Abstract

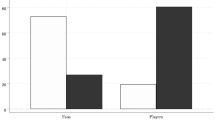

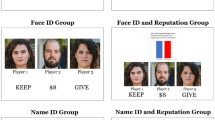

I build a dynamic game consisting of a continuum of players to investigate the effects of previous winners’ actions on the spreading of subsequent players’ actions. In each stage, besides the private signal, each player also observes actions taken by the winners of all previous stages as public signals. A unique equilibrium of the game is found and characterized. I then define the variances of three forms of gap: the gap between the average play and the underlying fundamental value, the gap between a generic player’s action and the average play, and the gap between a generic player’s action and the winner’s play. By checking their dynamics in the equilibrium, it is shown that the accumulation of private signals always reduces the first variance and the accumulation of the public signals always reduces the second variance. However, the effects of accumulated public (private) signals on the first (second) variance are rather ambiguous. Based on a theoretical finding that expresses the third variance as a weighted sum of the other two, I conduct an empirical study on the Miss Korea pageant during 1994–2013. I find a descending trend in the variance of the gap between the average face and the underlying “true beauty” face over these years. Moreover, this process is accompanied by ascending trends in the other two variances, indicating that contestants’ faces have been converging to the “true beauty” overall but diverging from each other over the two decades, which is consistent with our theoretical results.

Similar content being viewed by others

Notes

It is important to emphasize that, although Keynes utilized the metaphor “beauty contest” to refer mainly to phenomena in financial markets, the current paper does not belong to the field of financial economics: The fundamental value is fixed in our model, which is different from the financial economics papers where the fundamental is usually varying over time, e.g., following a stochastic progress. This paper cites Keynes’ metaphor only to illustrate the idea of an economic environment where higher order beliefs matter.

The most well-known form of game among them, is perhaps the p-beauty contest game, which is mainly used in behavioral and experimental economics, as a tool to identify the depth of individuals’ real cognitive power and to question the classical assumptions on rationality. The current work does not belong to that line of research.

As stated in part II, chapter 12 of Keynes (1936), “It would be foolish ...to attach great weight to matters which are very uncertain. It is reasonable, therefore, to be guided to a considerable degree by the facts about which we feel somewhat confident, even though they may be less decisively relevant to the issue than other facts about which our knowledge is vague and scanty”. Applying this argument to the model, with private signals as the uncertain matters and the public signal as the certain matter, explains the result.

For instance, although we can have all daily prices for the 4-month lifetime of all NYMEX crude oil futures since 1985, it is impossible to have also the public signals that are revealing the winners’ actions.

See, http://gawker.com/plastic-surgery-blamed-for-making-all-miss-korea-contes-480907455, for an instance.

Actually, this was pointed out in the initial post on this issue. However, almost all following posts just ignored this and argued that those were the Miss Korea contestants’ pictures.

The instantaneous utility function defined in (1) is slightly different from that used by Morris and Shin (2002), who take \(U_{it}=-(1-\gamma )(a_{it}-\theta )^2 -\gamma (L_{it}-\bar{L}_t)\), where \(\bar{L}_t=\int _{0}^{1}\ L_{it}\, \mathrm {d} i \). The inclusion of term \(\bar{L}_t\) makes sure the sum of the second parts of the utility functions always equals zero. As a result, the social welfare depends exclusively on how close the actions are to the fundamental value in average. However, since we do not care about social welfare in the current work, term \(\bar{L}_t\) becomes irrelevant here and is eliminated from the utility function.

The main results of the paper still hold without this assumption because of the continuum setting of players. We adopt the assumption only to simplify the notations in the rest of the paper. If a player knows she has been picked out as the winning player and remembers her action in previous stages, she can induce the true fundamental value. In each stage, we have only finite many these players, whose actions thus have no effect at all in a model with a continuum of players. However, we have to distinguish between these zero-measured fully-informed players and other players when it comes to the strategies and beliefs, which makes the definitions and notations unnecessarily tedious.

The proofs of all the lemmas, propositions, and corollaries present in this work are given in Appendix 1.

See, for example, http://fashionista.com/2013/08/inside-miss-korea-scandal-glory-lee/.

There is another reason why the analysis includes only faces between 1994 and 2013. The authority of the Miss Korea pageant actually provides pictures of the faces of all final-round contestants since as early as the 1960s. However, the faces of contestants during the 1960s, 1970s, and 1980s look so different from the faces of contestants in the 1990s and thereafter. While the faces during the former period could be considered traditionally Asian faces, the faces during the latter period generally look closer to Western-world faces, e.g., with much more double eyelids, deeper eyes, higher-bridged noses, sharper faces, and narrower jaws. It suggests that the “true beauty” could be treated as rather stationary, at least since the 1990s. Otherwise, we should be able to observe a qualitatively obvious change in the styles of faces again after the 1990s. However, this change is not found while checking the data. In other words, the other reason we include only faces between 1994 and 2013 to analysis is that, the fundamental value (“true beauty”) could be treated as fixed during this period, which is consistent with the setting of a fixed \(\theta \) as in the theoretical part.

Almost all contestants have at least one picture available online, exceptions are 1 contestant’s picture is missing for 1996, 2 missing for 2004, 1 missing for 2012, and 1 missing for 2013. For these contestants, we just exclude them from considerations. For contestants with multiple pictures available, we pick out the one that best depicts the contestant’s facial characteristics, as well as has similar photo backgrounds with other contestants’ pictures.

The details and proofs can be found in Chapters 1, 2, 3, and 6 of Jolliffe (2002).

Actually, because \(BB^{T}\) is a \(25000\times 25000\) matrix and the dimension of \(\Sigma ^{A}\) is only \(1125\times 1125\), in practice we first calculate eigenvectors \(\omega _{n}\)’s for \(\Sigma ^{A}\) and then calculate \(\nu _{n}\)’s by \(\nu _{n}=B \omega _{n}/ \Vert B \omega _{n} \Vert \).

The results in the empirical part could be considered seriously only for the contestants of the final rounds of the Miss Korea pageants. Otherwise, we must suffer from selection bias. Because there must be women that refrain from participating the beauty pageant, and we have excluded from analysis the data of beauty pageants in the district and city levels as preliminary competitions for the final contest studied in the paper.

References

Allen F, Morris S, Shin HS (2006) Beauty contests and iterated expectations in asset markets. Rev Financ Stud 19(3):719–752

Amador M, Weill PO (2012) Learning from private and public observations of others’ actions. J Econ Theory 147(3):910–940

Angeletos GM, Pavan A (2007) Efficient use of information and social value of information. Econometrica 75(4):1103–1142

Angeletos GM, Werning I (2006) Crises and prices: information aggregation, multiplicity, and volatility. Am Econ Rev 96(5):1720–1736

Angeletos GM, Hellwig C, Pavan A (2006) Signaling in a global game: coordination and policy traps. J Polit Econ 114(3):452–484

Bacchetta P, Van Wincoop E (2008) Higher order expectations in asset pricing. J Money Credit Bank 40(5):837–866

Corsetti G, Dasgupta A, Morris S, Song Shin H (2004) Does one soros make a difference? A theory of currency crises with large and small traders. Rev Econ Stud 71(1):87–113

Haller H, Yi M (2013) Paths of a continuum of independent random variables. Working Paper, Virginia Polytechnic Institute and State University, Department of Economics

Jolliffe I (2002) Principal component analysis. Springer, New York

Judd KL (1985) The law of large numbers with a continuum of IID random variables. J Econ Theory 35(1):19–25

Keynes JM (1936) The general theory of employment, interest and money. Macmillan, London

Morris S, Shin HS (2002) Social value of public information. Am Econ Rev 92(5):1521–1534

Turk M, Pentland A (1991) Eigenfaces for recognition. J Cogn Neurosci 3(1):71–86

Vives X (2008) Information and learning in markets: the impact of market microstructure. Princeton University Press, Princeton

Wang C (2013) Bailouts and bank runs: theory and evidence from tarp. Eur Econ Rev 64:169–180

Acknowledgements

The author would like to thank the two anonymous reviewers for their insightful and constructive comments that greatly contributed to improving this paper. The author is grateful to Hans Haller, Éric Bahel, Joao Macieira, Zhou Yang, Shihui Ma, Fei Chen, Jiaqiang Zhuang, Kui Zhao, and the seminar participants at Virginia Tech, Huazhong University of Science and Technology, Wuhan University, Nanjing University, China Economics Annual Conference 2015, and Zhongnan University of Economics and Law, for their comments and suggestions. Nevertheless, the author is solely responsible for all remaining flaws and errors. This work has been supported by the Fundamental Research Funds for the Central Universities, HUST: 2016AB007.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix

Proofs

The proofs below use extensively the tools of Bayesian inference and the conjugate distribution property of normal distributions. An uninitiated reader can check sections 10.1 and 10.2 in Vives (2008) for detailed introductions.

1.1 Proof of Lemma 1.

To prove it, let us assume there exists an equilibrium such that for some i and t we have \(a_{it}\ne (1-\gamma )E_{it}(\theta ) +\gamma \,E_{it}\left( \int _0^1 a_{jt} \,\mathrm {d}j\right) \). Let \(a'_{it}\) be defined as in Eq. (6), and substitute \(a_{it}\) with \(a'_{it}\) while keeping player i’s other stage strategies as well as all other players’ strategies the same as in the initial equilibrium. Because Eq. (6) is the first order condition for maximization of the expected stage payoff, player i’s stage-t payoff increases after the substitution. This substitution has effects on player i’s expected payoffs for future stages if and only if she turns out to be the most successful player of stage t, which is a zero-probability event according to the continuum setting of the player set. As a result, \(a_{it}\) cannot be part of an equilibrium, contradiction. So in any equilibrium, the equality must be satisfied for each player in each stage. \(\square \)

1.2 Proof of Lemma 2.

To see that it is optimal for player i to adopt \(a_{i1}=\frac{\beta _1 y_1+(1-\gamma )\alpha _1 x_{i1}}{\beta _1+(1-\gamma )\alpha _1}\) given others are doing so, notice that the conditional distribution of \(\theta \) on \(h_{i1}\) is

given all players are taking this stage strategy, we have

So the RHS of Eq. (6) could be expressed as

which is exactly the LHS of the equation under the stage strategy. So the first-order condition, Eq. (6), is fulfilled.

We then adopt the method used in Morris and Shin (2002) to show that there are no other choices for \(a_{i1}\). Define operator \(\bar{E}_1(\cdot )=\int _0^1 E_{j1}(\cdot )\, \mathrm {d} j\) as well as

The initial first order condition (6) can thus be rewritten as

where the second equality adopts the fact that the first order condition (6) must hold for all players in the symmetric equilibrium, and the third equality uses the definitions above as well as the iteration rule.

Define \(\mu _1=\alpha _1/(\beta _1+\alpha _1)\), based on (29) and (32), it is straightforward to have \(\bar{E}^n_1(\theta )=(1-\mu _1^n)y_1+\mu _1^n \theta \) and \(E_{i1}(\bar{E}^n_1(\theta ))=(1-\mu _1^{n+1})y_1+\mu _1^{n+1} x_{i1}\). Also notice that \(\mu _1<1\) always holds, so the RHS of (33) is bounded and is rewritten as

This is the unique solution that satisfies condition (6), and it also makes sure every player is maximizing her stage-1 payoff given others’ strategies, so the first half of the statement is now proved. For the second half, notice that for individuals \(i\ne j\) we have \( x_{i1}-x_{j1}=\theta +\varepsilon _{i1}-\theta -\varepsilon _{j1}=\varepsilon _{i1}-\varepsilon _{j1}\), so in the equilibrium play

In the equilibrium, player i’s stage-1 payoff becomes

Now suppose player i turns out to be the most successful player of stage 1, Assumption 1 makes sure that \(\varepsilon _{i1}\) is a maximizer of the RHS of (37) in \(\mathbb {R}\). Further denote by \(\varepsilon ^*_1\) the value of private noise of the first stage’s most successful player, it thus solves the first order condition

which in turn gives us

So the most successful player in stage 1 receives private signal \(x^*_1=\theta +\varepsilon ^*_1=\theta +\frac{\beta _1}{\alpha _1}(\theta -y_1)\). The lemma is proved. \(\square \)

1.3 Proof of Proposition 1.

We prove the proposition by induction. Lemma 2 has already assured the validity of the statement for the first stage. Now for \(t\ge 2\), suppose the statement is true for stage \(t-1\), it suffices to show the statement is also true for stage t. Suppose that in stage \(t-1\) we have

Then in stage t, there are two signals added into player i’s history:

where \(a^{*}_{t-1}\) is the action taken by the most successful player in stage \(t-1\). Based on the validity of the statement in stage \(t-1\), we can adopt the same logic of the proof for \(x^*_1=\theta +\frac{\beta _1}{\alpha _1}(\theta -y_1)\) in Lemma 2, and get

Inserting the stage strategy \(a_{i,t-1}\) and (43) into (42) yields

Rearranging (44) gives us

Denote the LHS of (45) by \(\Upsilon _t\) and clearly we have

where \(\Omega _t=\left[ \frac{(1-\gamma )(\tilde{\alpha }_{t-1}+\tilde{\beta }_{t-1})}{\tilde{\beta }_{t-1}+(1-\gamma )\tilde{\alpha }_{t-1} } \right] ^2\). Player i can thus update her belief on \(\theta \) using (41) and (45). The two noise terms in these are independent and both normally distributed, the conjugacy property of normal prior and posterior distributions gives us

The proposition also defines \(\tilde{\alpha }_t=\tilde{\alpha }_{t-1}+\alpha _t\), \(\tilde{x}_{it}=(\tilde{\alpha }_{t-1} \tilde{x}_{i,t-1} +\alpha _t x_{it} ) /\tilde{\alpha }_t\), \(\tilde{\beta }_t=\tilde{\beta }_{t-1} +\Omega _t \beta _t\), and \(\tilde{y}_t=(\tilde{\beta }_{t-1} \tilde{y}_{t-1} + \Omega _t \beta _t \Upsilon _t )/\tilde{\beta }_t\). We thus rewrite (47) as

We then impose here again the logic in the proof of Lemma 2 by analogously defining \(\mu _t=\tilde{\alpha }_t/(\tilde{\beta }_t+\tilde{\alpha }_t)\) as well as getting \(\bar{E}^n_t(\theta )=(1-\mu _t^n)\tilde{y}_t+\mu _t^n \theta \) and \(E_{it}(\bar{E}^n_t(\theta ))=(1-\mu _t^{n+1})\tilde{y}_t+\mu _t^{n+1} \tilde{x}_{it}\). As a result, we must have in an equilibrium

So in the equilibrium, given the statement of the proposition as well as property (48) are both true for stage \(t-1\), it must also be the case for stage t. And the validity of both the statement and the property for stage 1 are shown in Lemma 2, uniqueness is depicted by (49) and the proof is thus completed by induction. \(\square \)

1.4 Proof of Corollary 1.

For the first half of the statement, based on the inductive logic used in the proof above, the steps we showed (43) also prove \(\tilde{x}^*_t=\theta +\frac{\tilde{\beta }_t}{\tilde{\alpha }_t}(\theta -\tilde{y}_t)\). For the second half, notice that

We rewrite the two noise terms in the equation above as

The last equality of (52) results from (45). And we already know \(\varepsilon _{in} \sim \mathcal {N}(0,{1}/{\alpha _{n}}) \), \(\sqrt{\Omega _n} \xi _n \sim \mathcal {N}(0,{\Omega _n}/{\beta _{n}})\) for \(n\ge 2\), and \((y_1-\theta ) \sim \mathcal {N}(0,{1}/{\beta _{1}})\). Because of the independence between noises, we thus have

All the properties above together suggest \((a_{it}-\theta )\) is normally distributed with mean 0 and variance \(\frac{\tilde{\beta }_t + (1-\gamma )^2 \tilde{\alpha }_t}{\left( \tilde{\beta }_t + (1-\gamma )\tilde{\alpha }_t \right) ^2}\). The whole statement is proved. \(\square \)

1.5 Proof of Proposition 2.

According to the definition of \(d_{1t}\), we have

The second equality above results from (51) and the last equality is because \(\int _0^1 \alpha _n \varepsilon _{in} \, \mathrm {d}i=0\) for each n. Property (54) thus leads to

the first part is proved. It is then straightforward to see \(\partial V_{1t}/ \partial \tilde{\alpha }_{t}<0\). To check the last property, we have

so \(\partial V_{1t}/ \partial \tilde{\beta }_{t}<0\) holds if and only if \(\frac{\tilde{\beta }_t}{\tilde{\alpha }_t}>1-\gamma \). \(\square \)

1.6 Proof of Proposition 3.

The definition of \(d_{2t}\) gives us

combining with (53) we have

The first half is proved. For the second part of the statement, it is straightforward to see it is true by simply checking the signs of \(\partial V_{2t}/ \partial \tilde{\beta }_{t}\) and \(\partial V_{2t}/ \partial \tilde{\alpha }_{t}\). \(\square \)

1.7 Proof of Proposition 4.

Based on the previous two propositions we have

Obviously, the RHS of the equation above is always decreasing from t to \(t'=t+1\) for any t. So as long as \(V_{1t}<V_{1t'}\), we must have \(V_{2t}>V_{2t'}\); and given \(V_{2t}<V_{2t'}\), we must have \(V_{1t}>V_{1t'}\). \(\square \)

1.8 Proof of Proposition 5.

In the equilibrium we have

\(d_{3t}\) is thus normally distributed with mean zero and variance

This completes the proof. \(\square \)

Data and codes

All datasets and codes used in the empirical study could be downloaded from the following link: https://www.dropbox.com/sh/kkepe449sd0lxsk/AACwSK8SwTNCQW8RaSfS4hsua?dl=0

To run the programs, you need to download the whole folder, have Matlab program with version later than R2012a installed on the computer, and follow the instructions in file “Read_Me”.

Rights and permissions

About this article

Cite this article

Yi, M. Dynamic beauty contests: Learning from the winners to win?. J Econ 122, 67–92 (2017). https://doi.org/10.1007/s00712-017-0530-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-017-0530-z