Abstract

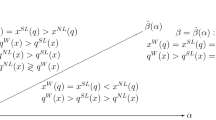

This paper analyzes a two-period setup in which firms differ with respect to costs of care and may use care-taking to signal type to consumers, who are able to observe precaution taken only ex post. Applying the refinement of the intuitive criterion to the concept of the perfect Bayesian equilibrium, we establish a unique separating equilibrium for every share of harm borne by firms. For low levels of victim compensation, we show that (i) firms choose weakly higher care in a setting in which customers do not know the firms’ type than in a setting in which they do, and (ii) the deviation in precaution taken due to asymmetric information on firm type is welfare-improving.

Similar content being viewed by others

References

Bagwell K, Riordan MH (1991) High and declining prices signal product quality. Am Econ Rev 81: 224–239

Cho IK, Kreps DM (1987) Signaling games and stable equilibria. Q J Econ 102: 179–221

Cooter R, Ulen T (2008) Law and economics, 5th edn. Addison Wesley, Boston

Daughety A, Reinganum J (1995) Product safety: liability, R & D, and signaling. Am Econ Rev 85: 1187–1206

Daughety A, Reinganum J (2008) Products liability, signaling and disclosure. J Inst Theor Econ 164: 106–126

Endres A, Lüdecke A (1998) Incomplete strict liability: effects on product differentiation and information provision. Int Rev Law Econ 18: 511–528

Geistfeld MA (2009) Products liability. In: Faure M. (ed) The encyclopedia of law and economics, 2nd edn. Edward Elgar, Cheltenham

Lipsey RE, Lancaster K (1956) The general theory of second best. Rev Econ Stud 24: 11–32

Marette S, Bureau J-C, Gozlan E (2000) Product safety provision and consumers’ information. Aust Econ Pap 39: 426–441

Polinsky AM, Shavell S (2009) The uneasy case for product liability. Harvard John M. Olin Discussion Paper Series No. 647

Rasmusen E (2007) Games and information. Blackwell Publishing, Oxford

Shavell S (2004) Foundations of economic analysis of law. Harvard University Press, Cambridge

Shavell S (2007) Liability for accidents. In: Polinsky AM, Shavell S (eds) Handbook of law and economics, vol 1. Elsevier, Amsterdam, pp 139–182

Visscher L (2009) Tort damages. In: Faure M (ed) The encyclopedia of law and economics, 2nd edn. Edward Elgar, Cheltenham

Wickelgren A (2006) The inefficiency of contractually-based liability with rational consumers. J Law Econ Organ 22: 168–183

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Baumann, F., Friehe, T. Product liability and the virtues of asymmetric information. J Econ 100, 19–32 (2010). https://doi.org/10.1007/s00712-010-0123-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-010-0123-6