\), as \(\beta <, >,\) or \(= \beta ^{*} \equiv (\theta \lambda _{C}h_{B}^{2})/4 h_{R}\). From these facts it follows that \(\pi _{B}\) is maximized at \(\hat{\beta }\), if \(\hat{\beta } \equiv (\lambda _{C}h_{R})/4\theta \le \beta ^{*} \equiv (\theta \lambda _{C}h_{B}^{2})/4 h_{R}\), that is, if \(\theta \ge (h_{R} / h_{B})\).

Suppose \(\theta < (h_{R} / h_{B})\) and thus \(\beta ^{*}\) is less than \(\hat{\beta }\). Then in this case \(f'(\beta ) = 0\) at \(\beta = \beta ^{*}\in [0,\hat{\beta })\) and therefore \(\beta ^{*}\) is a candidate optimal value for \(\beta \). We say candidate because it still may pay the type B firms to generate a discrete jump in \(\pi _{B}\) by increasing \(\beta \) from \(\beta ^{*}\) to \(\hat{\beta }\).

Note that if \(\beta = \beta ^{*} \equiv (\theta \lambda _{C}h_{B}^{2})/4 h_{R}\) then \(z^{*} \equiv (\theta /2) (h_{B}/h_{R})\) and the payoff to the type B firms is \(\pi _{B}(\beta ^{*}) = (\theta \lambda _{C} h_{B}^{2})/2h_{R} - (\theta \lambda _{C} h_{B}^{2})/4h_{R} = (\theta \lambda _{C} h_{B}^{2})/4h_{R}\). However, this must be compared to \(\pi _{B}(\hat{\beta }) = h_{B}\lambda _{C} - (\lambda _{C}h_{R})/4\theta \). One finds that when \(\beta ^{*} < \hat{\beta }\),

The quadratic function \(g(\theta )\) has zeros at \(\theta = (h_{R}/h_{B})(2 - \sqrt{3})\) and \(\theta = (h_{R}/h_{B})(2 + \sqrt{3})\) and is negative on the interval \((h_{R}/h_{B})(2 - \sqrt{3}), (h_{R}/h_{B})(2 + \sqrt{3}))\). Thus on this interval the optimal value for \(\beta \) is \(\hat{\beta }\). When \(\theta < \theta _{C} \equiv (h_{R}/h_{B})(2 - \sqrt{3})\), the optimal value is \(\beta ^{*}\) and we have an interior solution with \(z^{*} < 1\). When \(\theta > (h_{R}/h_{B})(2 + \sqrt{3})\), \(\theta > (h_{R}/h_{B})\), and our previous analysis has established that the optimal value is \(\hat{\beta }\) \(\square \)

Rights and permissions

About this article

Cite this article

Cothren, R., Radhakrishnan, R. Productivity growth and welfare in a model of allocative inefficiency. J Econ 123, 277–298 (2018). https://doi.org/10.1007/s00712-017-0575-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-017-0575-z